Crypto Market Forecast: Week of December 19th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, Sam Bankman-Fried's planned Senate testimony is released, Binance deals with a large outflow of BTC & stablecoins and we summarize a difficult 2022 for the crypto space.

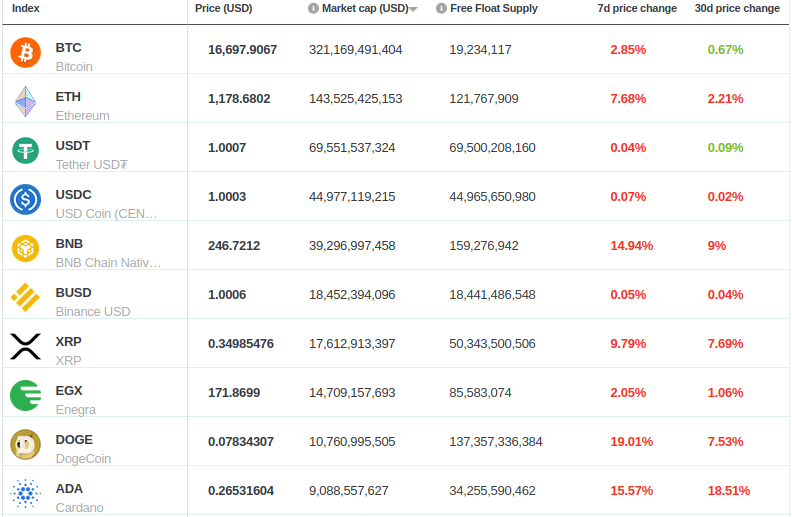

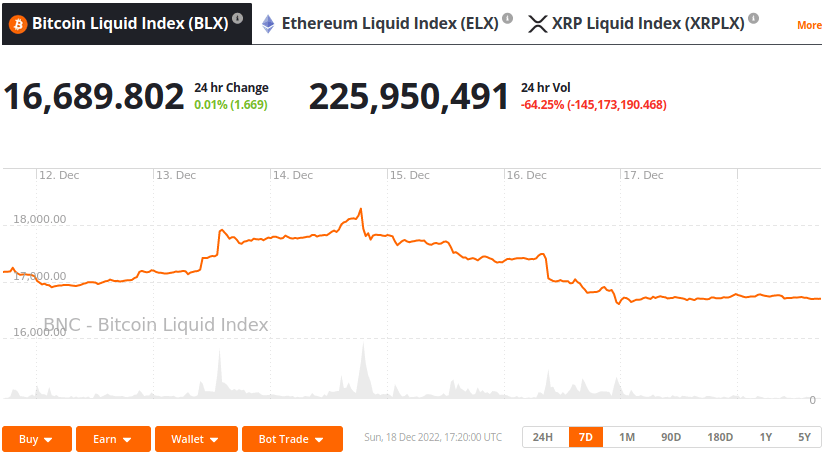

The price of Bitcoin (BTC) ends the week with a ~2.9% decrease versus the previous week and currently sits at ~US$16.7K. Ether (ETH) has had a 7.7% drop, and is currently at ~US$1.18K. Binance-coin (BNB) saw nearly a 15% drop and presently trades for ~US$247.

The industry is still living through the aftermath of the FTX implosion, with Sam Bankman-Fried (SBF) now arrested in the Bahamas — oddly enough, the arrest happened the day before SBF’s scheduled testimony to the US House Committee on Financial Services.

Forbes, however, was still able to obtain a draft of SBF’s would-be testimony last week and released its full content, including a vague admission at its beginning that “I fucked up”. But the draft also contains a fair bit of blame-shifting directed towards Binance’s Changpeng Zhao (CZ), FTX’s new CEO John J. Ray III, law firm Sullivan & Cromwell, FTX US general counsel Ryne Miller, and a “historical accounting quirk”.

SBF now has charges brought against him by the US Department of Justice (DOJ), the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Between them, the charges were summarized last week in a press conference as: defrauding FTX customers, defrauding lenders to Alameda Research, defrauding FTX investors, and violating campaign finance laws. However, the US Attorney’s Office in the Southern District of New York also lists charges of “conspiracy to commit wire fraud, wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, conspiracy to commit money laundering”.

SBF presently awaits likely extradition to the United States from the Bahamas.

