Crypto Market Forecast: Week of November 15th 2021

A curated weekly summary of forward-focused crypto news that matters. This week, bitcoin hits a new all-time high, drops off, and then recovers. The network also completed its first major upgrade in almost four years, aiding in its price recovery.

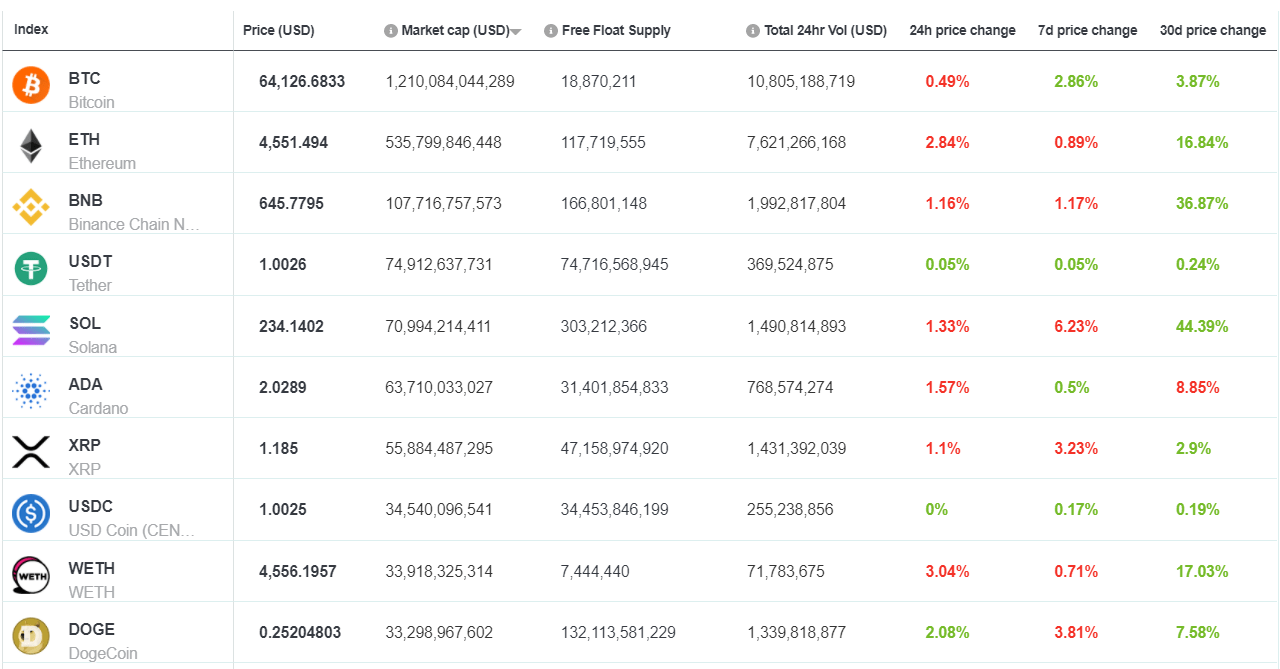

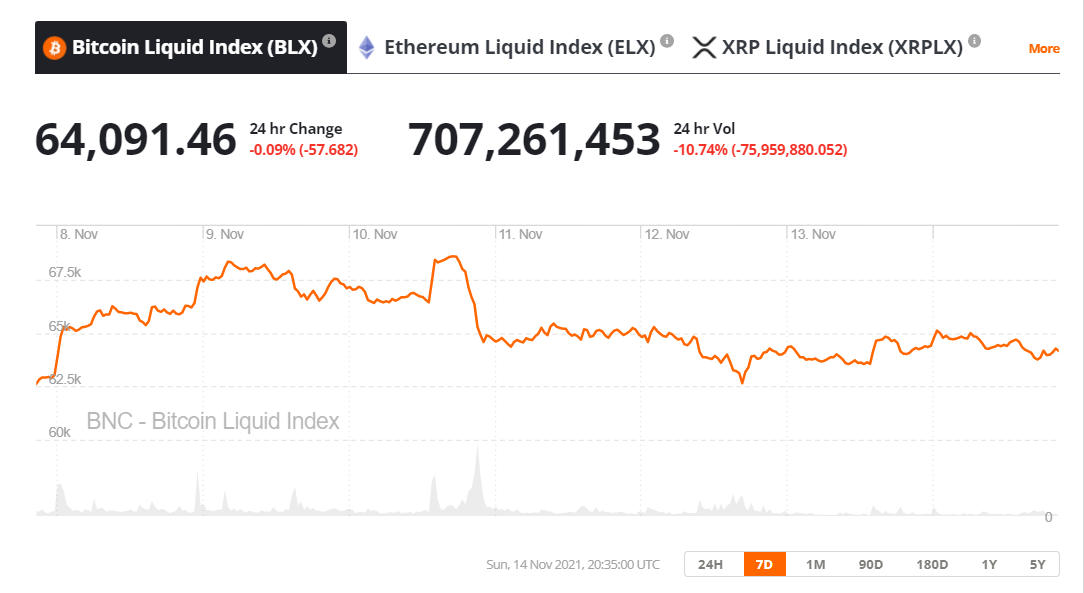

Digital asset markets appear to be stabilizing having found support following a market-wide crash on Wednesday. Bitcoin (BTC) ends the week up ~3% and trading around ~US$64,100. At one point earlier in the week, however, the BTC price touched ~US$69,000 on major exchanges. Ethereum (ETH), and Binance-coin (BNB), the second and third largest assets on the Brave New Coin market cap table, are both down ~1% in the last week.

Risk markets tanked last Wednesday after concerns surrounding a potential loan default by Chinese mega property developer, Evergrande. Ultimately the company averted a crisis and was able to make last-minute debt payments – with Bloomberg confirming on Thursday that customers of international clearing firm Clearstream had received overdue interest payments on three Evergrande dollar-denominated bonds.

Evergrande had to make this latest round of payments before a 30-day grace period ended on Wednesday. While the lateness of the payments created market anxiety, it appears Evergrande has been able to restructure its debt for now. A series of articles from Chinese state media signaling that support was arriving, helped reduce stress in markets. After the Bitcoin price slipped down to support at US$62,500 on Friday it has since recovered.

Another factor behind the severity of Bitcoin’s price drop from US$69,000 to below US$63,000 was an overleveraged derivatives market. Data from Coinglass indicates that US$536 million worth of BTC long positions were liquidated on Thursday. This resulted in a long squeeze on Thursday. Long squeezes occur when long traders are forced to close their positions (at a loss) due to a sudden price drop. These traders are forced to cover, by selling, to quickly save positions before the price goes even lower. The easy access to leverage in crypto (reduced capital & KYC requirements) accentuates this factor.

