Crypto Market Forecast: The week ahead, 4th February

Interested in staying up to speed with the events that will impact crypto prices in the week ahead? Then bookmark Crypto Market Forecast for a curated weekly summary of forward-focused crypto news that matters

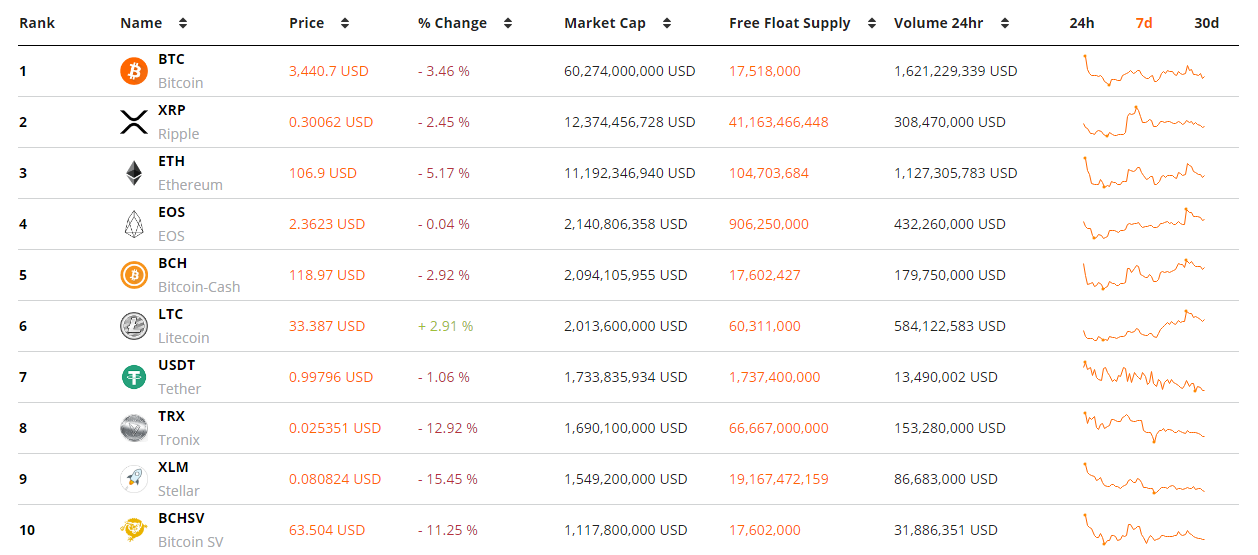

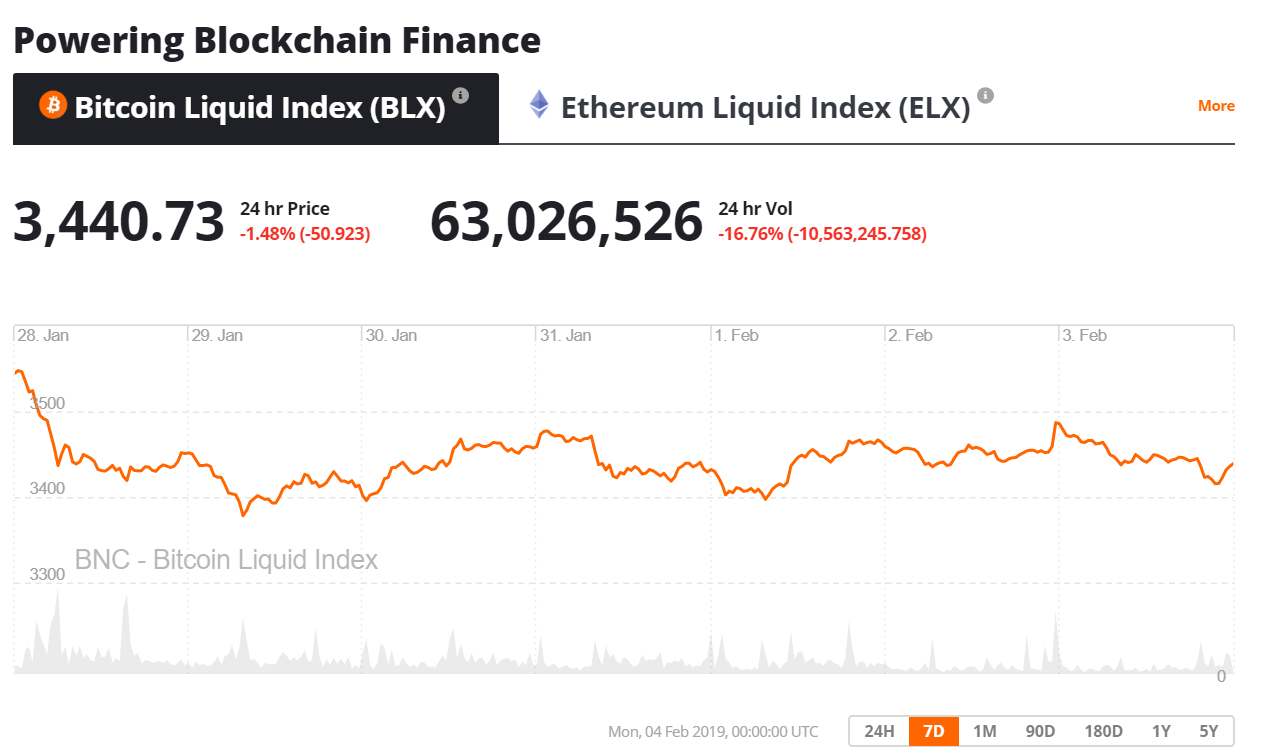

It has been another challenging trading week in digital asset markets, characterized by sharp selling pressure at the start of the week, and an inability for most crypto’s to recoup these losses as it progressed. Crypto benchmark BTC fell ~4%, while number 2 and number 3 assets XRP and ETH fell ~3% and 5% respectively. The overall market cap for crypto slid ~4.5% with a number of alts facing similar trajectories associated with heavy early week similar.

It is difficult to pinpoint a technical or fundamental reason for this most recent period of short term selling. Crypto markets are still in a long term bear trend, and will continue to face cycles of negative trading weeks, without identifiable selling triggers until a market bottom is confirmed.

