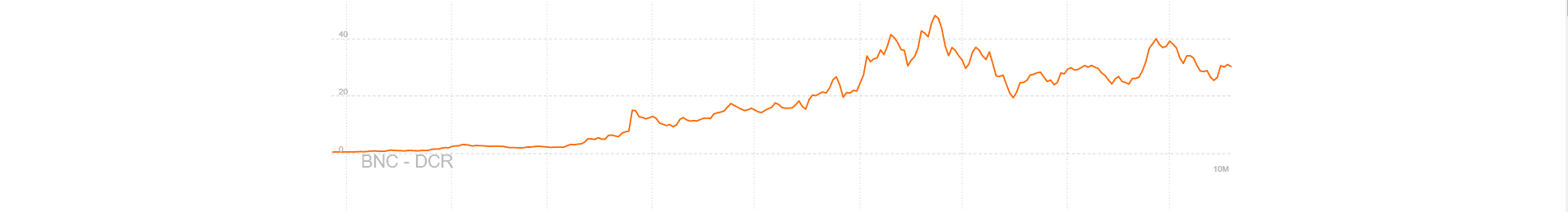

Decred Technical Analysis – Continuing upward momentum

The Decred (DCR) hash rate has increased substantially this year, and has continued in a strong upward trend. Price has also followed this upward trend, which began with a release of the [DCR 2017 roadmap](https://blog.decred.org/2017/01/09/2017-Decred-Roadmap/) on January 9th.

DCR uses a hybrid Proof of Work (PoW) and Proof of Stake (PoS) model they have dubbed Proof of Activity (PoA). The PoA model attempts to satisfy proponents and critics of both PoW and PoS.

The Decred (DCR) hash rate has increased substantially this year, and has continued in a strong upward trend. Price has also followed this upward trend, which began with a release of the DCR 2017 roadmap on January 9th.

PoW favors those with high amounts of capital to invest in mining infrastructure and have access to low electricity costs or low scarce resource costs. The model attempts to incentivise distributed consensus, but has been subject to miner centralization.

PoW also has specific vulnerabilities, like a 51% attack, which allows majority hash rate or miner collusion on a blockchain to control the blockchain and the transactions. With some mining pools holding vast majority of total hash rate, this type of attack is not too far from reality, and has been a concern in the past.

PoS favors early adopters, especially when initial distribution is not fair or widespread. The benefits of PoS include decreased infrastructure costs and the ability for any user to realistically participate. PoS criticisms focus on problems with single signer consensus vs distributed consensus, allowing for “stake grinding” to favor yourself and your reward. This effectively allows a PoS miner to fork and create an alternate blockchain.

Pure PoS models also promote an artificial decreased supply by locking up large swaths of coins for extended duration of time in order to mine the block reward. From a speculative point of view, an artificially decreased supply also favors volatile market conditions due to lack of market participants.

Stakeholders who have purchased tickets have the chance to vote on the block. 5 tickets are chosen randomly from the ticket pool and if at least 3 of them vote ‘yes’ the block is permanently added to the blockchain and the transactions are cleared. Both PoS and PoW miners are compensated with DCR for the resources used to mine the block. Currently, about 42% of DCR is locked in PoS.

Tickets can also be used to change any governance issues such as block size or changing the consensus algorithms. Learn more about DCR staking here. This hybrid system attempts to ensures that a small group cannot dominate the flow of transactions or make changes to Decred without the input of the community.

The goal of course is to further decrease centralization of power over the protocol itself. Bitcoin users resorted to a user activated soft fork (UASF) in order to push for SegWit protocol changes due to the lack of consensus surrounding the change. This would likely be avoided with the hybrid system.

Block rewards are split 60% to PoW, 30% to PoS, and 10% to developers. The current block reward breakdown is 14.3 DCR for PoW, 1.43 DCR per ticket for stakeholders, and 2.39 DCR for the developer subsidy.

The development subsidy allows for the devs to earn an income for improving the protocol based on submitted community proposals. Although this guarantees income for a dev, it also opens them up to potential regulatory risks as a planner for the protocol.

Today, the Decred team announced an atomic swap with the help of Charlie Lee, creator of Litecoin. Full details have not yet been released, but the exchange involved hash time-locked CheckLockTimeVerify (CLTV) transactions.

