Crypto Market Forecast: Week of May 23rd 2022

A curated weekly summary of forward-focused crypto news that matters. This week, the World Economic Forum discusses CBDCs, the market focuses on the transparency of top stablecoins, and Solana drops sharply in value.

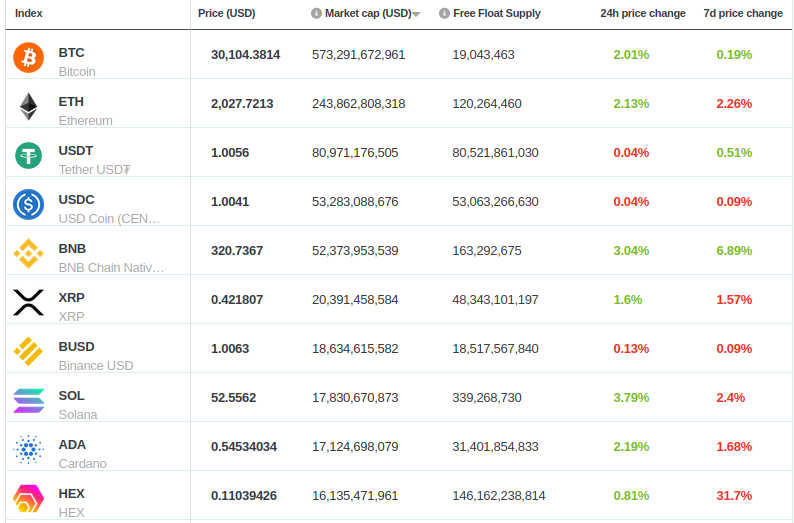

Another challenging week for crypto sees the Bitcoin (BTC) price continue to range around the US$30K mark. Ether (ETH) is down just over 2% (US$2K), and Binance coin (BNB) is up by almost 7% (~US$320). The latter two maintain their status as the second and third largest (non-stablecoin) assets on the Brave New Coin market cap table.

The crypto-ecosystem as a whole has taken a dive following not only the macroeconomic environment (and arguably a correction from the “free money” era of COVID spending) but also since the TerraUSD and Luna series of events, beginning on May 8th. But the broader ecosystem of the traditional financial system also felt the pinch. MicroStrategy, Coinbase, and Robinhood all saw drops in their stock prices following 8 May (albeit with some recovery since then).

MicroStrategy currently owns over 129,000 bitcoins, and its CEO, Michael Saylor, has said his company would buy more if the BTC price dropped to the US$21K price point. Saylor has called MicroStrategy a “non-existent spot ETF”. But as an ongoing strategy, the company “will be buying bitcoin at the top forever”. MicroStrategy’s new CFO, Andrew Kang, confirmed in an interview with the Wall Street Journal this week that “There are no scenarios that I’m aware [in which] we would sell”.

Some Learnings From The Terra/Luna Debacle

The idea of algorithmic stablecoins, and even stablecoins more generally, pose some problems that deserve close consideration.

First, there is the problem of centralization. Terra tweeted on May 12th that they had “halted” their blockchain. This in itself shows just how centralized the Terra blockchain was to begin with. (For benchmarking, compare this to Bitcoin’s ~15K reachable “full nodes”). Certainly it is arguable that a stablecoin (whether backed by real assets or algorithmic) must be centralized so that somebody can be held accountable for its ‘stability’. But to the extent that you centralize, you necessarily move away from the trustlessness (or “trust minimizing”) characteristic that cryptographic assets are supposed to represent.

Second (yet another point of centralization), the Terra blockchain is a proof-of-stake (PoS) model, which despite the perk of relative environmental friendliness, prompts the envitable questions of “Who then owns the majority of the stake? And what are the stakeholders’ interests and values?”

Third, just how good is the algorithm that has been deployed for this “stable” coin’s supposed stability? The very fact that the Luna Foundation Guard acquired ~80K bitcoins in the first place to maintain the 1:1 peg between TerraUSD and the US dollar implies, on one hand, some level of conscientiousness on their part in case something were to “go south” (as it did) but, on the other hand, a lack of confidence in their own algorithm.

The 20% yield offered by the Anchor protocol for TerraUSD holders led investors to skip due diligence that they otherwise might have done. And the inflationary climate in which we now live pushed investors towards higher risk, higher potential reward like TerraUSD and Luna to begin with. The two factors are interconnected in a subtle but important way.

Does Mike Novogratz possess the world’s most regretable tattoo?

Crypto news for the week ahead

24 May

The DC Blockchain Summit will focus on public policy around crypto Tuesday, with both in-person and streaming tickets available for the event. The summit will host top industry leaders, legislators, and regulators.

25 May

Community voting on whether to implement the proposed Terra Luna rescue plan ends. The plan involves the creation of an entirely new Terra chain and the airdropping of its tokens to existing holders of Luna and UST. At the time of writing, votes in favor were at 65%.

24-26 May

An online event called Metaverse Ecosystem & Investment Conference will discuss NFT, DeFi, gaming, and more. The event will focus on the Asian market with industry speakers from around the region.

Top 10 Crypto Summary

With the exception of Binance coin (BNB) and HEX (HEX), this week’s top crypto asset prices by market cap are strikingly similar to the week before. HEX was the hardest hit, with almost a 32% drop versus the previous week. Although the reason for HEX’s sharp drop in price is unknown, the ERC20 token’s boast of 38% average annual staking returns is reminiscent of the unusually high yields (20% annually) offered to holders of not-so-stablecoin TerraUSD (UST) on the Anchor protocol before the recent death spiral. This, along with HEX battling accusations of it being a scam, seem indicative of market participants derisking under the current climate.

Bitcoin Price Chart

Bitcoin still struggles to fully recover after the downward push as the Luna Foundation sells off the majority of its 80K bitcoins in a failed attempt to maintain the 1:1 peg of its TerraUSD “stable” coin. Glassnode notes that the bitcoin selloff was among the largest realized losses in its history (summing all realized losses divided by total market cap at the time of sale).

Don’t miss out – Find out more today