Kyber Network Price Analysis: HTC announcement compliments fundamental gains

The KNC token's price has benefited from a boost of speculative buying pressure following announcements that the Kyber network liquidity solution would be inbuilt to HTC EXODUS 1 token swap solutions. These gains come following a recent uptick in onchain network activity and a number of positive fundamental indicators, though short term technicals favor bears.

The Kyber Network is an Ethereum-based liquidity protocol designed to facilitate instant and seamless digital asset transactions between exchanges, platforms, and ecosystems.

It is comparable to other Ethereum-protocol solutions, like 0x or FunFair, where the protocol is essentially ‘leased’ to blockchain projects so that operations like payments or trade settlements can be expedited. Unlike other protocols, Kyber is a purely on-chain solution.

The price of KNC is currently ~$0.26 and is currently ranked 102nd on the Brave New coin market cap table.

In recent days, the price of KNC has benefited from favorable market conditions and project-specific news. It rose ~24% on May 14th, driven by an announcement that the HTC EXODUS 1 blockchain smartphone will soon support Ethereum token-based trading via the Kyber Swap liquidity network. The integration will happen via the Zion wallet and gives users an immediately usable token swap solution which is transparent and traceable because users are in control of their own funds and keys.

This is not the first time KNC has benefited from rumors that it would be built into a blockchain smartphone’s trading system. In early March 2019, following speculation that the Samsung Galaxy S10’s inbuilt Enjin ERC20 would utilize the Kyber Network to support decentralized token swapping, the price of KNC rocketed upwards. An official announcement from Samsung followed. The token’s value rose 112.5% between March 5th and 10th before a pullback.

The excitement around these blockchain phone integrations was a key driver of buying pressure, pushing KNC firmly off a bear market bottom in mid-December. Future announcements related to these smartphone projects may drive further short term buying momentum.

The Kyber Network solution

The Kyber Network solves a simple problem. It allows users of Dapps, DEXs and token swap platforms to send and receive tokens via their preferred mediums. If one party wants to accept payments in DAI but the sender only wants to make payments in ETH, the Kyber Network can facilitate this transaction. The user making the payment accepts a conversion rate for ETH to DAI set by the liquidity provider and approved by the Kyber Network. The conversion rate has no slippage because the Kyber Network operates without an order book, every user is a ‘taker’.

The Kyber contract will first check if there is enough ETH in the sender’s wallet. Once this is confirmed, the DAI will be sent to the recipient’s wallet, (while observing the sender’s ETH address in their wallet). The ETH is then sent to the Kyber Network reserve pool, along with a small fee, to the reserve origin location from where the DAI was sent to the recipient.

The network has three key attributes: An aggregated liquidity pool to ensure the best possible market rate will be offered, diverse sources of liquidity across the Dapp ecosystem, and a permissionless nature to allow any developer to easily access the network and create reserves from various options.

In the Kyber Network ecosystem, users/takers are the senders and receivers of payments. Registered Reserves play an important role as providers of liquidity and facilitators of reserve funds for each respective token listed (there needs to be enough of each Kyber Network listed tokens to ensure that swap payments can be facilitated). The Kyber Core smart contracts also include a function for takers to query the best rate among all the registered reserves, and perform the trades with the corresponding rate and reserve. There are clear interfaces for the reserves to comply and be able to register to the network when adding support for new trading pairs.

Kyber Network Crystal (KNC) is the multi-purpose native ERC-20 token for the ecosystem. It is used for economic facilitation, i.e. reserves need to purchase KNC in order to conduct network operations. Every time a transaction occurs on the Kyber Network, the associated reserve is charged a fee in KNC to prevent wash trading. Users who want quicker liquidity can also use it to speed up trades. In the future, it will have functionality as a governance membership token to access the Kyber DAO.

The Kyber treasury holds a significant reserve of KNC. In the future network maintainers and the DAO members can leverage these reserves as a source of funds to fund the development, marketing, and growth of the Kyber protocol.

