Crypto Market Forecast: Week of July 4th 2022 – Vauld joins Celsius and others in collapse

A curated weekly summary of forward-focused crypto news that matters. This week, the digital asset markets deal with more firms facing liquidity challenges, traders attempt to short Tether, and Cardano's Vasil Hard Fork is delayed.

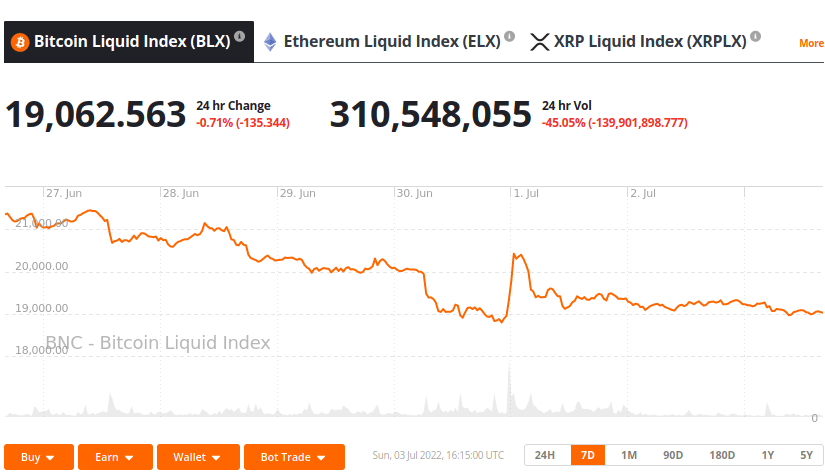

The Bitcoin (BTC) price dropped by over 10.5% this week — and is currently hovering just over US$19K. Ether (ETH) and Binance-coin (BNB), the second and third largest (non-stablecoin) assets on Brave New Coin’s market cap table, also lost value – sitting at US$1,059 and US$217 respectively, experiencing 13.8% and 9.8% drops in the last 7 days.

The digital asset industry continues to sort out overleveraged players from those that were more conservative in their investments. Over the past couple of months, following the Terra/LUNA debacle, we have seen a cascade of lending platforms on shaky ground: from Celsius, to BlockFi, to Three Arrows Capital (3AC). Allegedly, 3AC owed money to Babel Finance, BlockFi, Celsius, and Voyager Digital. The firm has now filed for chapter 15 bankruptcy in New York.

Just as we saw with Celsius, Voyager Digital and Vauld have now also frozen customer withdrawals. Voyager reportedly had “significant exposure” to 3AC, and the company claims that 3AC failed to adhere to loan repayment requirements after 15,250 BTC and $350 million in USDC were lent.

Genesis Trading, another crypto lender, faces similar trouble due to its connection with 3AC. And, as if these were not enough margin calls for one week, crypto lender CoinFlex claims that “Bitcoin Jesus” (Roger Ver) owes it US$47M in USDC. Ver refutes the claim.

Vauld founder Darshan Bathija says Vauld has called in the lawyers and suspended withdrawals – saying since the Luna/UST and Celsius failures, Vauld customers have withdrawn nearly US$200 million from the platform – a rate which he says the Singapore-based company could no longer sustain. "Our management remains fully committed to working with our financial and legal advisors to the best of our abilities," he says, "to explore and analyse all possible options, including potential restructuring options, that would best protect the interests of Vauld’s stakeholders."

Kimberly Grauer, Director of Research for blockchain analysis company Chainalysis, reported this week that on-chain transactions show the risks taken by these lending giants. As more and more lending platforms entered the market over the last bull run, they found themselves engaged in riskier investments to bring in high returns for their users – and sometimes invested in each other’s risky platforms.

Custodia Bank CEO Caitlin Long published a thoughtful article in Newsweek last week arguing that “Nowhere in Satoshi’s brilliant Bitcoin white paper did the words ‘margin call’ appear” and that “Bitcoin doesn’t need to be leveraged to deliver a positive inflation-adjusted return”.

As stated in previous weeks, the market process of weeding out the overleveraged, riskier players will be healthy for the ecosystem over the long-term.

Further demonstrating bearish market sentiment and even (more specifically) a lack of confidence in stablecoins following the TerraUSD crash, hedge funds and traders have reportedly attempted to short Tether (USDT). Considering that Tether is the third largest digital asset by market cap (including both stablecoins and non-stablecoins), Tether’s resilience to attack could have significant consequences for many digital asset holders.

Using a combination of spot market short-selling, “DeFi pools unbalancing” and buy-backs (at a hopefully lower price), the hedge funds apparently attempt to capitalize on potential liquidity weakness. So far the values have apparently reached “hundreds of millions of dollars” according to Leon Marshall, head of institutional sales at Genesis Global Trading.

Crypto news for the weeks ahead

19-21 July

The Ethereum community will launch a major event in Paris in July: the upcoming Ethereum Community Conference. It will host “more than 100 speakers from all over the world, multiple side events, meetups, panels and parties”.

End-of-month in July

The smart contract platform Cardano (ADA) has delayed the “Vasil hard fork” of its blockchain. The upgrade will increase the block size limit (allowing for more transactions per block) and hopes to achieve lower transaction fees. The previous deadline was scheduled for June 29th but is now set for the final week of July.

Top 10 Crypto Summary

Another bearish week “in the red” across the market. Solana (SOL) leads the way with an almost 20% decline versus the previous week. All other assets in BNC’s top crypto assets by market capitalization top-10 list also dropped by a minimum of 9.79% each following recent cascading events in the aftermath of Terra/LUNA in May.

Bitcoin Price Chart

Glassnode’s most recent weekly report noted that about 181,000 bitcoins were sold in June by long-term holders. In an attempt to conclude whether these long-term sellers would best be described as fearful that Bitcoin would “go to zero” or were merely buyers from the 2021 cycle selling off, “finally capitulating… [after] being underwater for so long”, Glassnode divided the coins sold off into two groups: (1) those held for two years or more and (2) those held between six months to two years.

As it turns out, very few of the coins sold were held for over two years — meaning the vast majority of those sold were held between six months to two years. As a sell off of older coins would indicate a “greater loss of conviction” (something we are not seeing), the data seem to suggest a continued belief in Bitcoin.

Don’t miss out – Find out more today