DOGE Price Analysis: Old skool crypto project sends mixed signals

DOGE’s tangible utility as a medium of exchange for tipping has generated some good fundamentals. Daily active user numbers are high and suggest DOGE may be undervalued based on network effects. The network is barely being worked on, however, and has been in a state of arrested development since 2015.

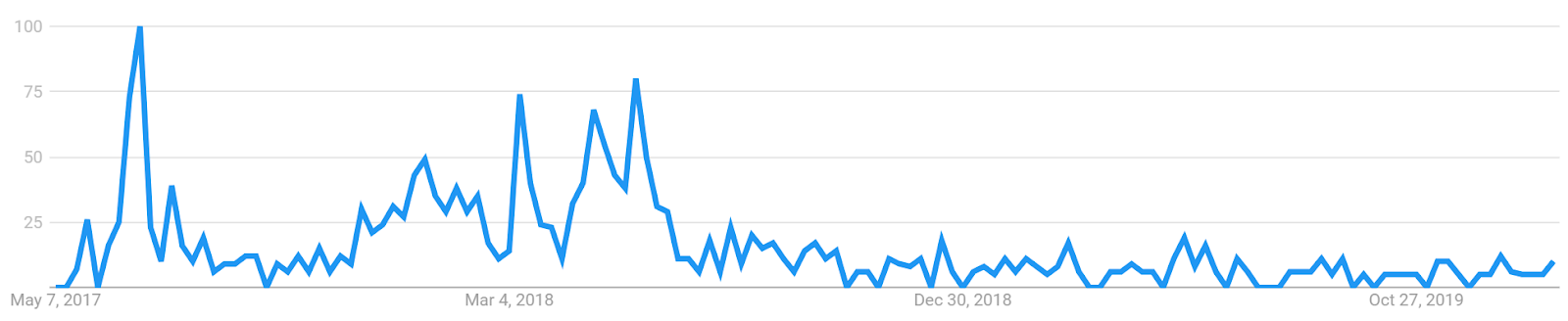

Dogecoin (DOGE) is a popular ‘memecoin’ in the cryptocurrency industry. The token takes its name from the 2013 Shiba inu dog meme. Australian developer Jackson Palmer created Dogecoin in 2013, intending the coin to be a satirical commentary on the increasing amount of low-quality projects in the blockchain ecosystem, and the exaggerated valuations these projects attracted.

DOGE currently occupies the 29th position on the Brave New Coin market cap table with a market cap of USD 383,315,997, trading at ~0.0032. The token appears to have bounced off the bear market bottom in late January 2019, with the price rising ~70% since the low on January 28th.

To the surprise of its creator, DOGE has gone on to become one of the most popular cryptocurrencies, with a vibrant community and an unusually idiosyncratic and volatile price history.

Source: Bravenewcoin.com

Source: Bravenewcoin.com

Beyond its novelty appeal as a fun memecoin project, DOGE offers two crucial fundamental user advantages when compared to most other cryptocurrency projects. It has always delivered fast block times and low fees — and is consistently faster and cheaper than Bitcoin, Litecoin, Dash and most other cryptocurrencies.

Source: Coinmetrics.io

Source: Coinmetrics.io

The Dogecoin blockchain has a long history as a micropayment and community-driven fundraising platform. The network’s cheap transaction fees and fast speeds enabled Dogecoin tip-bots such as Doger and Sodogetip, which let users tip content providers for creating quality content on platforms such as Twitter and Reddit

DOGE is accepted by a wide range of online merchants and vendors and can be used to buy gift cards from Amazon, Dominoes and Dunkin’ Donuts. The Dogecoin community is known for its charity initiatives including raising US $50,000 to aid the Jamaican Bobsled team for a trip to the Sochi Winter Olympics in 2014, US $30,000 for World Water Day in 2014, and US $55,000 to sponsor NASCAR driver Josh Wise.

DOGE is known for having a large, friendly community and the memecoin is responsible for introducing many users to the wider cryptocurrency ecosystem. Projects like Dogeminer, a game that replicates the processes of cryptocurrency mining, were created by community developers as a way to introduce new DOGE users to blockchain mechanics. Dogeminer is supported by community and DOGE tips.