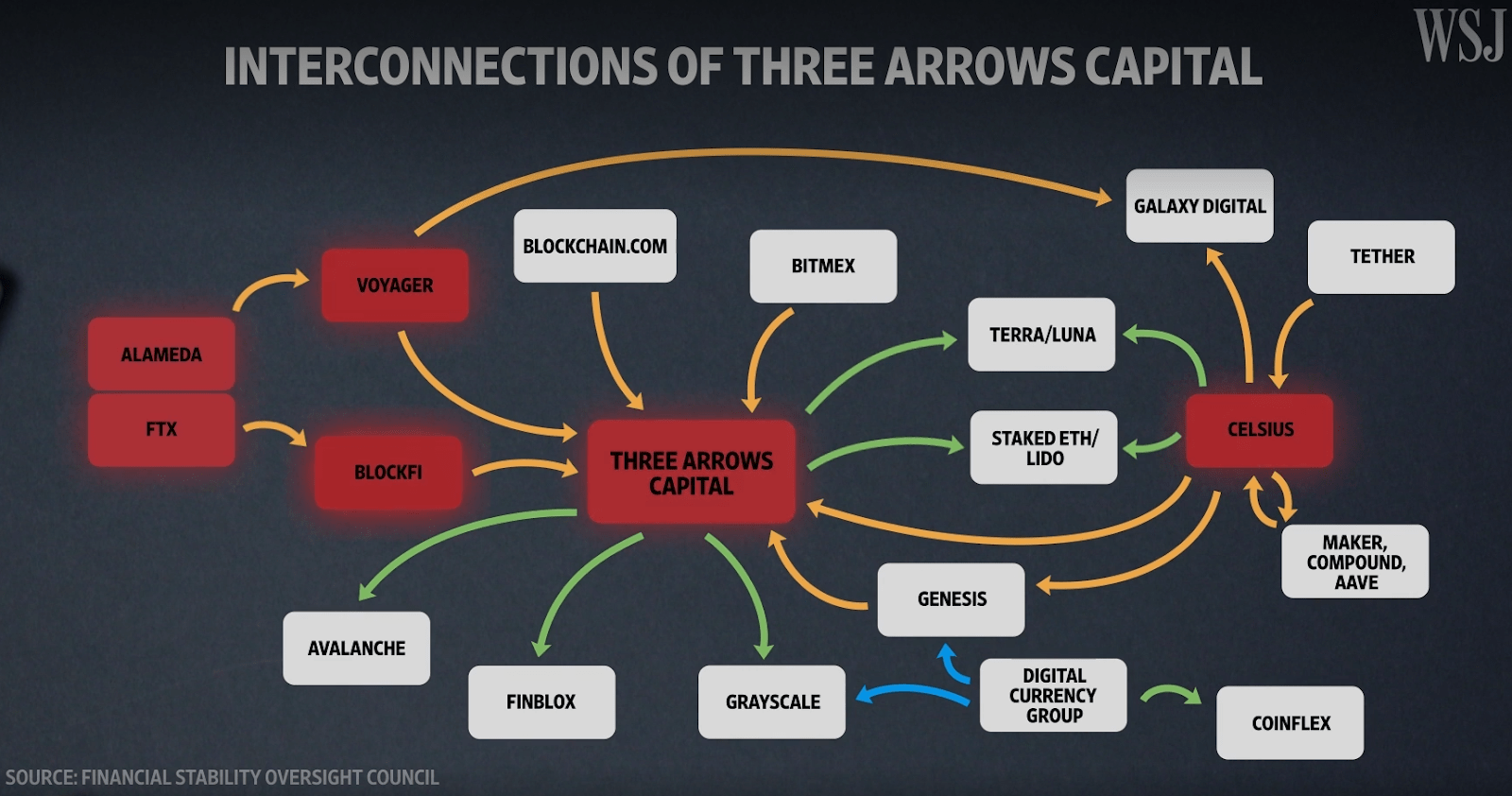

The crypto industry started 2022 still living in the euphoric buzz experience of having just topped all-time price highs. Bitcoin’s price in November 2021 reached around $68K. By the 1st of January 2022, it had fallen to $48K — a price only seen again in 2022 for a brief moment in March. May 8th saw the fall of Terra/LUNA, and from there the dominoes began fall one-by-one.

It soon become apparent that many players in the space had engaged in risky lending and borrowing, overleveraing, and fractionally reserving crypto assets that were not intended to be fractionally reserved in the first place. (Bitcoin’s layer-one, for example, does not allow for fractionally reserving on the chain. What may happen in the real-world or on a second layer, for example, is another story).

2022 showed us the interconnectedness of the industry. It reminded us that the learnings from economics that apply everywhere else still apply to cyberspace. We learned the importance of asking “Where does this yield come from?”, to demand proof of reserves, to take self-custody, and that crypto assets had been propped up by central banks’ inflationary monetary policy, just as housing, the stock market, and commodities all had.

Source: WSJ

And that’s a wrap up! Brave New Coin’s kickstarter newsletter will return early, 2023. We wish you happy holidays, and thanks for reading this year! Feel free to reach out by LinkedIn. I always enjoy hearing from readers.

Crypto news for the weeks ahead

12 January

The US Bureau of Labor Statistics will release its Consumer Price Index (CPI) numbers for the month of December. This is a key indicator the Fed will look to when it considers even further rate hikes going forward.

31 January

The Federal Open Market Committee (FOMC) will be meeting. Possible further additional interest rate hikes will be announced. Markets are presently leaning towards a sixth interest rate hike, currently expected at 25 bps.

Top 10 Crypto Summary

Red ink, price drops, all the way down this week for Brave New Coin’s top 10 digital assets by market cap. DogeCoin (DOGE), Cardano (ADA) and Binance-coin (BNB) were hit hardest: each with double-digit drops. DOGE’s drop follows recent spikes in anticipation of Elon Musk turning newly-acquired social media platform Twitter into a payment platform. (Musk has publicly spoken favorably of DOGE on numerous occasions).

Bitcoin Price Chart

Onchain analytical service Glassnode followed the impact of FTX’s collapse on major global exchange Binance and noted a few important points – indicating major net outflows as users take custody into their own hands. On December 13th alone, the exchange saw its largest USD value of BTC withdrawn in the exchange’s history. The same day, ETH recorded similar net outflows, and over $3.2B of USDT, USDC, BUSD, and DAI were withdrawn from the exchange over a 30-day period. For more on Binance happenings, check Aditya Das’s piece here.

Don’t miss out – Find out more today