Crypto Market Forecast: Week of May 31st 2021

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin bounces, Michael Saylor organizes a mining council with Elon Musk, Ether trading volumes exceed Bitcoin, and Uniswap jumps as it prepares to integrate a layer 2 scaling solution.

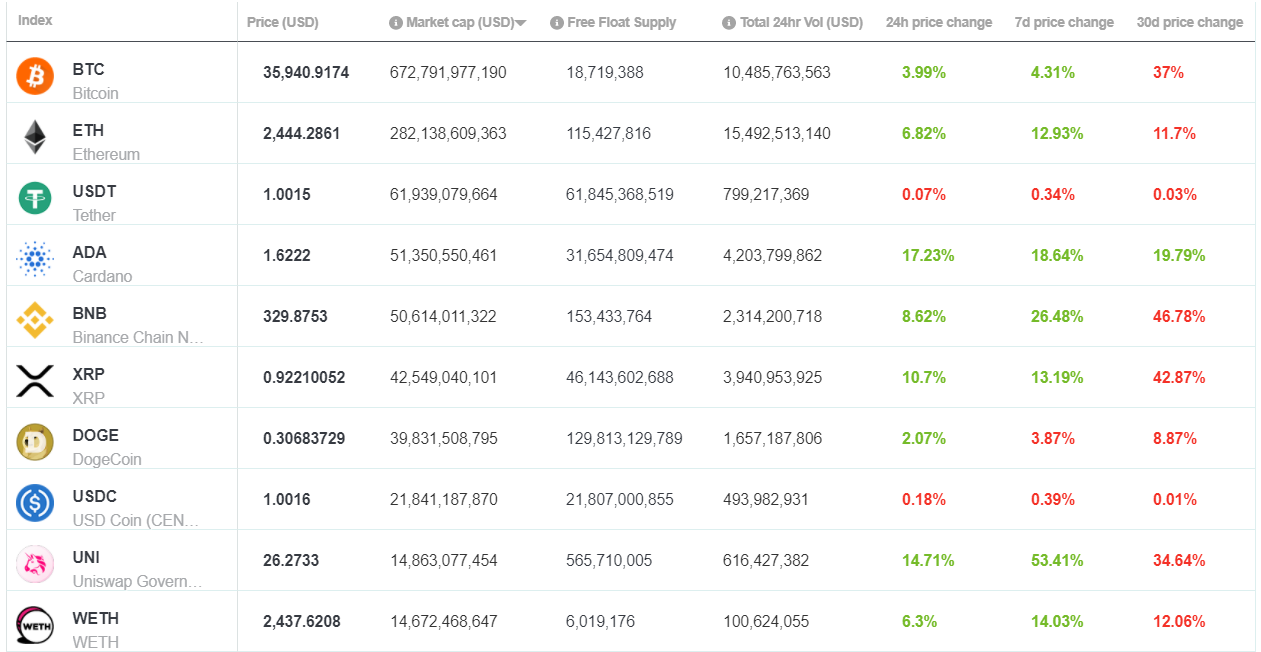

A volatile week in digital asset markets ends with the price of bitcoin (BTC) green and up by ~6%. Ethereum (ETH) and Cardano (ADA), the second and third largest assets on the Brave New Coin market cap table, are up 19% and 33% respectively.

Speaking Tuesday at the Consensus 2021 conference, MicroStrategy CEO and Bitcoin mega bull Michael Saylor announced the formation of the Bitcoin Mining council. Saylor says the “loose” group will be formed with Elon Musk and a selection of North American miners and it will work towards publishing transparent mining energy usage data. The mission of the council will be to address concerns and negative narratives that Bitcoin is not environmentally friendly.

Saylor said he was initially able to connect Musk with a group of eight North American miners, who are estimated to control about 10% of Bitcoin’s hashrate, and host a discussion around the energy usage of the network. On Twitter, Musk suggested the meeting had a ‘promising’ outcome. The formation of the Bitcoin mining council appears to have been driven by this initial meeting.

Musk’s tweet galvanized Bitcoin buyers on Monday, pushing the price of the asset to reach US$39,500 having started the day around US$35,500. Musk and his company Tesla have shown a concerning ability to influence the Bitcoin price and market sentiment. In February, Tesla’s announcement that it had purchased around $1.5 billion of Bitcoin is credited as being a major driver of 2021’s Bitcoin bullrun. Then last month, Tesla’s announcement that it would stop accepting Bitcoin for car purchases because of environmental concerns drove heavy selling and market anxiety that shaved over US$350 million off BTC’s market cap.

