Crypto Market Forecast: Week of November 7th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin and crypto maintain momentum as US citizens head to the polls, DOGE continues to rally as the market speculates on Elon Musk's Twitter payment plans, and traders prepare for key US economic announcements in the coming week.

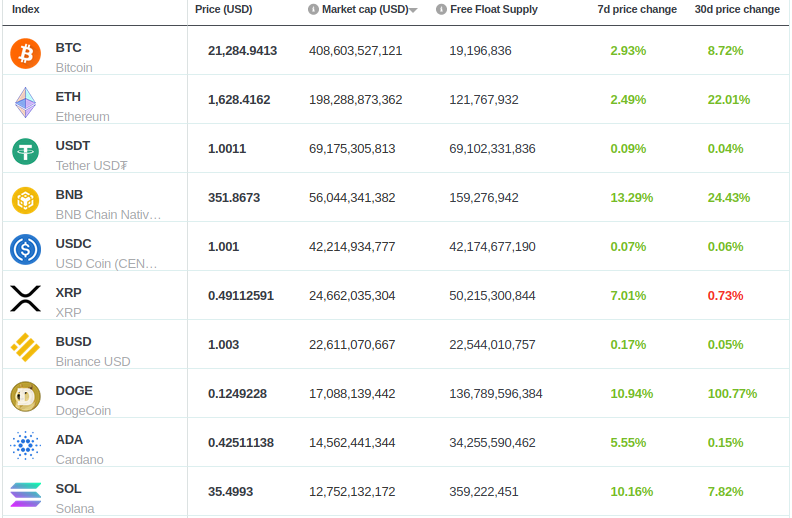

The price of Bitcoin (BTC) has risen by 2.9% this week and currently trades around ~US$21K. Ether (ETH) also had a moderate spike. It is up by 2.4% and trades for ~US$1.6K. Binance-coin (BNB) had a solid 13.3% increase and currently trades at ~US$351.

The fate of cryptocurrency regulation is on the line as US voters go to the ballot-box to place their votes for candidates for both the House and Senate. Tuesday, November 8th is the official date, but CNN reports that as of November 5th, over 34 million votes have already been cast across 47 states.

The next couple of years are likely to produce cryptocurrency regulation that should clarify who-does-what and put the turf battle between the Securities and Exchange Commission and Commodity Futures Trading Commission to rest. It will also see regulators take a stab at consumer protections as the Digital Commodities Consumer Protection Act (DCCPA) will attempt to do, set standards for stablecoins (in the aftermath of Terra-LUNA), and determine if regulators will continue to allow private issuers of stablecoins at all or nudge towards their obsolescence in lieu of a central bank digital currency (CBDC).

According to CoinDesk, “crypto lobbying” has reached an unprecedented milestone ($80 million) — matching that of health care, energy and even Wall Street. The Crypto Action Network, a project by Coinbase, ranks candidates using a scorecard according to their level of “crypto-friendliness”, with “A” being the highest score and “F” being the lowest. For both the Senate and House, the Crypto Action Network suggests a strong level of bipartisanship.

We noted last week the handsome jump in DogeCoin’s (DOGE) price following the news of Elon Musk’s successful Twitter acquisition. On Monday of last week, Fortune published an article expanding on Musk’s interest in Twitter as a payments platform.

Custodia Bank CEO Caitlin Long reminded Fortune in an interview of a reoccuring theme across Musk’s career: the ongoing attempt to disrupt ACH payments (first at X.com, then at PayPal). Further, Musk may succeed with payments where Facebook failed with Libra, Long argues, by utilizing Bitcoin’s Lightning network — thanks to its decentralized structure and reduced political baggage.

Further backing the narrative that Musk’s interest in Twitter is primarily about payments is a pitch deck for investors summarized by the New York Times in May this year. The deck allegedly stated the objective to make $15 million from payments over Twitter in 2023, with the expectation to grow it to $1.3 billion by 2028. Musk’s acquisition also comes with the financing and partnerships from major players in crypto and PayPal.

Crypto news for the weeks ahead

10 November

The US Bureau of Labor Statistics will release its Consumer Price Index (CPI) numbers for the month of October. This is a key indicator the Fed will look to when it considers even further rate hikes going forward.

1 December

The Theta Network will launch its “Metachain” on December 1st.

14 December

The Federal Open Market Committee (FOMC) will be meeting. Possible additional interest rate hikes will be announced. Markets are presently split between a 50 and 75 bps rate hike. To the extent that crypto assets may still be seen by traders as risk-on, this would mean downward price pressure.

Top 10 Crypto Summary

Only positive news all the way down this week for Brave New Coin’s top-ten assets by market cap. Since last week, Binance-coin (BNB) rose by over 13%, DogeCoin (DOGE) by nearly 11%, and Solana (SOL) by just over 10%. On October 6th, BNB’s Smart Chain suffered a major hack, after which time, the price fell from $296 to $261 just a week later. Since then, BNB’s price has recovered strongly, now reaching its May 8th price point, the date of the infamous Terra-LUNA death spiral.

Bitcoin Price Chart

Following Bitcoin’s recent decoupling from tech stocks (at least over the short-term) Glassnode looked at a couple of indicators that imply that Bitcoin’s bottom may have already been reached in the $18-19K ballpark price range. If we look at the UTXO Realized Price Distribution, for example, we notice that many of the coins that have been acquired during the present bear market were acquired by sellers that purchased those coins at much higher price points. This lower cost basis for the new owners of those coins implies much less psychological pressure to sell.

Don’t miss out – Find out more today