Crypto Market Forecast: Week of February 6th 2023

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin performance has been mixed, strong employment data emerges from the United States, the market waits expectantly for an upcoming Fed Chairman speech, and Binance is suspending US dollar transfers.

After a strong start to the year, the Bitcoin price began sliding on Thursday with the negative momentum continuing over the weekend. Even so, the BTC price remains up 1.16% this week. Ethereum (ETH), the second largest asset in crypto, managed to maintain its momentum more efficiently and is up ~4.33% this week.

A factor in BTC’s weak weekend may have been an exceptionally strong January U.S. job report. Nonfarm payrolls, the number of US workers excluding farm workers, increased by 517,000 for the month, blowing past analysts’ expectations of a rise of 187,000. At the same time, US unemployment fell to 3.4% – the lowest since May 1969.

The report also revealed the job gains were widespread, led by the leisure and hospitality sectors. Wages have grown by 4.4% in the last year, again, more than expected.

The numbers from the report suggest that a recession in the U.S. is not imminent. Consumers may still have spending power and investors will still be able to allocate some capital toward discretionary investments like cryptocurrencies.

Nonetheless, good news is often bad news in macroeconomics and in the shorter term the positive indicators mean the Fed now has more room to continue rate hikes and use monetary policy to control inflation which still sits well above the targeted 2% level. This can be considered a short-term bearish signal because capital will become more expensive.

All eyes are now on Federal Reserve Chairman Jerome Powell and his upcoming speech at the Economic Club in Washington, D.C. on Tuesday afternoon. Last week when he spoke at the FOMC press conference and said that disinflation was kicking in and interest rates may pull back, markets were sent into a bullish frenzy.

US equities and cryptos both enjoyed an intense period of buying. Today, if Powell decides that the strong job market data is permission to be hawkish, then markets may flip bearish again.

Today, mega crypto exchange Binance has announced that it will temporarily suspend US dollar bank transfers. The exchange has said it will contact affected customers directly. They say that just 0.01% of its users leverage the feature but they will work quickly to try and get it up and running again.

Other methods of buying and selling crypto on the exchange remain intact. This includes deposits and withdrawals with other fiat currencies, credit and debit cards, Apple and Google pay, and the Binance P2P marketplace.

Binance did not confirm why it is suspending US dollars transfers but it is believed that the move is not related to any equity issues and instead is connected to problems with Binance’s American banking partner Signature Bank. Last week the bank said it would stop processing crypto SWIFT transactions under US$100,000.

Crypto news fo the weeks ahead

13th February

On Monday, The New York Fed releases its 1-year and 5-year inflation expectations. The expectation is a gauge of how deeply entrenched inflation is in the mind of consumers and whether they think inflation will continue.

March 2023

Ethereum’s next major upgrade since the Merge, the ‘Shanghai’ hard fork, will allow stakers to withdraw staked ETH, which presently remains locked.

Q1 2023

The Cosmos Hub network expects to launch various upgrades in Q1 pertaining to security, fee structure, multi-sig, etc.

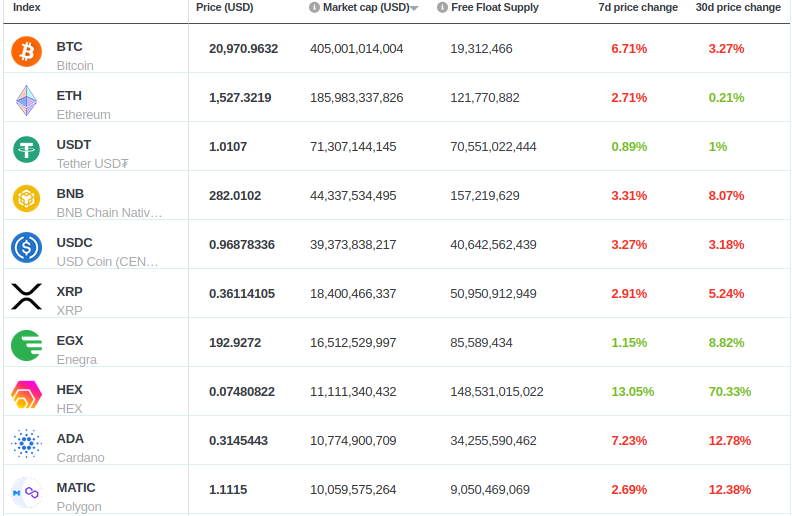

Top 10 Crypto Summary

While Bitcoin had a middling week, large-cap altcoins performed strongly. Onchain activity on the Ethereum network has been boosted by improved interest in Non-fungible tokens (NFTs) and the release of a new NFT-based mini-game, Dookey Dash by Yuga Labs. Another driver of onchain activity is the upcoming Shanghai hard fork that will allow staked ETH to be unstaked for the first time since the launch of the Beacon Chain.

Bitcoin Price Chart

Data from Onchain analysis firm Glassnode indicates that the difference between long-term holders and short-term holders is at an all-time high. This is a bullish flag. It suggests that there are more strong, committed hands in the Bitcoin market than weak, willing-to-sell hands which reduces selling pressure in the market.

Don’t miss out – Find out more today