Komodo Price Analysis: Antara update targets new developers

Along with a new website and token rebrand, the Komodo project’s launch of the Antara multichain integration layer in mid-July brings hope for price gains in the second half of 2019.

Komodo (KMD) is often described as a 3rd generation blockchain and was built using core design elements from the Bitcoin and Zcash (which is itself based on Bitcoin’s code) blockchains.

The unique value proposition of the Komodo blockchain is a highly secure platform blockchain. Through its unique delayed proof-of-work (dPoW) mechanism it proposes to offer security comparable to the much larger and higher hashrate Bitcoin network at a significantly cheaper cost.

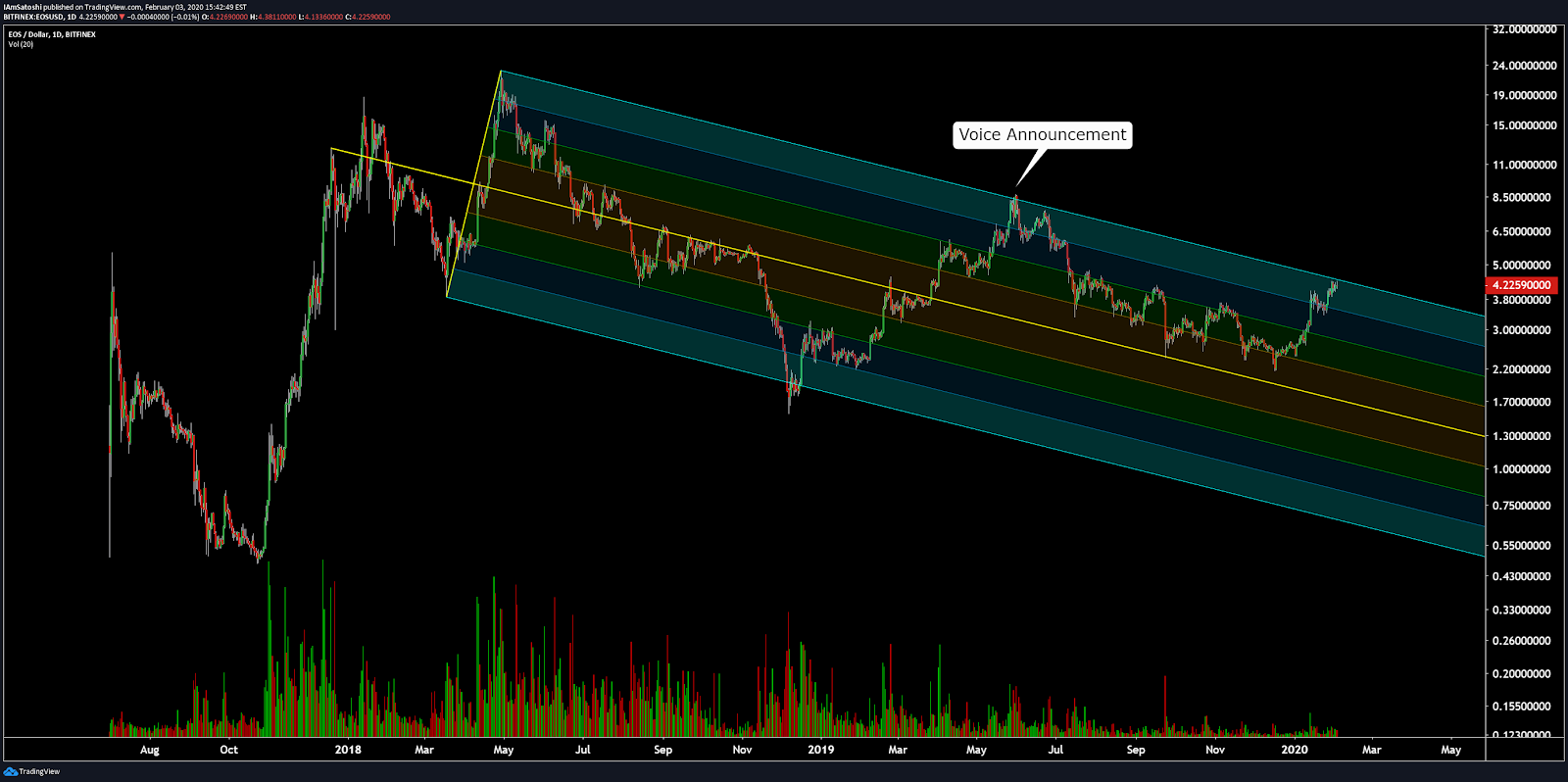

Over the last month, the price of the network’s native token KMD has fallen ~16%, suffering from the wider bearish conditions across the altcoin market. Year-to-date, however, the price of Komodo has risen ~60% and currently trades at ~USD 1.26 with a market cap of ~USD 145 million, occupying the 48th position on Brave New Coin’s market cap table. Leading altcoin ETH has observed a price increase of 65% year-to-date.

The project recently added a platform blockchain element to its network through the addition of the Antara layer. It was launched on July 15th with a new website and project rebrand.

Antara is designed to provide blockchain developers with sovereignty over their creations. Presently blockchain developers have to build based on a single chain, for example, a Dapp built on Ethereum is constrained by its scalability solutions, network fees, speeds, and smart contract design. The new Komodo layer proposes to give builders complete control over their token solutions through smart chains.

