Crypto’s Best Blockchain Music Projects

The music business would seem to be primed for disruption by blockchain – but so far it remains a very difficult nut to crack. In this feature, we explore 3 projects that are actually making progress in the space.

You say you want a revolution, well you know, we’d all love to change the world.

Much has been written about the huge potential for disruption blockchain presents to the music industry. On its face it looks like a sure bet – music is digital and delivered over the internet, streams and sales are tracked and recorded, there’s mountains of user data – and who doesn’t like music? So there must be some way to plug blockchain into that and make money right? Well… maybe.

Why Crypto Cracking The Music Business Is So Hard

There are many crypto music projects out there now but we won’t list them. Why? Because almost to a one, they are not performing to expectations and we’re not here to throw shade. For the most part they’re not performing at all. Very low traffic numbers, no artist success stories, no marketplace buzz.

So why aren’t they working? One of the main reasons they have been unsuccessful so far, is because they’re ‘technical’ projects. Their founders are code writers and blockchain evangelists, and maybe even music lovers – but they aren’t music industry people. And while there is a train of thought that non-music industry people will bring new disruptive ideas, that’s a naïve approach to the music business that’s going to burn up a lot of funding for zero results.

It’s naïve because the music business has always been, and remains today, one of the most complicated tangled webs of intersecting legal rights, cash flows, egos and fashion, that has ever existed. The legacy players are deeply ingrained and precisely integrated into this hot mess, exactly where they need to be to make money. They cannot, and will not, be moved.

But as complex and confusing as the music business is, there does remain one abiding truth. And that is, that aside from a few ancillary things like live concert tickets and merchandise sales, the flow of all revenue in the entire business is determined by who owns the copyrights to the music.

How to Integrate Blockchain into the Music Business

You tell me that it’s evolution.

So what can be done? In deciding which projects to feature in this article we have selected three that ‘get’ the problem and are working ‘with’ the business rather than against it. They’ve chosen unique niches or aspects of the business that can be separated, streamlined and improved by blockchain, without trying to throw everything out. And, most importantly, although they’re all technically impressive, their founders (or their closest advisors and investors) are music business people who understand well which paths are do-able – and which are proverbial roads to nowhere.

What’s The Basic Thing It Does?

With each of these projects, there is much that could be written about what they do, but we think simple is better. So, at its core, Audius offers decentralized music streaming in a format / service similar to Spotify, Apple Music and Amazon.

What’s The Blockchain Angle?

The Audius economy all revolves around its music crypto token, AUDIO. It is integrated into everything the company does but essentially serves to incentivise the three main operational aspects of Audius. These are;

Node Operations

The Audius blockchain music streaming service is decentralized, with one group of 3rd party node operators serving the content (the streams) while another group maintains the databases of user profiles, playlists and followers. These operators are rewarded with AUDIO tokens for doing so.

Musicians

Although big name musicians Nas, Katy Perry and Jason Derulo are early investors in Audius, you won’t hear much of their music on the streaming platform. In fact, by far the majority of artists whose music is streaming on Audius are unknown independents.

Fans/Listeners

Streaming platforms need listeners and artists need fans. Audius rewards them with AUDIO for engagement with artists, through the creation of popular playlists and a range of other activities. Audius also makes semi regular airdrops of AUDIO to platform users. AUDIO can be staked and staking gives holders rights to vote on the governance of the Audius platform.

Financial Backers

According to Crunchbase, since its founding in 2018, Audius has raised $14.6M from investors. Aside from the aforementioned ‘star’ investors, other major investors include Coinbase Ventures, Pantera Capital and Multicoin Capital.

Technical Details

AUDIO is an Ethereum-based ERC-20 token. Music is streamed at 320kps. Audius can be accessed via desktop app as well as on mobile with iOS and Android devices.

