Arbitrum launches token – Layer 2 the narrative of 2023

Returns so far this year for Layer 2 projects have far outstripped Bitcoin and Ethereum. Strengthening the crypto ecosystem’s ability to serve both new users and new use cases, Layer 2s are a driving force in the narrative of 2023. So what are they, and why should you care?

The Arbitrum Foundation today announced the launch of DAO governance for its Arbitrum Nova and Arbitrum One networks. To power the new decentralized structure, a governance token will be launched, called $ARB. The token will be airdropped to users of Arbitrum on Thursday, March 23rd

L2beat.com lists Arbitrum One as the largest layer-2 platform and the holder of 56.1% of the Layer-2 Total Value Locked. The Arbitrum token airdrop has been highly anticipated because of the size and popularity of the project. Layer-2 airdrops have a strong recent history of success, including the Optimism airdrop (OP).

The Aribtrum news follow another recent major Layer-2 announcement. In late February 2023, publicly listed Digital Asset exchange Coinbase launched Base, a new Layer 2 that is built using OP Stack, an open-source, shared standard for building Layer 2s released by Optimism.

Layer 2 refers to any secondary framework or protocol built on top of an existing blockchain that adds features that improve the scaling capabilities of the base chain. Base layer blockchains like Bitcoin and Ethereum, can slow down and become expensive when they are congested because of events such as popular NFT drops.

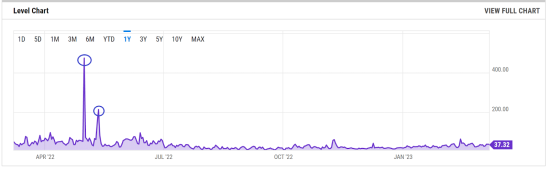

Ethereum gas fees over the last year. Source: Ycharts

The chart above demonstrates the inconsistent nature of Ethereum gas fees and their tendency to spike.

The launch of BASE is set to introduce Web 3.0 solutions and networks to a whole new audience of users. Coinbase has an estimated 110 million verified users and US$80 billion worth of assets locked on its platform. The launch of BASE is potentially a watershed mainstream moment for the layer 2 space and it now appears to be cemented into the crypto consciousness. BASE arrives with the layer 2 space booming. One important feature of layer 2s is that they are designed to maximize the blockchain User Experience (UX) which is a perfect fit for Coinbase, a platform that has made crypto accessible for millions.

L2beat, a layer 2 analytics platform, says that over the last year the US dollar value locked on Ethereum layer 2 platforms has risen from US$4.1 billion to US$6.2 billion, a ~51% rise. The amount locked onto layer 2s has also risen in ETH terms from ~3.45 million ETH to 3.96 million ETH, an ~15% increase. L2beat does not include the Polygon network, an Ethereum scaling solution, which many technologists state is not a ‘true’ layer 2. If we add Polygon’s TVL to this mix, the layer 2 TVL then becomes ~US$7.3 billion.

Currently, the top layer 2 platforms in the world are Ethereum-focused, but platforms such as Stacks, which is focused on building scaling solutions for the Bitcoin blockchain, are growing in popularity. The layer 2 solutions space is being developed rapidly.