The Dogecoin subreddit, r/Dogecoin, is notable for being friendly to newcomers and for having civil online discussions. Top posts in the subreddit over the last year include this post which favorably compares the Dogecoin subreddit to other more politically charged subreddits. The subreddit has 134,643 subscribers and is the 1458th most popular subreddit on the platform.

One flaw with the Dogecoin semi-altruistic community development model is a lack of serious projects that are designed to expand the ecosystem and create tangible economic activity on the Dogecoin network. Development has dropped off significantly in recent years. Initiatives like the Dogethereum fork, which created speculative buying pressure for DOGE in 2018, was either a joke or a scam, with no serious plans for future expansion.

Dogecoin’s technology stack has remained somewhat static following the initial wave of network development when the token was first launched. This is in stark contrast to other cryptographic token projects which aim to continually release technical network updates and announce new business deals. S

Additions and deletions on the main Dogecoin Github account: No activity since 2015

However Dogecoin has had 5 code releases since the beginning of 2018, and a soft fork in 2019. In late 2018 the Dogecoin also implemented BIP-65 to the network is a new opcode (OP_CHECKLOCKTIMEVERIFY) from the Bitcoin scripting system that allows a transaction output to be made unspendable until some point in the future.

Dogecoin has a number of significant tech influencer and celebrity fans, however. In a tweet from April 2019, Tesla CEO Elon Musk declared “Dogecoin might be my fav cryptocurrency. It’s pretty cool.” The tweet was in response to a Dogecoin Twitter community poll run on April Fool’s day asking the Twitter public who should be the cryptocurrency’s next CEO (an obvious joke given the decentralized, open source nature of the project). Elon Musk won the poll with 54% of the votes.

Elon (a self-professed fan of memes) gleefully accepted the position of Dogecoin CEO and continued to tweet about Dogecoin for the next day, with posts like this one.

Despite the comedic nature of the interactions between Dogecoin and Elon Musk, the event seemed to galvanize Dogecoin bulls and the price of DOGE spiked around the dates of the April Fool’s Day poll. In the 4 days between March 31st and April 4th, the price of the token rose an impressive ~80%.

Dogecoin has an unlimited supply. As of June 6th, 2019, the Dogecoin network had a circulating supply of 119,809,177,262 DOGE. There is a static amount of 5.256 billion coins generated each year. The total amount of DOGE in circulation will increase each year, but the amount generated per year, 5.256 billion, is static. This means that the inflation rate actually decreases every year.

DOGE does not have the same long term store-of-value appeal as other tokens but its blockchain functions efficiently within its own restrictions. The circulating supply decisions were made deliberately to keep individual DOGE denominations small and maintain its edge as a tool for easy tipping. Despite its role as a currency/medium of exchange, the token has provided a handsome return on investment of ~482% since inception.

Dogecoin was created as a fork of the proof-of-work Luckycoin, which in itself is a fork of Litecoin. DOGE uses the same scrypt algorithm as Litecoin, which was initially designed to be an ASIC-resistant alternative to the Bitcoin blockchain, but in 2014 the algorithm became ASIC minable.

Because of concerns surrounding a potential 51% attack, Litecoin founder Charlie Lee proposed a merged mining solution between Litecoin and Dogecoin, which would allow both chains to be mined simultaneously because they both use the same hashing algorithm. The fork that initiated the merged mining solution was implemented on block 371337, in September, 2014.

Immediately before the fork, the hash power on the Litecoin network was around 14 times higher than the Dogecoin network. However, the hashrates of both networks are now closely aligned.

In mid-April 2019, both networks began to reach hashrate all-time-highs. This coincided with strong price gains for both tokens through 2019. Price generally leads hashrate because a higher price for the mined token means greater mining profitability, incentivizing more mining and higher network hashrates.

Other factors also influence network hashrate, in fact the biggest driver of Dogecoin and Litecoin’s surging hashrate is most likely a new next-gen Scrypt mining ASIC, the Antminer L5. According to the LitecoinTalk forum, the next generation miner is now available for rent to industry players on BitDeer, a computing power-sharing platform, with public use to follow. It is expected to offer superior performance to current Scrypt mining rigs. This is due to more efficient electricity consumption and double the current hashrate capabilities of the older generation Antminer L3++ rigs.

