FTX Bankruptcy – OKX To Return US$157M

Good news for creditors in the FTX bankruptcy as the OKX exchange prepares to return US$157 million in frozen FTX funds held by OKX.

In response to a motion filed in the FTX bankruptcy proceedings OKX has announced today that it will turn over to debtors approximately USD157 million in frozen assets related to FTX and Alameda Research,

In the days surrounding FTX’s collapse in November 2022, OKX says it proactively initiated investigations to determine whether there had been any FTX-related transactions on its platform. When these investigations discovered assets and accounts associated with FTX and Alameda Research, OKX froze the assets and has been awaiting instructions on what to with the funds since.

OKX says it welcomes the motion and will continue to cooperate with the FTX debtors and law enforcement officials in the hope that these assets will eventually be returned to FTX users through the bankruptcy process.

Background

With crypto’s 2nd largest exchange now insolvent, and its founder and several key staff under arrest, investigations reveal an all too familiar story of disproportionate reliance on illiquid assets of questionable real-world value.

The collapse of the FTT, the native token of mega exchange FTX, has created wider contagion fears that have sent crypto markets spiraling downwards and seen BlockFi suspend withdrawals. The collapse of the token is directly connected to a withdrawal/bank run on the FTX exchange and the illiquidity of algorithmic trading firm Alameda research. FTX and Alameda Research are both a part of Sam Bankman-Fried’s crypto trading empire.

FTX is a Hong-Kong based one-stop-shop cryptocurrency exchange that offers derivatives, fiat-to-crypto, crypto-to-crypto, and OTC solutions for investors and traders. Despite only being founded in 2019, FTX has risen to a position of prominence within the crypto exchange space. It is one of the most used fiat-to-crypto, crypto-to-crypto, and crypto derivatives platforms in the world, owning a significant market share in each of these categories.

FTX has developed an aggressive marketing and branding strategy. In the summer of 2021, it was announced that FTX had bought the naming rights for NBA franchise, the Miami Heat. The exchange bought the rights for a whopping US$135 million and the former American Airlines arena is now the FTX arena. It is one the most visible crypto exchanges in the United States, endorsed by sport Superstar Tom Brady, and ran a major Super Bowl commercial earlier this year (which now seems remarkably prescient) featuring comedian Larry David. In the ad, David plays a series of doubters through the ages, passing on world changing inventions like the wheel, inside toilets and lightbulbs – before finally passing on FTX. “Arrr – I don’t think so,” he says, “and I’m never wrong about this stuff… never.”

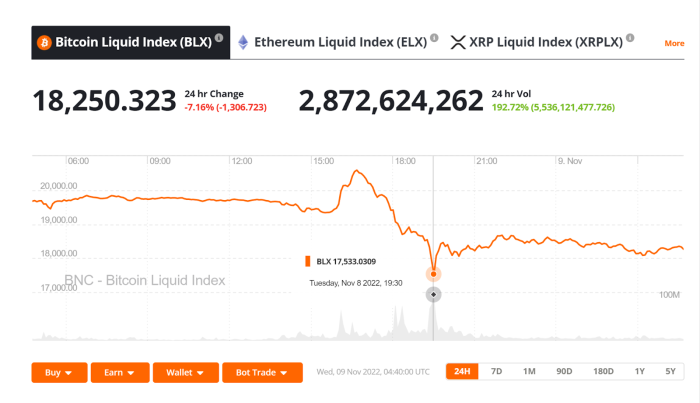

The price of Bitcoin (BTC) has fallen from trading at around US$20,630 at around the time of FTT collapse to currently trading for ~US$16,798.

The price of the FTT token has collapsed from trading for US$19.24 to currently trading for US$4.74, a fall of ~75%. Solana (SOL), an asset closely connected to the SBF ecosystem through funding and partnerships, fell from trading for US$38.03 to trading for US$22.10.

