Crypto Market Forecast: Week of August 9th 2021

A curated weekly summary of forward-focused crypto news that matters. This week, Ethereum drives the market forward following the successful implementation of the London hard fork, and the U.S. Senate is poised to pass an infrastructure bill with major implications for the blockchain industry.

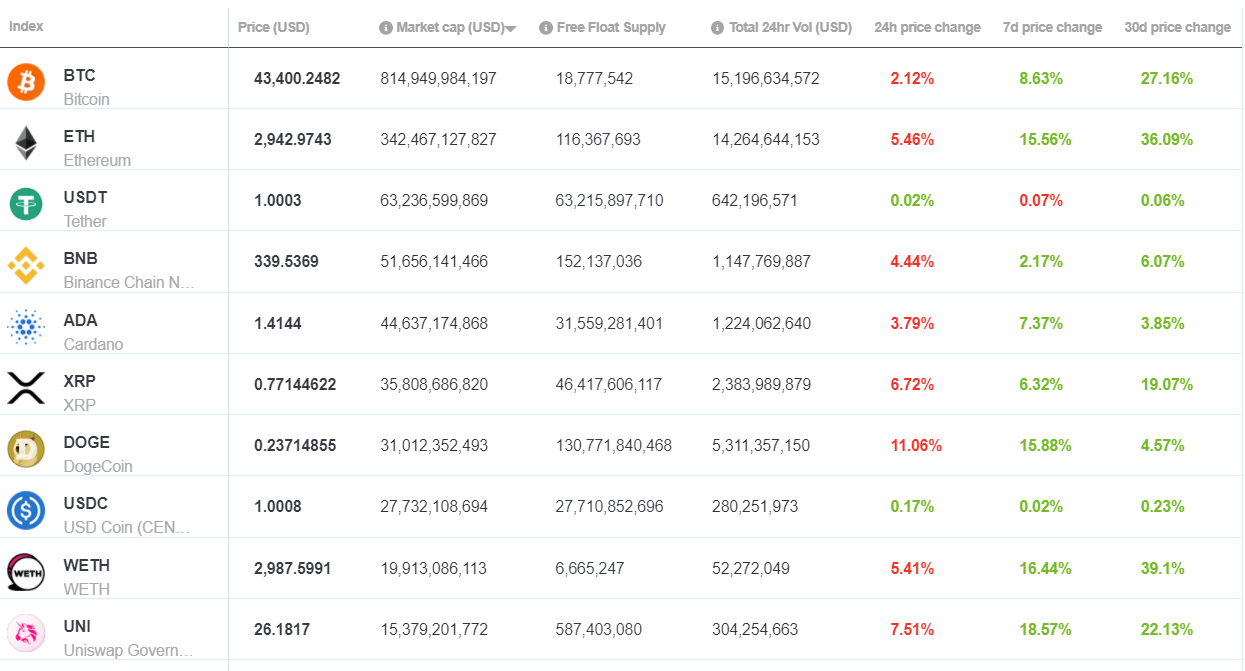

Digital asset markets enjoyed a strong week of steady gains led by a surging Ethereum (ETH), the second-largest asset on the Brave New Coin market cap table. Bitcoin (BTC) ended the week up ~9%, while Ethereum was up an impressive ~16%. Other large-cap assets to perform strongly included Dogecoin (DOGE) and Uniswap (UNI), rising ~16% and ~19% respectively.

The key driver for Ethereum’s bullish week was the successful deployment of the London Hard Fork. The Hard Fork went live on August 6th at 12:34pm UTC. There were some concerns following testnet issues, however, the launch occurred without incident. The network has been running smoothly with the newly implemented upgrades since Friday.

The change that has the Ethereum and digital investment community most excited is the new burn feature. This feature of the London Hard Fork, EIP1559, introduces a base fee to Ethereum transactions. The base fee represents the minimum fee that will have to be paid for a transaction to be included in a block.

With the new fee model, transactors can also add a miner tip, on top of the base fee, as a separate fee that can be offered to incentivize miners to prioritize a transaction. Because there is a possibility that Ethereum miners could collude to fix the base fee in their favor, the entire base fee for each transaction will be burnt.

So far, ~15,340.50 ETH (~US$46 million) worth of base fees has been burnt. This new burn mechanism represents a fundamental change to the monetary policy of the network. Eric Connor, the founder of Ethereum research resource EthHub.io, said on Twitter that ETH’s yearly inflation rate is set to drop from 4.2% to 2.6%. He says this inflation is set to drop further following the transition to Ethereum 2.0 and a Proof-of-Stake consensus mechanism. This new tighter, more scarce token issuance adds a new store-of-value narrative to the ETH story. As long as demand to transact on Ethereum remains, which appears likely because of the popularity of sectors such as DeFi and NFTs, the medium-to-long term future of Ethereum appears bright.