Antara Smart Chains are designed to support token solutions and independent crypto projects of any form. Smart Chains are completely customizable, with 18 different customization options at launch, including consensus rules, hashing algorithm, pre-mine supply, block time, block rewards, privacy settings and more. Additionally, smart chain transaction fees are designed to be paid with a created project’s native token, and with no imposed reliance on the Komodo network’s native KMD token.

Antara also includes a plug-and-play module library that smart chains can access to create specific token solutions. At launch, Antara’s Module Library includes pre-built modules, such as stablecoin solutions, data oracles, instant micropayments, and a few others. For example, experienced app developers in Boston also have the option to contribute their own custom modules to the Antara open library.

The final element of Antara is an integration layer designed to streamline the final Dapp development process for builders. Developers have options to write Remote Procedure Calls (RPCs) into their programs and applications and have them run natively on independent Smart Chains. The Integration Layer also gives early developers access to White Label Products, such as a multi-coin wallet, and a mobile DEX powered by atomic swaps and others.

Multi-chain integration and custom blockchain solutions have grown in popularity with other projects like Cosmos and Polkadot, which offer similar developer-targeted services to Antara, gaining investor interest and driving media coverage.

Komodo will hope an existing community and its robust security attracts developers to its network versus Antara’s competitor solutions. However, all multi-chain integration networks are new concepts with only marginal adoption at this stage. It may take time for Antara to grow an ecosystem of dapps that creates real network effects. However, the release extends the project’s long-term prospects. It may also add to the inherent value of KMD tokens because of factors like an expected pick up in transaction activity on the mainchain, driven by eventual Antara adoption.

[ ]

]