Maintainers refer to any participant who is given permission to access the functions for the adding/removing of reserves and token pairs, such as a DAO or the team behind the protocol implementation.

All reserves have a transparent fund management model. The Kyber Network provides dashboard and dev tools for reserve managers to help manage profits, calculate exchange rates and manage funds.

The latest Kyber network whitepaper released in late April 2019, also outlines future plans to make the liquidity protocol blockchain agnostic. The network has plans to offer its solution to other platform blockchain networks like EOS through cross-chain liquidity provision. KNC will be the universal token across chains when these expansions are implemented.

Network participants

Source: Kyber network blog

The main contributors of Kyber Reserve assets are decentralized trading solutions like Uniswap and the Kyber project itself. Kyber is a natural fit for decentralized exchange protocols because by contributing they can passively earn revenue on sitting reserves and access liquidity options through the wider Kyber network.

The fact that Kyber itself has been overtaken as the largest liquidity provider on the Kyber Network is an encouraging sign that Kyber is gaining traction in the Ethereum ecosystem.

The Kyber model may have problems as it scales due to its dependency on third-party liquidity. If there is greater demand for new tokens or specific channels become very popular, the Kyber Network is dependent on high liquidity third parties such as funds or token trusts to sustain user requests.

While the potential to earn revenue through depositing funds in Kyber reserves may be appealing to institutional token holders, adoption could be a challenge. The returns for reserve management are variable and dependant on the spread between Kyber Network transactions. This makes the model inherently risky and potentially off-putting for some large funds, especially when platforms like Compound and Reloanr let funds passively earn a safe yield on a variety of Ethereum based tokens.

The core value proposition of the Kyber solution is to make any digital token usable and exchangeable on any platform or Dapp. The Kyber Network is sector agnostic and its liquidity provision services are currently used by wallet solutions, decentralized exchanges (DEXs), crypto data providers and blockchain gaming companies.

Source: Kyber network blog

Presently the heaviest user of Kyber Network liquidity is the project’s in house exchange solution, KyberSwap. It handled over ~64,000 ETH transactions in April and grew significantly in usage between March and April 2019. Popular decentralized finance platform Nuo, which offers accessible non-custodial lending and margin trading options, has also seen a sharp increase in Kyber Network supported usage and trading.

Nuo has over USD 2 million in reserve and is listed by De-Fi aggregator as the largest lending protocol in Asia. It has benefited in recent months from the uncertainty and volatility of interest rates on the MakerDAO CDP. The Nuo model pools lender funds in a contract, which directly lends to borrowers or provides margin to trade against Kyber or Uniswap liquidity pools.

A promising ecosystem participant is the inhouse KyberSwap iOS smartphone app. It was launched in late March 2019 and is already a popular way to utilize the Kyber Network. Crypto smartphone apps are the medium most people use to buy and sell crypto. At present, the Cash app is the number 1 finance app on the app store with ~187,000 user ratings, while Coinbase is the 24th most popular finance app with ~695,500 ratings.

A stable base of mobile users through mobile ERC-20 trading solutions like Enjin and Kyber Swap iOS may be a key future driver of on-chain volume for the Kyber Network.

Source: Kyber network blog

The Kyber Network is dependant on wider ecosystem sentiment and the demand for Ethereum blockchain solutions. When there are fewer projects building Dapps, fewer users trading on DEXs and less demand to use ETH and ERC-20 tokens as mediums of exchange, this directly affects the value of the Kyber Network as a facilitator of ecosystem payments.

The recent surge in the Bitcoin markets is starting to be reflected with price appreciation and buying activity in altcoin markets. There has been a clear increase in Kyber user activity and on-chain volume. DappRadar lists Kyber as the 6th most popular Dapp in the Ethereum ecosystem at present.

Source: Dappradar

As a token with usage and fundamental value that appears to be cyclically driven, KNC is likely to derive value from the increase in altcoin trading activity. With buy volumes increasing across the crypto markets, usage and interest in the Kyber network may grow in the coming weeks.

