Crypto Market Forecast: Week of August 14th 2023

A curated weekly summary of forward-focused crypto news that matters. This week, the SEC postpones a key spot Bitcoin ETF approval decision, Paypal launches a stablecoin, and volumes on the Bitcoin futures market dry up.

The price of Bitcoin (BTC) ticked upwards by 1.5% to ~US$29.4K in the last week. Ether (ETH) moved similarly, rising by ~0.9% to ~US$1.9K. Binance-coin (BNB) dropped by a mild ~1.4% to ~US$240.

On Friday, August 11, By initiating a 21-day public commentary period, the U.S. Securities and Exchange Commission (SEC) essentially postponed a decision to approve, or decline, ARK 21Shares’s spot Bitcoin exchange-traded fund (ETF). The spot ETF application was submitted in May, which allows the SEC a 240-day decision time.

All previous Bitcoin spot ETF applications have been denied, including previous attempts from ARK Investment Management and ARK 21Shares, which have sought a spot ETF since 2021. The SEC has, however, previously greenlighted Futures-contract base Bitcoin futures ETFs.

As covered by Brave New Coin in June, BlackRock, WisdomTree, Invesco and Bitwise have all submitted their own respective applications for Bitcoin spot ETFs. Approval for any of these applications would signal positive news for the space. BlackRock has caught attention as the firm’s assets under management reported to the SEC in December 2022 totaled $8.6 trillion.

The stablecoin landscape is in the process of a shift with FinTech giant PayPal joining the ranks of companies creating such assets. Last week we covered off the features and benefits of the new stablecoin, called “PayPal USD” (PYUSD). Paypal says that PYUSD “is fully backed by U.S. dollar deposits, short-term U.S. treasuries, and similar cash equivalents, and can be redeemed 1:1 for U.S. dollars”.

PYUSD is the only stablecoin supported within PayPal’s digital assets wallet and runs on the Ethereum blockchain. Issuance is handled by Paxos Trust Company, which PayPal partnered with in 2020 to manage its portfolio of “crypto” offerings.

The company claims that PYUSD can be transferred “to compatible wallets”. As both PayPal and its subsidiary Venmo have repeatedly been accused of financial censorship, questions inevitably arise as to whether a company like PayPal will allow its stablecoin to be freely accessible on “permissionless” blockchains, or, to what extent regulators may permit it to.

PayPal’s decision to launch a stablecoin has already called attention in Washington. Congresswoman (D-CA) Maxine Waters issued a statement on Tuesday last week expressing concern over PayPal’s announcement: “I am deeply concerned that PayPal has chosen to launch its own stablecoin while there is still no Federal framework for regulation, oversight, and enforcement of these assets”.

A stablecoin bill is presently being pushed forward in the Republican-controlled House.

Crypto news for the weeks ahead

August 31

The US Bureau of Economic Analysis’ (BEA’s) release of July’s Personal Consumption Expenditures (PCE) numbers will be released. This is the primary indicator used by the FOMC to measure inflation and is considered carefully when considering interest rate levels.

September 13

The Consumer Price Index data for August will be released – this is one of the indicators the Federal Open Market Committee (FOMC) watches when considering interest rate hikes.

September 20

The FOMC will be meeting. Futures markets are strongly leaning towards a prediction of no further rate hikes, thus leaving the federal funds rate target at 5.25 – 5.5%. Fed Governor Christopher Waller, however, hinted in mid-July of additional rate hikes.

