Crypto Market Forecast: Week of September 27th 2021

A curated weekly summary of forward-focused crypto news that matters. This week, markets deal with China's latest crypto ban, institutional investors lean towards Ethereum instead of Bitcoin and the lightning network hits fresh milestones.

It was a difficult week of trading in the digital asset markets as a new bout of China-driven Fear, Uncertainty, and Doubt (FUD) dragged markets downwards. Bitcoin (BTC), the market’s largest and oldest asset, ended the week down ~10%. Ethereum (ETH), and Cardano (ADA), the second and third largest assets in the crypto markets, both fell by ~10%.

On Friday, 10 Chinese government bodies, including the People’s Bank of China, issued a joint statement stating that all cryptocurrency-related services in the country are now prohibited. This includes trading digital assets, order matching, token issuance, and derivatives. The group said that overseas crypto exchanges providing services to Mainland Chinese services are now illegal.

China ‘banning crypto’ is not unprecedented. Regulators in the country have targeted the digital asset industry at multiple occasions since 2017, with the wording and specific services being banned, varying each time. The latest developments, however, appear to be the most draconian. Some observers have said the PBoC and others have left very little wiggle room for crypto users and service providers in the country.

Huobi Global, a major global crypto exchange popular with Chinese users, has said it will suspend all China-based user accounts later this year.

After the reveal of the new policy, the price of Bitcoin crashed, dropping by ~9% in just 4 hours. The crash saw BTC drop from ~US$45,000 to US$41,100. The price of Bitcoin has recovered since Friday and currently trades around US$43,000.

Speaking to CNBC’s Power Lunch, Sam Bankman Fried, the chairman of billion-dollar crypto spot trading and derivatives platform FTX, was measured in his perspective on the new ban. He told hosts that he was not “super surprised” by the move. He also explained that some of the initial strong reactions may have been because of the “exaggerated” translation of the original text and while the statements would have an impact, they were “nothing new.”

Derivatives data provider Bybt reports that on Sunday, September 26th, investors piled back into long Futures positions with the current long/short ratio sitting at 52.4%/47.6%. This suggests that derivatives traders, often viewed as smart money, are betting that the sharp price drop on Friday was an overreaction. Futures trading volumes are up ~17% in the last 24 hours.

Ether has recovered even more strongly than BTC. The asset is up ~11% since its Friday low trading near US$3,100. These gains come after a report from Investment banking giant JP Morgan which expounded that institutional investors are beginning to shy away from Bitcoin futures in favour of Ethereum. Analysts at the bank say that Bitcoin futures on the Chicago Merchantile Exchange (CME) have been trading at a discount to the spot market. "This is a setback for bitcoin and a reflection of weak demand by institutional investors that tend to use regulated CME futures contracts to gain exposure to bitcoin," the analysts wrote.

JP Morgan said there has been a “strong divergence in demand,” towards Ethereum products. The bank explains that the driver of this demand has been the booming Non-fungible Token and Decentralized Finance sectors.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

Crypto news for the week ahead

September 28th – Kraken opens trading for Raydium (RAY) and Oxygen (OXY)

On Tuesday, September 17th, Kraken will begin supporting two new tokens — Raydium (RAY) and Oxygen (OXY). Both tokens are built on the Solana platform blockchain ecosystem. Raydium is an automated market maker (AMM) and ecosystem liquidity provider that offers access to token swaps, launches, and yields. Oxygen is a decentralized finance (DeFi) prime brokerage service. RAY and OXY are down ~25% and ~12% respectively in the last week.

September 30 – Cardence Cardano Launchpad launches

Cardence is a Cardano-focused multi-chain platform for token presales, initial DeFi offerings (IDOs), and incubators, that is set to launch on September 30th. It is part of a wave of Decentralized Applications (Dapps) that is set to launch on Cardano, which began enabling smart contracts on September 12th as part of the Alonzo hard fork. Cardence has some buzz and its official Twitter account already has ~40,000 followers. ADA is down ~5% in the last week.

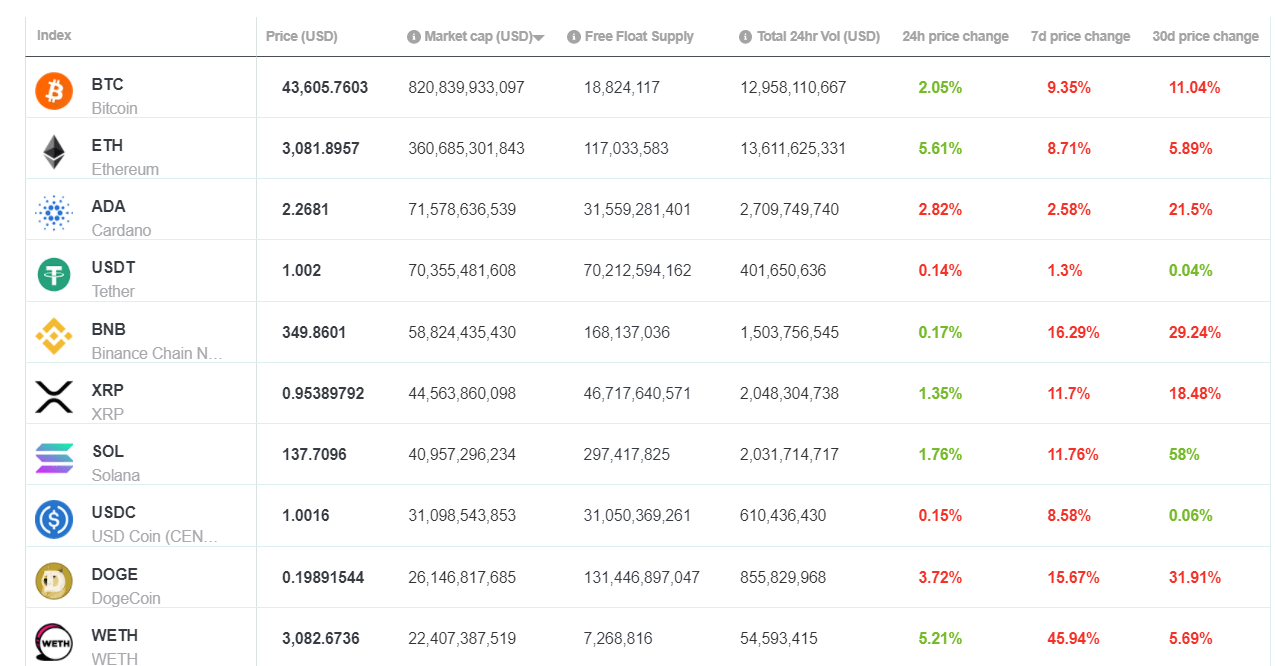

Top 10 Crypto Summary

It was a difficult week for all assets on the Brave New Coin market cap table. One of the worst performers on the table was Binance Coin (BNB). BNB is the native token of the world’s largest crypto exchange, Binance, who alongside Huobi announced this week that it would retire all accounts tied to China by the end of this year. Both exchanges have now stopped letting users register mobile numbers from Mainland China.

Bitcoin Price Chart

The price of Bitcoin (BTC) ends the week trading near US$43,500. After price drops over the past two weekends, the asset has found price support near the US$41,000 level. Outside of the current China FUD, fundamentals for the network continue to look strong. Glassnode reports that the lightning network, Bitcoin’s leading layer 2 scaling solution, has hit a new all-time high for open channels. There are now 72,380 open payment channels on the network. This is up 226% from the stable baseline of ~32k channels established throughout 2019-20.

Don’t miss out – Find out more today