Crypto Market Forecast: Week of August 1st 2022

A curated weekly summary of forward-focused crypto news that matters. This week, the price of Bitcoin rises despite a Fed interest rate rise, Vitalik discusses what to expect from Ethereum post-merge, and Coinbase pushes back against SEC probe.

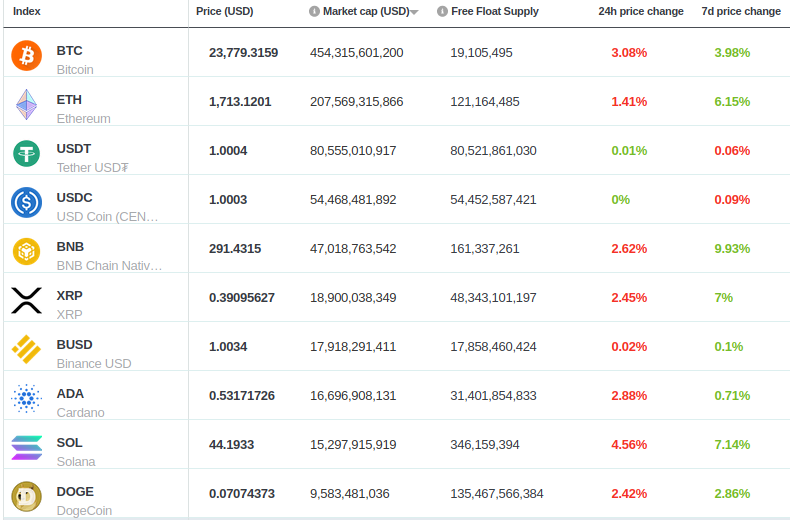

Bitcoin’s (BTC) price recovered this week by almost 4% and is currently trading for just under US$24K. Ether (ETH) and Binance-coin (BNB), the second and third largest (non-stablecoin) assets by market cap, experienced ~6% and ~10% recoveries this week, and sit at ~US$1.7K and ~US$291 respectively.

Federal Reserve Chair Jerome Powell spoke at the FOMC press conference this past Wednesday and announced a ¾ percentage point increase — with the Effective Federal Funds Rate hiked from 1.58 to (now) 2.33%. The rise is part of an ongoing attempt to bring inflation under control. (The Fed’s stated inflation target is still 2%; June’s official CPI was 9.1%).

Interestingly, Bitcoin’s price spiked (upward) following the announcement (from ~US$21.2K to as high as ~US$24.6K). This implies that, to the extent that the rate hike may have applied downward pressure, the market took the expectation of interest rate hikes into consideration before the announcement and that (as is often the case) there were simultaneously even stronger upward pressures from elsewhere.

Ethereum founder Vitalik Buterin spoke at the recent EthCC Paris conference, detailing what to expect from upcoming changes to the blockchain post-“Merge” (the proof-of-work to proof-of-stake transition).

But noteworthy to Ethereum’s (ETH’s) price over the long-term is a change to the monetary policy which will modify the issuance (creation of new coins) from ~13,000 ETH/day pre-merge (by mining) and ~1,600 ETH/day pre-merge (by staking) to just ~1,600 ETH/day. In addition, there is a “burning” phenomenon that happens when ETH is removed from circulation. The Ethereum website states that “[at] an average gas price of at least 16 gwei, at least 1,600 ETH is burned every day, which effectively brings net ETH inflation to zero or less post-merge”.

If fewer ETH are issued per day and demand remains constant, expect upward price pressure for the asset. It must also be noted that there is a possibility that the Ethereum development team will change the monetary policy yet again because of public backlash and governance considerations.

The US Securities and Exchange Commission (SEC) has begun probing Coinbase(COIN) for allegedly listing nine unregistered securities on its platform. Coinbase fired back with a “Petition for Rulemaking” and a blog post accusing the SEC of operating under “arbitrary enforcement” and “guidance developed behind closed doors” instead of “formal procedures and a public notice-and-comment process”.

SEC Chair Gary Gensler has reiterated his belief that “many tokens” are securities. The SEC’s recent rule-by-enforcement with Coinbase may be the regulatory agency’s attempt to set the terms of discussion as the Lummis-Gillibrand bipartisan “crypto bill” (Responsible Financial Innovation Act) circulates around Washington for commentary.

Crypto news for the weeks ahead

31 July

The THORChain has announced a “planned obsolescence” by the end of July. The THORChain Twitter account posted that the team will be “fully unvested, [and] will have consumed the treasury and will leave the network”.

31 July

The Qtum network will hard fork “around July 31st” at block 1967616 to implement Taproot, Schnorr Signatures, Evmone, and various other upgrades.

Week of September 19th

The Ethereum blockchain is now scheduled to launch its long-awaited proof-of-stake (PoS) “Merge” during the week of 19 September.

Cardano fork – a "few more weeks"

Cardano (ADA) has announced yet another delay of its blockchain’s “Vasil hard fork”. The upgrade was previously scheduled for June, then for the end-of-July, and is now postponed yet again for “a few more weeks”.

Top 10 Crypto Summary

This week, asset prices recovered across the board with some sign of at least mild recovery after a long crypto winter. Ether (ETH) had another great week — up over 6% versus last week — preceding its now-scheduled September proof-of-work to proof-of-stake “Merge”. Binance-coin (BNB) and Solana (SOL) also had great weeks, up by 10% and 7% respectively.

Bitcoin Price Chart

Glassnode this week noted a confluence across various indicators, comparing present prices to previous cycle “bottoms”, suggesting that Bitcoin’s present cycle bottom may have already been reached. After weeks of bearish market conditions, we have seen an uptick in prices (a “sling shot event”), but still no sign of a strong recovery — despite the recent flush out.

Don’t miss out – Find out more today