Wider interest

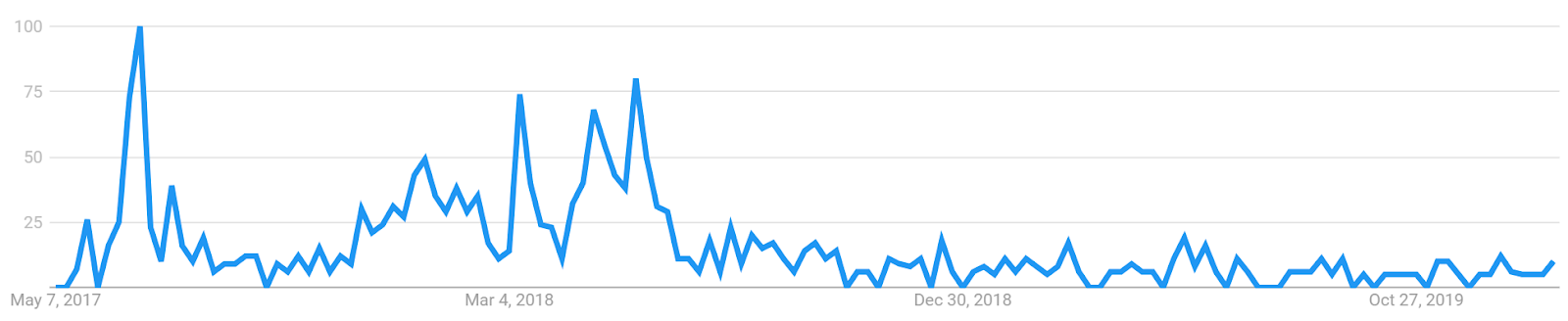

Source: Google Trends

Source: Google Trends

There appears to have been an increase in Google search trends for the Kyber Network, with a major spike on May 14th likely driven by the HTC EXODUS 1 announcement. Much of this search interest appears to originate in major crypto regions in Asia (Singapore, South Korea). There was also a sharp uptick in related search terms ‘Kyber network ico’ and ‘Kyber network coin’. These search patterns suggest the interest is speculative and focused on token trading and not Kyber Network product use.

If the crypto bear market is ending and the recent sentiment shift attracts speculators to the KNC token, the project has an opportunity to begin driving users into the Kyber Network, eventually driving further price gains.

The crypto and Dapp token ecosystem have been through this cycle before during the 2017 bull market with networks like Ethereum benefiting from the flywheel upcycle. As a crypto token liquidity provider, the Kyber Network offers a solution that derives value from an increase in speculators participating in the markets. As new entrants execute trades on decentralized exchanges, KNC may be one of the first tokens to hit the ‘user’ stage of the flywheel cycle and eventually create ‘belief’.

Onchain cycle indicators

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin.

Crypto markets are prone to bubbles of speculative purchasing that don’t reflect underlying network fundamentals. The NVT signal provides insight into what stage of this price cycle a token may be at.

A high NVT signal is indicative of a network that is going through one of these bubble periods and may move towards a position of becoming overbought/overvalued, as the market’s speculative momentum slows.

Onchain data source: Coinmetrics community data

Onchain volume indicators lean bullish for KNC. The NVT signal for the token hit an oversold inflection point of ~12 points in early April. It is turning upward and will put upwards pressure on the price.

This pressure has not yet translated into significant gains, however, with positive market sentiment and a boost of speculative buying following the recent HTC EXODUS 1 news, KNC prices have room to grow with the NVT signal in its current position.

With an increase in Ethereum Dapps using the Kyber Network liquidity solution between March and April, there are indications that this usage is driven by altcoin trading. These factors may keep a check on the NVT signal, quickly hitting an overbought inflection point if positive price activity continues in the near term.

