EOS Price Analysis – something bullish this way comes

EOS has outperformed other crypto in the market cap top 10 over the last month and technicals suggest this forward momentum looks set to continue. Fundamentals also look strong for the most part with Dapp usage continuing and projects migrating from other blockchains onto EOS.

EOS is a computing and smart contract platform which intends to deploy a myriad of decentralized applications (Dapps) and decentralized autonomous corporations (DACs). The asset has gained 51% over the past month but remains down 85% from an all-time high established in April 2018. The market cap currently stands at US$3.205 billion with US$812 million in trade volume over the past 24 hours. The crypto asset is ranked 4th on the Brave New Coin market cap table, just above Litecoin (LTC).

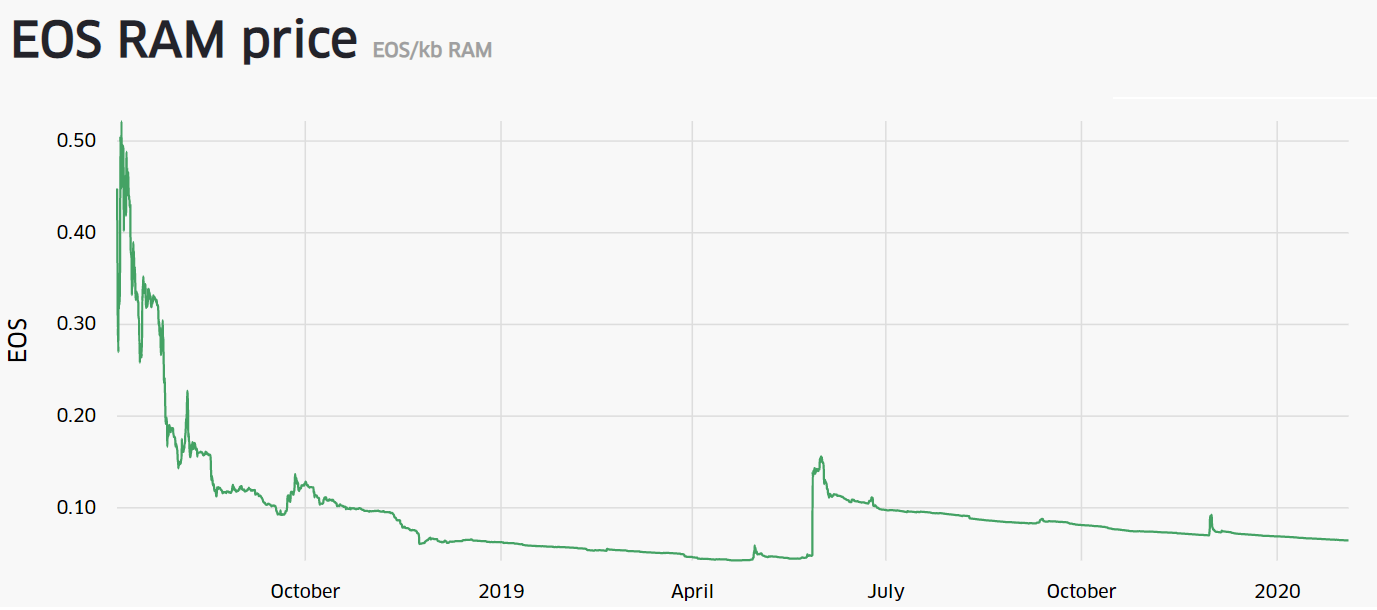

The EOS platform, created by Block.One, is a global computing network running smart contracts on Virtual Machines and looks to rival other dApp or smart contract enabling blockchains, like Ethereum (ETH), Tronix (TRX), and NEO (NEO). The ETH and NEO platforms use gas to pay for units of computing power while EOS uses RAM. EOS went live on June 14th, 2018, after raising ~US$4.2 billion in a year-long ICO, where the average token price was US$5.74.

