Crypto Predictions 2019: Alt-Coin Contenders — ZCASH

In 2019 the cryptocurrency sector will continue its evolution. While its early years have been dominated by almost entirely speculative trading, as the market matures, a digital asset’s ‘fundamentals’ will become increasingly important as value indicators. BNC’s 'Alt-Coin Contenders' series introduces assets with fundamental characteristics that set them apart from their competitors and justify their inclusion in any investor’s ‘ones to watch’ list.

From an investment perspective, valuing businesses is typically done using time honored formulas like price to earnings and price to book ratios, PEG calculations and dividend yields. In the crypto space, none of these methods apply directly — and investors continue to wrestle with how best to assign a value to digital assets in a nascent industry that is sentiment driven and characterized by wild volatility.

To that end, the purpose of this ‘Alt-Coin Contenders’ series is to identify specific assets that BNC analysts have identified as having fundamental characteristics that at the very least, justify investors including them in a ‘ones to watch’ list.

Our selections are made based on a range of criteria – things like Hashrate or an increase in on-chain transactions. Or the amount of Github activity and the size and enthusiasm of an asset’s ‘community’. Or apparent liquidity — significant exchange listings and fiat on-ramps. Exposure to potential legislative action is also important, as are the people behind the scenes — inspiring leaders with ‘rock star’ social media status, or alternatively, big-time financial backers with deep pockets and a track record of success.

No single asset will tick every box, and some will tick more than others, but what this series aims to do is move readers beyond simplistic FUD, FOMO and speculation — and introduce the range of fundamental token attributes that should become recognized value indicators as the industry matures.

The Zcash Blockchain: Banking on privacy

Zcash (ZEC) was founded by cypherpunk personality Zooko Wilcox-O’Hearn in 2016. Zcash’s founder is known for his rags to riches story, having built the blockchain which has a market cap of over $350 million, while living out of his car.

It is designed as an open, permission-less cryptocurrency that protects transaction privacy using zero-knowledge cryptography. Zero knowledge proof cryptography involves a prover being able to prove something to a verifier to be true, without revealing any additional information about it other than it being true.

The Zcash network’s capacity to deliver private transactions without compromising the security of senders and receivers has been lauded by many in the blockchain and financial ecosystems. The network has built partnerships with financial powerhouses such as JP Morgan, and its ZK-Snark protocol has been integrated into transactions on the Ethereum blockchain.

These factors have contributed to its position as a market leading privacy payment solution.

The case for Zcash in 2019

Zcash derives much of its value specifically from its capacity to deliver private transaction solutions to users – and recent enhancements to that feature set mean 2019 may be a breakthrough year for the currency.

Critical update slashes processing time & removes adoption hurdles

While the cryptographic and mathematical technology underpinning Zcash is undeniably exciting, for the most part, usage of Zcash’s dominant feature has had little uptake.

Unlike Monero, where all transactions are private by default, Zcash transactions can be switched to shielded or unshielded (more private or less private), depending on user preference. However, the processing-intensive nature of shielded transactions has meant that to date, user adoption of this feature has been low. Building an address for a shielded transaction requires extra steps, has issues working on mobile platforms, and is not backwards compatible with Bitcoin transactions. The friction is clear and only ~13% of Zcash transactions are shielded.

For users interacting with the Zcash blockchain over third party wallets and exchanges there is generally not even a choice to shield a ZEC transaction, because the added time and hassle involved with supporting shielded addresses is not viable for these multi-coin operations.

This narrative appears likely to change after the release of the Sapling update for the network on October 28th 2018. The network’s evolution from its initial release, ‘Sprout’, to ‘Sapling’ has led to a 90% time reduction for constructing transactions and a 97% memory use reduction over shielded addresses.

The knock on effect of this is the potential opening of doors for vendors, mobile providers and exchanges to now more easily support Zcash’s shielded transactions.