What It’s Doing Well

Audius has built and deployed a music streaming service on the blockchain, which in itself is a huge achievement. The Audius interface and player are slickly designed and its performance is on a par with all the other major streaming platforms. Audius partnered with TikTok in 2021 in an arrangement that allows artists whose songs are on Audius to make their tracks available to TikTok content creators. Currently Audius says it is averaging about 4 million users a month, which, while only around 1% of Spotify’s users, is still a massive number by crypto standards. Independent site audit firm Similarweb puts traffic to the Audius website at between 500,000 and 700,000 per month. Either way, they’re impressive numbers.

Summary

Audios looks good and does what it says it will do. It has onboarded millions of users and songs. It has successfully created an ecosystem and economy around its token AUDIO, and the announcement of its relationship with TikTok saw the AUDIO market cap surge to over $1 billion for a short time. For a blockchain business with (comparatively) modest financial backing these are all important metrics and bode well for some kind of future.

With all that said, what is currently not certain or clear about Audius, is how successful a ‘music business’ play it could possibly be. In reality, it has little chance of competing with the big streamers like Spotify and Apple. It does not charge a subscription fee, nor does it charge artists to upload their songs. And it does not own any copyrights to the music it streams. So where will its revenue come from? With impressive user numbers and celebrity backers, Audius is certainly off to a good start, but sooner or later it will have to pivot harder towards the ‘business’ side of the music business if it wants to reach its full potential.

Download the Audius White Paper.

What’s The Basic Thing It Does?

Unlike the other contenders on this list, Tunedly has opted to create an entire music ecosystem. Its offering includes music production, music streaming, fan engagement, music publishing, and music royalty revenue sharing – all centering around the TunedCoin (TUC) utility token.

What’s The Blockchain Angle?

The Tunedly ecosystem today has grown out of its original online music production business, which has completed 30,000 music projects since it was founded in 2016. Concerned about how difficult it is for artists to break through on the legacy streaming platforms, Tunedly says it created its own free streaming platform at Tunedly.com, where artists can upload their tracks and listeners can stream a range of genres such as Pop, Country, Hip Hop and Rock for free.

The Tunedly motto is ‘Only Music Matters’ and what’s different about the Tunedly streaming service is that aside from their names, tracks being played come with no additional information. No artist pictures, bios or videos – just the music.

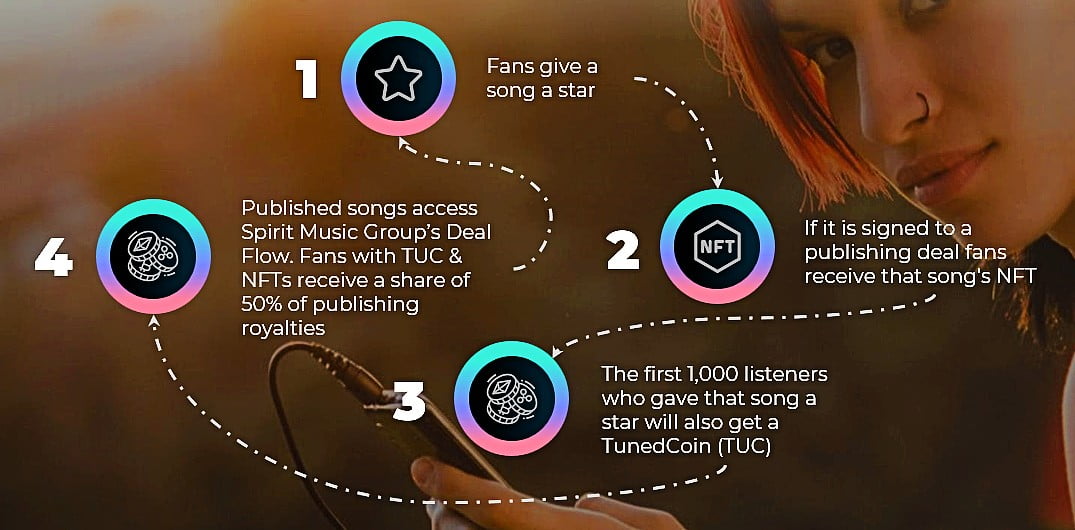

Listeners can upvote their favorite tracks and receive a mixture of TunedCoins and song NFTs for their efforts, while hopefully only being influenced by the quality of the music in their voting choices. Top tracks, according to fan votes and Tunedly’s site analytics, are then offered publishing deals (Tunedly has partnered with leading U.S. music publishers the Spirit Music Group). Tunedly then splits its publisher’s percentage of the total copyright royalties 50/50 with the first group of fans who upvoted the songs and have a copy of the song’s NFT. Royalty payments can be made via blockchain.