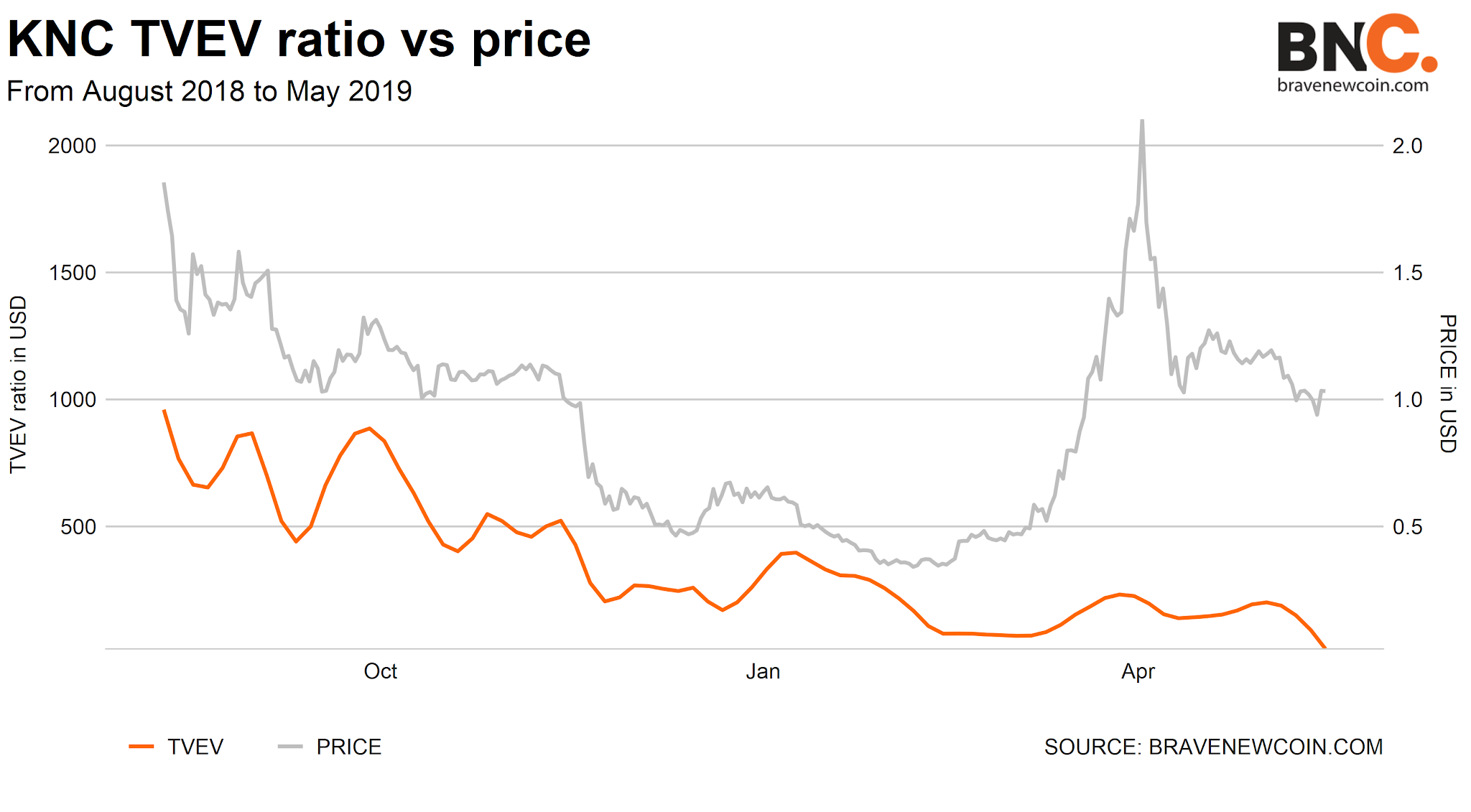

One of the most popular utilizations for the Kyber Network’s is the in-house decentralized exchange Kyber Swap, for example it is one of the most popular exchanges to trade the ETH/DAI pair. This considered, token value over exchange value may be a useful indicator for perceptions and fundamental value of KNC.

A metric used to assess the relationship between an exchange based token, and volume of the underlying exchanges was suggested by data scientists at Coinfi. Token value/exchange volume, or TVEV, is calculated using the ratio of daily token value (market cap) divided by 24hr exchange volume.