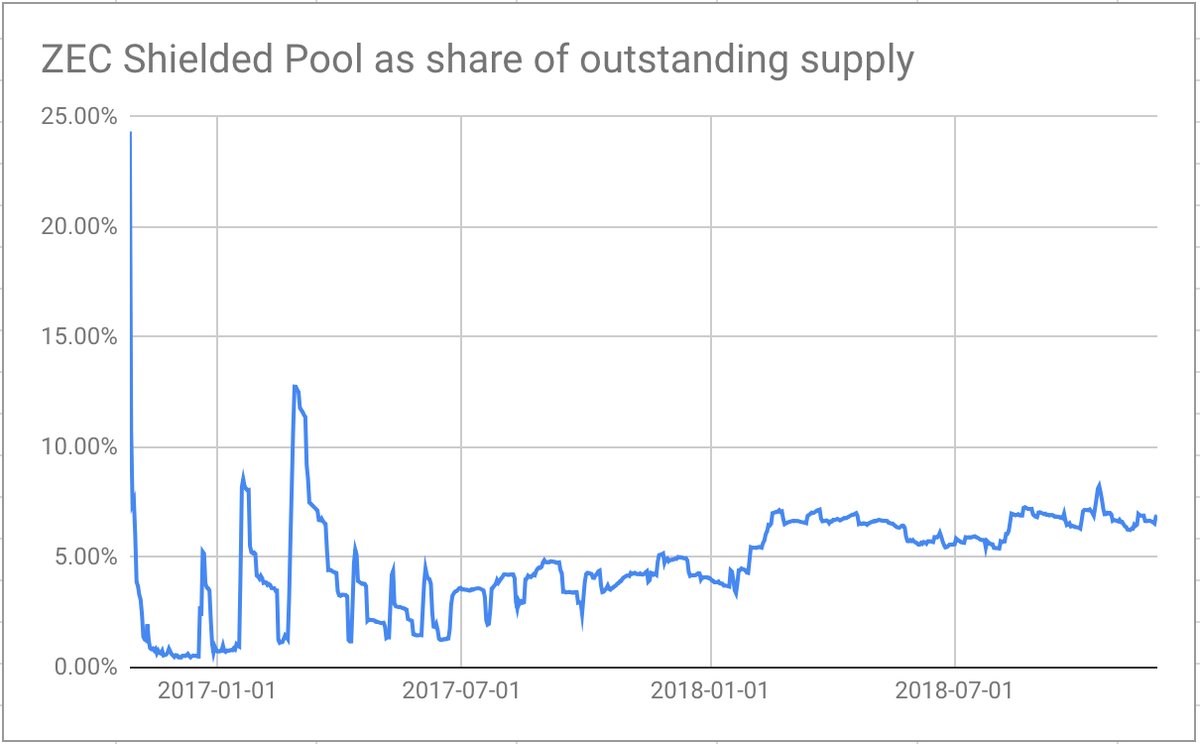

There has already been a tangible positive shift in network shielded transaction usage in the lead up to and since the Sapling release, indicating community enthusiasm for the update as well as the efficacy of the solution it provides.

