Decred Price Analysis: Emergence as a digital store of value

The DCR has enjoyed a strong start to 2019, with price increases of close to 80% since the year began. Fundamental buying pressure has been driven by the impressive passive incomes offered when staking on the network and active stakeholder backed onchain-voted development decisions run through the Politeia platform. Concerns like Decred's high inflation rate and lack of practical cryptocurrency usage do remain

Decred (DCR) is a hybrid proof-of-work/proof-of-stake blockchain with a unique approach to network governance and decision making. The native token of the Decred digital currency network is DCR. Decred is designed to provide an alternative to bitcoin and aims to solve issues such as governance, development funding, network security, and miner centralization.

DCR currently occupies the 37th position on Brave new coin’s market cap table. Like many other digital assets, it has enjoyed a strong start to 2019 and has risen ~80% since the start of the year. It has risen ~9% in the last 7 days.

Decred is also notable for having endorsements from key figures in the crypto investment space, including leading analysts Willy Woo and Chris Burniske. Chris Burniske’s well-respected Placeholder Ventures firm is an investor in DCR, and as venture capital investors, they assist with Decred’s ecosystem and business development. Speaking at the Texas Bitcoin Conference Chris Burniske and Joel Monegeo discussed assisting the Decred project in finding fiat exchange solutions for DCR and assisting with communications with regulators to help DCR earn the distinction of ‘not-a-security’.

In Decred, miners propose new blocks by solving proof-of-work hash problems, with stakeholders (DCR holders) responsible for verifying the miners’ work. Both parties are rewarded for their respective networks – Decred block rewards are allocated; 60% to PoW miners, 30% to proof-of-stake voters, and 10% is sent to the Decred treasury. The combination of a high hash power requirement and PoS vote count makes the Decred network very difficult to 51% attack.

The Decred treasury is designed to support the building of protocol development initiatives such as the building of infrastructure to support Decred decentralized exchanges, and the allocation of funds towards the professional marketing and public relations of DCR’s value as a secure, adaptive, and self-sustaining cryptocurrency. It is in DCR holders best interest to use the network and grow the treasury fund.

To stake, users buy ‘tickets’ with DCR through the Decred online client. Each time a block is produced, 5 random tickets are chosen from the ticket pool to vote on the validity of the block. At least 3 out of 5 stakers must approve the block for it to be added to the chain. If minimum consensus is not achieved, the block can be vetoed and discarded with no rewards for the blocks.

Tickets are also used to vote on potential upgrades to the Decred protocol. Votes for these changes are allocated every 8,064 blocks (or ~30 days) and the entire ticket pool votes on these decisions. At least 75% of the voting group needs to approve a protocol upgrade for it to be implemented.

A market internal to the blockchain determines the price of tickets using a staking difficulty algorithm which calibrates the price of new tickets to ensure that a target pool size of 40,960 tickets is retained.

Source: Dcrstats.com

The monetary incentives built into consensus participation should ensure a steady stream of willing users looking to be paid for their services governing the network.

For DCR investors there is security knowing that token value cannot be evaporated by a few bad actors in a situation such as a 51% attack, or a network power struggle.

Decred is known as a ‘hard fork resistant’ blockchain because forks, when they occur, are controlled, pre-confirmed, and agreed upon. Governance battles like 2018’s Bitcoin Cash drama, are mitigated by the baked-in, open participation voting protocol of the Decred blockchain. Social media threats by bad actors are not a likely attack vector and the potential for a single consortium to dominate the network’s hash rate is removed.

For users intimidated by the process of PoS participation (it requires a constantly unlocked wallet and low latency internet) tickets can be allocated to a staking pool which may act as a token holder’s representative.

The largest staking consortium in Decred, Stakeminer, represents 4075 users and ~14% of the total network staking pool. There are a number of different stake pool fee structures. Stakeminer provides users a ‘pay what you want’ option with a minimum fee for managing funds set at 1%, while alternative dcrstats.com offers a flat 5% fee for its staking services.

The current block reward is 17.87 DCR, paid across the 3 stakeholders who earn rewards. The block reward adjusts every 6,144 blocks (21.33 days), with adjustments scaled by a factor of 100/101. The high block rewards are an incentive for PoW miners and PoS voters to maintain the Decred network.

