Humans Die. Cryptocurrencies Don’t.

What will happen to my bitcoin and other assets when I die? This is a question most of us want to avoid, because we don’t know, because we don’t like to think about death, because we can think of 100 other more fun things to contemplate - like all the drama surrounding 2X and who said what on twitter or reddit. But with self-controlled assets, ignoring our own mortality comes at a cost to our descendants, dependents, community groups, and political causes because our keys, and therefore access to the assets, could die with us. But it doesn’t have to be that way, there are simple, easy things you can do yourself to prevent this from happening and that’s what you’ll learn if you continue reading.

What will happen to my bitcoin and other assets when I die?

This is a question most of us want to avoid, because we don’t know, because we don’t like to think about death, because we can think of 100 other more fun things to contemplate – like all the drama surrounding 2X and who said what on twitter or reddit. But with self-controlled assets, ignoring our own mortality comes at a cost to our descendants, dependents, community groups, and political causes because our keys, and therefore access to the assets, could die with us. But it doesn’t have to be that way, there are simple, easy things you can do yourself to prevent this from happening and that’s what you’ll learn if you continue reading.

Before we look at the how, let’s look closer at why.

The short answer is that by planning, you have choices you don’t otherwise have. Did you know that if you die without a will, or testament as it’s sometimes called, local law decides how your assets are divided? These laws are called laws of intestacy and what you need to know is that most of them only recognize formal legal relations — meaning relations by blood or marriage. Your long-term, live-in domestic partner? No. Your best friend since preschool? No. Your children through marriage? No. Your favorite charity, community center, or political cause? No. Even if you’re not concerned about how your assets will be allocated, if you have children, consider writing a will to designate someone to care for your children if both parents die. While that has nothing to do with crypto, it’s something those of you with children should think about.

Moving back to cryptocurrency, because these assets are not controlled by a third party, there is no third party to comply with a court order to release the assets to your heirs. The assets will only be available to your heirs if you have made a plan. If you have instructed them, in some way, about what you have and how to access it. This does not mean you have to disclose your keys and plans before you die, more about that later.

The takeaway here is that planning places you in control. With a plan, you get to decide if and how your own assets will be distributed. Isn’t that how things should be?

If we know we should plan, then why don’t we?

In talking to people around the world, there are some common mistaken beliefs that stop us from planning.

Mistaken belief #1:

I have to hire a lawyer. There are two sides to planning for assets we control: the technical (access to keys) and the legal (local laws, jurisdiction). Without access to keys, the legal plans are pointless. Therefore it’s best for most people to start with a key access plan and add-on a legal component. Most lawyers have no idea what a private key is and they could not help you design a plan for securing your keys during your lifetime while allowing them to pass only upon death. That doesn’t mean you don’t need a lawyer to help with the legal side of things, like writing your will and making sure your wishes will actually be carried out. The point is that you don’t need to wait to hire a lawyer to design your key access strategy.

Mistaken belief #2:

I have to trust a third party. The point of owner-controlled assets is to not give power over them to others. There are creative ways to design key access plans that will activate in the future, without handing out immediate access to everyone. While these types of solutions are often unique, an example of a simple option you can use today is to use a passphrase on your Trezor. This way the seed words alone and the passphrase alone are insufficient to control the coins.

Mistaken belief #3:

Writing all of this down will make my coins less secure or increase the risk that someone will find it and steal everything! You’re much more likely to lose your coins by failing to backup your new wallet, leaving money on an exchange, losing your backup or paper wallet, or forgetting your password/passphrases. That said, it would not be smart to store a single document with all of your passwords, passphrases, access points, holdings and amounts online or on your internet connected device. But you’re smarter than that. You know to hand write these things down on paper and use a password manager. Divide the information into a couple of different secure storage locations (a couple, not 5 or 10). You can find more information on how to securely store bitcoin at thirdkey.solutions.

Mistaken belief #4:

The value of my crypto is too low for me to bother with planning. While this might be true for you today, the value of these assets change very quickly. Since April of this year, when the price started rising, many people have realized that their “small” holdings have become significant. You don’t know what the value will be in the future, but you’re holding on to what you have now for a reason. That’s reason enough to plan.

While people often say those are the reasons they don’t plan, I believe the real reason is denial and fear. We don’t like to face our mortality. It’s not pleasant to focus on dying. And planning for our own death forces us to think about it for more than a minute. We seem to believe that if we don’t think about dying it won’t happen. Like we can prevent death by avoiding it. But we know that’s not true.