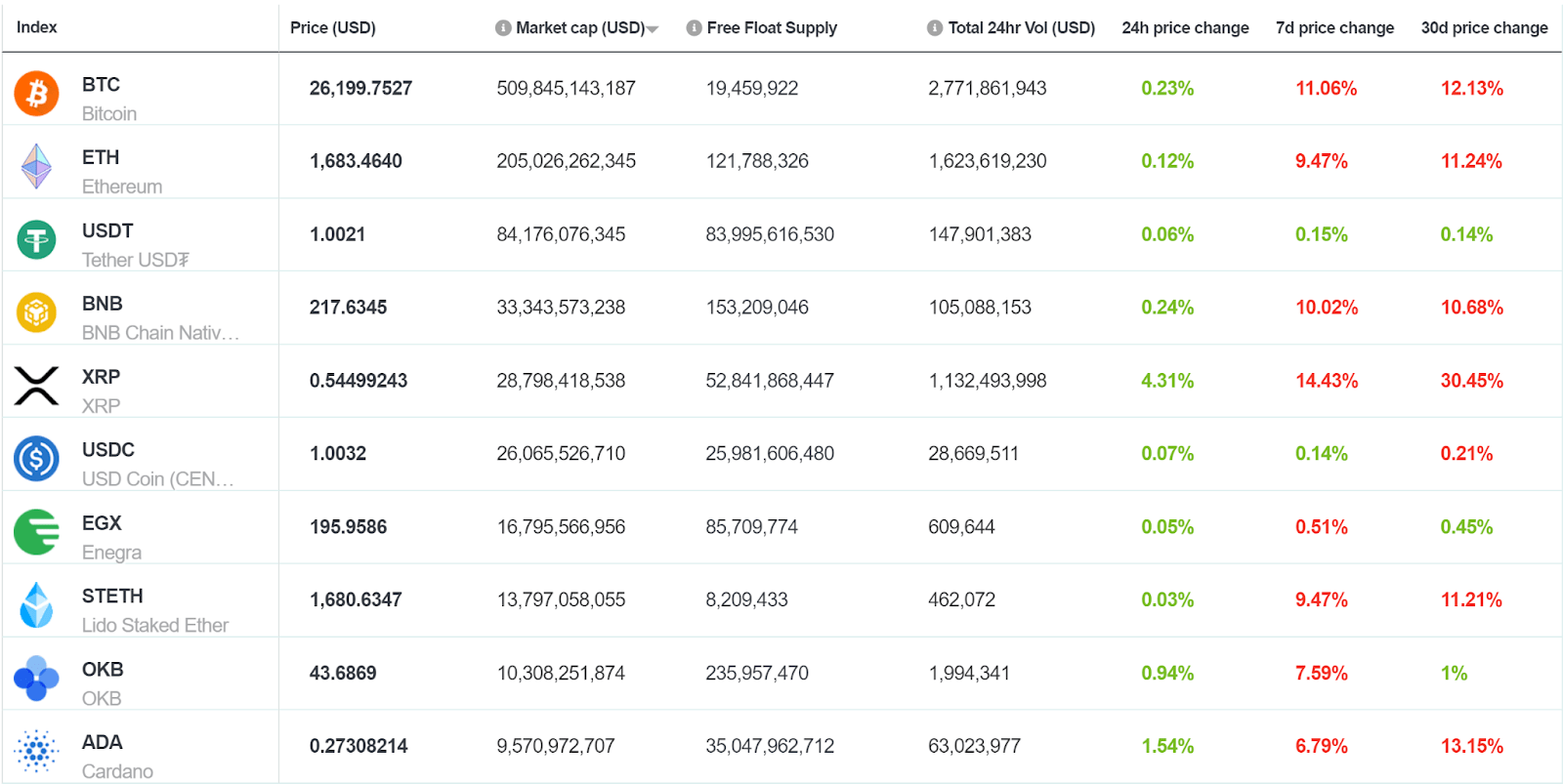

Top 10 Crypto Summary

For yet another week, BNC’s top 10 assets by market cap traded sideways. During the week, BTC traded between $28.7K to $30.0K.

Bitcoin Price Chart

GLASSNODE this week described BTC’s recent price stability as a “volatility compression”. They also write that the BTC futures markets is “notably flat” with trade volume at an all-time low. Options markets have “priced in the lowest implied volatility premium in history, with put options in particular seeing the lightest demand”.

Don’t miss out – Find out more today