Crypto Market Forecast: Week of January 23rd 2023

A curated weekly summary of forward-focused crypto news that matters. This week, driven by more positive economic data, the price momentum in crypto markets continues, BNB conducts its first coin burn of 2023 and Russia takes steps towards de-dollarization.

The price of Bitcoin (BTC) has risen by yet another 9.4% since last week and currently sits at just under US$23K. Ether (ETH) rose by 6.1% over the week, and currently trades for ~US$1.64K. Binance-coin (BNB) finished the week almost flat, up by just under 1%, and presently trades for ~US$304. Momentum driven by more positive economic data emerging from the United States this year continues to drive crypto markets upwards.

For a weekly deep-dive into how wider markets and key indicators like the Ccnsumer Price Index and the Personal Consumption Expenditure Price Index are immpacting crypto markets, don’t miss Svit Svitlo’s Weekly Market Report.

Binance announced last week that it had burned around $575 million of its Binance-coin (BNB) exchange token from circulation. The burn is part of the BNB blockchain’s “auto-burn” formula, which according to Binance, since 2017, has worked towards reducing the total supply of BNB to an eventual 100 million units. Last week’s event also included an additional burn as part of the so-called “Pioneer Burn Program”, removing from circulation an equivalent total to “provable lost funds by eligible BNB Chain users”.

Binance’s announcement stated that the recent burn was “its 22nd BNB burn and first quarterly burn of 2023”. It was initiated on transaction ID 34167E903B9F662A64817266D8A6CE4FE096868DAD0B883E4F838331E280EEFF and can be verified on the BNBChain.org explorer.

A view of BNB’s price action indicates that markets had already priced anticipation of the burn in before the event. BNB’s price dropped on January 18th (the day after the burn) from ~$302 to ~$290 and remained there for the next two days. On January 20th the price recovered to the ~$305 range, where it presently sits.

Two weeks ago, BNC reported that Russian majority state-owned bank Sberbank had launched a digital financial asset on its own proprietary blockchain, redeemable for gold and that a senior official from that bank had stated outright that the initiative was part of a greater “de-dollarization of the economy”.

The push for de-dollarization comes amidst high USD inflation as well as the politicization of the dollar system and SWIFT payment network. The blocking of the sovereign holdings of Russia, Afghanistan, and Iran illustrates the power the United States (and NATO member countries more generally) has to remove countries from the global financial system that aren’t politically aligned with the US.

This last week Zoltan Pozsar, global head of short-term interest rate strategy at Credit Suisse, published an op-ed in the Financial Times alerting readers to what he calls an assault on the “exorbitant privilege” that the US dollar holds as the global reserve currency.

Pozsar says that over the past year "China and India have been paying for Russian commodities in renminbi, rupees and UAE dirhams”; India has launched its own “rupee settlement mechanism”, and China is working with GCC countries to settle energy imports in renminbi.

As BRICS+ and non-aligned countries look for a safe means to transport value across the globe, they are increasingly looking to build their own payment networks, as (Pozsar notes) “financial sanctions are implemented through the balance sheets of western banks," and that these institutions "form the backbone of the correspondent banking system that underpins the dollar”. The construction of alternative payment networks, combined with CBDCs and “enforced with bilateral currency swap lines”, Pozsar argues, are expediting the move towards a multipolar world.

Crypto news for the weeks ahead

25 January

The Cosmos network will launch its Kava 12 DAO tooling.

31 January

The Federal Open Market Committee (FOMC) will be meeting. Possible additional interest rate hikes will be announced. Markets are presently leaning towards a sixth interest rate hike, currently expected at 25 bps.

March 2023

Ethereum’s next major upgrade since the Merge, the ‘Shanghai’ hard fork, will allow stakers to withdraw staked ETH, which presently remains locked.

Top 10 Crypto Summary

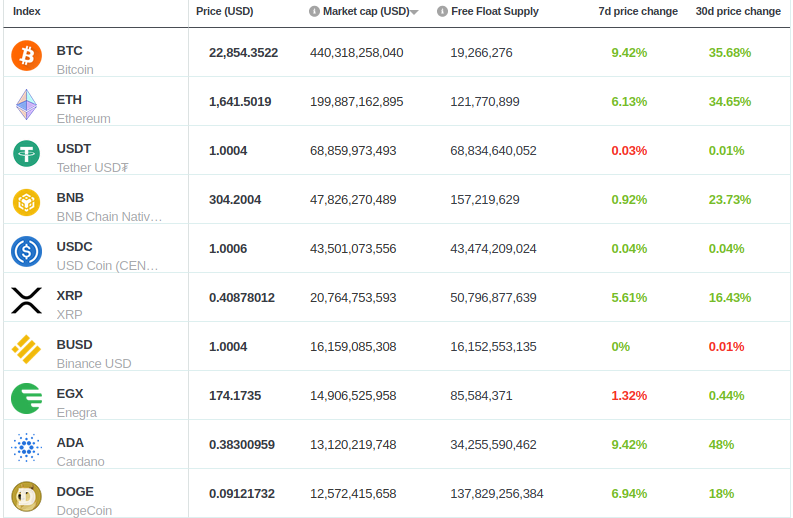

It has been yet another great week for most assets in Brave New Coin’s top 10 list by market cap — with Bitcoin (BTC) and Cardano (ADA) leading the way, both with a 9.4% climb. The present spike in the market appears to have been largely instigated by institutional investors increasing their holdings as well as (at least for now) a “softer landing” despite ongoing Fed rate hikes.

Bitcoin Price Chart

On-chain blockchain analytical service Glassnode this week noted that across several indicators, the average Bitcoin investor is finally sitting on unrealized profits. The positive news comes after a two-month low point in the aftermath of the FTX collapse in the midst of a long “crypto winter” and is a welcome relief for struggling miners. Glassnode notes that as is typical during bear markets, investors are often eager to just break even, selling at cost. Presently, the ASOPR indicator is at a value above 1, meaning that the “at cost” point has been reached for many investors.

Don’t miss out – Find out more today