Litecoin mining will become more difficult once a scheduled block reward halvening occurs later this year. The retail release of the Antminer L5 may help boost both the Litecoin and Dogecoin hashrates post halvening.

Hashrate and a secure network can create buying pressure for a proof-of-work coin because if mining pools stay online they may keep reinvesting in the networks they are mining. This reinvestment is particularly strong if they are mining during a bull market and the value of their mined assets is growing.

For example, data from the Bitmain IPO document suggests that the mining company bought significant amounts of crypto with mining revenues earned in 2017. In bullish market conditions, an increase in mining activity on the Dogecoin network may create additional buy pressure for the token.

Four main groups dominate hash power in the network (57%). A significant contributor is the mining operation f2pool, which also mines BTC, XEC and Ethereum based hashing algorithms. Tt controls ~19% of network hashpower.

Objective on-chain indicators

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitry Kalichkin.

Crypto markets are prone to bubbles of speculative purchasing that don’t reflect underlying network fundamentals. The NVT signal provides insight into what stage of this price cycle a token may be at.

A high NVT signal is indicative of a network that is going through one of these bubble periods and may move towards a position of becoming overbought/overvalued, as the market’s speculative momentum slows.

The DOGE NVT signal leans bearish and suggests that recent price gains and increases in external value have pushed the token to a point of overvalued fundamentals. The NVT signal line of DOGE has already begun pushing downwards and if this pattern continues significant negative price pressure may follow.

The NVT signal is low when compared to other cryptocurrency networks and suggests any downward price pressure created by overvalued fundamentals is likely to be temporary on a long enough timeframe.

PMR signal

Metcalfe’s law is a measure of the connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

PMR has been negative in natural log points since the genesis of the Dogecoin network, meaning Metcalfe’s law (network connections) has always exceeded the market cap of DOGE, pointing to long term undervaluation based on implied network effects.

In the short term, the PMR signal for DOGE appears to be below any oversold inflection levels, suggesting it may create some positive fundamental price pressure.

A cryptocurrency’s network effects increase when new users join and strengthen the network, making it more valuable for existing users. The most direct network effects are improved liquidity and utility. More daily active users can be indicative of a higher level of merchant adoption (more places to spend DOGE) and more counterparties willing to accept DOGE for payments.

Adjusted Coin/Bitcoin Days Destroyed

Coin days are defined as the quantity of coins multiplied by the number of days since those coins were moved. Once a coin has been idle for a period of time, moving that Bitcoin “destroys” the number of days that it has accrued. Coin days destroyed, by assigning a higher value to a coin that has been idle for longer, more accurately reflects market participants who have been in the ecosystem for longer. Adjusted coin days destroyed divides coin days destroyed by circulating supply to account for the effects of new coins being created by mining and on-chain operations, like upgrading wallets, conducted by centralized crypto exchanges. Adjusted coin days destroyed is meant to more accurately reflect the movement of DOGE by long term hodlers.

The adjusted coin days destroyed on-chain cycle indicator has gained exposure following an explanatory article by crypto asset firm Ikigai Asset Management. While the article focuses on the Bitcoin network, it can be applied to other UTXO chains such as DOGE to derive similar insights.

Circulating supply and Coin days destroyed collected from blockchair

Spikes in ACDD (Adjusted Coin Days Destroyed) indicate periods where long term/medium term whales decided to sell DOGE. For the most part, it appears as though a number of DOGE whales were able to time their sell-offs around price cycle peaks. This is not always the case, there were also spikes in June 2014, December 2015, and December 2016. These DOGE whales most likely regret not waiting longer to sell their long term positions.

In the short term, the ACDD of DOGE suggests that the token has been in a long period of accumulation beginning in July 2018 during which old coins were primarily held onto by long term DOGE whales. The spike occurring around mid-May 2019 may be of some concern to traders currently long on DOGE.

ACDD spikes tend to occur at the end of positive price periods with whales choosing to be opportunistic and take profits. The large movement may be a whale who believes the 2019 bull run is ending, and decides to exit part of a large, long term DOGE position. Whether this spike is isolated or part of a bigger trend is unclear at this stage.