If a DCR holder does not stake their tokens towards PoS staking, the token inflation dilutes their holdings by ~28% per annum, a high percentage compared to Bitcoin’s 3% per annum inflation rate. ~47% of the total DCR supply has been mined so far on the Decred chain. As with other PoW networks, users can mitigate this dilution factor by mining and allocating hashing power towards network block production operations. Or they can choose to stake or allocate stake to pools to maintain the nominal value of tokens. The PoS nature of Decred also helps to facilitate transaction fees cheaper than comparable Bitcoin-style PoW networks.

Source: Coinmetrics.io. Average daily transaction fees of the Decred, Bitcoin, Litecoin and Dogecoin networks.

The rapid dilution/inflation may affect the adoption of DCR as a medium of exchange. It is a challenge to endorse the use of a consumer currency that has an inflation rate of 28% per annum. This may hinder its long term digital store of value proposition.

Decred, however, is a very different token when staked to the network and considered purely for investment purposes as a digital store of value. The fundamental demand for DCR comes from its value as an asset that generates a passive income through staking rewards, and strong USD returns during crypto bull markets.

The yield for the Decred network self staking is ~10.5% per annum when holding tickets (the estimated cost of a single ticket is ~116.5 DCR), based on staking data aggregator stakingrewards.com. Staking also drops the expected dilution rate for a DCR holder to ~5.5%. The value proposition as a digital store of value is further enhanced by the network’s strong sybil resistance. This will strengthen if the Decred blockchain implements its proposed privacy features and ecosystem infrastructure additions such as integrated DEXs.