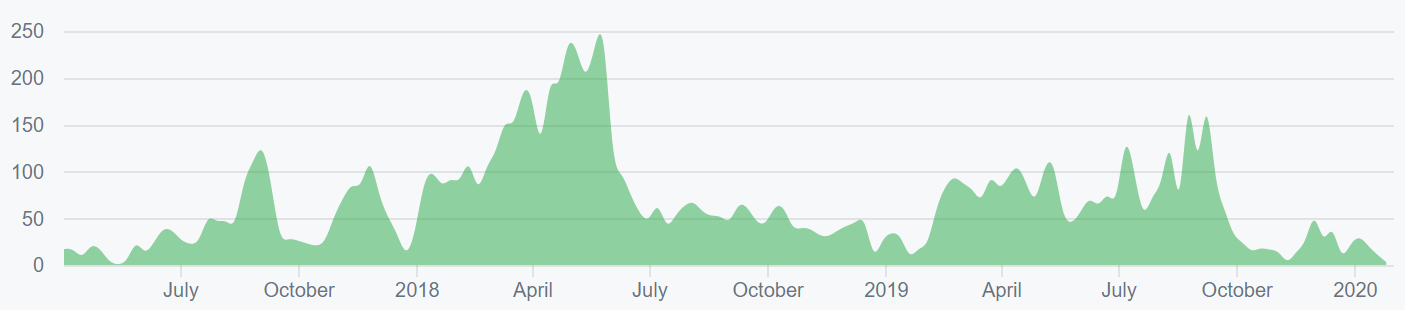

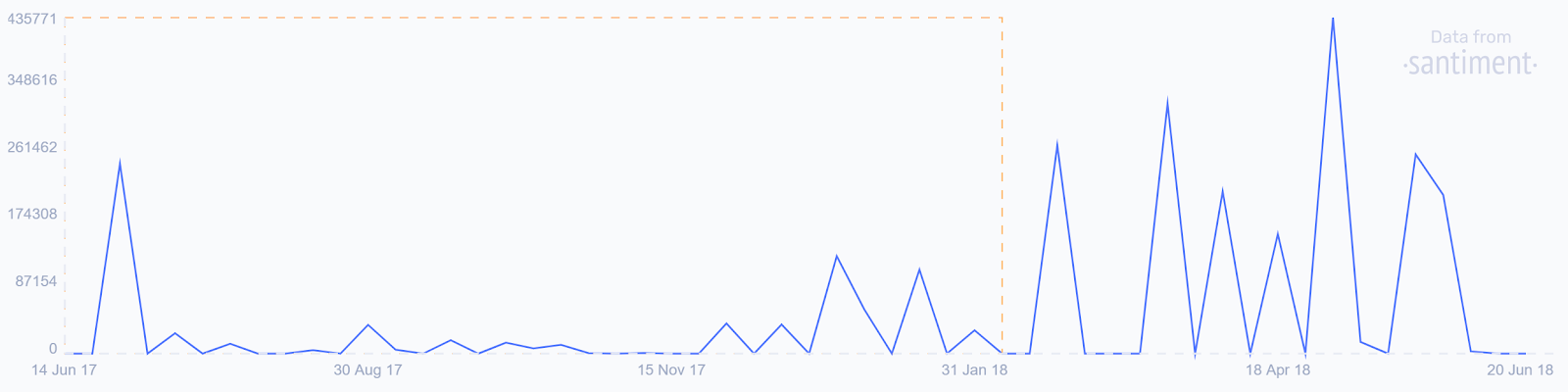

There has been a slight pick up in “Komodo” mentions following the website rebrand and Antara release. There also appears to be a positive correlation between “Komodo” mentions on social platforms like Twitter, Reddit, and Discord and the KMD price. Source:Sanbase

Delayed proof-of-work

Komodo is a modification of the blockchains it is built on. Komodo is based on the Zcash and Bitcoin codebases, this allows for zero-knowledge privacy and increased network security by leveraging Bitcoin’s hash rate.

At intervals of ten minutes, Komodo takes a snapshot of its blockchain. This snapshot is then written into a block on the Bitcoin network in a process called notarization. This creates a backup of the entire Komodo system, which is then saved within the Bitcoin blockchain.

Through this method, in the event of an attempted attack on Komodo’s blockchain history, even a single surviving copy of the Komodo main chain will allow the entire ecosystem to overwrite and over-rule the attacker’s attempted changes.

dPoW consensus is powerful because it does not recognize the ‘Longest Chain’ rule for any transactions that are older than the most recent ‘back-up’ of the Komodo blockchain. In effect, dPoW ‘re-sets’ a blockchain’s consensus rules every time a block is notarized, with resets occurring every 10 minutes and potential attacks constrained to within a short window of time, and much easier to prevent for smaller hashrate proof-of-work networks.

Double spend attacks are a concern for smaller PoW networks — attacks on Verge (XVG) and Bitcoin Gold (BTG) show that these can be viable attack vectors. By using a robust PoW network like Bitcoin as storage space for ‘backups’, every 10 minutes, recording recent transactions on the blockchain. This makes trying to carry out the commonly used 51% double-spend attacks, immensely more challenging.

51% attacks work when hackers accumulate enough processing power to solve solutions for their own transactions, and then not publishing these blocks for network miners to achieve consensus. They do this by forking the network and creating a separate chain for the unpublished blocks.

While the attack is ongoing, there is a rogue chain and a true chain simultaneously operating, with miners on the true chain unaware of the presence of the malicious chain. The attacker then enacts a transaction on the truthful chain, such as exchanging crypto for fiat, which is then confirmed by miners on the true chain. There is now a race for the attacker to ‘reverse’ this transaction (by publishing blocks from the fraudulent chain) before miners detect the fault.

