Crypto Market Forecast: Week of September 19th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, high inflation rates in the US spook investors & make more interest rate rises likely, the Ethereum price drops post Merge, and a South Korean court issues an arrest warrant for Terra/Luna founder Do Kwon.

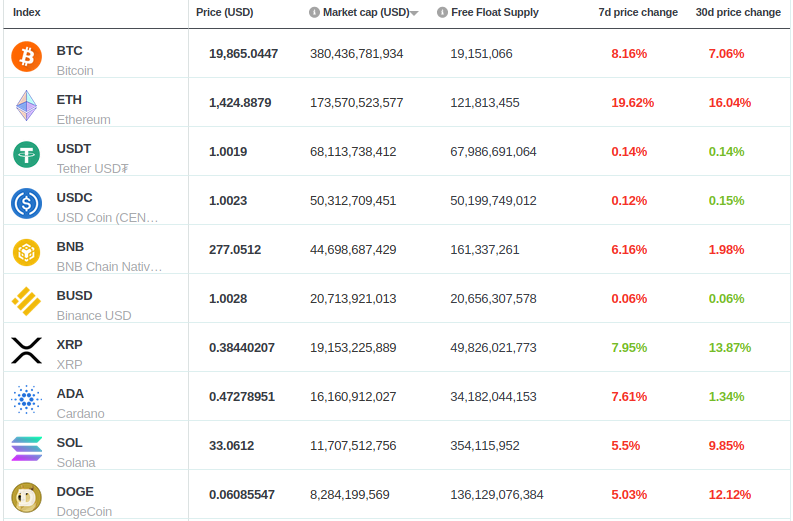

The Bitcoin price (BTC) finished the week down 8% and currently sits at just under US$20K. Ether’s (ETH) price plummeted by nearly 20% to ~US$1.4K despite the long-awaited “Merge”. Binance-coin (BNB) also fell by 6% to ~US$277.

On Tuesday of last week, the US Bureau of Labor Statistics released the August Consumer Price Index (CPI) numbers, revealing an overall 8.3% increase in price across a consumer basket of goods over the past 12 months. On August 26, Fed Chair Jerome Powell signaled a potentially “unusually large increase” in the federal funds rate “depend[ing] on the totality of the incoming data and the evolving outlook”. With current relatively low unemployment, the Fed may be in a position to more confidently lift rates.

CME Group’s FedWatch Tool shows that markets are pricing in an 82% probability of a third consecutive 75 basis point (bps) hike for the Fed funds target range (to 3.0%-3.25%) and another 18% probability of 100 bps to be announced at the next FOMC meeting on Wednesday this week.

With the USD suffering its highest inflation in four decades, additional spending programs from Washington (seemingly contradicting the Fed’s stated plan to control inflation), continued Fed rate hikes, and the market still treating “crypto” as a risk asset, we are likely to see continued downward price pressure for crypto assets.

American cryptocurrency services company Abra announced last week that it will launch a crypto bank both in the United States and abroad. Abra Bank will be state-chartered as a full bank (not a trust) to serve the US market, while Abra International will focus outside the US.

Abra CEO Bill Barhydt said in an interview that the company expects to launch by Q1 2023. He says Abra not seeking to access Fed master accounts has also allowed the company to speed up the regulatory process.

Abra Bank’s upcoming banking services include credit cards, NFT services, and interest-earning accounts for digital assets.

A South Korean court has issued an arrest warrant for Terraform Labs co-founder Do Kwon and five other individuals. The allegations assert that the individuals violated the country’s capital markets laws.

Do Kwon is said to have relocated to Singapore sometime following March’s Terra/LUNA collapse. Yahoo Finance reported that Korean prosecutors will request the support of Interpol so that Kwon can be arrested even while residing outside of the country.

Crypto news for the weeks ahead

21 September

EOS will launch its Leap 3.1 upgrade (previously referred to as “Mandel 3.1”).

21 September

The Federal Open Market Committee (FOMC) will be meeting. The market expects the Fed to proceed with further interest rate hikes to tackle inflation and inflation expectations.

22 September

The Cardano blockchain has confirmed a new projected date for the Vasil hard fork, which will increase the block size in an effort to lower transaction fees.

Top 10 Crypto Summary

It was a tough week for the top-10 crypto assets by market cap (other than Ripple (XRP)). Ether (ETH) took the hardest hit with a nearly 20% drop — despite a largely successful transitional “Merge” to proof-of-stake. The drops this week follow last Tuesday’s release of August consumer price index (CPI) numbers, indicating that monetary and fiscal policymakers have a ways to go if they want to tame present inflation levels. Crypto assets continue to be seen as a risk asset and remain highly correlated to Nasdaq tech stocks.

Bitcoin Price Chart

The present bear market continues on, and unrealized losses are an important indication of just how troubled the waters currently are. Looking at unrealized profit/loss ratio (30d MA), we see that the present bear market’s lowest point was reached in June 2022, and we remain in unrealized loss territory. These unrealized losses have not yet reached the heavy levels as previous low points from 2014 and 2019, but they are close. Glassnode recommends watching for when the profit/loss ratio on this metric reaches a value of 1. Historically, this signals the beginning of a recovery.

Don’t miss out – Find out more today