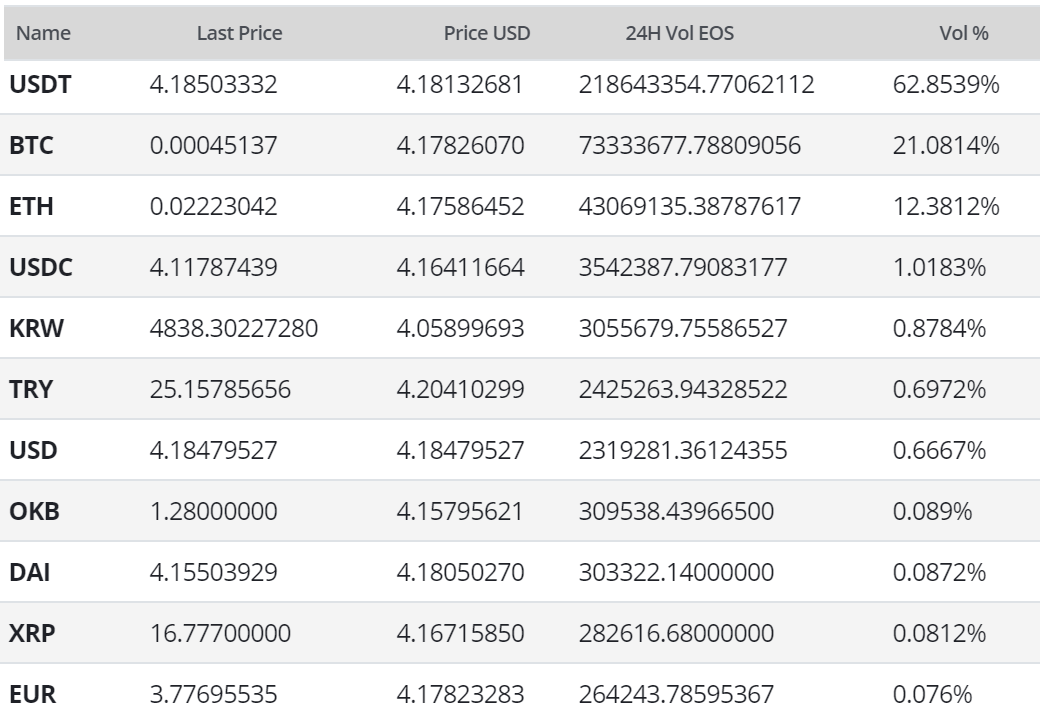

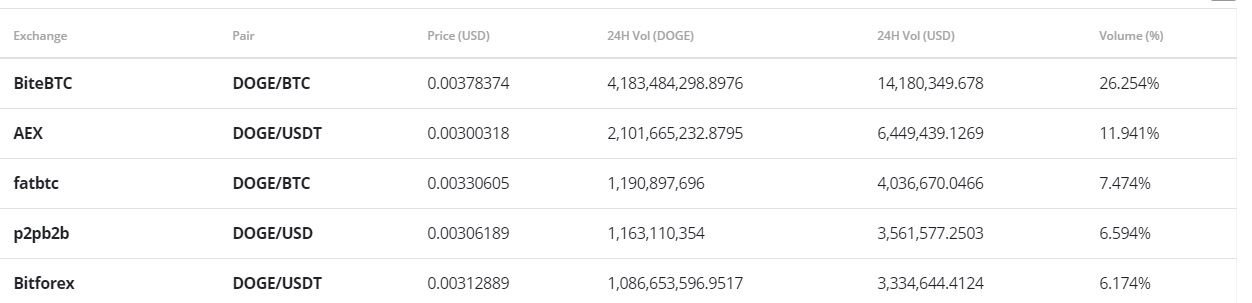

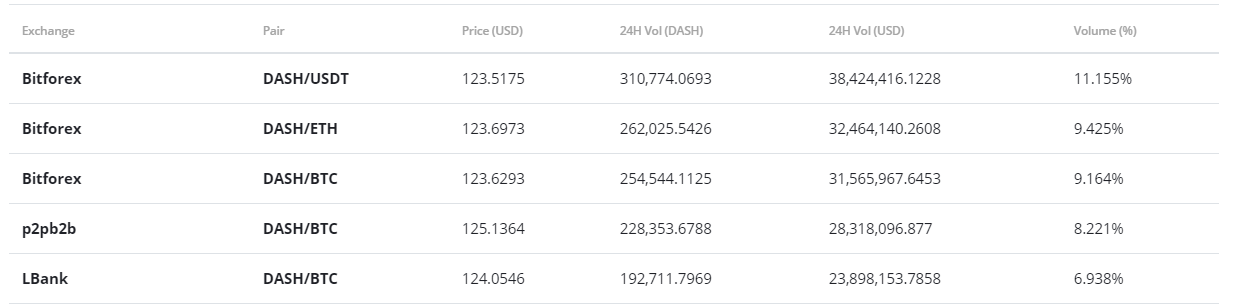

Exchanges and trading pairs

[ ]