Financial Backers

Since its inception in 2016, Tunedly has raised approximately $1.5 million in seed capital. The company plans to conduct an IEO for TunedCoin in Q3 2023.

Technical Details

TunedCoins are ERC-20 tokens built on the Polygon Smartchain, while the corresponding song NFTs are built on the ERC-1155 protocol.

What It’s Doing Well

Where Tunedly and TunedCoin stand apart from the other platforms on this list is that it has built an entire music ecosystem on top of an existing profitable music production business. Artists whose songs are produced by Tunedly can upload them to its music streaming service (and others can too, Tunedly does not currently restrict upload access to its streaming platform).

Fans are then incentivized to listen and act as virtual A&R representatives by upvoting what they think are the best songs for rewards of TunedCoins and song NFTs. The most popular songs get publishing deals, and revenue from all related publishing earnings (not just streaming revenues) are then shared with the fans based on the TunedCoin and NFTs they earned for listening and voting on songs.

Summary

Tunedly’s numbers are currently small, but respectable. It has an existing production business with 3000 production clients and over 30,000 projects completed. Over time it has built out its own streaming platform with a unique positioning (just music, no hype), and has partnered with music industry legacy businesses like Spirit Music Group – which in turn exposes it to the majority of revenue streams that exist in music today.

Importantly, Tunedly incentivises contribution and engagement from artists and listeners by sharing half its net publishing revenues with the fans who chose what songs should be signed to deals. Its advisors are impressive too – and include Recording Academy (they run the Grammy Awards) CEO Harvey Mason Jr, and Matthew Knowles – who amongst other things is Beyonce’s father – and the founder of Music World Entertainment.

According to Similarweb, monthly website traffic is around 100,000, and the company says listeners to its streaming platform are averaging around 5000 a month, growing at a rate of 20% MOM. While all this is a great achievement with such limited funding, the challenge for Tunedly now is growth and it will need to find a way to boost its listener base and communicate its vision to a lot more people in order to assure its long term success.

Download the Tunedly White Paper

What’s The Basic Thing It Does?

