Crypto Market Forecast: Week of July 18th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, the US Treasury issues a response to President Biden's crypto executive order, Russia bans cryptocurrency payments and BTC rises despite bearish headwinds.

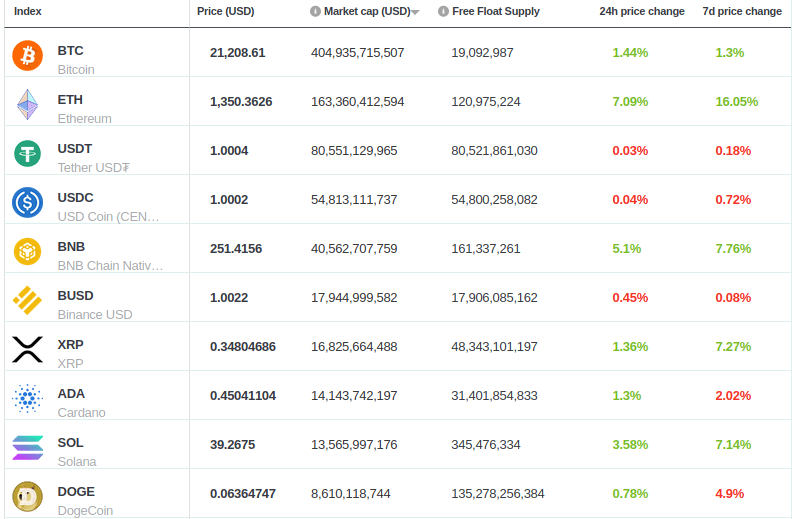

Despite a dip, Bitcoin (BTC) performance finished off the week with a ~1% recovery, currently sitting at ~US$21K. Ether (ETH) and Binance-coin (BNB), the second and third largest (non-stablecoin) assets by market cap, had strong recoveries at ~16% and ~8% for the week respectively.

Following Joe Biden’s March 2022 executive order directing US government agencies to study the “responsible development of digital assets”, the Treasury Department has issued a response entitled “Fact Sheet: Framework for International Engagement on Digital Assets”. The fact sheet highlights the usual points (consumer protections, money laundering, ransomware, etc.) but also emphasizes the need to reinforce America’s leadership in the global financial system. The overall tone is one that emphasizes the risks that (privately-issued) crypto assets bring without such emphasis on benefits that such innovations may also bring. The fact sheet calls for global governmental cooperation to ensure “compliance across jurisdictions” to crack down on “opportunities for arbitrage” that come about due to “uneven regulation”.

Following a 2020 law banning cryptocurrencies being used as a means of payment in Russia, Vladimir Putin has now signed into law a new ban on digital securities and utility tokens as a means of payment. The new law could also impact Russian citizens (even those not sanctioned) at home and abroad who have found themselves cut off from financial services in the wake of the present war in Ukraine.

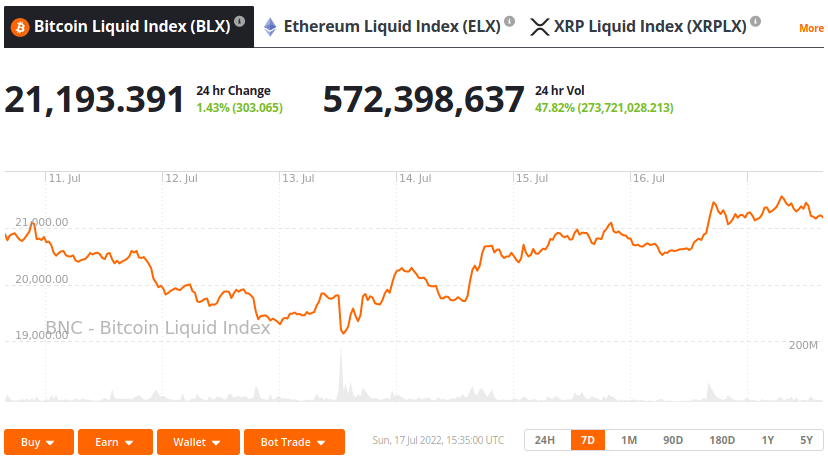

The price of Bitcoin has risen steadily since Thursday and is up ~4% in the last 3 days. This is despite inflation in the United States hitting a new 4-year high on Wednesday and Crypto lending firm Celsius filing for Chapter 11 bankruptcy the same day. The lacking of selling pressure after the events suggests markets may have already priced in high dollar inflation and the complete collapse of Celsius.

A new court filing from Celsius’s advisory partner, Kirkland & Ellis, has revealed that the firm may have a US$1.2 billion hole in its balance sheet. The filing revealed that Celsius holds $4.3 billion of assets and $5.5 billion of liabilities. This situation may worsen because part of Celsius’s asset are US$600 million in CEL tokens. At $0.78 The platform’s native token is down ~18 in the last week and down 90% from its June 2021 all time high of $7.76.

Exchange Giant Coinbase has ended its affiliate program for US customers.The company says “due to current crypto market conditions and the outlook for the remainder of 2022, Coinbase is unable to continue supporting incentivized traffic to this region.” From July 19th affiliate partners will have to list the US as a “restricted region” Coinbase says.

Crypto news for the weeks ahead

18 July

Celsius Network has filed chapter 11 bankruptcy in the United States Bankruptcy Court for the Southern District of New York and will be appearing in court on July 18th.

19-21 July

The Ethereum community is set to host a major event in Paris this week: the Ethereum Community Conference, which will include “more than 100 speakers… from all over the world, multiple side events, meetups, panels and parties”.

End-of-month in July

The smart contract platform Cardano (ADA) has delayed the “Vasil hard fork” of its blockchain. The upgrade will increase the block size limit (allowing for more transactions per block) and hopes to achieve lower transaction fees. The previous deadline was scheduled for June 29th but is now set for the final week of July.

Top 10 Crypto Summary

Ether (ETH) experienced the strongest comeback this week — up by over 16% versus the previous week. Binance-coin (BNB), XRP (XRP) and Solana (SOL) also recovered by over 7% each. Ethereum’s price jump follows a recent developer teleconference announcement for “the Merge”. The upgrade will witness the mainnet switch from proof-of-work (PoW) to proof-of-stake (PoS). After high expectations within the Ethereum community and a number of delays, the merge is currently projected to be live on the week of September 19th.

Bitcoin Price Chart

As of late, we have seen both Bitcoin holders and miners under financial stress. Glassnode on-chain analysis for the Bitcoin blockchain notes from its SOPR (Spent Output Profit Ratio) indicator that, on average, long-term holders who are spending their coins are realizing about a 33% loss and that the majority of the coins sold were acquired within the present cycle (fewer than two years ago). Similarly, if we look at miner income using the Puell Multiple indicator (one that looks at mining profitability), we see financial stress in action here as well.

Don’t miss out – Find out more today