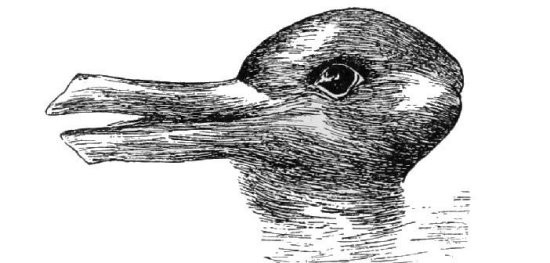

My father was raised as a Christian Scientist and he taught me that we have the ability to shape our current experiences simply by thinking differently. As humans we have the power to change our perspectives. Consider this photo:

https://commons.wikimedia.org/wiki/File:Duck-Rabbit_illusion.jpg

Do you see a duck? Do you see a bunny? Can you see both now? Can you switch at will between the two? Like the duck bunny, I’m going to give you three alternative ways to see inheritance planning, not as facing mortality but as something else.

Give a gift. Imagine if you received a gift of bitcoin or another cryptocurrency. You’d be thrilled wouldn’t you? Think about how others might feel receiving such a gift. Think about what a difference you could make in funding open source development or political causes you care about. This is an opportunity to give wonderful gifts to the people and causes you care about.

Security Makeover. If you’re more practical, and less interested in gift giving, think of this as an opportunity to do a complete security makeover. You’ll need to identify all of your assets (including that one ICO you bought but didn’t tell anyone about), your backups, and update your overall security. It’s something you can do for yourself, that will benefit others in the long-term.

Time Machine Mission. This one is my personal favorite. Your mission, should you choose to accept it, is to create a secret cache that your loved ones will find at some point in the future. With it, they’ll be able to unlock untold riches!

Estate planning doesn’t have to be awful. It can actually be fun if you choose to look at it that way.

The Technical (Key Access) Side

Where to start? There are a couple of free resources that can help you get started. I’ve written a Letter to Loved Ones template. It’s a letter you leave to let people know you have crypto-assets and how to access them. It’s meant to be customized by each person, so take what you like, delete the rest. Additionally there is another article, 7 steps to bitcoin estate planning, which outlines, in detail, things you can do to prepare. Now we’ll look at some of those steps.

Inventory

Develop an inventory of what you have and how you access it. This is the minimum requirement for key access. If you don’t tell someone what you have and how to access it, it will likely be lost forever. You should not include the quantity or fiat value of the assets in the inventory. In its simplest form, the inventory would be handwritten and simply list the asset, key locations, and software. Inventory example: Bitcoin, accessed on my smartphone, using Samourai Wallet. Ether, accessed using my laptop and Trezor device, using myetherwallet.

Security Self-Audit

Ask yourself, can I improve my security? Do I have all of my backups? Do I have old wallets that I haven’t accessed for a long time? Should I put some of my assets into cold storage or move them onto a hardware wallet? This is also the time to make sure you’re using a password manager and have implemented 2-factor authentication for every sensitive account. It’s also a great time to remove SMS (your phone number) as a recovery feature for all of your accounts because you don’t own your phone number — the carrier does.

Time Machine Message

What will they need to know if you’re not around? In order to ensure they’ll be able to unlock the riches, you need to make sure you provide clear, detailed instructions on what, where, and how to access your cryptocurrencies. After you’ve written down the message, test it. Pretend you’re them, pretend you’ve gotten amnesia and don’t know anything, follow the messages step-by-step and see if you can unlock the treasure. If so, you’ve done it right!

The Legal Side

While that’s all you need to do for key access estate planning, at this point you might want to consider the legal side of things. You can incorporate, by reference, your key access plan into your will or testament, but don’t make it part of your will. Wills become public record in many jurisdictions.

These assets will become part of your estate in most jurisdictions and will be subject to the local laws, including taxes, whether or not you want them to. This is the reality of our current system. If you’re really interested in controlling your assets and keeping them out of your estate, you can consider creating a legal trust, which is kind-of like a holding company that exists independently and isn’t subject to the traditional estate planning laws. Be aware though that trusts have their own tax and reporting laws, and may or may not be right for you. The details of the legal side of estate planning are beyond the scope of this article but contact us if you want to explore this in greater detail.

The Deadman’s Switch

What about a software solution, what about the deadman’s switch?

Whenever I talk about estate planning inevitably this question comes up. There are at least 4 projects I can think of that are trying to build a software solution to estate planning problems. However, the technology is too immature to trust for long-term solutions like estate planning. We are still discovering bugs in smart contracts that are costing millions. Additionally, software solutions assume constant or near constant access to the network. But when natural disasters strike, power can be out for days, weeks, months. A deadman’s switch could also encourage someone to intentionally keep you from accessing the network. Bottom line, easy access is never guaranteed. Finally, automatic transfer of assets can cause myriad legal problems for the people receiving it. They could be subject to lawsuits if the person or cause is not “legally entitled” to the asset. Even with software solutions, legal plans are also needed to avoid unintended outcomes and messy court battles.

Humans die. Cryptocurrencies don’t.

Your bitcoin and other cryptocurrencies don’t need to go with you; they can take your loved ones to the moon!

Start planning today.

Link to slides that go along with this presentation, delivered at #HCPP17 in Prague.

Don’t miss out – Find out more today