Every transaction on Kyber Swap increases requires a KNC payment, so increasing volume on Kyber Swap should drive value into the KNC buy proposition and a pattern of high exchange volume against token value should conceivably push price upwards.

Historical patterns suggest that KNC’s price and TVEV move closely together, and as such when token value falls, exchange volume also tends to fall on the Kyber Swap exchnage. This suggests that activity on the exchange is dependent on public perceptions and sentiment surrounding the Kyber Network and vice versa.

Since around late March 2019, KNC’s TVEV has started to fall against an upward trending price line. This is a bullish flag that price activity is driving increased usership on Kyber Swap and onchain transactions of KNC.

Development activity

Source: Sanbase Dashboard

Most blockchain projects use the developer community GitHub, where files are saved in folders called "repositories" or "repos”. Changes to these files are recorded with "commits" which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

The development activity score (combines the number of GitHub events like pulls, commits, and wiki edits) of KNC appears to have been steady through most of the 2018 crypto bear market. A large amount of ETH raised during the KNC ICO was sold in November 2018, suggesting possible cash flow issues during the bear market. Of the 200,000 raised during the KNC ICO, ~82,000 remains.

The Kyber Network has recently begun experimenting, but not officially implementing, Decentralized Autonomous Organization (DAO) style governance. Between March and April, 60 (out of 52,894) unique KNC addresses voted on a “should Kyber set up a Community Grant (in KNC), to be governed by the KyberDAO?” poll. The poll ran on Aragon allocating 0.56% of the total KNC supply. The vote ended with a “yes” for the proposal and ran smoothly, however, the turnout was disappointing.

Kyber blamed the low participation on “resistance towards Dapp usage and community voting initiatives in general.” It may require more stages of experimentation before a community DAO project allocating KNC towards building ecosystem projects is officially launched.

PMR signals

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

Onchain data source: Coinmetrics community data

Because the primary on-chain utilizers of KNC are designed to be reserve managers and contributors, the PMR of KNC appears to be unnaturally high, sometimes close to double digits. Reversals in PMR have tended to be small in 2018, and have put very little forward fundamental pressure on price. However, KNC is still tradeable on DEXs and daily active address numbers between 200-400 suggest a network that is under-utilized. Active address numbers doubled between May 13th-May suggesting bullish conditions.

Because users can hold any token to make payments on Kyber Network, wider growth in the active addresses of KNC is unlikely to be a major factor in its value. However, if the Kyber Network does grow in popularity as a tool for making Ethereum network transactions, active address/Metcalfe’s law numbers should rise as well.

