Pamela Morgan

More from this author

Inheritance Planning for Cryptocurrencies: 3 Steps in 3 Minutes

I’ll be expanding these ideas in a forthcoming article and book but with prices skyrocketing, and so many new people owning tokens for the first time, I want to provide a quick reference guide that you can complete in less than 10 minutes to help protect your new assets.

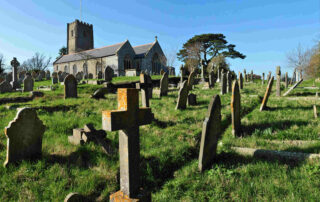

Humans Die. Cryptocurrencies Don’t.

What will happen to my bitcoin and other assets when I die? This is a question most of us want to avoid, because we don’t know, because we don’t like to think about death, because we can think of 100 other more fun things to contemplate - like all the drama surrounding 2X and who said what on twitter or reddit. But with self-controlled assets, ignoring our own mortality comes at a cost to our descendants, dependents, community groups, and political causes because our keys, and therefore access to the assets, could die with us. But it doesn’t have to be that way, there are simple, easy things you can do yourself to prevent this from happening and that’s what you’ll learn if you continue reading.

Letter to Loved Ones: a template for your cryptocurrency estate planning

Most people have never thought about what will happen to their bitcoin, ether, and other crypto-assets if something bad happens to them. Even if you do understand the concept of passing your crypto-assets to your loved ones, actually doing the work to make it happen is often a daunting prospect. It’s one of those tasks, without a hard deadline, that gets pushed to the end of your to-do list, repeatedly. Most people don’t know where to start and there are very few resources available to help guide you through the process. But it doesn’t have to be that way.

Bitcoin Security Made Easy: using 2-factor authentication

By now you’ve probably heard of 2FA, or two-factor authentication, and know you should probably be using it. When I first heard of 2FA, I didn’t really understand how it worked or why I would intentionally want to add more time and steps to logging in. It sounded like a time-consuming chore. I was worried that if I didn’t have cell service, I’d be locked out of my accounts (not true). Or that I’d lose access to everything if I lost my phone (also not true). Today I use 2-factor on all of my important accounts and you can too!

Bitcoin Security Made Easy: simple tips for non-experts

This is the first article in a series discussing general security practices that become essential when your money is digital. I have a confession. While today I work to help people and organizations secure their bitcoin, in 2013 my security practices were abysmal. My passwords were terrible. Really awful, like 12345 and Abc123.

Vaccinating ourselves from local courts

A pandemic is plaguing the cryptocurrency industry today, yet most of us don’t yet know we’re infected. These diseases arise from extreme exposure to hundreds of national and local laws, jurisdictions, rules, and unknown legal risks due to engaging in open global systems in a world that is largely still clinging to nation-centric, hyper-local rules and controls.

Bitcoin security is more than multisig

Following the Bitfinex hack it’s become apparent that people don’t really understand bitcoin’s multisig feature. There seems to be a lot of confusion over what multisig is and isn’t, what it inherently does or does not do. This article aims to clarify some of the most common misconceptions, explain how multisig actually works today, why policy controls aren’t a substitute for organizational security, and what you can do to protect yourself.

Seeking justice: No ID required

Most justice systems today require identification as a precondition to participation. In 10 years of legal practice, I’ve never had a client ask why ID is required. We simply accept, without question, that in order to get justice we must disclose identity. But what if that’s not true? Can we uncouple identity and justice?

P2P markets need P2P justice

Peer-to-peer marketplaces are forcing change on the systems we use for dispute resolution. Algorithmic dispute resolution, software-guided settlement negotiation, and even full-service stepped mediation to arbitration online dispute resolution (ODR) projects [all existed](http://scholarship.law.duke.edu/cgi/viewcontent.cgi?article=1073&context=dltr) in 2002–2003. Yet despite the promise of lower costs, faster speed, and jurisdictional autonomy, most of those projects have long been abandoned. They simply didn’t catch on. Now, with the invention of bitcoin, open blockchains, and smart contracts, there’s a renewed interest in these services.

Gone Forever: Bitcoin, AltCoins, Asset‐Tokens, & Death

If you died tomorrow would your family inherit your bitcoin, altcoins, and asset-tokens? The answer depends on you. While legally, the answer is yes, if your passwords, passphrases, and key locations die with you that probably won’t happen. Without those things your crypto-assets will be inaccessible. Like gold coins buried in a meadow; they may know the treasure exists but they’ll never be able to access it.