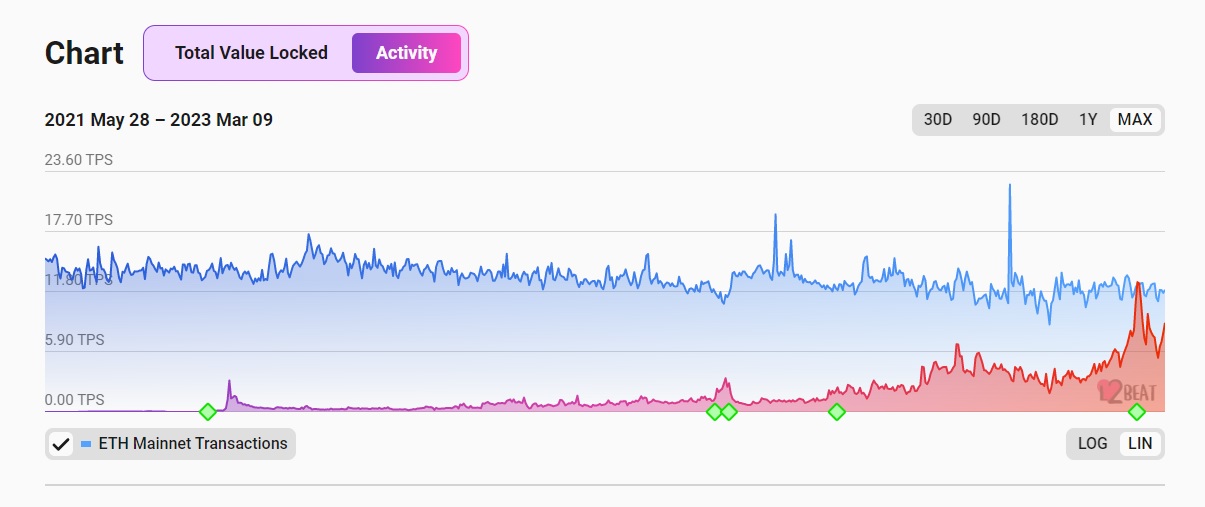

Since August 2022, transaction activity on Arbitrum, the top Ethereum layer-2 platform, has surged.

The wider trend for Ethereum, the base chain that Arbitrum supports, is much more flat and apart from a few isolated spikes, the daily transaction activity for Ethereum is marginally lower than it was 18 months ago.

Arbitrum transactions exceed Ethereum’s – Source L2Beat.com

On February 22nd, the total number of transactions on the Ethereum chain hit 100,080,869. On Arbitrum on the same day, the total number of transactions was 100,103,187. This has not happened since or before but indicates that daily transactions on a single layer 2 can top those on the base chain.

There are forecasts that eventually layer 2s will replace Ethereum as the platforms for everyday transactions while Ethereum will maintain utility as a settlement/verification layer. What happened on February 22nd, is a clear indication that this future is possible.

Types of Layer 2 Solutions

True Layer 2s

Optimistic Rollups – This is the technology that supports the two most popular ‘True’ Roll-up solutions, Arbtitrum and Optimism. Like other layer 2 solutions, Optimistic Rollups reduce computation on the Ethereum chain by processing transactions and state-storage off-chain.

Optimistic rollup operators bundle multiple off-chain transactions together in large batches before submitting them to the Ethereum main chain. This method enables the spread of fixed costs across multiple transactions. Rolling them up into batches reduces fees and the compression techniques used also reduce the amount of data posted on Ethereum.

Optimistic roll-ups are called ‘Optimistic’ because they assume the transactions they shift off-chain are valid. There is no onchain proof of validity.

Arbitrium and Optimism makeup over 80% of the Layer 2 market share.

Zero-Knowledge Rollups – This is the solution used by dYdX, Loopring, and ZkSync Lite. ZK roll-ups in many ways are similar to Optimistic Roll-ups, Zero Knowledge roll-ups publish cryptographic proofs-of-validity for off-chain transactions. Operators of ZK rollup chains submit validity proofs to the main chain that demonstrate with cryptographic certainty that the proposed changes to Ethereum’s state are due to a batch of valid transactions that were processed off-chain.

ZKrollups are inherently more secure but because they are less scalable they have been less popular. Optimism can process larger batches of transactions more quickly. It is also more popular because it is easier to implement and operate.

Validium – A more niche solution that is used by a number of EVM-based Dapps including Immutable X, ApeX, Sorare. Validium, like Zk-Rollups, proves the validity of transactions with Zero-Knowledge proofs; it does not store transaction data on-chain, which significantly reduces the amount the Validium contract interacts with the Ethereum mainnet. Storing data transactions has trade-offs like security, but significantly increases throughput and scalability. Validium’s throughput is reportedly comparable to Optimism and is said to be able to process ~9000 transactions per second.