So far, the crypto markets have been able to shake off news of a last-minute cryptocurrency tax provision built into the US$1.2 Trillion Bi-partisan infrastructure bill in the United States. The provision will impose more federal regulation on cryptocurrencies and significantly expand the number of cryptocurrency users that need to declare their crypto holdings with the Internal Revenue Services (IRS). Advocates of cryptocurrency, however, have come out in force to oppose the provision.

Democratic Senators Ron Wyden of Oregon and Pat Toomey of Pennsylvania as well as Republican Senator Cynthia Lummis of Wyoming are seeking to add an updated amendment to the original legislation. The amendment narrows the scope of the bill and reduces the number of crypto users who would be required to provide information to the IRS.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

Crypto news for the week ahead

August 10th – BAND, INJ, MIR, and 1INCH open for trading

On Tuesday, four new assets will list for trading on licensed US-based digital asset trading platforms, Band Protocol (BAND), Injective Protocol (INJ), Mirror Protocol (MIR), and 1inch Network (1INCH). All four assets are part of the burgeoning DeFi sector and will be available for trading with the US dollar and Euro fiat. BAND, INJ, MIR, and 1INCH are up ~7.3%, ~220%, 8.8%, and 5.3% respectively.

August 11th – US Bureau of Labour Statistics releases July CPI data

All eyes will be on the US economy this Wednesday. US inflation hit a 13-year rise in June driven by the rising price of products such as used cars. Consumer prices rose 5.4% in the 12 months to the end of June, up from 5% the previous month. This is much higher than the 2% rate targeted. With positive unemployment data recently being released, a slowdown in inflation may create some bullishness for the US economy.

Top 10 Crypto Summary

It was a strong week for large-cap assets on the Brave New Coin market cap table. Uniswap (UNI) was the top-performing asset in the top 10 rising ~19%. Total Value Locked (TVL) on the platform has risen quickly since the 19th of July. Uniswap V2 and V3 now account for over 65% of the volume within the Ethereum decentralized exchange space.

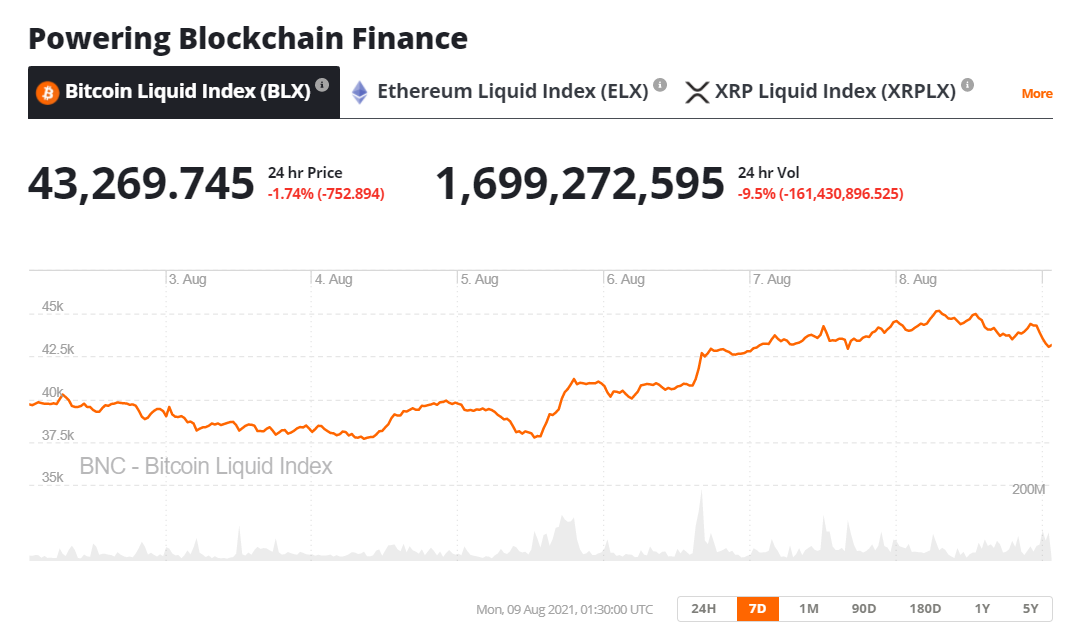

Bitcoin Price Chart

The price of Bitcoin continues its medium-term bull trend. Last week the price of the asset hit a new 30-day high reaching US$45,000 on Sunday, August 8th before hitting resistance and pulling back. Glassnode reported that the Bitcoin supply held by Long-Term holders has been on an uptrend for most of 2021. A large amount of the supply being held by long-term holders has been a bullish signal historically.

Don’t miss out – Find out more today