The attacker will try to create blocks faster than the miners on the truthful chain, thereby creating a ‘longer’ chain than the original chain. This manipulated chain will then be published, with a reversal of the confirmed transaction, and the true chain is forced into accepting it.

Because the bad actor needs to have more processing power than the rest of the miners to produce blocks faster than the rest of the network, it is known as a 51 percent attack.

What the dPoW consensus mechanism does, by keeping a constant record of ‘back-ups’ on a notarizing chain, is making the process of creating a ‘longer chain’ far more challenging for the attacker.

Accumulating at least 51% of the network’s block producing capabilities is no longer the sole determinant in a double spend attack being successful. The truthful miners have a constantly updating log of blocks being produced and can deflect any attempted attack based on information posted in the notary logs.

Theoretically, it would still be possible to carry out a 51% double-spend attack on the dPoW Komodo algorithm, given that there is a 10-minute window in between when miners are informed of the snapshots. However, the Komodo consensus method adds an extra security layer beyond that of competing PoW networks.

Additionally, this robust security passes through to asset chains (now called Smart Chains and designed to be used as part of Antara) which attach themselves to Komodo. They can likewise elect to have backups of their own records inserted into the Komodo main chain with records of the secondary chain also included in the backup that is pushed into the main PoW blockchain (Bitcoin).

New KMD coins are created in two ways; mining and a reward scheme available to every holder. 64 special nodes that create their own dPoW peer-to-peer network, and communicate with each other, exchanging the latest blocks and dPoW consensus information related to the blockchains it is securing. The 64 Notary Nodes are required to run the full blockchains of Bitcoin, and Komodo, as well as all other dPoW-protected blockchains. This means they have high processing power expenses but are not required to hold any KMD as collateral making them different from masternodes on networks like DASH.

Each newly mined KMD block gives the miner a reward of 3 KMD. A new block is mined every minute. In total ~1.58 million KMD tokens are mined each year. 25% go to normal Komodo miners who simply work on the main Komodo network, and 75% go to Notary miners. 100 million Komodo tokens have been issued following its ICO. The final supply will be 200 million tokens, and this is expected to be reached within 14 years. The current supply of KMD is ~115 million tokens.

All KMD holders also earn 5% interest on token holdings. The interest reward helps mitigate for token inflation and as more users accumulate KMD, the overall token dilution rate decreases as more and more people receive interest payments. This model incentivizes long term KMD holding and may be an effective way to bootstrap community growth.

Atomic DEX

Currently in beta, the Komodo AtomicDEX is designed to allow seamless, decentralized trading across multiple currencies, blockchains, and exchanges.

Leveraging atomic swap technology, the AtomicDEX solution will allow users to exchange tokens directly without intermediaries. Each trade is executed directly on the blockchain, making the process completely trustless and eliminating the need for custody. Users, as is the case with most decentralized exchanges, always maintain control of their private keys and no information leaves the client.

Cross-platform trades between blockchains are also supported, via cross-chain atomic swaps. This means AtomicDEX will allow for the direct, decentralized trading (self custody) of Bitcoin or Ethereum protocol based tokens with each other.

Based on communications from the Komodo team, the framework for integrating AtomicDEX with tokens like ETH, EOS, and XTZ is currently being worked on. The first stablecoin planned for implementation into the DEX is the USD-C (US dollar-coin).

What AtomicDEX may look like in practice

The AtomicDEX also aims to address the traditional DEX challenges of poor liquidity through increasing the range of available trades and by connecting users to multiple marketplaces, including centralized exchanges.

Kadan Stadelmann, Komodo’s CTO explained in an interview that “We (Komodo) have the technical capabilities of attaching two centralized exchanges for individual users,” Stadelmann said. “So users can use their API key to grab order books. You can be listening to all order broadcasts in the network.”

That suggests that once launched AtomicDEX will be able to arbitrage between exchanges and utilize coins off a centralized exchange and set up sell orders when there appears to be unfulfilled demand and bootstrap liquidity through more active platforms like Binance.