An atomic swap involves a direct cross-chain swap for one coin to the other without the use of an intermediary like an exchange.

Atomic swaps can also be completed with CheckSequenceVerify proposed in Bitcoin Improvement Protocol 112, which also involves hash time-locked contracts used in bidirectional payment channels.

The Lightning Network takes this one step further, allowing for hub and spoke bidirectional payment channels. Atomic swaps between Lightning Network enabled coins will be possible in the future.

Decred is predominantly traded for Bitcoin on Bittrex and Poloniex. As with any coin, direct fiat on ramping, of which DCR is not privy, typically generates substantially more exchange volume than a Bitcoin pair alone. Volume over the past 24 hours is BTC985 (US$3.9M).

Technical Analysis

Any fresh look at the chart for a coin should be done on a high time frame. DCR has been around long enough to have pertinent information on the weekly chart.

Using a fibonacci retracement from the high in march to the low in August yields a 1.618 fib extension of ~0.0326. There is plenty of room for this target based on momentum, or RSI, which has reset from highs, now around 50. Volume has continued to increase despite price making lower lows, which suggests a type of bullish divergence.

A break of the current horizontal zone would confirm pattern completion. There may also be a throwback returning to the horizontal zone before the target is reached.

A 50/200EMA golden cross in February signaled start of this uptrend almost perfectly.

The indicator uses a moving average and dynamic support and resistance to make key zone projections. Its goal is to capture 80% of any given trend. While it may seem complicated when viewed on the price chart, it is really a straightforward indicator that is very usable.

As long as the price remains above the Cloud, sentiment remains bullish. Price in the Cloud indicates a neutral trend, and below the Cloud indicates a bearish trend.

The best entry signals for the Cloud occur when the trend is obvious, but 1 or 2 signals have yet to become confluent with a higher time frame trend:

When the Tenkan (T) is over the Kijun (K) sentiment is bullish. K over T would indicate bearish sentiment. When the Lagging Span (LS) is above the Cloud and above the price sentiment is bullish, below the Cloud and below price would indicate bearish sentiment.

Additionally, in any given trend, price will continually attempt mean reversion to determine support levels. These pullbacks or corrections can be seen through touches of the Kijun, also known as the Kijun bounce.

On the daily chart, an edge to edge trade recently triggered, with a candle close in the cloud a few days ago. The target for this edge to edge trade, always the opposite edge of the cloud, is modest, but does signify winds of change for a trend that has been decidedly bearish since July, when it fell under the Cloud for an extended period of time.

Using faster Ichimoku Cloud settings on the daily chart, 10/30/60/30, there is a bearish TK cross above the cloud, which is a long exit signal. Singled Cloud settings on the daily time frame have been back tested on more than 50 alt coins. The data shows superior and improved entries for Kumo Breakouts and TK Crosses when compared to the double 20/60/120/30 settings (data not shown).

The doubled cloud settings on the daily show another Cloud trading principle: ‘flat kumo = magnet’ at ~0.012. This zone also correlates with the double bottom 1.618 fib extension target. The flat kumos occur when price remains sideways in a zone after a significant movement and also represent 50% of the previous range.

A flat cloud is essentially telling traders to look for some sort of consolidation pattern preceding the cloud itself, in this case, the double bottom.

There is also the possible of an additional edge to edge long entry signal to occur when price closes inside of this cloud. The target for that trade becomes a bit more obvious that the previous edge to edge trade on the singled cloud due to the flat nature of this cloud.

Similar to the four hour 50/200EMA cross, the four hour cloud signals are all decidedly bullish. Again, this would be an aggressive long entry signal because a horizontal resistance zone on a higher timeframe has yet to break. When these cases exist, I typically open a small portion of the desired amount at this level and add to the trade once the horizontal zone breaks.

Conclusion

Conclusion

DCR uses an interesting hybrid PoW/PoS model in an attempt to assuage concerns from supporters of each faction, preventing either side from controlling the consensus algorithm which governs the cryptocurrency. Although in its nascent stages, the roadmap and dev subsidy on the block reward suggests an active and dedicated community in it for the long haul.

Technicals indicate an immediate test of the 0.012-0.014 level, creating a new uptrend which would have a high likelihood of retesting the previous all time high zone.

Don’t miss out – Find out more today