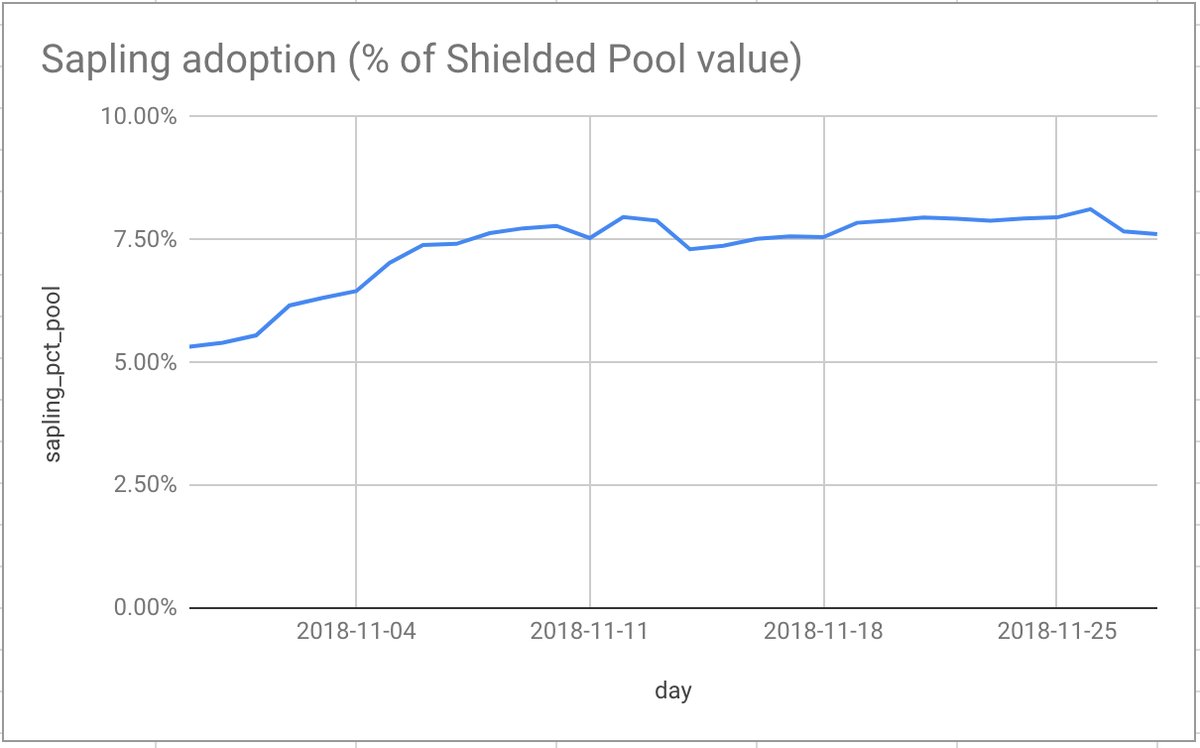

Third party infrastructure, such as the Jaxxx and Bitgo online wallet services have begun supporting Sapling shielded addresses, and it is likely shielded address preference and implementation will continue to grow into 2019. If Sapling continues to embed its usage across the Zcash blockchain, then Zec’s true value as a private, but secure, payment medium should be reflected in its price.

Previous price runs of Zcash have for the most part been built on speculative momentum during periods of general blockchain ‘hype’. Genuine shielded transaction adoption by 3rd party infrastructure and its increased usage by network participants could allow Zcash to stand out in altcoin-markets as a genuine privacy coin solution alongside Monero – with likely even stronger technology underpinning it.

Steady growing rate of Shielded address token pool as a share of outstanding supply. Charts from Coinmetrics.io

Sapling adoption beginning to grow in the Zcash blockchain. Charts from coinmetrics.io

Rising hashrate strengthens Zcash security and immutability

Zcash uses equishash, a memory oriented PoW structure that focuses on RAM, short term memory, over processing speed. This has meant that until recently, cost effective ASIC processors used by enterprise mining groups have been inefficient when mining Zcash.

In February 2018, the Pascalproject announced the release an equihash efficient ASIC mining model. Once readily available, the onset of equihash capable ASICs will likely to lead to the domination of Zcash block production and the hashrate of the Zcash network has increased dramatically in the last year as large scale cost-efficient mining operations have entered the Zcash ecosystem.

Rising hashrate is good for the security and immutability of a blockchain, and sends strong signals to the crypto market of fundamental strength – but it generally comes at the cost of mining decentralization. At a meeting held in late June 2018, Zcash’s governance panel could have voted to make ASIC mining resistance a priority for ZEC, but instead voted 45 to 19 against the idea, leaving the door open for ASIC mining pools.