Exchange and trading activity

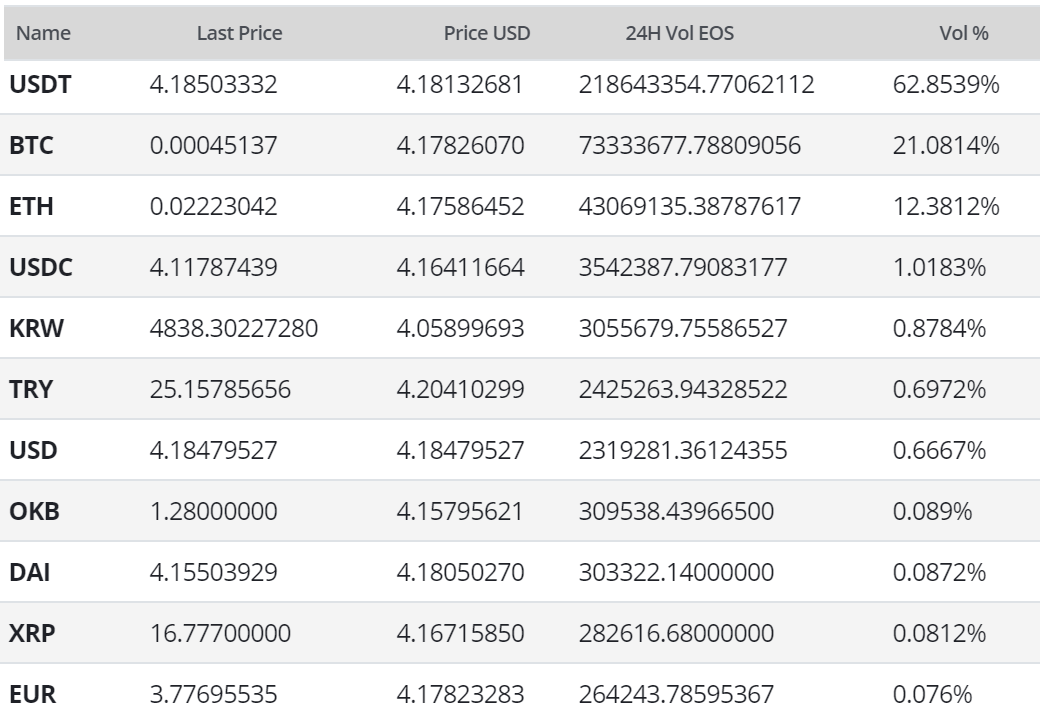

Source: Brave New Coin

The most popular trading option for KNC is USDT with the pair currently handling over 50% of daily trading volumes. The second most popular market is the KNC/BTC pair. Together the top two pairs make up close to 75% of daily trading volume. The USD value of the daily volume of the entire KNC trading market is ~USD 7,4 Million. While fiat options for KNC do exist in the form of US Dollar and Thai Baht onramps, these markets appeared to be rarely used and illiquid.

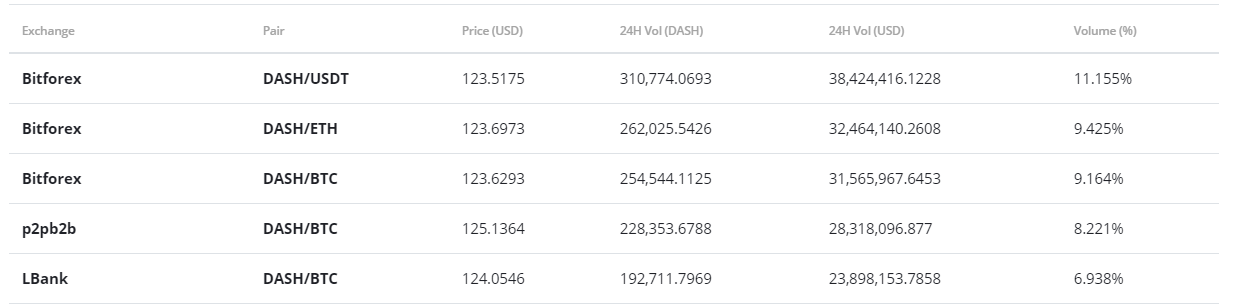

Source: Brave New Coin

A mix of exchanges make-up the KNC trading ecosystem. Markets on major exchanges, OKEx and Binance, operate the top two pairs in the marketplace with the KNC/USDT pair on OKEx by far the busiest marketplace for KNC trading. SNT is also tradeable on prominent exchanges such as Bitfinex and Poloniex.

Technical analysis

Moving averages and price momentum

On the 1D chart, KNC has followed a negative linear price trend with a Pearson’s R correlation between time and price of ~0.79 (not shown), which has allowed a death cross to persist since 2018. Since early-February, KNC has seen a ~25% surge, which has price currently sitting near $0.25. However, despite the recent uptrend, a golden cross has yet to occur, and price failed to break above the 200 day EMA (first arrow). One point of positivity is that price still remains above the 50 day EMA (red line), which will now act as support.

On the 1D chart, furthering the current bearish sentiment, price failed three times to break above the 0.5 Fibonacci retracement level of ~$0.30. However, price currently sits at the 0.382 Fibonacci retracement level, which is acting as support. A significant increase in buying volume is needed to both maintain the current support level and breach above the 0.5 Fibonacci resistance.