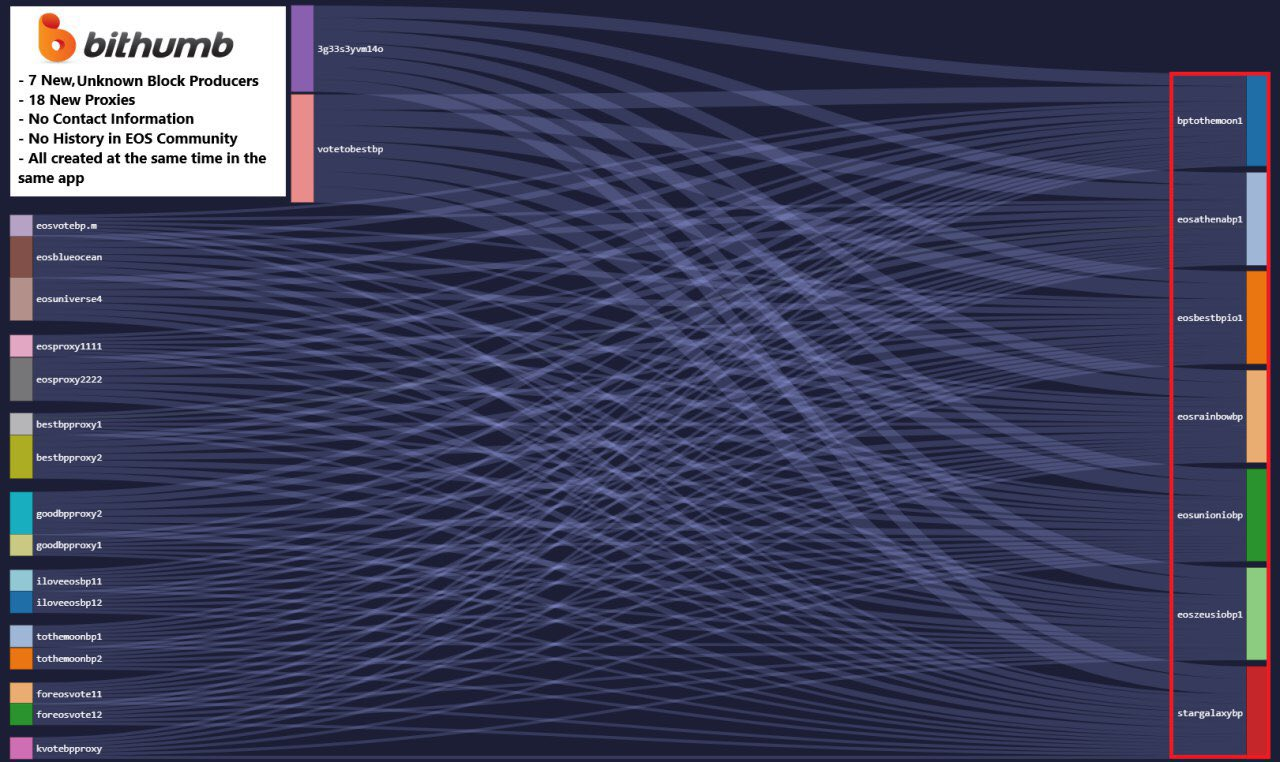

The EOS blockchain uses a Delegated Proof of Stake (DPoS) consensus mechanism, which was pioneered by EOS and Block.One CTO Dan Larimer. DPoS is also currently being used by BitShares, Steemit, Lisk, Ark, and Tezos. With DPoS, users vote for delegates, or Block Producers (BPs), who are considered trusted and good actors. The top 21 EOS BPs validate the blockchain, collect a passive income, and are expected to help further protocol development by proposing changes or improvements.