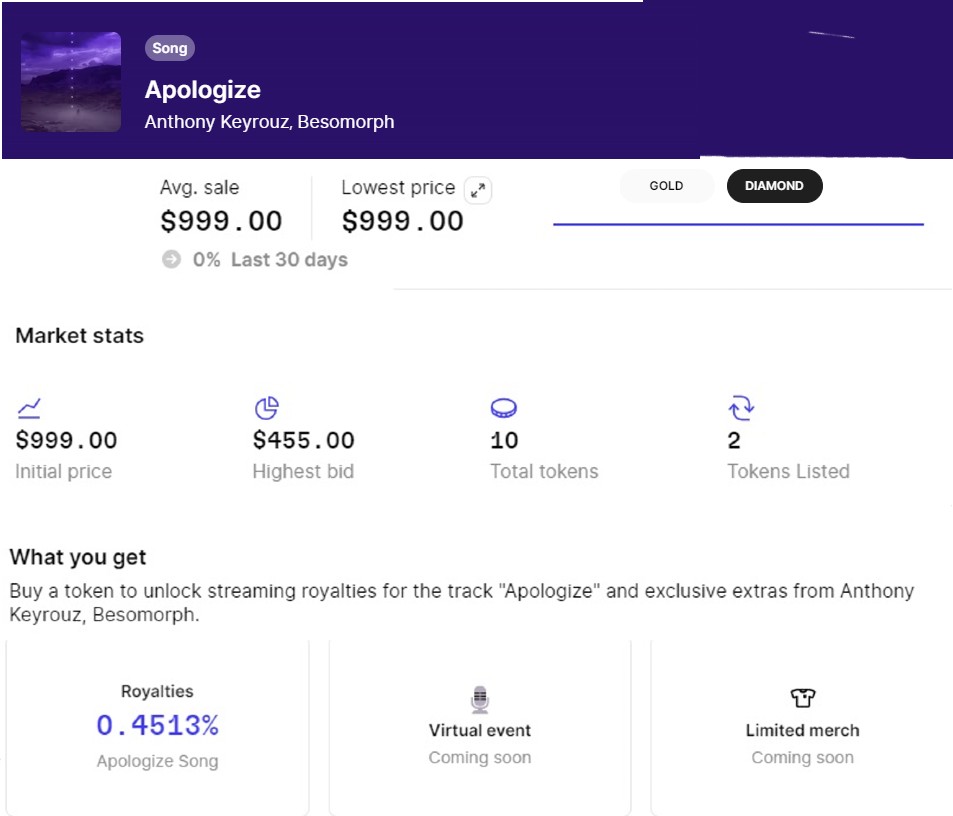

Royal.io connects music fans who want to own a piece of a song’s streaming royalty revenue, with artists who want to sell a percentage of those revenues.

Interestingly, Royal is very ‘hands off’ with regards to the transaction between artists and rights holders. This isn’t obvious from a cursory look at the Royal website, but is stated very clearly in its terms of service. “Royal provides a peer-to-peer web service that helps Users discover and interact with each other and Song Tokens available in public blockchains. We do not have custody or control over the Song Tokens or blockchains you are interacting with and we do not execute or effectuate purchases, transfers, or sales of Song Tokens. Our Services also allow music professionals (“Artists”) to sell certain non-fungible tokens (each, an “Song Token”) to third party entities or persons (“Purchasers”) via the Royal Platform. Royal is not a party to any transaction between Artists and any Purchaser. Royal does not control or vet content provided by Artists, nor does Royal assume any responsibility for the accuracy or reliability of any information provided by Artists. Royal is not a party to any agreement between any Users. You bear full responsibility for verifying the identity, legitimacy, functionality, or authenticity of any User or Song Token (and any content associated with such Song Token) visible on the Service.”

So what does all that mean? In simple terms, Royal is just a connection platform. It won’t ensure you receive the tokens you buy, it won’t ensure you receive the royalty revenues you’re expecting. Each relationship between an artist and a rights buyer, is one to one. If you buy the rights from an artist, that relationship is entirely between you and the artist, so you have to trust that they’ll deliver what they promise.

What’s The Blockchain Angle?

Users who want to buy a share of an artist’s royalties purchase an NFT (which Royal refers to as an LDA) in an initial ‘drop’ on Royal. Drops are comparable to an ICO or IEO – but for a song. Artists can set the price for these LDAs – typically by tiers- for example, Gold, Platinum or Diamond. More expensive tiers offer a higher percentage of artist royalties and the NFTs/LDAs can be embedded with additional rights to things like fan experiences and digital art etc.

Artists raise funds and fans secure royalty shares in artist ‘drops’.

Artists raise funds and fans secure royalty shares in artist ‘drops’.The purchase transaction takes place on the Polygon blockchain using MATIC via the user’s MetaMask wallet. When the artists receive their royalty revenue from the likes of Spotify, the plan is they will place the percentage they allocated to fan ownership into a smart contract, and the royalty revenue is distributed to those owners based on their pro-rata share of the song’s streaming revenue.

After the initial drop, these NFTs/LDAs can be on-sold via secondary markets such as Opensea. Royal does not have its own token. Instead the ‘value’ of each song’s NFT/LDA is fully dependent on the streaming success of the song after its initial drop.

Financial Backers

If data from Crunchbase is to be believed, Royal has raised a phenomenal amount of money in an initial seed round ($16 million) and then $55 million in a Series A round in November 2021. Famous investors include performers The Chainsmokers and rapper Nas (who is also involved with Audius). Andreessen Horowitz (a16z) took the lead on the Series A round. Coinbase Ventures and Paradigm also invested.