Lastly, on the 1D chart, the volume flow indicator (VFI) is still sufficiently above 0 despite the recent price weakness. However, VFI has plateaued and is fighting to reignite its uptrend, thus, as mentioned prior, price will need another uptick in buying momentum to break key resistance levels.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are mixed: price is below the Cloud, Cloud is bearish, the TK cross is neutral, and the Lagging Span is below Cloud and touching price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price completed a Kumo breakout in early-March 2019 but has struggled ever since. Recently, the price has fallen beneath the Cloud and failed its first breakout re-attempt at Cloud resistance of $0.30 (arrow). Further dampening the likelihood of a new breakout in the near term, is the RSI metric of 64, nearing overbought territory, coupled with Cloud resistance coinciding with 0.5 Fibonacci resistance.

Currently, there are few positive factors for KNC, but some include:

- VFI is still in the bulls’ favor

- If VFI picks up, price can push demonstrably higher despite an overbought RSI

In the event of a new breakout, price targets are $0.37 and $0.45. If price continues to drift lower, support levels are $0.22, $0.20, and $0.18.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are mixed: price is below the Cloud, Cloud is bullish, the TK cross is bearish, and the Lagging Span is below the Cloud and touching price.

The slower settings yield similar results with price currently sitting beneath the Cloud; including similar price targets and support levels.

Conclusion

The Kyber Network is a developing project and its native token KNC shows signs of immaturity. While on-chain volume indications lean bullish, the lack of user activity suggests a minimal network effect and a KNC token that is potentially overvalued based on PMR. The price of KNC has been volatile and prone to spikes around unexpected events making price discovery a challenge.

However, since the start of 2019, the Kyber Network has displayed an impressive ability to connect with users for their on-chain liquidity protocol across a wide range Dapps. There appears to be market interest for their product, while deals to integrate with major smartphone brands Samsung and HTC have piqued the interest of traders. The Kyber Network solution that currently targets DEX and De-Fi leveraged traders as demand drivers, may also benefit from a pick up in usage if short-term altcoin buying interest continues.

The current technical indicators for KNC favor the bears, while the bulls’ primary hopes are for current support levels to hold, coupled with an increase in buying volume, which may occur given the renewed positive sentiment in the market. However, on the 1D chart, both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30) will await price to complete a new Kumo breakout above $0.30 (Cloud and Fibonacci resistance) before entering a long position. Success will yield price targets of $0.37 and $0.45. Failure will highlight support levels of $0.22, $0.20, and $0.18.