Source: http://eosnetworkmonitor.io/

While the top 100 BPs are paid for their services, the top 21 BPs earn the highest reward. Should any of these BPs go against the community’s wishes, they can immediately be fired and replaced. To encourage voting participation, EOS has implemented a vote decay system with newer votes initially carrying the most weight and have a minimal impact after two years.

The governance structure is similar to that of a two-layer representative democracy with landowner suffrage. Each stakeholder has influence proportional to their stake in the system. BPs can also offer reward sharing to encourage votes from stakeholders. However, this can encourage BPs offering the highest reward to stakeholders to become elected and does not necessarily encourage what is in the network’s best interest. The current reward for staking on EOS, beyond voting on network proposals, is use of the Virtual Machine (VM) components, including; bandwidth, RAM, and storage.

Another arm of the EOS governance system is the EOS Core Arbitration Forum (ECAF), a volunteer-led tribunal. Thus far, ECAF has given nine public notifications of arbitration and has facilitated 21 orders or rulings since June 2018. The process often involves blacklisting accounts, which only works if 21 of the 21 producing BPs use the blacklist to function properly. Last week, a newly rotated top 21 BP, games.eos, failed to apply the blacklist correctly, thus allowing 2.09 million EOS, or about US$7.25 million, move out of a blacklisted account. Due to the incident, games.eos is no longer a top 21 BP. Going forward, there are plans to cancel out the keys on the blacklist entirely, so they can never be used on the EOS blockchain.

On the network side, the EOS blockchain has grown to 4TB over the past eight months, with only five BPs, Greymass, EOS Sweden, CryptoLions, EOS Tribe, and EOS Canada, running a full archival node. These nodes are essential for fully-functional dApp activity as 20% of blockchain lookup requests involve observing the entire blockchain history.