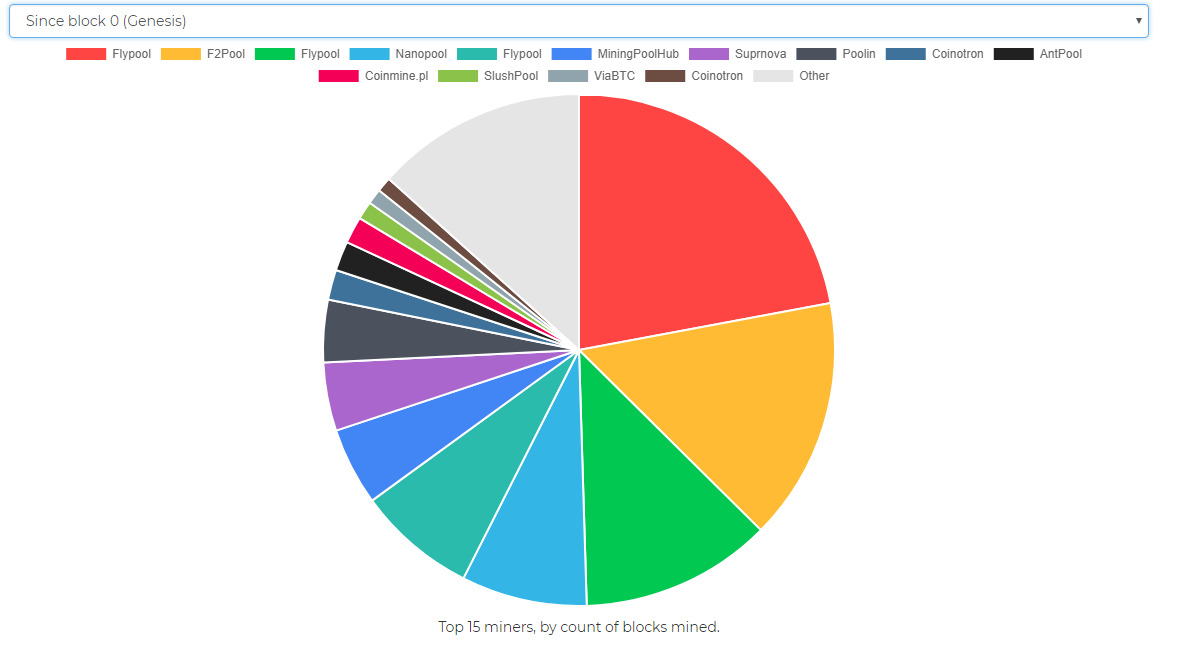

The distribution of mining hash rate since genesis block (October 2016)

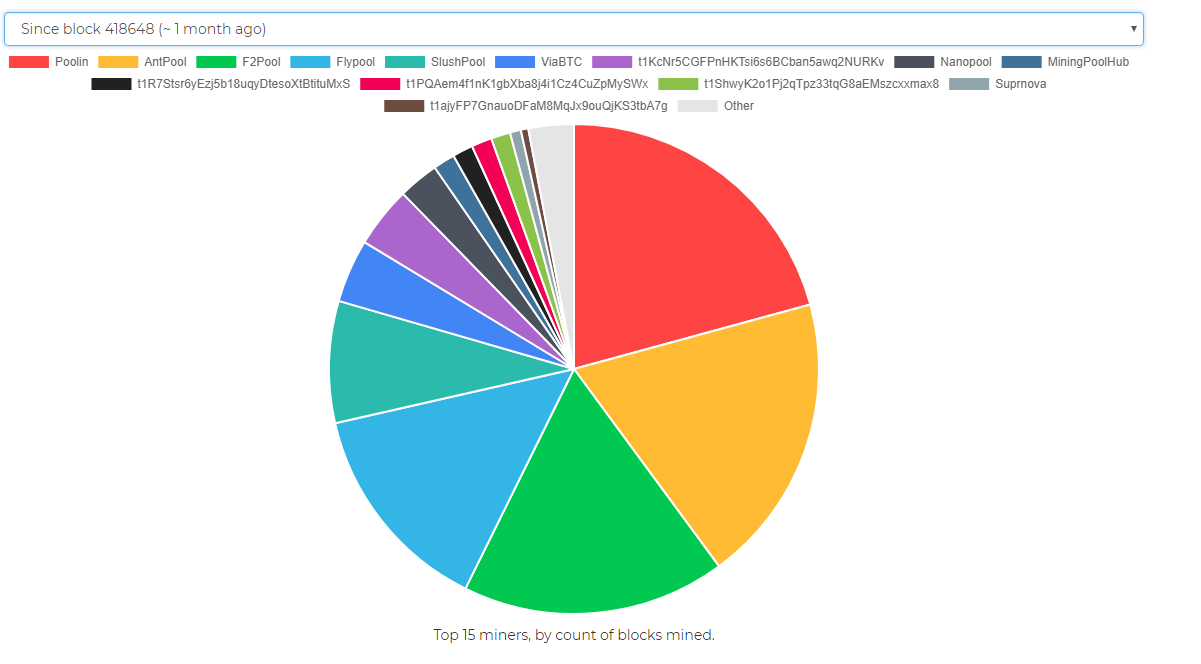

The distribution of mining hash rate: 4th November to 4th December

Although Equihash allowed Zcash to maintain a relatively decentralized block reward schedule, these charts show a fall in production of ‘other’ smaller miners not operating as part of larger mining operations or farms since the introduction of ASIC mining to the blockchain.

Average daily hashrate of the Zcash blockchain from November 2016 to present. Parabolic rise upwards starting from July 2018. Chart from bitinfocharts.com

Miners having too much power can have long term implications for a blockchain. During the recent Bitcoin Cash power struggle Craig Wright and Calvin Ayre, threatened to cripple the BCH chain with their accumulated network hash power but this sort of governance breakdown is a black swan.

There are dangers of fully opening up a network to ASIC mining operations, however, Zcash appears to have a stable governance panel and the network always has the option to return to an ASIC resistant mining algorithm if it wishes.

