Crypto Market Forecast: Week of July 12th 2021

A curated weekly summary of forward-focused crypto news that matters. This week, Chinese miners selling their GPU mining rigs, Bitcoin markets face a wave of shorts, and Binance coin readies itself for its next quarterly burn.

Digital assets dragged back and ranged in the last week. Bitcoin (BTC) ends the week down ~1%, while Ethereum (ETH) and Binance coin (BNB), the second and third largest assets end it down ~4% and up ~8% respectively. One apparent trigger for Bitcoin and Ethereum’s difficult week was news of ongoing fire sale of mining equipment in China. This has sent signals to the market that China’s miners are exiting the ecosystem, as opposed to temporarily switching off machines, because of the recent threats of heavy regulation there.

The reports say in the past month there has been an uptick in posts selling stacks of GPUs on Xianyu, one of the largest second hand goods marketplace apps in China (owned by mega technology company Alibaba). Ethereum has seen an 18% decline in hashrate since the 20th of May and another GPU mineable network, Dogecoin (DOGE), has also slid by ~27%.

When Liu He, the director of the office serving the Central Financial and Economic Affairs Commission of the CCP, made statements addressing cryptocurrencies in May, he specifically singled out Bitcoin for a crackdown. Provincial governments, however, have been more broad in their interpretation – demanding that mining farms shut off all virtual currency mining operations.

So while it may have appeared that Bitcoin would bear the brunt of Chinese crypto regulations in 2021 it now appears that the wider digital asset market will have its operations disrupted.

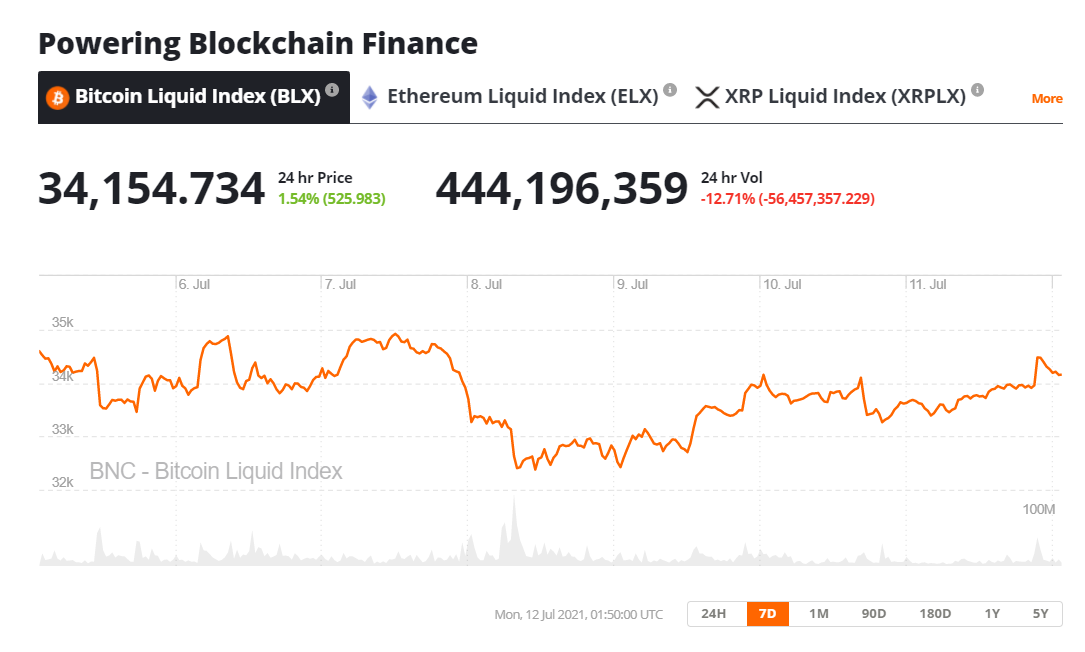

On Wednesday 7th July, the price of Bitcoin retraced from trading near US$35,000 to hit prices around US$32,000. The price drop came hours after a whale tried to short BTC with a leveraged position of at least 5,219 Bitcoin valued at ~US$173 million. The position created a glut of selling pressure and also pushed other traders on Bitfinex to try shorting Bitcoin (data provider Bybt reported a spike in BTC shorts compared to longs on the day). The price of Bitcoin has since recovered to trade around the US$34,200 price level. Since June 20th, the price of BTC has been yo-yoing in a range between US$32,000 and US$35,000 as Bulls and Bears continue to take turns playing Cat and Mouse.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

Crypto news for the week ahead

July 15th-18th – The next Binance Coin burn

Between Thursday and Sunday, Binance is expected to carry out its next quarterly coin burn. A feature of the Binance exchange platform’s native BNB coin is that burning events of the token take place every quarter. The BNB burns are paid for with 20% of the total exchange profits from the quarter. The burn resembles a dividend and by removing coins permanently from circulation, the remaining coins theoretically become more valuable. The last Binance coin burn was the largest ever and burnt $595,314,380 USD worth of Binance tokens. BNB has outperformed the rest of the crypto market in the last week rising by ~8%.