There is also potential for the AtomicDEX to act as a liquidity provider and OTC solution. AtomicDEX could potentially be capable of running private trades between two traders, much like a traditional OTC trade, with both parties maintaining privacy.

AtomicDEX is only in the beta phase of development and it is not yet clear how many of these initiatives will be actionable in practice. There are likely to be high computational and operational requirements to run an active trading marketplace for cross chain atomic swaps.

AtomicDEX may be a platform that is well set to explore the potential of Atomic swap trading solutions because it is Komodo’s second iteration of this style of DEX solution. The Komodo BarterDEX was released in December 2017 as the first GUI for a fully atomic swap powered crypto trading marketplace. BarterDEX successfully evidenced that it could on a DEX, execute trades like DCR-LTC, ETH-DOGE and many other cross-protocol token swaps.

However, the growth of BarterDEX has been hampered by the platform’s current clunky UI/UX state. Some Komodo community members have been frustrated by the platform’s challenging UI and the complexities in interpreting the data it displays. A core component of AtomicDEX will be an improved user interface layer.

Exchanges and trading pairs

Source: https://bravenewcoin.com/data-and-charts/assets/KMD/price

The most popular trading option for KMD is BTC with the pair handling ~79% of the daily trading volume. The second most popular market is the KMD/Korean Won pair, suggesting strong liquidity options for KMD in Asian markets. Together the top two pairs make up over 91% of the daily trading volume. The total USD value of the daily volume of the entire KMD trading market is just ~USD 2.3 Million.

Source: https://bravenewcoin.com/data-and-charts/assets/KMD/markets

A mix of exchanges dominates the KMD trading marketplace, with 5 different platforms operating the top 5 trading pairs. The KMD/BTC market on Binance is the most active in the ecosystem. KMD is also tradeable on high profile exchanges such as Bittrex and Huobi Global.

Technical Analysis

Moving Averages and Price Momentum

KMD has experienced a volatile year while still following a strong linear trend. This trend has price sitting ~54% higher, year to date. On the 1D chart, given the consistent rise in price, a golden cross has persisted since late-May. However, price is currently below both 50 and 200 day EMAs; currently trading near $1.23. If this dynamic persists, price is likely to breakout of the upward linear trend range, negatively, thus risking a reversal into a death cross over the coming weeks.

During the linear uptrend, price has followed Fibonacci retracement levels. Most recently, price failed to break above and hold the 1.618 level of $1.61. Furthermore, the ‘double’ failure appears to have created a double top pattern. If so, price is likely to retest the 0.618 level of $0.93 in the coming weeks or months.

On the 1D chart, the volume flow indicator (VFI) is currently still well above 0, which is positive for price. Additionally, the VFI level of 10 appears to be providing near term price support, but VFI is currently looking downward. If that support level fails, that will likely be the catalyst that sends price to the 0.618 Fibonacci level, i.e. $0.93.

