GameCredits Price Analysis – high probability of trend reversal

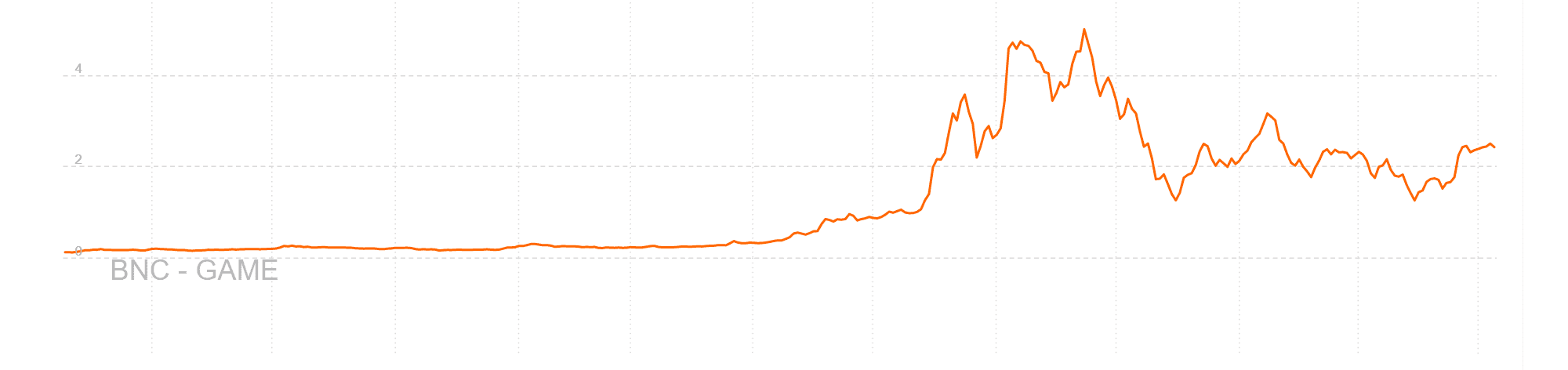

GameCredits (GAME) currently has a US$159 million market cap, and rose in value by a factor of 10x in 2017. However, the asset has lost just over half of those gains in the past three months.

GAME was created in 2016 by European developers and aims to be a universal payment method for in-game transactions. The team has also been working on the Gamecredits Mobile Store and Platform, an alternative to the Google Play and Apple stores. GAME’s app store currently boasts over 300 games, with more on the way. The store keeps 10% of total game sales as opposed to the 30% cut by Apple and Google, much needed competition which helps indie developers keep more proceeds.

GameCredits (GAME) currently has a US$159 million market cap, and rose in value by a factor of 10x in 2017. However, the asset has lost just over half of those gains in the past three months.

GAME was created in 2016 by European developers and aims to be a universal payment method for in-game transactions. The team has also been working on the Gamecredits Mobile Store and Platform, an alternative to the Google Play and Apple stores. GAME’s app store currently boasts over 300 games, with more on the way. The store keeps 10% of total game sales as opposed to the 30% cut by Apple and Google, much needed competition which helps indie developers keep more of their proceeds.

The cryptocurrency is a fork of Bitcoin, using Proof of Work with 90 second block targets. There will be 84 million coins in total, distributed in a deflationary manner. The protocol also uses a much shorter block difficulty retargeting timeframe, one block as opposed to Bitcoin’s 2,016.

The network hash rate has almost doubled over the past month, and is currently sitting at 702.0 GH/s, a hash rate achieved by Bitcoin around April 2011. Hash rate was likely influenced by increased profitability as price has rebounded slightly from its three month descent.

The crowdsale proceeds will be reinvested as follows; 20% to MGO projects, 30% to legal fees, licensing, and branding, and 50% to gamer acquisition marketing for the app store. MGO will also use 10% of profits generated from the app store to purchase and burn MGO tokens on secondary markets.

Last week, GAME joined HyperLedger, a company whose goal is to connect siloed industries through blockchain technologies. GAME and MobileGo also announced a partnership with ESL, a gaming network, to host a DOTA 2 tournament in Bulgaria.

Exchange traded volume is led almost exclusively by the BTC pair where volume is shared between Bittrex and Poloniex.

Technical Analysis

Technical Analysis

After three months of down trend, technical signals for GameCredits are beginning to show a possible change of direction. Volume over the past two months has been the highest ever recorded, which suggests an accumulation zone.

The Ichimoku Cloud on the daily chart, using singled settings (10/30/60/30) for quicker signals, still remains mainly bearish but a trend shift is nearing. A bullish TK cross occurred below the cloud, a short exit signal. Price is currently below cloud and future cloud is bearish, but a Kumo Breakout would be a strong long entry signal, more so if future Cloud is bullish. Due to the long flat Kumo, which acts as a price magnet, a high probability target of 70k sats is nearing.

Conclusion

As mobile gaming and cryptocurrency awareness continues to grow around the world, GAME and MGO are positioned to capture much of this market share. A competitive fee structure in the app store encourages more and more developers to seek alternatives from Apple or Google. Further outreach to gamers on popular MMOs will also help growth and demand.

Technicals suggest that there is a high probability of trend reversal soon, after three months of retracement from all time highs. A breach of 60k sats triggers a long entry with a minimum 2x for a longer term target.

Don’t miss out – Find out more today