Forks and Hybrids (Optimistic chains like Metis) – There are a few forks of layer 2 solutions that add modifications designed to optimize the original solutions. An example of this is the Metis platform, launched by MetisDAO. Metis propose that they offer a best-of-both-worlds solution, combining the scalability of Optimistic roll-ups with the security of Zero-Knowledge proofs. Metis has its own suite of unique dapps like Hummus exchange (a fork of platypus finance) and Hermes (a fork of Solidly).

Sidechains

Polygon – A scaling solution that is in a category of its own. Polygon is actually a variety of scaling layers built with a Polygon infrastructure that has built a technology to communicate with Ethereum. The most popular is the Polygon Proof-of-Stake (PoS) sidechain that is currently live and actively used. Polygon PoS supports faster and cheaper transactions for the Ethereum main chain by running a parallel sidechain, with its own consensus model and token, which periodically checks in with the base chain for security purposes. Polygon’s scaling technology is supported by Plasma.

Price performance of Layer-2 tokens

Optimism (OP) – Price at the start of the year – US$0.917, Price now – US$2.47. YTD Returns – 169.4%

Loopring (LRC) – Price at the start of the year – US$0.188, Price now – US$0.321. YTD Returns – 70.4%

Skale (SKALE) – Price at the start of the year – US$0.0199, Price now – US$0.0416. YTD Returns – 109.0%

Metis (METIS) – Price at the start of the year – US$16.05, Price now – US$28.53. YTD Returns – 77.8%

Boba Network (BOBA) – Price at the start of the year – US$0.613, Price now – US$0.243. YTD Returns – 49.1%

Zk space (ZKS) – Price at the start of the year – US$0.0444, Price now – US$0.0675. YTD Returns – 52.0%

Polygon (MATIC) – Price at the start of the year – US$0.759, Price now – US$1.15. YTD Returns – 51.5%

Stacks (STX) Price at the start of the year – US$0.213, Price now – US$0.917. YTD Returns – 330.5%

Immutable X (IMX) – Price at the start of the year – US$0.384, Price now – US$1.18. YTD Returns – 207.3%

dYdX (DYDX) – Price at the start of the year – US$1.10, Price now – US$2.43. YTD Returns – 120.3%

Benchmarks

Bitcoin (BTC) – Price at the start of the year – US$16540.69, Price now – US$25,081.81. YTD Returns – 51.6%

Ethereum (ETH) – Price at the start of the year – US$1196.61, Price now – US$1683.86. YTD Returns – 40.7%

Key Takeaways

-

Layer 2 scalability solutions can come in many forms, and are designed to boost the throughput and scalability of base layer blockchains. Base layer blockchains like Bitcoin and Ethereum can be slow and expensive when they are congested.

-

Layer 2s are booming. The value of assets being deployed onto layer 2 platforms is hitting unprecedented levels in the billions of dollars. The upcoming Arbirtrum airdrop is set to galvanize the space further

-

Publicly traded company Coinbase has announced that it is launching its own layer 2 solution, BASE. The solution will be agnostic and not exclusive to Ethereum, it will also be usable with other blockchains like Solana.

-

There are a variety of different approaches to layer 2 solutions. Leading the way, at least in terms of total value locked, are ‘Optimistic’ rollup based solutions. This layer 2 technology powers the two largest layer solutions Arbitrum One and Optimism.

-

Not all layer 2s are born equal, just as Vitalik Buterin prophesied in his Blockchain Trilemma, there are sacrifices that have to be made between security and scalability for layer 2 solutions.

-

ZK Layer 2s which have onchain verification and an added element of verification, tend to have slower throughputs than ‘Optimistic’ chains and are less popular as a result.

-

The price performance of tokens attached to layer 2s has been exceptional in 2023.

Don’t miss out – Find out more today