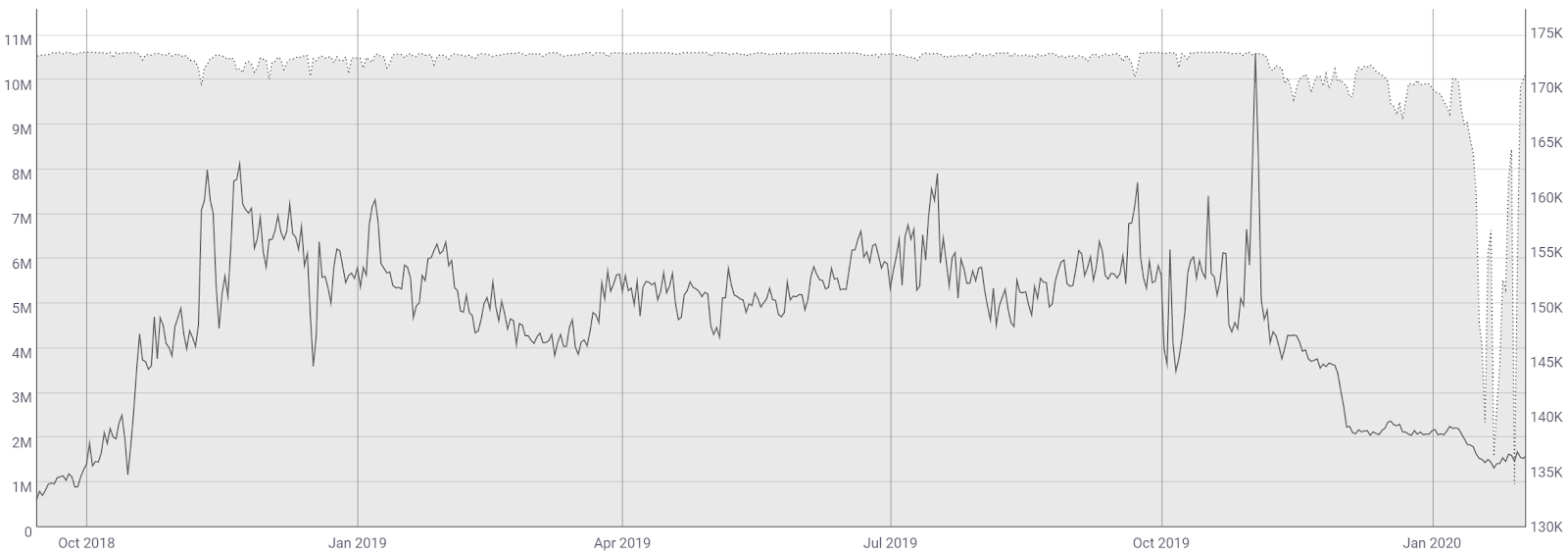

Currently, 53% of all circulating EOS tokens are being staked, and the network is confirming around 36 transactions per second. The record number of transactions on the network at one time stands at 3,996 per second. The current number of total transactions per day on the network (line, chart below) stands at ~4.79 million, which has increased substantially since June 2018, and is likely related to dApp activity. The average transaction value (fill, chart below) is currently US$51, which is down from a May high of US$38,000 and is also likely related to dApp activity.

Source: coinmetrics.io

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) fell rapidly from November to January but began to rise throughout February. A clear downtrend in NVT suggests a coin is undervalued based on its economic activity and utility, which should be seen as a bullish price indicator, whereas an uptrend in NVT suggests the opposite. NVT is difficult to compare between coins that use different transactions types, but the ratio can be used to assess a network’s relative utility over time. EOS’ NVT, at 25, is currently lower than TRX, at 43, ETH, at 34, and NEO, at 33.

Daily active addresses (DAA) reached a new ATH of almost 95,000 in mid-January but have since begun to decline slightly (fill, chart below). EOS currently has fewer DAA than ETH, but more DAA than TRX and NEO. DAA are important to consider when determining the fundamental value of the network based on Metcalfe’s law. Grassroots interest on meetup.com shows over 65,000 people in 180 EOS groups worldwide and over 63,000 subscribers on Reddit’s /r/eos.

Source: coinmetrics.io

The cost of RAM on the EOS virtual machine continues to push all-time lows, currently ~0.052EOS/kb. After an account is created, there are minimal transaction fees on the EOS blockchain. RAM on EOS is subject to supply and demand, as well as speculation, and is required to create new accounts or interact with Dapps. New account creation uses 4kb of RAM. A few users attempted to corner the RAM market in July 2018 when RAM costs skyrocketed to ~900EOS/MB, which meant a new account cost ~US$32 at that time. In response, 15 of the 21 EOS BPs approved a measure to double the supply of RAM, flooding the market and decreasing RAM costs.