Aside from Evergrande averting a default, another driver of Bitcoin’s recovery is bullishness surrounding Taproot, a major upgrade to the Bitcoin network. Taproot was deployed on Sunday after four years of development. The upgrade has been celebrated across the crypto community and is much less contentious than the network’s last major upgrade, Segwit. Disagreements around the execution of Segwit were the key reason for the Bitcoin Cash hard fork in 2017.

Taproot is an upgrade that focuses on back-end improvements like Signature aggregation. As a result of Taproot — Users of Multi-signature transactions will now have greater privacy, the capabilities of the lightning network are set to expand and it may allow the network to have some advanced smart contract solutions in the future.

Crypto news for the week ahead

November 16th – Vechain begins upgrade to POA2.0 consensus model

The Vechain project will begin a phase 1 activation on its VechainThor blockchain as it transitions to its novel POA2.0 consensus model. “This major upgrade to the network greatly enhances finality and data security by uniquely combining the two most common consensus types – the Nakamoto and Byzantine Fault Tolerance (BFT) consensus mechanisms,” Vechain explains. VeChain (VET) is up ~33% in the last month.

November 17th-18th – Stellar Meridian conference

This week Stellar (XLM) hosts its annual community conference, Meridian, with the theme of “build locally, impact globally.” Speakers at the conference include Dante Disparte, Chief Strategy Officer at Circle and Jed McCaleb, the co-founder and Chief Architect of the Stellar Development Foundation. In the past, McCaleb was a guest on BNC’s crypto conversation where he discussed Stellar’s intentions to enhance rather than replace the existing financial system. The price of XLM is up ~3% over the last week.

Top 10 Crypto Summary

It has been a mixed week for the market cap top 10 with most assets buffeted from the winds affecting risk markets, higher than expected inflation, and Evergrande fears. Data provider Santiment reports that Activity Address activity on Ethereum continues to spike despite a recent Ether uptick. The asset is up ~21% in the last month. Users are jumping onto the network despite its present ‘expensive’ price and high transaction fees.

Bitcoin Price Chart

A strong streak of Bitcoin price momentum peaked on Thursday when the BTC price on the BLX pushed to US$68944.6172. Glassnode reports that a large chunk of coins, ~474,000 BTC, was spent above the US$65,000 price level. This indicates there are still new, committed buyers to the BTC markets who are holding onto an unrealized loss.

Don’t miss out – Find out more today