Crypto Market Forecast: Week of August 30th 2021

A curated weekly summary of forward-focused crypto news that matters. This week, risk markets including Bitcoin jump with money printing in the US set to continue, Solana hits new all-time-highs and the market prepares for US unemployment numbers this week.

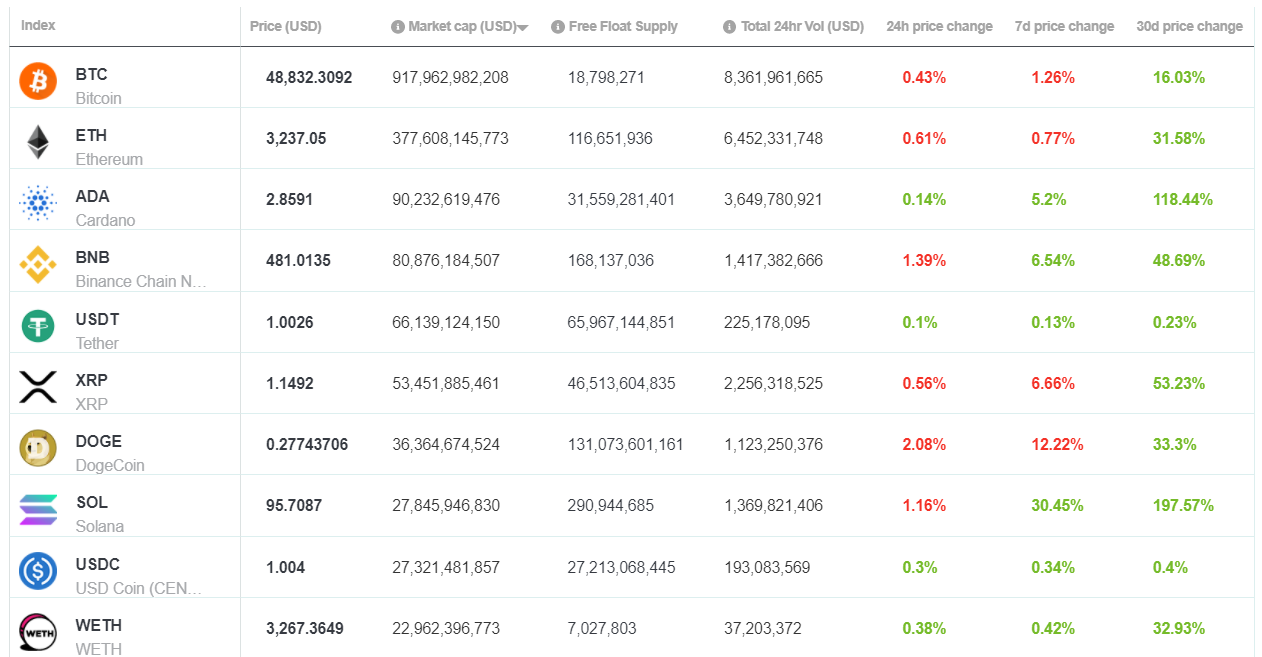

It was a mixed week of trading in the digital asset markets. After a modest pullback, a bullish weekend saw Bitcoin (BTC) recover to end the week down ~1%, still just below the key US$50,000 psychological price level. Ethereum (ETH) and Cardano (ADA), the second and third largest assets on the Brave New Coin market table, ended the week down ~1% and up ~5% respectively. The top-performing assets in the top 40 last week were Tezos (XTZ) and Solana (SOL), which appreciated ~62% and ~31% respectively.

Bitcoin had a strong weekend rising by US$2000 between Friday and Sunday. The bullish move was in response to Fed chairman Jerome Powell’s push for more dovish short-term policy during his keynote speech at the Jackson Hole symposium for American Central bankers. Dovish Monetary Policy means a looser, aggressive monetary policy that encourages increasing the money supply leading to lower interest rates to encourage investment.

Powell’s statement plunged the dollar lower and pushed prices in risk-on markets higher. With more money sloshing around in the economy, the resulting increase in liquidity encourages investment in riskier, speculative assets like BTC. Bitcoin’s bullish move was mirrored by the S&P 500 and the NASDAQ Composite, which both ended the week at new all-time highs.

There was some speculation before the Jackson Hole event, that the Fed could flip hawkish immediately and begin to contract money supply to prevent an overheating of the American economy. Instead, Powell pushed the goalposts out and said monetary tapering may happen later this year. He views the current high inflation in the USA as only temporary.

One factor behind Bitcoin’s rise is the concern that the Fed is minimizing inflation and the US dollar may be set to weaken even more in the medium to long term. Bitcoin exists as the antithesis of an intrusive monetary policy regime. For now the Fed is continuing to use debt to purchase bonds and keep Wall Street propped up, a strategy with short term benefits and long-term risks. Bitcoin, by contrast, has a set monetary policy that is always deflationary irrespective of external circumstances.

With concern over the Fed’s dovish strategy still permeating, investors are also stocking up on BTC as an inflation hedge – a digital alternative to gold. On-chain signals suggest that Bitcoin holders are accumulating. Glassnode reported last week that the amount of Bitcoin moving off exchanges into private wallets is increasing.

Over the weekend Twitter and Square CEO, Jack Dorsey, revealed that Square is launching a decentralized unit to build a Bitcoin decentralized exchange. Mike Brock, who will lead the division, said buying and trading the largest and most popular digital asset generally involves trusting centralized third parties such as Coinbase. The DEX will seek to address this issue by building a trading platform that is open-source, permissionless, and Bitcoin native.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

Crypto news for the week ahead

August 30th – Zilliqa network upgrade

Platform blockchain Ziliqa will conduct a network upgrade this Monday. The upgrade of the sharded blockchain is set to improve performance in areas of memory clean-up, node syncing, and proof-of-work submission handling. The native token of Zilliqa, ZIL, is up ~2% in the last 7 days.

September 3rd- US unemployment announcement

All eyes will be on the U.S. economy this Friday. In July, U.S. unemployment dropped to 5.4% and hit its lowest point since March 2020. The Department of Labor said 943,000 new jobs were added in the month. This could be a signal that the U.S. economy is continuing to normalize and could be a bullish macro flag. In turn, a bullish macro environment could push investors to take more risks and back emerging technologies like crypto assets.

Top 10 Crypto Summary

It was a mixed bag for large-cap assets in the market cap top 10. While assets like Dogecoin (DOGE) retracted, others like Solana (SOL) soared. SOL continues to climb up the table and the asset hit new all time highs in the last week. On August 25th, it was announced that Chainlink price feeds are now live on the Solana devnet. On August 31st, Solana ignition begins. It remains unclear exactly what Ignition is, however, it appears to be a tool to make Solana Dapp development easier.

Bitcoin Price Chart

It was a tale of two halves for the BTC price, with early week losses recouped during a strong second half. Glassnode noted that at the start of the week, the proportion of older, longer-held BTC spent on-chain has increased. This suggests long term investors were locking in profits as BTC approached US$50,000.

Don’t miss out – Find out more today