13th July – Kraken lists AXS, CHZ, OGN, and PERP

On Tuesday, July 14th, Kraken will begin supporting three new tokens – Axie Infinity Shards (AXS), Chiliz (CHZ), Origin Protocol (OGN), and Perpetual Protocol (PERP). Axie Infinity is an Ethereum-based game that has been growing in popularity since its launch and in the last week, crossed US$25 million daily volume – selling over 50,000 NFTs on the 9th of July. AXS is up ~103% in the last week.

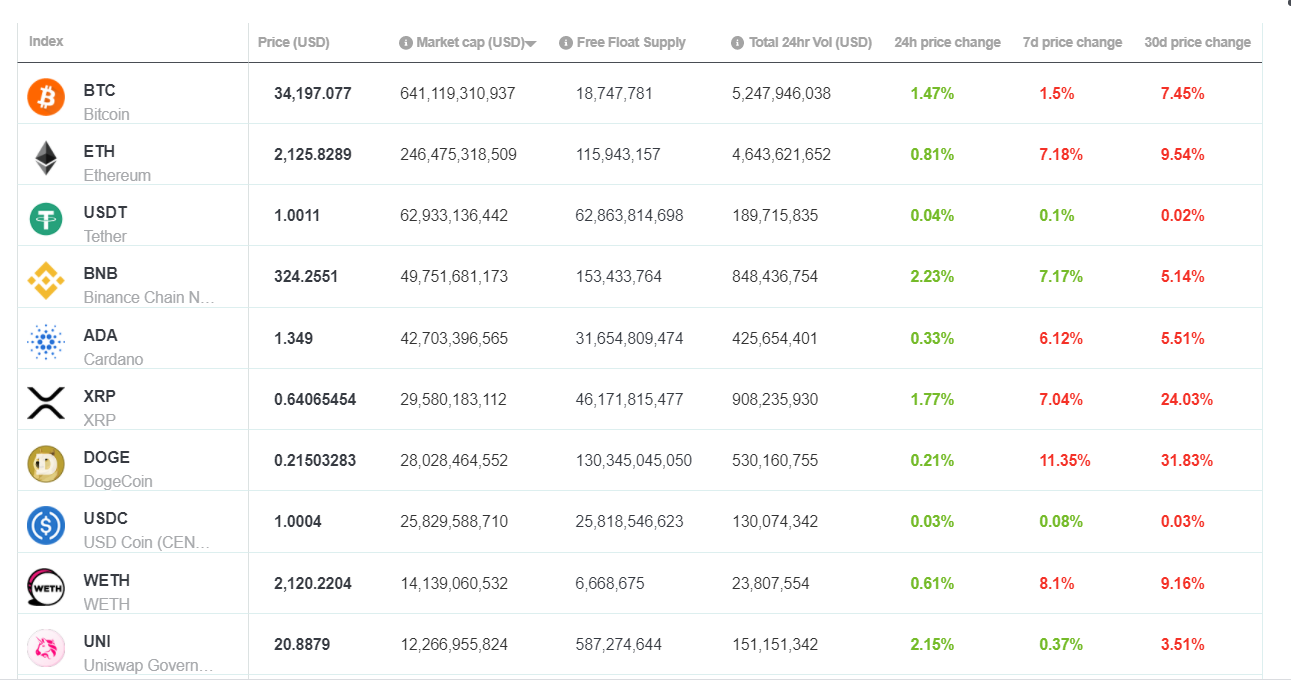

Top 10 Crypto Summary

It was a difficult week for most large-cap assets on the Brave New Coin market cap table, apart from Binance coin (BNB) which rode a wave of momentum around its upcoming burn. Popular crypto legal expert Jeremy Hogan endorsed the 5th largest asset Cardano (ADA) for conducting its ICO in Japan before the token shifted to exchanges where Americans then had access to it. Hogan says, for this reason, it is unlikely that Cardano will be targeted by the SEC anytime soon.

Bitcoin Price Chart

The Bitcoin price dropped to US$32500 price levels on Wednesday but immediately recovered and has been rising steadily since. Glassnode reports that funding rates on the BTC Perpetual Futures markets have been consistently negative since the major market sell-off in May. A negative funding rate means shorts pay longs, or that shorters have been losing. The last time funding rates remained negative for such an extended period of time was in March-April 2020 preceding a major uptick in price.

Don’t miss out – Find out more today