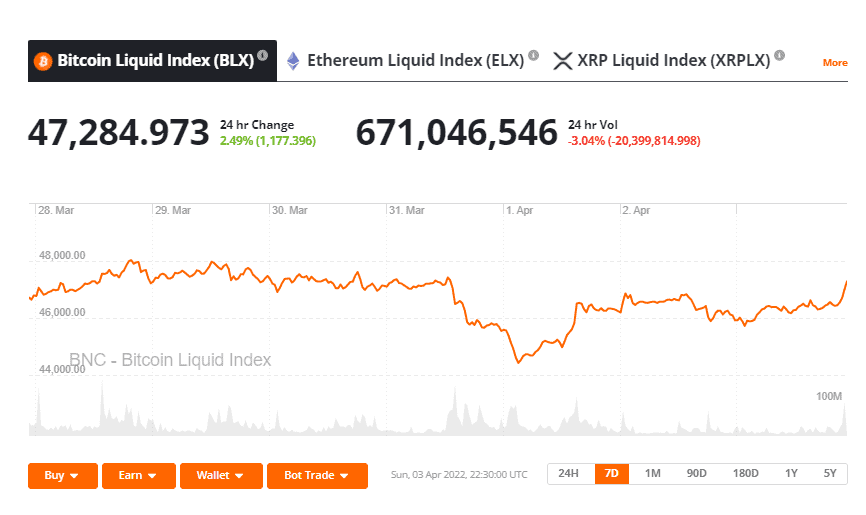

Over the course of the day crypto markets fell, had a short-lived recovery as investors considered whether the news was good or band – beforing collapsing to lower lows as markets determined Binance’s purchase of FTX was not actually a bullish tailwind. The deal continues a week of drama that has often been played out over Twitter.

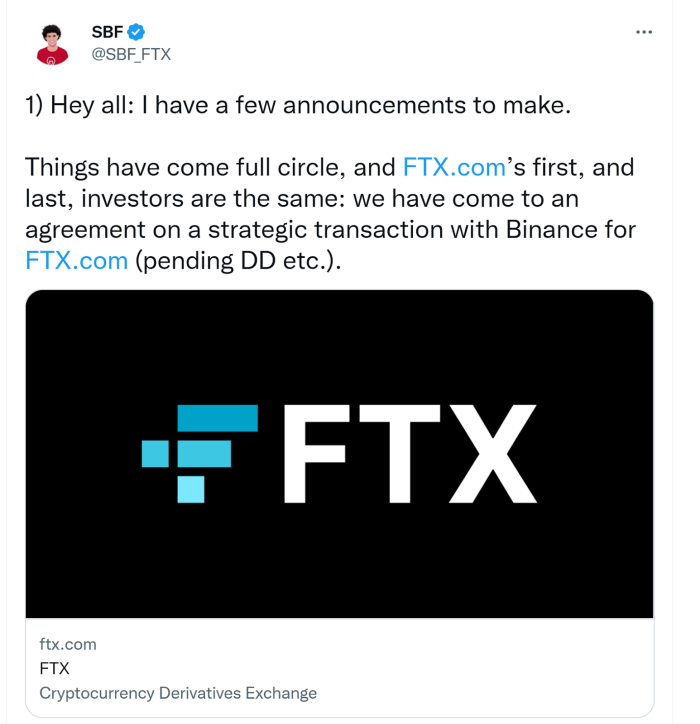

FTX CEO Sam Bankman-Fried tweeted on Tuesday that an agreement on a strategic transaction between FTX and Binance had been agreed pending due diligence and other factors. It appears as though Binance is stepping in to bail out and acquire FTX, with Binance’s CEO Changpeng Zhao explaining on Twitter that FTX had asked for his company to pull them through a significant liquidity crunch. FTX US and Binance US, the exchange’s respective US arms are not involved.

There have been rumors that FTX has been asking numerous parties about the strategic transaction, even Elon Musk. The rumored price of FTX is US$6 billion. Earlier this year, FTX was valued at US$32 billion. Investors in the exchange include Blackrock, the Ontario Pension Fund, Sequoia, Softbank, Circle, Tom Brady, and Kevin ‘O Leary (of Shark Tank fame).

The news of the Binance deal follows the release of a story the balance sheet of FTX’s sister company Alameda research was too heavily reliant on illiquid assets. This included FTX’s FTT tokens – sparking concern that FTX’s balance sheet was compromised because it was being used to keep prop up Alameda. FTX is supposed to have over 5 million users each trusting the exchange with their funds. A potential halting of withdrawals seemed possible but unlikely at this stage.

