Crypto Market Forecast: Week of May 1st 2023

A curated weekly summary of forward-focused crypto news that matters. This week, a new report offers arguments that bitcoin is undervalued, Bitcoin's block reward halving is getting closer, and more BTC holders are in a position where they are holding unrealized profits.

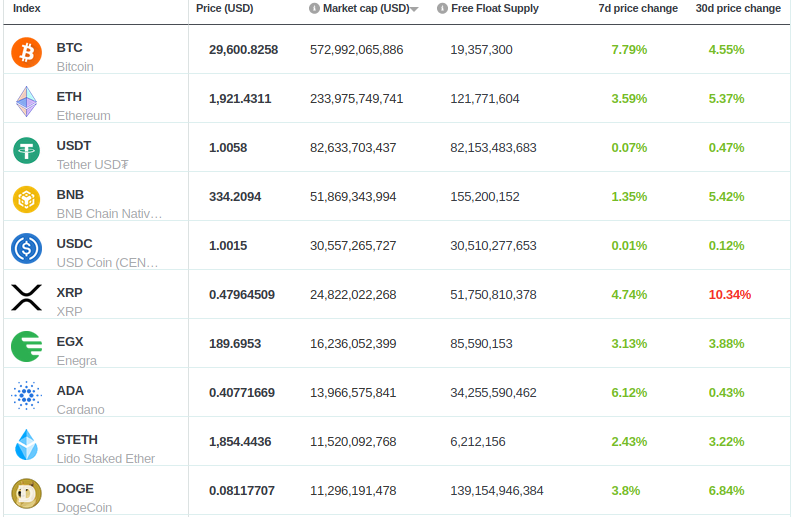

The price of Bitcoin (BTC) has risen by 7.8% since last week, to ~US$29.6K. Ether (ETH) rose by 3.6% to ~US$1.9K. Binance-coin (BNB) similarly had upward price movement, by just 1.4%, to ~$334.

Adamant Research and Unchained have partnered to publish Tuur Demeester’s latest report, arguing that in the present bear market, Bitcoin offers “an exceptional opportunity for value investors”.

Demeester released previous reports of this kind in 2012, 2015 and 2019, each time Bitcoin’s price proved (over time) to be subsequently undervalued. This latest April 2023 release argues that “During this accumulation phase, we expect for bitcoin to trade in a range of $22,000 to $42,000, until a new multi-year bull market pushes it well north of $120,000”.

In the report, entitled “How to Prepare for the Bitcoin Boom”, Tuur Demeester makes the bullish case for Bitcoin, arguing that: Bitcoin is undervalued, that it’s decoupling from stocks is around the corner, that the global macroeconomic uncertainty makes Bitcoin particularly attractive, that the startup environment is “complicated but attractive”, that nation-state adoption is “set to become a big theme”, and that collaborative custody will reduce risk of lost coins for new users.

An interesting part the report is a regulatory section entitled “Could Bitcoin See a Legal Crackdown?”. For the short-term, Demeester argues that Bitcoin is largely unaffected by the regulator scrutiny across “crypto” because much of the regulation by enforcement is around fraud and securities. SEC Chair Gary Gensler’s has had clarity in his statements that Bitcoin is not a security. Regulators could (and do), target the on-ramps to Bitcoin as well as go at it from various custodial angles (targeting both self-custody and custodial services). But the regulatory threat against Bitcoin, Demeester argues, is “most likely… when a new BTC price melt-up makes headlines in conjunction with widespread concerns over inflation of the US dollar – and for that it would need to be a magnitude larger than it is today”.

Bitcoin’s next halving (or “halvening”) event is presently estimated to land at end-of-April 2024, and historically this has been a trigger for bull markets. Many view the current macroeconomic turbulence the includes crises of war, banking, currency, and even political legitimacy itself, along with Bitcoin’s increasing correlation to gold over the past 12 months, as further potential triggers for upward price movement.

At block height 840,000, Bitcoin’s block reward, for successfully-mined blocks, will halve from 6.25 coins to only 3.125. This will continue at the same rate for another 210,000 blocks. Roughly another four years. Miners are showing signs that they are acquiring coins while a 6.25 coin reward is maintained. With mining difficulty at historic highs, this doesn’t come without significant cost. Meanwhile, total miner revenues remain low, as do total transaction fees.

Crypto news for the weeks ahead

May 2-3

The FOMC will be meeting. Futures markets are predicting a high probability of a 25 bps interest rate hike.

May 10

The Consumer Price Index data for April 2023 will be released – one of the indicators the Federal Open Market Committee (FOMC) watches when considering interest rate hikes.

May 26

The US Bureau of Economic Analysis’ (BEA’s) release of March’s Personal Consumption Expenditures (PCE) numbers will be released. This is one of the primary indicators used by the FOMC when considering interest rate levels.

Top 10 Crypto Summary

Digital assets in BNC’s top 10 market cap experienced an upward price climb across the board this week. This seems to come as a correction from last week’s price drop following ongoing uncertainty in the traditional banking sector along with regulatory uncertainty only having heightened just after SEC Chair Gary Gensler’s appearance at the House Financial Services Committee on April 18th.

Bitcoin Price Chart

Since December 2022, we have seen the vast majority of coins moving away from unrealized losses to unrealized profits. GLASSNODE’s report this week notes that at this point, with a wide divergence between those unrealized profits to losses), the incentive to realize those profits grow. This suggests short-term bearishness and downward price pressure if traders start to sell. Check Svet Market’s Weekly Update for other important macro economic data impacting the Bitcoin price.

Don’t miss out – Find out more today