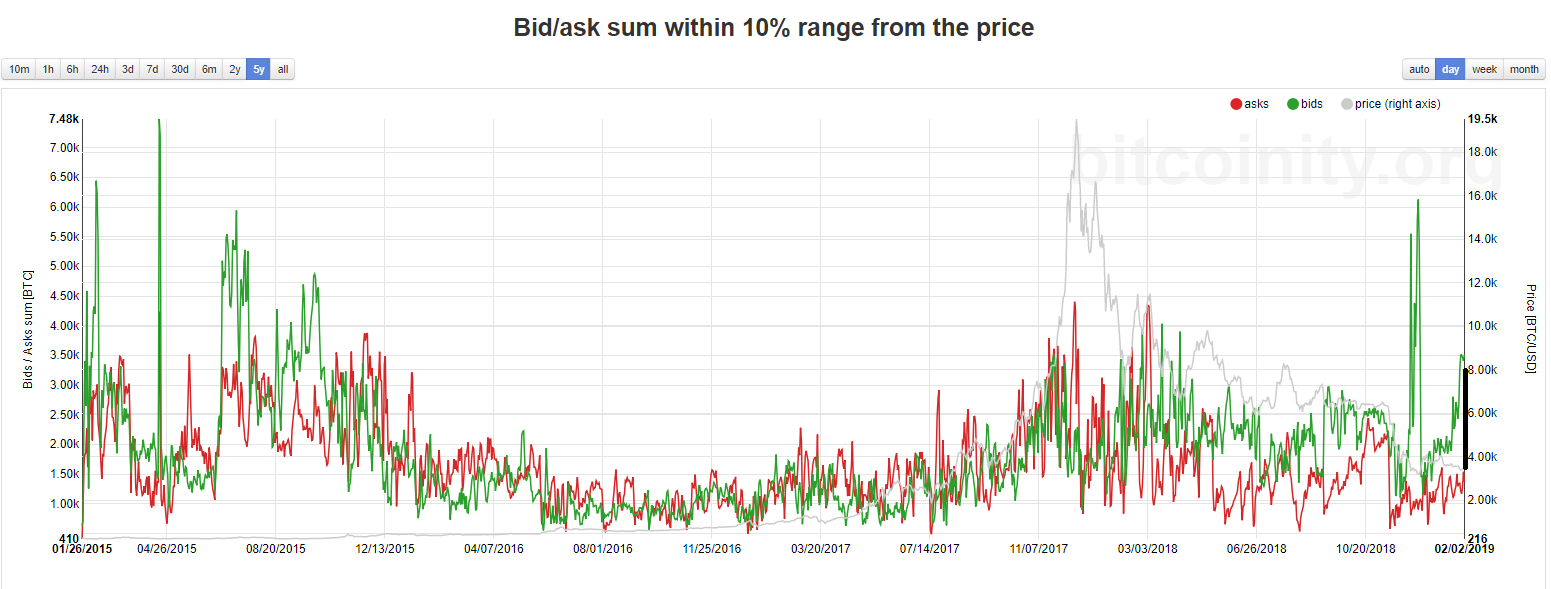

A bottom may be close, however. Exchange order book data indicates a large buy wall emerging on major exchange Coinbase Pro around the low- $3000 level that will likely prevent, at least in the short run, a push down towards a $2000 level (Coinbase data is used because it is more difficult to set up faked or spoofed bids because bids are fiat backed and faking bids has much higher costs involved).

There is a significant gap emerging between Bids and Asks on Coinbase Pro around current price levels. Suggesting a buy wall emerging as the price of BTC approaches the low $3000’s level, and pointing to temporary price relief. A previous build up of a similar Bid-to-Ask pattern in early December pushed price from ~$3200 to ~$4000 over a 10 day period.

For crypto investors with longer term horizons, announcements last week that Wall Street giant Fidelity will be launching its crypto custody solution in March, may be of interest.

Questionable security of existing crypto platforms, coupled with the operational challenges of managing private keys, has often been considered a barrier for institutional investors considering investments in crypto assets. The Fidelity custody product could provide an access point for large institutional investors looking for a trusted party to handle their crypto custody needs.

Upcoming events in crypto

4th February – BTT airdrop snapshot for TRX holders

Following the recent ICO launch of the BTT token, airdrops will begin rolling out to TRX holders. With around 10% of total BTT supply expected to be airdropped to TRX holders over the next 6 years, there is likely to be some speculative buying opportunities around airdrop dates because they will be a once a year event likely to excite participants. Meanwhile, the TRX price has held well in a bearish market, rising ~17% in the last month.

11th February – New Ethereum Cooperative executive director Bob Summerwill AMA

The acquisition of former key Consensys and Ethereum foundation developer Bob Summerwill by the Ethereum cooperative, an Ethereum Classic development group, has been covered by a number of crypto media outlets and is considered something of a coup for the ETC ecosystem. The AMA will be an opportunity for Summerwill to interact with ETC stakeholders, and potentially help the project recapture some lost sentiment following a recent 51% double spend attack. The price of ETC has fallen 27% in the last month.

It was a difficult week for most large cap cryptos with many ending the week in the red. Stand out amongst the top 10 was Litecoin (LTC) which may be benefitting from a bout of positive speculation based around an upcoming ‘halving’ (block reward reduction) which in the past has triggered sharp upward price runs.

Following selling days on Monday and Tuesday next week, resistance was found around the ~$3400 level and price hovered close to this level for the rest of the week unable to fully recover early week losses. There are positive signs that Bitcoin may be close to a bottom based on the high bid levels emerging on exchanges around current price levels.

The next difficulty adjustment is expected to small but positive at ~2%. The difficulty and hashrate of the Bitcoin network continue to stabilize around a tight range, follow a period of falling hash levels between September and December last year.

Subscribe to BNC’s newsletters for insights and forecasts direct to your inbox

Don’t miss out – Find out more today