Source: stakingrewards.com

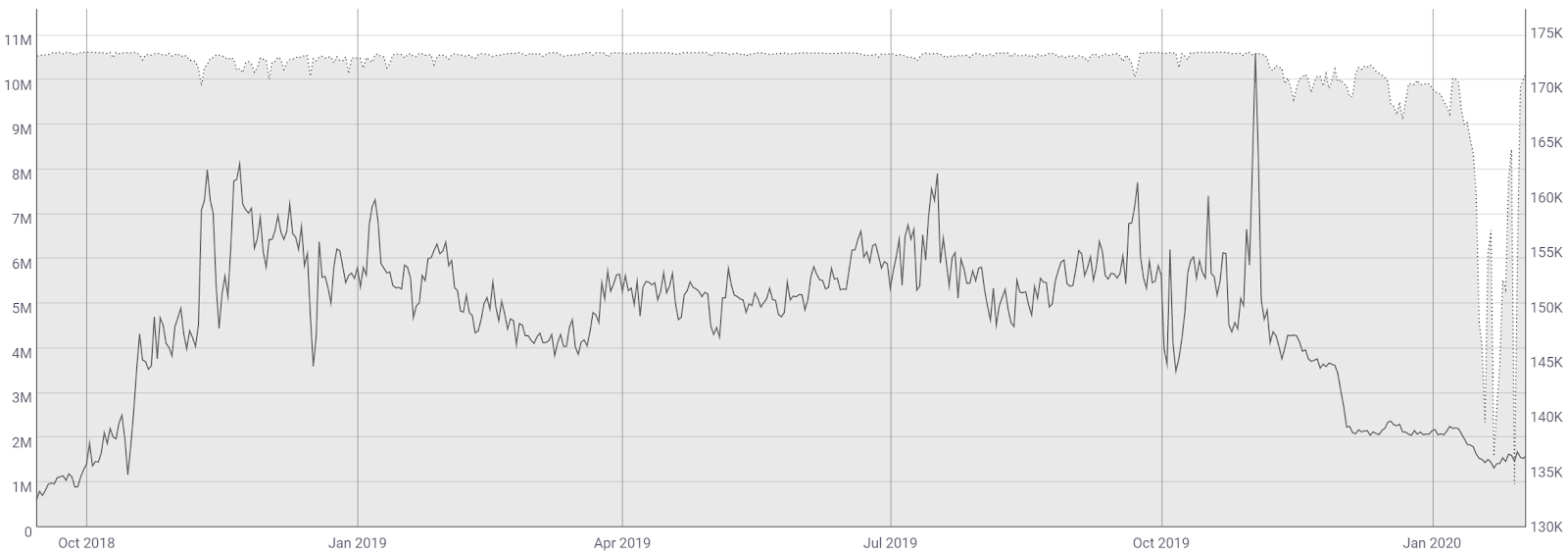

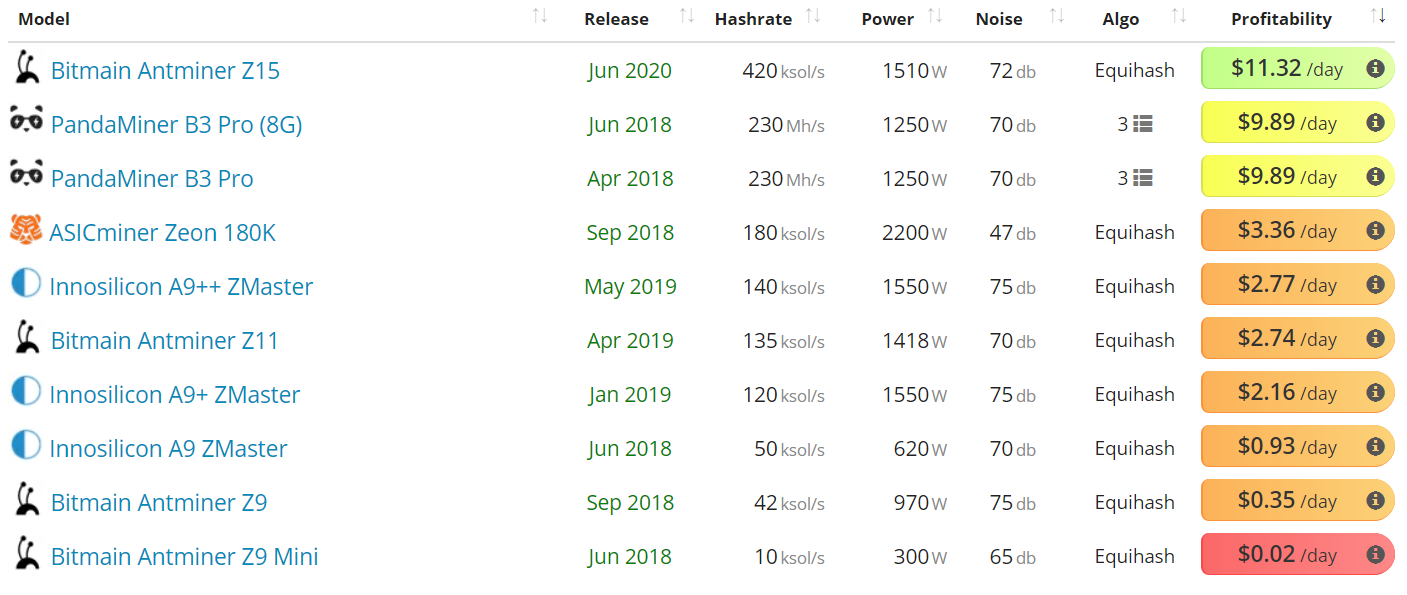

Decred’s hash-rate is exploding. It has grown about 3,000% since June 2018, as ASICs capable of mining Decred’s Blake256 hashing algorithm began coming online.

Source: Dcrstats.com

If for example, Decred miners are mining to mitigate Decred’s inflation rate, or as an alternative to direct investment, then the increase in hashing may be a driver of increased buying pressure.

Beyond the on-chain voting on block validity, proof-of-stake ticket holders can also participate in network development decisions through the off-chain voting system Politeia that the treasury funds.

Politeia is an off-chain governance platform that allows ticket holders to vote on work proposals made by ecosystem participants who want to grow the network. All off-chain voting takes place in Politeia, where anyone can create a funding proposal and have it be voted on by stakeholders.

The motivation for Decred to decentralize control of the treasury via a DAO, is to give stakeholders complete sovereignty over how their funds are spent.

Previous Decred Politeia decisions. Source: https://proposals.decred.org/?tab=discussion

To acquire tickets, DCR holders have to time-lock their funds for an average of 28 days. All governance is handled with tickets, not DCR. Because funds are time-locked and require commitment, stakeholders are incentivized to exercise their vote and deal with the repercussions of every outcome. The Politeia model is designed to drive rational economic decision making from DCR holders. This is based on the assumption that DCR holders want to protect their investments and will make the possible decisions that promote ecosystem growth.

Issues like Decred’s small merchant network and lack of payment ecosystem development are currently at the forefront of stakeholder proposals and decision making. At present, the treasury is centrally managed by Decred Holdings Group LLC, a corporate entity that owns the keys to the multi-sig treasury address. For security purposes, the addresses of the Trustee holders are not known publicly.