Source: https://eos.feexplorer.io/

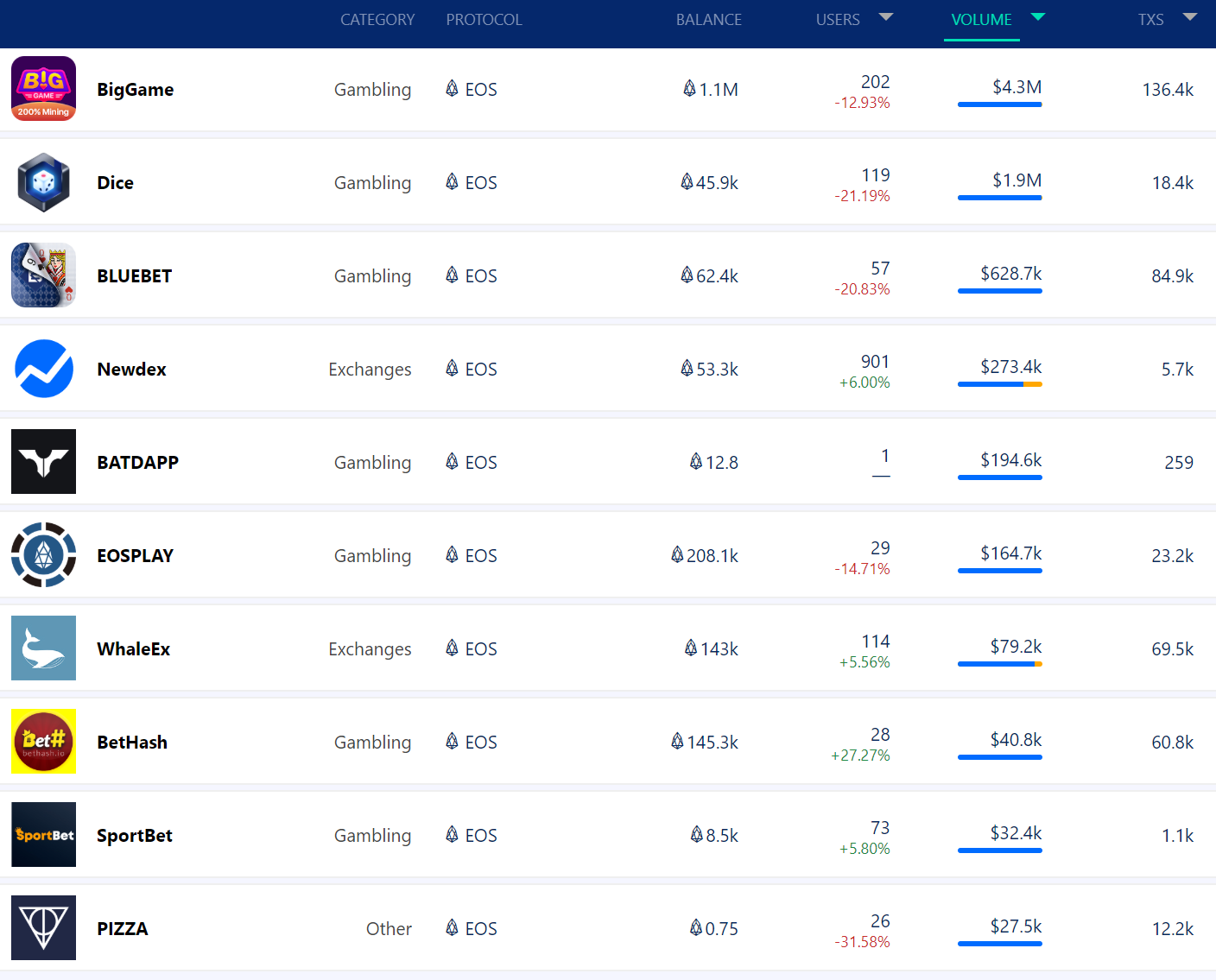

Volume across most EOS Dapps has fallen over the past month. The top EOS Dapps over the past week, ranked by transactions, were dominated by gambling Dapps. However, EOS Knights, a mobile role-playing game, has seen sustained user growth since being launched in August 2018. EOS Knights also consistently has over 5,000 users in a 24 hour period. Gambling Dapps are popular because gambling is normally highly regulated in most countries. These Dapps are currently outside of legal purview, at least for the moment.

Transaction costs are also very minimal, or non-existent, when interacting with EOS Dapps. Several Dapps have migrated from ETH or NEO or chose EOS over ETH or NEO in recent months citing concerns over scalability or transaction costs. These Dapps include; Effect.AI, Tixico, Unico, Medipedia, Sense Chat, Billionaire Token, EOSBet, HOQU, Everipedia, and Insights Network. Additionally, Tapatalk, a forum app with 300 million registered users, is building a reward system using the EOS blockchain.

Source: https://dappradar.com/eos-dapps

Turning to developer activity, the EOS project on GitHub contains 54 repos with the main repo accruing a cumulative 4,118 commits over the past year (shown below). Larimer’s commits dropped off precipitously after June 2018.

