Crypto Market Forecast: Week of July 5th 2021

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin has its largest ever difficulty adjustment, Ethereum surges as anticipation around the London hard fork heats up, and Bitcoin mining profitability looks set to rise in the short term.

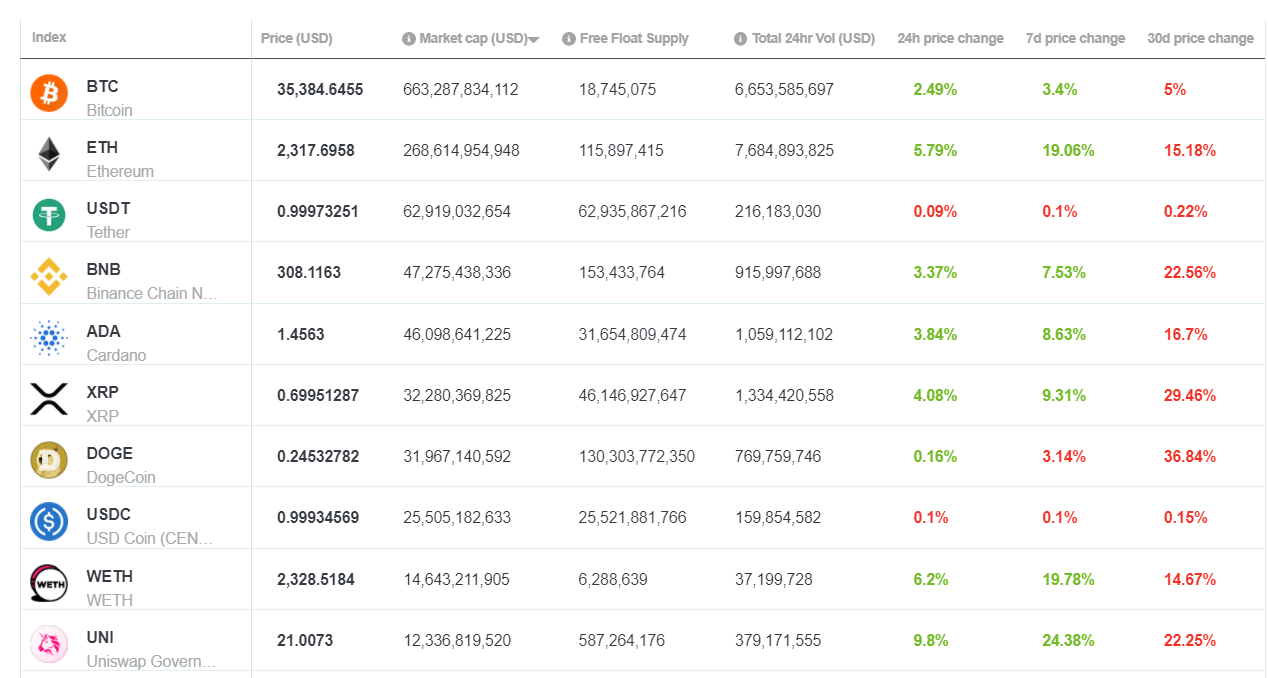

Digital asset markets have enjoyed a week of healthy gains. The Bitcoin price ends the week up ~2% but was outshone by the 2nd largest asset on the Brave New Coin Market table, Ethereum (ETH), which finished the week up ~17%. The fourth and fifth-largest assets on the market cap table, Binance Coin (BNB) and Cardano (ADA), are up ~15% and 16% respectively.

On Saturday, the Bitcoin network underwent its biggest mining difficulty adjustment ever. Mining difficulty dropped by a drastic ~28%. Bitcoin’s difficulty adjusts approximately every two weeks in order to keep the average time between blocks steady as the hash power of the network fluctuates.

The Bitcoin hashrate has fallen dramatically in recent weeks as the Chinese government has cracked down on China’s mining and cryptocurrency industry. Since June 9th, the network hashrate has dropped by ~43% as miners in regional hubs like Inner Mongolia, Sichuan, and Yunnan have switched off machines due to regulatory threats. This has led to daily average block times on Bitcoin rising to between 14-24 minutes, well above the network’s target of 10 minutes per block.

Network difficulty has thus adjusted downwards to accommodate a less power-hungry, competitive bitcoin network. Accompanying this drop in difficulty and hash power has been a drop in Bitcoin transaction fees. Following the difficulty adjustment, fees for transacting have dropped from US$10 to US$6 and a cheaper, faster BTC may have been a factor in the asset’s strong price performance in the past week.

Ethereum’s bullish week was driven by momentum and expectations around the upcoming London hard fork that is set to be implemented in mid-July. The London upgrade will bring in five key Ethereum Improvement Proposals (EIPs) —EIP-3554, EIP-3198, EIP-3529, EIP-3541, and the hotly anticipated EIP-1559. EIP1559 will introduce a base fee to Ethereum transactions that will represent the minimum fee to be paid for a transaction to be included in a block. The fee will be burnt and a mechanism within EIP-1559 will allow for the dynamic expansion and contraction of block sizes to address Ethereum’s congestion issues.

London was launched on the Ropsten testnet on June 24th, and the London upgrade will be also be deployed on Ethereum’s Goerli, Rinkeby, and Kovan testnets before an eventual release on the Ethereum mainnet.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

Crypto news for the week ahead

July 5th – Polkadex launches the final testnet version of its orderbook

Polkadex is a new orderbook based decentralized exchange set to be launched on the Polkadot blockchain. The DEX aims to deliver high throughput and low latency trading using an orderbook based system – and during previous tests speeds of up to 500,000 transactions per second were reached. During the testnet, users will be able to try out the platform with simulation trading and testnet tokens.

July 6th – Covalent (CQT) trading starts on Kraken

On Tuesday, July 6th, Kraken will begin supporting Covalent Query Token (CQT). The Covalent project provides an API for any individual, company, or decentralized application to access blockchain data from networks like Ethereum (ETH), Polkadot (DOT), and Elrond (EGLD). CQT is Covalent’s native token and powers payments between developers querying for data and validators who answer those queries

Top 10 Crypto Summary

It was a strong week of trading for large-cap assets on the Brave New Coin market cap table. Ethereum based assets in particular performed strongly. Major decentralized finance tokens like Uniswap (UNI), Aave (AAVE), Maker (MKR), and Curve (CRV) all had strong weeks with gains exceeding 20%. UNI was the best-performing asset in the top 10, gaining on the back of major crypto market data provider CoinMarketCap launching a Uniswap-based swap feature.

Bitcoin Price Chart

Bitcoin traders will hope that the bullish gains over the weekend will carry on into the new week. The exodus of miners and hashrate out of China may have some short-term negative consequences for the network. Some market participants, however, say it is likely to lead to an increase in mining profitability and opportunities for new mining projects across the globe to occupy the space left behind by the banned Chinese mining operations.

Don’t miss out – Find out more today