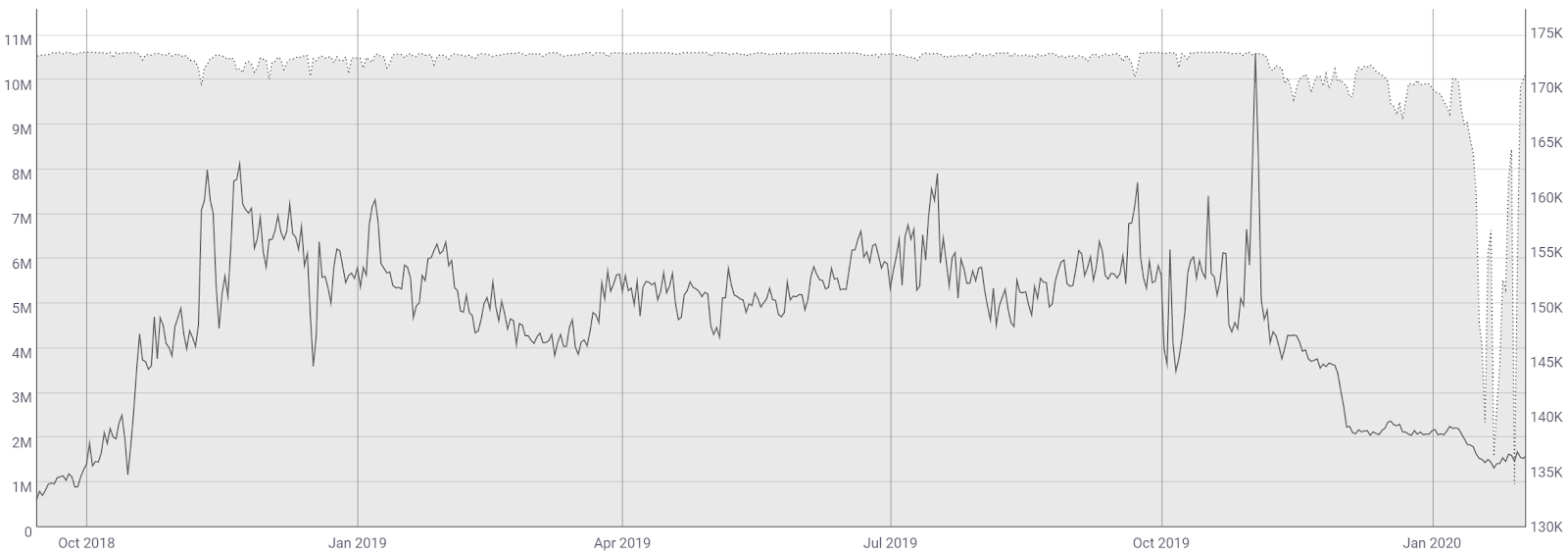

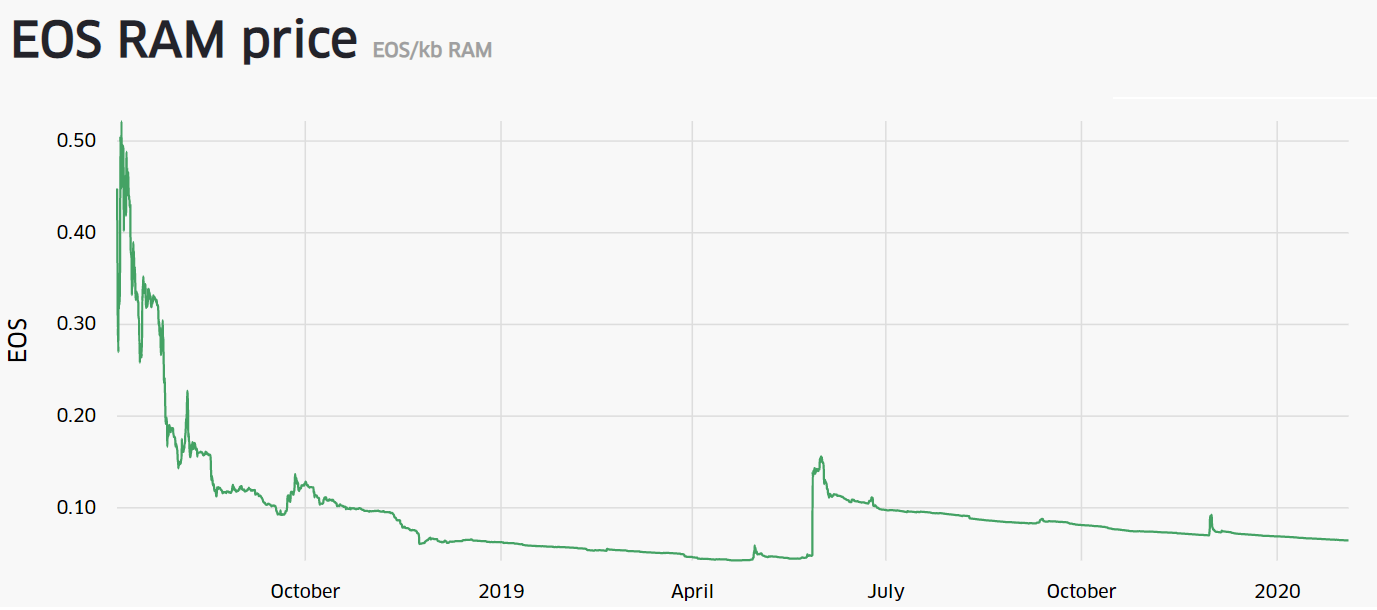

Don’t miss out – Find out more today