A current proposal up for discussion asks for funds to be allocated to ‘Incentivize BD (Business Development) evangelists within the Decred ecosystem’ The proposal suggests that “In order to find use cases and early users, most centralized technology companies have a so-called ‘BD Team’ to build the business case for platform; attract partners, users, and build momentum.” In this case use cases refer to the Decred network’s payment solutions that are adapted to provide strong security, adaptability and stakeholder governance.

Politeia has also had a successful proposal to approve 2019 Marketing Plan Funding. This aimed to improve mainstream participation through a more accessible content and website model that will deliver more frequent ecosystem updates, easier to digest, less technical monthly journals and media updates.

Another successful Politeia proposal allocated treasury to the hiring of a PR company, Ditto communications, for a campaign to raise awareness and adoption of Decred. The campaign will have several angles and will address Decred’s inability to find real-world use as a payment network.

“Decred must articulate ‘who’ is being impacted by the lack of governance, scalability, and other limitations. Finally, after you have sufficiently defined the landscape and illustrated who is being impacted by deficiencies, Decred will have the opportunity to solidify and reinforce its true mission and higher value proposition.”

The motive for Decred stakeholders to drive the adoption and usage of DCR as a payment token is that Decred is utilizing the self-sustaining element of its value proposition successfully. The flexibility of the Decred governance model may help drive future adoption of the digital currency network but until then it lags behind direct alternatives and other competitors in the space.

Objective on-chain indicators

NVT signal

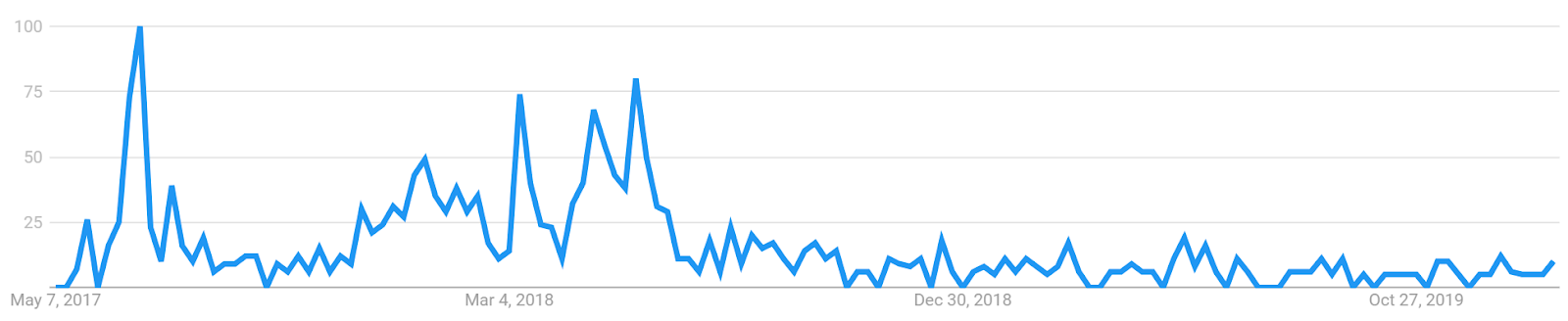

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitry Kalichkin.

Crypto markets are prone to bubbles of speculative purchasing that don’t reflect underlying network fundamentals. The NVT signal provides insight into what stage of this price cycle a token may be at.

A high NVT signal is indicative of a network that is going through one of these bubble periods and may move towards a position of becoming overbought/overvalued, as the market’s speculative momentum slows.

Short term on-chain fundamental indicators lean bearish for DCR. The price of DCR has risen ~98% since hitting the bottom of the bear market in December 2018. This has dovetailed with a rising NVT signal line that is approaching a historically indicated ‘overbought’ (likely between 40-50 points) level. The line appears to be close to hitting a cycle inflection point, and if this is hit, downward pressure will be put on price because of the overvalued fundamentals.

Currently, there is demand to transact/conduct operations on-chain with DCR because of networks with a proof-of-stake solution offering passive income from investment. An increase in usage of the network as a payment solution may help create more daily on-chain volume for the blockchain. This would be bullish as the price cycles last longer and help put a lid on periods where short term price gains quickly lead to assessments that the DCR token is overbought based on overvalued fundamentals.

