Crypto Market Forecast: Week of December 5th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, low unemployment numbers in the United States increase the likelihood of interest rate hikes, Sam Bankman-Fried prepares to testify in front of the House Committee on Financial Services, and sales of hardware wallets spike.

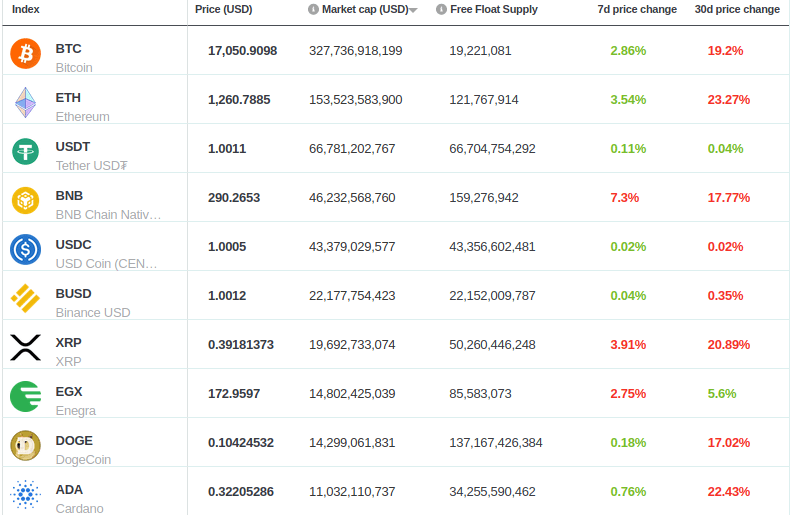

The price of Bitcoin (BTC) finished off the week with a 2.9% improvement in price versus the previous week and now sits at ~US$17K. Ether (ETH) saw a moderate 3.5% improvement, and now sits at ~US$1.26K, while Binance-coin (BNB) saw a 7.3% drop, and presently trades for ~US$290.

The US Bureau of Labor Statistics (BLS) published its unemployment numbers for November on Friday (December 2nd). Payroll employment increased by 263,000, and the low 3.7% rate remains within what has been observed since March this year (never peaking above the 3.7% level for any month). Notably, these are within pre-COVID levels; for all twelve months prior to March 2020, U.S unemployment never reached higher than 3.8%.

With November’s latest low unemployment numbers, the Fed is likely to announce interest rate hikes again in its FOMC meeting on Wednesday (December 14th) of next week — especially if November’s Consumer Price Index (CPI) numbers to be published December 13th prove to be high. A high CPI indicates to the Fed that it still has work to do to bring down inflation, and raising interest rates is the usual tool of choice for central bankers.

As the Fed tries to bring inflation down to its stated goal of 2%, continued rate hikes remain likely, although recent statements from the Fed indicate that the rate of increases may begin to taper over time.

Nonetheless, the market for crypto assets has likely already taken expected rate hikes into account, and these expectations are already reflected in digital asset prices. And, as crypto assets are still considered risk-on, this manifests itself in downward price pressure. Whether stronger upward price pressure from elsewhere will be successful in countering downward pressure from the Fed in a price tug-of-war remains to be seen.

Congresswoman Maxine Waters (D) and Congressman Patrick McHenry (R) have asked Sam Bankman-Fried (SBF) to testify to the US House Committee on Financial Services on Tuesday, December 13th.

In what looks to be something of a Madoff-Theranos-Mt.Gox cocktail mix, regulators, investors, and retail customers are all scrambling to make sense of the FTX collapse and Bankman-Fried himself. But even beyond FTX’s bankruptcy and sloppy business practices, the matter remains particularly complicated in that SBF had a cozy relationship with regulators and policymakers.

In the recent US midterm elections, for example, SBF was the second largest donor to the Democratic Party (second only to George Soros), and was the sixth largest donor overall (to Democrats and Republicans). This raises questions about possible special treatment for FTX when it was operational – and any potential prosecution for wrongdoing now.

In the immediate aftermath of FTX market trust in centralized entities is at an all time low (just last week, we covered how centralized exchanges were working to prove their reserves to customers). But, interestingly, there is at least one area of the industry that seems to be doing well with both Ledger and Trezor hardware wallet manufacturers reporting sales spikes as crypto owners are reminded of the importance of self-custody.

Crypto news for the weeks ahead

13 December

Sam Bankman-Fried has been requested by Congresswoman Maxine Waters (D) and Congressman Patrick McHenry (R) to testify to the US House Committee on Financial Services.

13 December

The US Bureau of Labor Statistics will release its Consumer Price Index (CPI) numbers for the month of November. This is a key indicator the Fed will look to when it considers even further rate hikes going forward.

14 December

The Federal Open Market Committee (FOMC) will be meeting. Possible additional interest rate hikes will be announced. Markets are presently leaning towards a fifth interest rate hike but to pivot away from the previous four consecutive 75 bps hikes to “only” 50 bps.

Top 10 Crypto Summary

Another week of only moderate (single-digit) price changes for Brave New Coin’s top 10 digital assets by market cap — albeit with minor recoveries from Ether (ETH, up 3.5%) and Bitcoin (BTC, up 2.9%). XRP suffered a minor 3.9% decline in price following Coinbase Wallet’s announcement on Tuesday of last week that it would remove support for XRP, citing “low activity”. BNB dropped by 7.3% following an exploit of a derivative tied to it, aBNBc, was exploited and dumped aggressively. aBNBc is tied to the ANKR protocol, which suffered heavy losses as a result of the exploit.

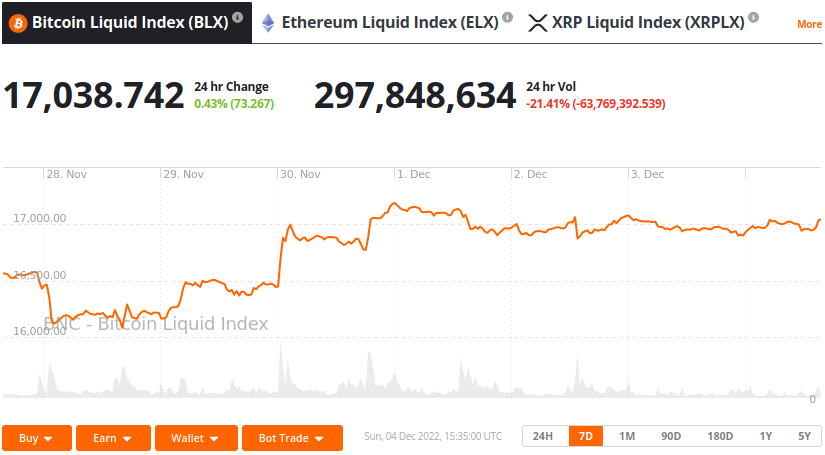

Bitcoin Price Chart

With FTX occupying the lion’s share of industry headlines, one could almost be forgiven for failing to notice that Bitcoin miners are operating under the highest sell pressure they have endured for about five years. Additionally, the November selloff turned out to be the fourth largest realized loss event in Bitcoin’s history, and as it turns out, the net position change of shrimps (holders with fewer than 1 BTC) nearly ‘hockey-sticked’ since the FTX implosion. In other words, smaller players are buying the dip at unprecedented levels.

Don’t miss out – Find out more today