Last week, The spot trading volume of Ethereum exceeded Bitcoin for three straight days. This backs the narrative of market observers and fund managers like Raoul Pal that crypto investors are increasingly shifting from Bitcoin to Ether. 24 hour trading volumes in Ethereum markets are currently around US$30 billion and have been rising thanks to demand to use the Ethereum network (Ether is used to pay for all transaction fees on the network) and a positive macroeconomic outlook.

Positive macro tailwinds include — the Ethereum 2.0 staking contract now has over 5 million ETH committed to it, A number of ETH ETFs have been filed by major financial institutions in the US, and a major update, EIP1559, is set to be launched in July that will add a deflationary element to ETH that will feed into its thesis of being a sound money asset.

Crypto news for the week ahead

June 1st – Mina protocol (MINA) begins trading on Kraken

Popular global exchange Kraken will begin supporting trading for the MINA token on June 1st. The token supports the Mina protocol and was developed as the world’s first ‘compressed’ blockchain platform. The entire blockchain is 22kbs in size – compared to the Bitcoin blockchain which is 300gbs. Trading will open with MINA/USD, MINA/EUR, MINA/GBP, and MINA/BTC.

June 1st – VanEck Crypto ETN’s list for trading on French and Dutch stock exchanges

On Tuesday, global investment manager VanEck will list its Vectors Bitcoin exchange-traded note (ETN) and Vectors Ethereum ETN on the Dutch and French portions of Euronext. This continues VanEck’s product expansion in Europe following the launch of a Bitcoin ETN in Deutsche Boerse Xetra. In the USA, the Securities and Exchange Commission (SEC) is currently weighing up the potential approval of a pair of VanEck Bitcoin and Ether exchange-traded funds (ETFs).

Top 10 Crypto Summary

It was a strong, but volatile, week for large-cap assets on the Brave New Coin market cap table. Uniswap (UNI) is the top-performing asset on the list. There has been excitement from Uniswap users in the last week because the exchange is set to deploy on layer-2 solution Arbitrum. Uniswap is the largest DEX on Ethereum and this move will allow it to offer cheaper and faster trading solutions.

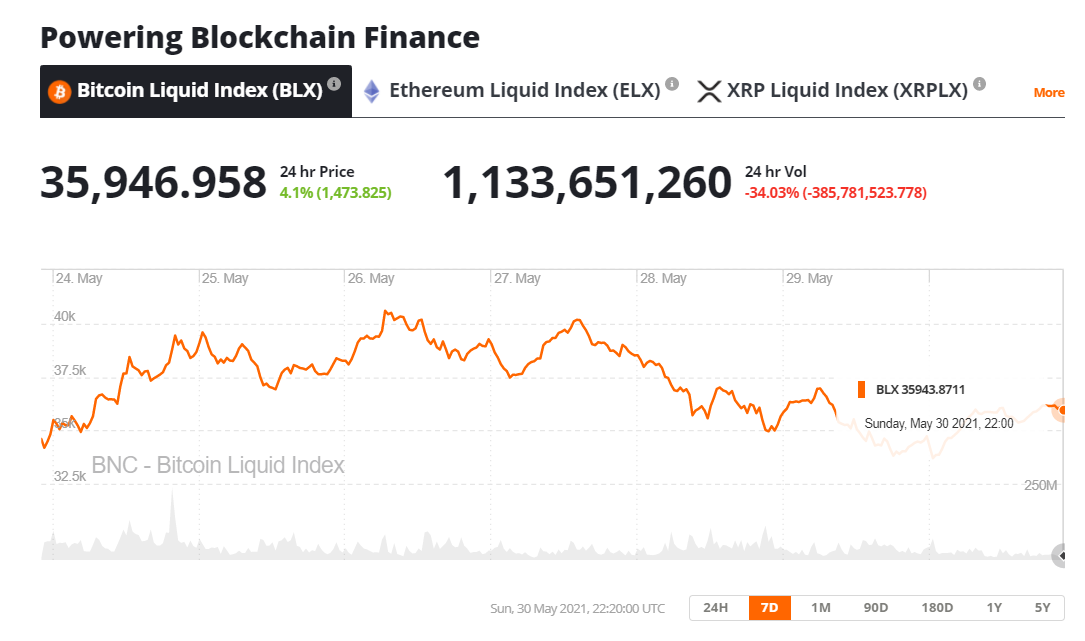

Bitcoin Price Chart

The price of Bitcoin is up ~6% since the start of the week but the US$40,000 price level has been flatly rejected on multiple occasions. Sentiment in BTC markets appears to be leaning towards circumspect and anxious with the Crypto Fear and Greed Index hitting a point of ‘Extreme Fear’ and a score of 10. According to the indicator, sentiment in crypto has dropped considerably 3 months. In early March, Fear and Greed Index had a score of 78 and was in a state of ‘Extreme Greed’. This reversal suggests that many market participants have had their fill of profits and our sitting back now.

Don’t miss out – Find out more today