PMR signal

Metcalfe’s law is a measure of the connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

The short term signals sent by DCR’s PMR also suggest that recent price gains of the token may be pushing it towards overbought levels. This may be at a PMR points level of around 2.

In this context, the medium and long term signals sent by the Decred PMR are more positive. DCR’s current PMR level of around 1.5 is low compared to many other blockchain networks and suggests that DCR’s current market cap of ~USD 284 million is backed by a strong base of active on-chain users.

Decred is notable for strong voter turnouts and staking participation versus competitors in the DAO (Decentralized Autonomous Organization) and formalized governance space.

_Data collected by the Wave financial group: for Decred community protocol amendment proposals (DCP’s) 0002 and 0003, which asked ticket holders whether the Lightning Network should be integrated into Decred, turnouts were as high as 86% of circulating token supply. _

The DCP-0002 and 0003 also had one of the highest numbers for % of network wallets represented in a governance vote at 14%. While average turnout for the first 15 approved Politea proposals was ~31% (based on the 40,960 Decred ticket holder base) while the average turnout for the first 8 rejected proposals was ~28%.

Development activity

Turning to developer activity, Decred has 68 repos on GitHub with active repos including ‘dcrd’,’dcrwallet’ and ‘dcrdocs’. Most coins use Github as their open development platform, where files are saved in folders called ‘repositories,’ or ‘repos,’ and changes to these files are recorded with ‘commits,’ which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Activity on the core ‘dcrd’ repo has been relatively consistent over the last year and through the bear market, with at least a few commits every week. The bar chart is heavily skewed by a week in March when over 100 commits were completed on the repo.