It was Binance, FTX’s purchasers, that added the next nail in the SBF coffin when Binance said the exchange planned to sell its sizeable holding of FTT tokens. In a tweet at the time, CZ wrote “Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t support people who lobby against other industry players behind their backs. Onwards.” CZ’s apparent dislike of FTX is another reason to potentially be bearish about the future of FTX and FTT.

CZ’s tweet and Alameda’s research’s rumored insolvency began pushing the price of FTT downward and triggered a large number of withdrawals from FTX. The combination of the run and FTX being unable to sell its FTT to cover debt and withdrawal obligations appears to be at the centre of the FTX drama.

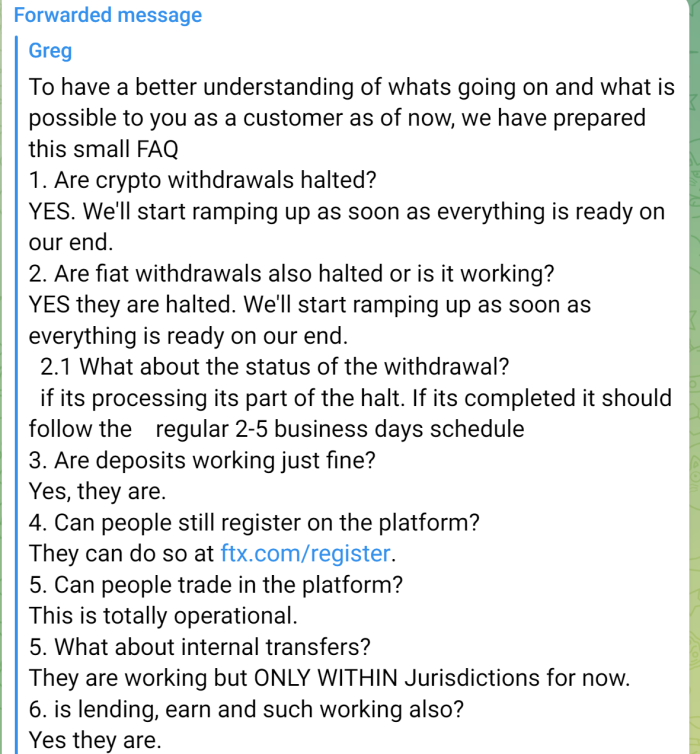

FTX has now halted withdrawals and messages on the FTX official Telegram has not provided any information about when the exchange will re-open.

The above message was posted on the official FTX Twitter page at 14:55 GMT time today. Operations remain compromised and concerns are mounting amongst users that they may not ever be able to recover deposited funds.

There is a sense that the drama surrounding FTX may continue. There are concerns about the yet unrevealed lenders to Alameda Research, who may now have to deal with another crypto trading firm going under and being unable to pay its debts.

Head of R&D at Coinmetrics, Lucas Nuzzi has revealed evidence that 40 days ago, 173 million FTT tokens worth over 4B USD became active on-chain. Investigations indicated that the activity was likely made by FTX to help cover Alameda’s losses. Nuzzi states that the move was the largest shift of FTT ever and one of the largest ERC20 token transactions ever. Nuzzi says he believes that Alameda blew up like Three Arrows Capital and other crypto trading firms in Q2 2022. Nuzzi said it only survived “because it was able to secure funding from FTX using as "collateral" the 172M FTT that was guaranteed to vest 4 months later.”

The Alameda bailout likely put a dent in the FTX balance sheet, which may have been salvageable if the price of FTT didn’t collapse. This trail is speculative but seems likely given how things have unfolded in the last week.

At the time of writing many questions remain yet to be answered:

- Why would such well funded powerful companies take such huge risks?

- How aware was SBF of Alameda’s precarious position?

- The role of Binance – in sending the price of FTT tumbling and then swooping in to purchase FTX

- What other crypto firms (likely lenders) will be affected by the collapse of FTX?

- If FTX, one of the most visible blue chip crypto companies can go under this quickly, who’s next?

Only time will tell, and even though it’s not entirely clear the patient is completely dead, the FTX post mortem has nonetheless begun.

Don’t miss out – Find out more today