In January, EOSIO V1.6.0 and EOSIO.CDT V1.5.0 was released which brings improvements to sustainable transactions per second, reduced CPU costs, lower latency on all EOSIO based blockchains, and enhanced tooling for smart contract development.

Most coins use the developer community of GitHub. Files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Source: https://github.com/EOSIO/eos/graphs/contributors

EOS exchange traded volume in the past 24 hours has predominantly been led by the Tether (USDT)

and Ethereum (ETH) pairs, with Bitcoin (BTC) accounting for a smaller but substantial percentage of the volume. The majority of trading occurred on OKEx, Huobi, and Bibox. Huobi, along with owning the top EOS BP, launched an EOS dedicated exchange on January 12th. Bitfinex is also a top EOS BP and plans to launch EOSfinex, an EOS-based DEX. EOS is not currently listed on Bittrex or Coinbase.

Technical Analysis

EOS has shown considerable bullish strength over the past month, potentially ending the year long bear trend. As the potential of a nascent bull trend approaches, exponential moving averages (EMAs), Pitchforks, Ichimoku Cloud, and volume can be used to find optimal entry and exits. Further background information on the technical analysis discussed below can be found here.

On the daily chart, 50/200EMA cross has been bearish since late July with price recently touching the 200EMA. The next bullish long entry signal will occur with a bullish 50/200EMA cross and likely bring price to the US$5.00-US$6.00 zone, based on previous volume. Bitfinex open interest remains mostly net long, with longs sitting near record highs (top panel, chart below). A significant price movement downwards will result in an exaggerated move as the long positions begin to unwind. There are no active RSI or volume divergences.

The current spot price continues to reside with the boundaries of a bearish Pitchfork (PF) with anchor points in December 2017, and March and April 2018. Price recently hit the median line (yellow), which happens frequently throughout any given trend. A breach of the ML to the upside could bring prices of US$7-US$11 based on the PFs upper resistance zone. If price moves lower, buyers will likely return in the bottom diagonal zone at US$1.23.

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

The status of the current Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are neutral; price is in Cloud, the Cloud is bearish, the TK cross is bullish, and the Lagging Span is in Cloud and above price. A traditional long entry signal will not occur until price is above Cloud, which may happen within the next week.

Lastly, the EOS/BTC pair has the most bullish momentum since April 2018. The daily chart shows bullish trend indications; price is above both the 200EMA and the Cloud. Further, a bullish 50/200EMA Golden Cross will likely occur this week. Volume history (horizontal bars) suggests very little resistance above the 0.001 BTC zone. The lack of overhead resistance will likely bring EOS to retest the previous ATH at ~0.025 BTC over the next few months.

Conclusion

Network fundamentals show a continued rise in Dapp activity over the past six months which have led to significant blockchain bloat with a full node now requiring 4TB of storage. All Dapp activity is reliant on five full node BPs, most of which are not in the top 21 highest paid BPs. Nevertheless, there continues to be a migration of Dapps from other blockchains to EOS thanks to the low or negligible transaction costs. Sooner rather than later, EOS will need to deal with the growing burden of both blockchain size and bandwidth requirements.

The ECAF and governance system of BPs shows a centralization of power which is not apparent in many other blockchains and, for many, is antithetical to crypto ideology in general. Even when functioning as intended, unless all 21 of the BPs have an updated blacklist, a compromised account can still slip through the cracks.

Technicals suggest the strongest bullish momentum in almost a year. EOS has outperformed most of the other top 10 coins over the past month and shows no signs of stopping. Based on the trend, the EOS/USD pair reached the daily 200EMA and bearish pitchfork median line. If bullish momentum continues, US$5.00-US$6.00 is very likely over the next month. This zone has shown considerable consolidation in the past, suggesting that price will not easily break US$6.00 on the first attempt. The average token price during the ICO was US$5.74, meaning that many ICO buyers will likely want to sell at break even, creating more horizontal price resistance.

Don’t miss out – Find out more today