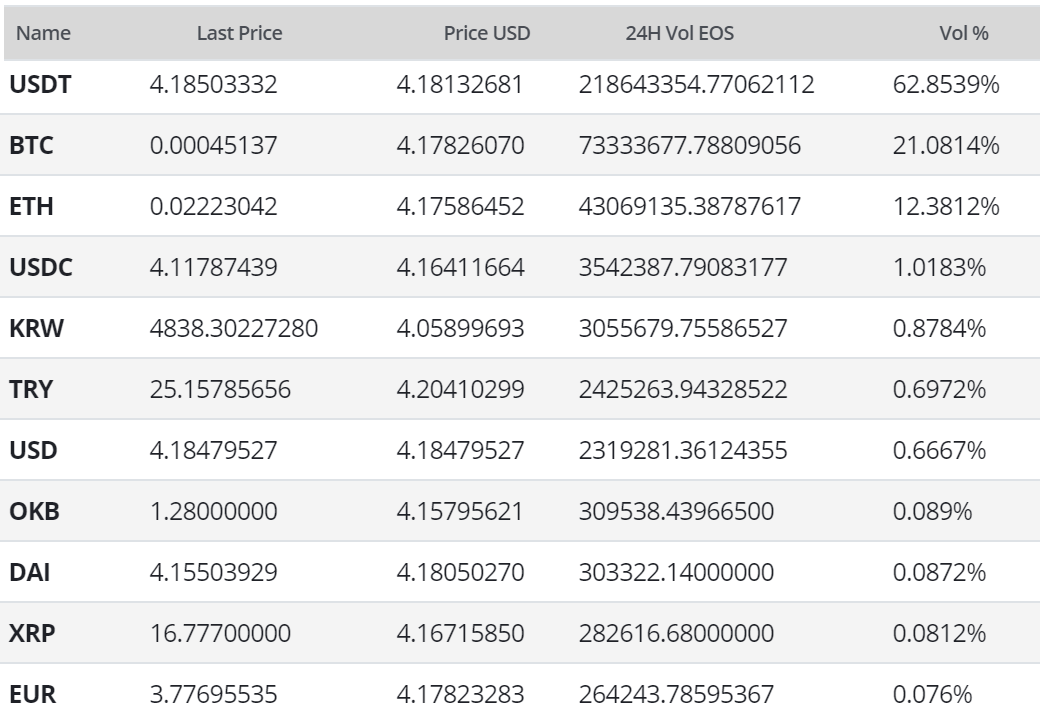

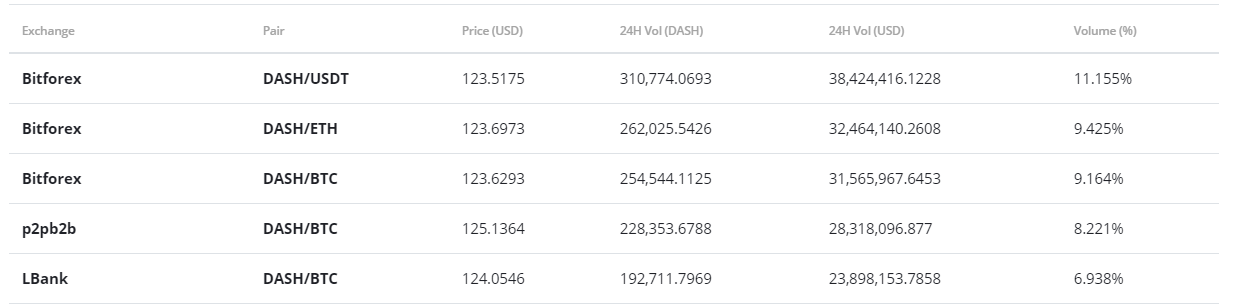

Exchange and Trading activity

The most popular trading option for DCR is BTC with the pair handling close to 40% of daily trading volumes. The second most popular market is the DCR/USDT pair. Together the top two pairs make up ~92% of daily trading volume. The Korean Won pair is the next most popular. The USD value of daily volume of the entire DCR trading market is ~USD 1.9 million.

A mix of exchanges contributes to the DCR trading ecosystem, with the top 5 pairs spread across 5 exchanges. The DCR/BTC market on Binance is the most active market in the ecosystem. DCR is also tradeable on high profile exchanges such as Bittrex and Kucoin.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart, a death cross has persisted since 2018 for DCR. Despite the continued death cross, price has risen ~90% since the mid-December 2018 bottom. Furthermore, a golden cross appears imminent as the 50 and 200 day EMA are tightly coupled near $27. Despite no golden cross, to-date, price remains above the 50 and 200 day EMA, with both likely to provide strong support around $27.

On the 1D chart, DCR has followed its Fibonacci retracement levels during this uptrend, which have included repeated patterns of falling wedges turning into positive breakouts. The recent resistance failure was against the 0.618 level of $30.76, which resulted in price bouncing off the 0.5 level of $27.69. Currently, price, $28.88, is looking to retest the 0.618 resistance level once more. If successful, a breakout to the 1.0 level of $40.69 is extremely likely (arrow).

Lastly, on the 1D chart, the volume flow indicator (VFI) is still above 0 and trending upward. Another attempt above Fibonacci resistance might be in the near future given the VFI is still making higher highs (arrow).

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are mixed: price is above the Cloud, Cloud is bullish, the TK cross is bearish, and the Lagging Span is above Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price initially completed a Kumo breakout in mid-March 2019 and has held onto it with relative ease. Two points of concern might be RSI of 59 forming a descending wedge and price making lower highs.

However, there are a few positive factors for DCR, including:

- VFI still in the bulls’ favor

- Key support levels are strongly in favor of the bulls

- Existing Kumo breakout looks strong

- Cloud support is not in real danger of being tested in the near term

If buying momentum resumes, price targets are $35.02 and 39.28. If key support fails, additional support levels are $27, $24, $21.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are bullish: price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and price.

The slower settings yield similar results; including current Kumo breakout, price targets and support levels.

Conclusion

The price of Decred’s native token has grown strongly since hitting an apparent bear market bottom in December 2018. It is beginning to establish tangible demand as a digital store of value that offers passive income via network staking solutions. The network’s self-sustaining model is working effectively with a number of fluid, well attended on-chain governance voting processes successfully completed on the network in the last year. This shows there is active stakeholder interest and participation in the development of the Decred network.

The lack of usage for DCR as a cryptocurrency payment solution is a concern, however. Decred’s base value as an alternative medium of exchange to Bitcoin is often lost because of a focus on its governance and this has affected consumer level adoption, this issue is accentuated by the network’s high dilution/inflation rate. These issues may be mitigated in the future by Decred’s liquid democracy capabilities.

The technicals for DCR are long term bullish, despite the recent price weakness. On the 1D chart, both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30) may view the existing Kumo breakout as sufficient for entering a long position. However, a more conservative trader may await an additional positive occurrence like successful golden cross or break above 0.618 Fibonacci level, before entering a long position. Regardless, the odds favor the bulls with price targets of $35.02 and 39.28. In the event the bears strike back, support levels are $27, $24, $21.

Don’t miss out – Find out more today