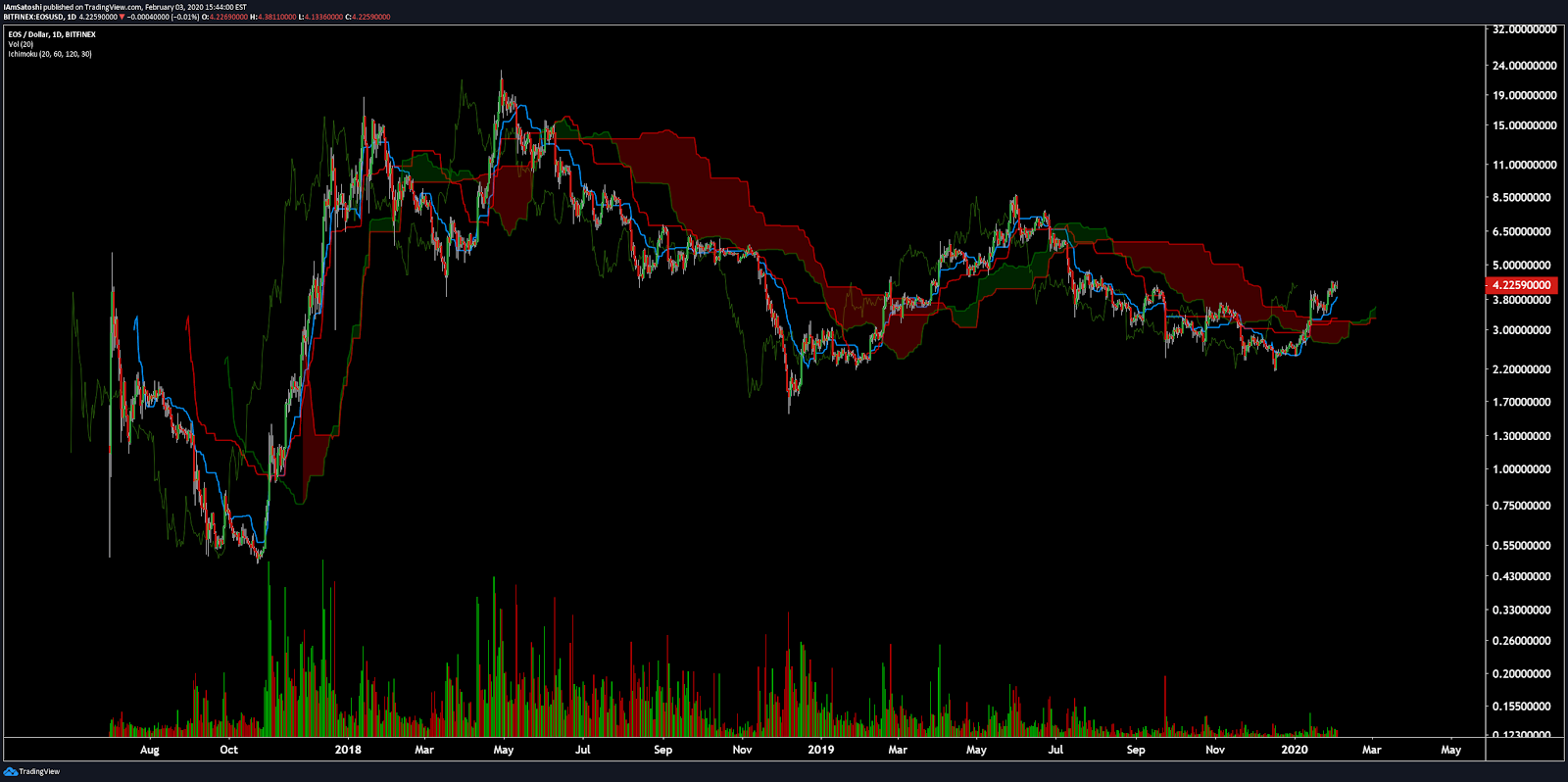

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are mixed: price is below the Cloud, Cloud is bullish, the TK cross is bearish, and the Lagging Span is above the Cloud and below price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Currently, price is beneath the Cloud and not showing many signs of recovery; especially considering the double top pattern. However, the positive VFI and lower RSI (40) may provide a short term reprieve to selling pressure. If that occurs, price will need to breach and hold above $1.36 at best and $1.50 at worst. If the current trend persists, support levels are $1.13 and $1.04.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are mixed: price is below the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and below price.

The slower settings offer a similar picture for KMD. The only difference being the significance of the $1.03 Cloud support level.

Conclusion

Komodo is a novel blockchain project, with a unique delayed-proof-of-work security model that has helped it stand out against other smaller hashrate PoW networks. Beyond this, Komodo has been an innovator with its atomic swap DEX solution. It has recently added a multi-chain developer platform layer, Antara, which may add to the market’s “gut-feeling” value of the native KMD token.

However, the tepid market response to the project’s recent releases, the increasingly crowded multichain integration competitor space and the clunky nature of previous Komodo DEX releases affect the project’s intrinsic value. Further gains in 2019 will depend on the ability of Antara to attract developers to its solution as well as wider altcoin market conditions.

The technicals for KMD are bearish, but offer a few potential catalysts that may aid price recovery. A fresh Kumo breakout will need price to break and hold above; between $1.36 and $1.50. However, if price cannot reverse the current trend or invalidate a double tap pattern, KMD falling to $0.93 is quite likely in the coming weeks or months, which will test support levels of $1.13 and $1.04.

Don’t miss out – Find out more today