Technical Details

Royal NFTs/LDAs are ERC-1155 tokens. The Royal transaction layer is on Polygon, via MetaMask or a built in Royal wallet. Royal says additional wallets will be added soon. To date there is no Royal app for Apple or Google Play.

What It’s Doing Well

Amongst crypto music projects, Royal is far and away the leader in terms of investor capital raised. It has also centered its offering around music royalty ownership rights, which is a part of the overall music copyright universe – so kudos for that.

In terms of signups to the platform, data from Royal has not been updated for some time, but the platform claims over 120,000 user signups. It also claims over $7.5 million in music rights have been traded, $2.5 million has been raised for artists (presumably from song drop revenues) and $156,000 in royalty revenues have been paid out to NFT holders. Similarweb reports monthly website traffic at around 62,000.

Summary

Royal made a good start in the space by concentrating on royalties – allowing LDA/NFT buyers to support their favorite artists for a share of that artist’s potential streaming revenues. Royal has also sold its story well and raised a giant war chest to invest in itself. The platform’s issues are less about what it’s doing and more about the music business in general.

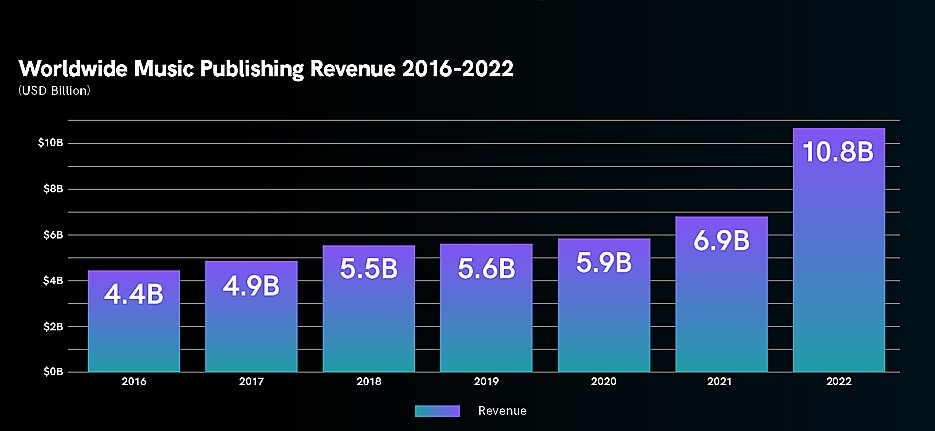

Wisely, Royal does not engage at all in the process of revenue collection and distribution – and in reality it can’t. Only the copyright holder to a song (or their nominated agent) can collect that song’s revenue. Streaming revenue is actually collected by Performing Rights Associations like ASCAP and BMI, who represent and distribute to the copyright holders. There is ZERO blockchain activity going on in that process and won’t be for a very long time, if ever.

Also, streaming revenue is a tiny fraction of overall music publishing revenue. So currently, Royal’s artists are keeping the lion’s share of their earnings for things like synchronisation rights to themselves. This is not to say those revenues could not be included in the Royal packages, but for whatever reason, they’re currently not. So there is an opportunity for expansion there.

On the downside, Royal cannot guarantee any royalties will be received by NFT holders. This is all dependent on the popularity of an artist’s tracks, and of course, on whether the artists are proficient at accounting for and distributing the NFT holder’s shares.

In terms of where its revenues will come from, Royal has suggested it will start charging for artist drops sometime in 2023, but it is unclear what form those charges will take. Aside from that, without a streaming platform of its own, a token, or a mechanism to secure some copyright share of artist’s tracks that it lists, there doesn’t currently appear to be an obvious revenue model underscoring Royal. That said, however, applied in the right way (a couple of strategic purchases for example) $55 million in investment funding could easily solve any of those problems.

Don’t miss out – Find out more today