The Coinbase effect

On November 30th, ZEC went live on bluechip crypto exchange Coinbase. The ‘Coinbase effect’ is well known in crypto circles as the positive price and perception momentum generated for digital assets leading up to and around the times of listing.

Following initial reports that Coinbase would be ‘exploring’ the idea of listing ZEC on July 14th, the price of the token rose ~30% in 12 days, peaking at ~$226.33 on July 26th. The average daily price of ZEC has not been higher than this since the initial announcement of trading.

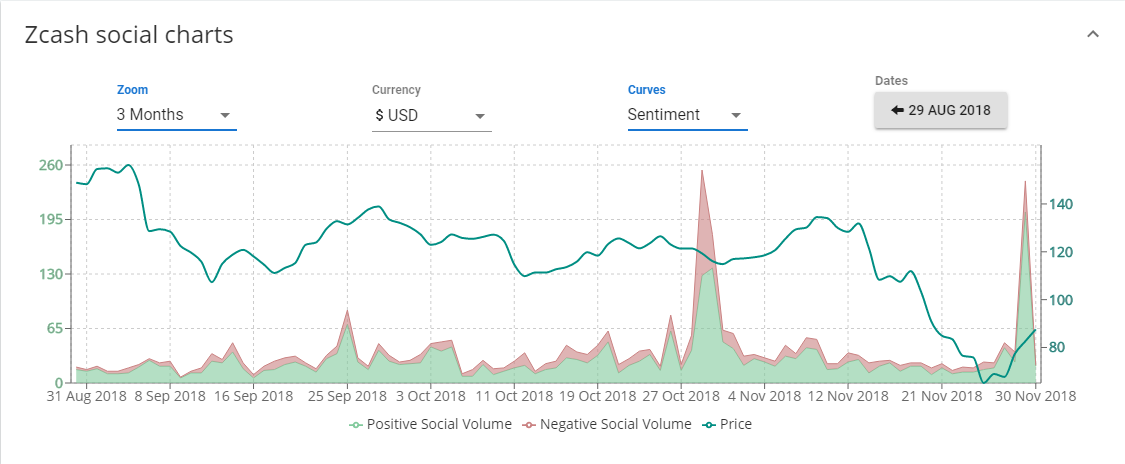

Zcash social volume (Twitter and Reddit) as compiled by solume.io shows a spike in social momentum around the time of the Coinbase listing announcement.

Investors and traders may not yet be willing to buy Zcash, given the wider crypto bear market, but they may still be monitoring the project’s progress and in a scenario when markets do turnaround, the mainstream exposure and general infrastructure benefits (market leading custody, for example) of ZEC’s listing on Coinbase, Gemini Global Trading and Genesis (all holders of a New York state BitLicense) may differentiate Zcash from close competitors like Monero or Dash.

Exposure to regulatory risk

Although ‘going mainstream’ via liquidity onramps like Gemini and Coinbase Pro is a plus, it remains to be seen whether shielded transactions will ever become available through those platforms or others like them. As authorities around the world have begun to get their collective heads around the differences between the various cryptocurrencies, one thing they have been able to agree on is that Anti Money Laundering and Know Your Customer (AML & KYC) regulations will be mandatory for all. Any participant in the crypto sector that is not prepared to follow that path to legitimacy will likely face enforcement actions around the world.

Within specific jurisdictions such as New York State, it appears that fully shielded transactions where controllable on private centralized platforms like Gemini & Coinbase Pro, will likely never be allowed. Fortunately, ‘privacy mode’ is optional for Zcash, so this should not affect its ability to gain listings on compliant liquidity introducing exchanges. That said, Zcash’s dominant value proposition is as a zero-knowledge private transaction solution, and with this feature rendered irrelevant its valuation may once again be determined more by speculation than its fundamental characteristics.

On the plus side of that equation, the technology is nonetheless valuable and there is a possibility that shielded address payments may be integratable within private blockchain solutions, as was the case when ZK-Snark technology was used within JP Morgan’s Quorum chain. Thus, shielding transaction data will likely have some use cases within a private payment network where users are permissioned but still entitled to hide aspects of transaction information.

Conclusion

Zcash is an evolving blockchain project that continues to redefine its value and position in the market. With a major network update, new highly liquid on-ramps and a change to the fundamental structure of its mining on the blockchain, 2018 has been a transitional year for the currency – setting it up nicely for 2019 should overall market sentiment turn positive.

Don’t miss out – Find out more today