]

The most popular trading option for DOGE is BTC with the pair handling over 50% of daily trading volumes. The second most popular market is the DOGE/USDT pair. Together the top two pairs make up ~77% of daily trading volume. The USD pair is the most popular fiat off-ramp liquidity solution. The USD value of daily volume of the entire DOGE trading market is ~USD 53 million.

A mix of exchanges contributes to the DOGE trading ecosystem, with the top 5 pairs spread across 5 exchanges. The DOGE/BTC market on BiteBTC is the most active market in the ecosystem. DOGE is also tradeable on more high profile exchanges such as Poloniex and Huobi.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart, a golden cross occurred on May 21, 2019, which had not happened since September 2018. In June 2019, DOGE has experienced a ~12% pullback. However, price bounced off 50 day EMA support, which keeps it above both 50 and 200 day EMA, for now.

On the 1D chart, using Fibonacci retracement levels, we are able to better categorize DOGE’s sharp price fluctuations during its price run since April 1, 2019. In particular, DOGE has relied on key Fibonacci support levels to stymie sharp price decreases, before it could resume its upward momentum. Since mid-May, price is still making higher highs and higher lows (trend line), and used the 0.382 Fibonacci level as support during its most recent fall. This level happens to coincide with the 50 day EMA. If the uptrend holds, a retest of the 0.236 level of $0.0032 should be expected. Whereas, a break of that trend line will invite a retest of the 0.5 ($0.0028), and possibly the 0.618 ($0.0026) level.

Lastly, on the 1D chart, the volume flow indicator (VFI) is still above 0 with the trend still slightly upward. If price falls beneath the trendline, coupled with VFI falling beneath 0, that would be a strong sell signal in the near term.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are mixed: price is touching the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is above Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price completed its most recent Kumo breakout in mid-May, but has struggled to maintain it ever since. Currently, price is retesting Cloud support of $0.003.

There are few positive factors for DOGE, including:

- VFI still in the bulls’ favor

- Key support levels seem strong (EMAs and Fibonacci Levels relatively coincide)

Despite RSI at 47, there is a growing divergence between price’s uptrend (red arrow) and RSI’s downtrend (black arrow). If this divergence persists, a trend reversal is likely, which would see Cloud support fail in the near term, and support levels of $0.0028 and $0.0026 come into play. If the divergence reverses, price targets are $0.0032 and $0.0035.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are bullish: price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and price.

The slower settings yield similar results; including retesting Cloud support, price targets and support levels.

Conclusion

DOGE may have started as a joke but the cryptocurrency network’s ability to maintain tangible utility as a medium of exchange for tipping has meant it has generated some impressive fundamentals. It is cheap, fast, and handles a high level of daily transactions. Daily active user numbers are high and suggest DOGE may be undervalued based on network effects. These numbers are buoyed by the token’s large, friendly stakeholder community.

DOGE is a difficult investment to recommend, however. The network is barely being worked on and has been in a state of arrested development since 2015. The network’s supply strategy is also designed to keep individual tokens cheap. DOGE’s most significant price gains in 2019 seem to have been primarily driven by a tongue-in-cheek endorsement from Tesla CEO Elon Musk, and not actual fundamental or technical factors. Despite this downside, DOGE remains a viable means of exchange with consistently fast transaction times and low fees.

The technicals for DOGE are currently conflicted with both bulls and bears seeing warning signs. On the 1D chart, both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30) may view the existing Kumo breakout as sufficient for entering a long position. However, a more conservative trader may await either Cloud support to hold or RSI divergence to breakdown, before entering a long position. Price targets for the bulls are $0.0032 and $0.0035. Support levels (price targets for bears) are $0.0028 and $0.0026.

Don’t miss out – Find out more today