LOOM Price Analysis: Scalable Dapp solution expands outlook

The Loom network has delivered a viable Ethereum scaling solution and created fundamental value for its native LOOM-token – which has enjoyed a period of strong price performance recently following the release of a series of new interoperability solutions.

The Loom network is a next generation blockchain platform designed to allow for large scale applications to be launched on the Ethereum blockchain. The Loom network is notable for being the first production ready solution capable of increasing the core capacity of Ethereum, launching in March 2018 beating to the pass more hyped scaling solutions like the Raiden network and Plasma.

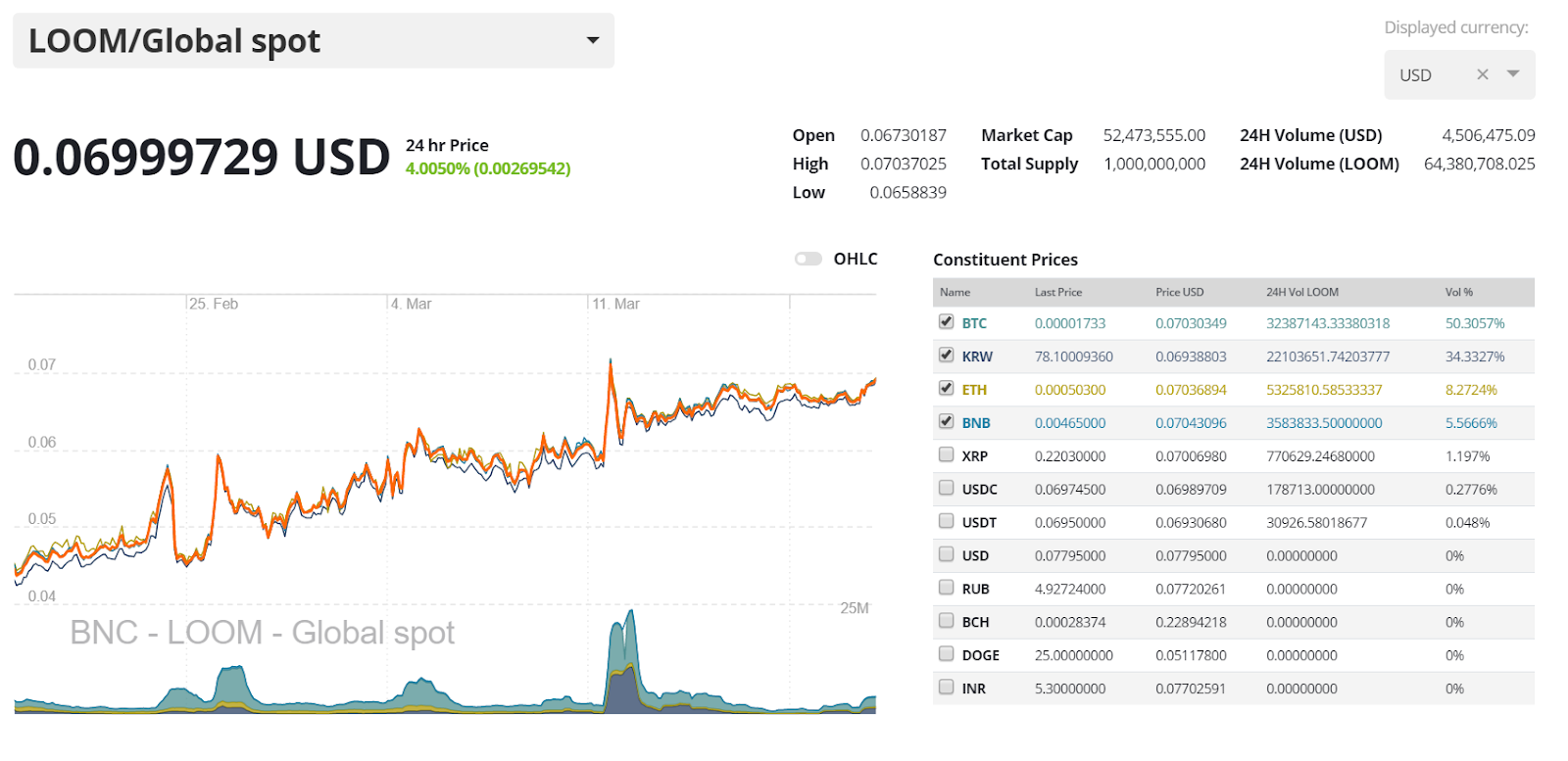

The Loom network’s native token, Loom-token, has risen ~57% in the last month and is currently trading at ~USD 0.07. The project has recently implemented a number of significant updates and has benefited from favourable wider market conditions. Price, however, remains down ~88% from an all time high achieved on 05/04/2018. LOOM currently occupies the 87th position on the Brave New Coin market cap table.

Drivers of short term value into the ecosystem include a recent listing on Coinbase Pro and announcements that the Loom network decentralized applications (Dapps) would begin accepting payments in a range of ERC-20 tokens, including leading stablecoins. The ERC-20 integration news also coincided with a collaboration with recent market stand out Binance Coin (BNB) that involved a 10,000 BNB give away to Loom network users.

On March 21st Loom network CMO and co-founder James Duffy announced that the project would be making a big step into the blockchain interoperability space by accepting payments in TRON and EOS tokens, while also supporting native wallets from those networks. Given the positive reaction that the ERC-20 integration news generated within crypto markets, this latest announcement may refuel positive sentiment and drive short-to-medium term price momentum. The price of LOOM jumped ~5% in the hours immediately following the EOS and Tron integration announcement.

Reaction to the announcement has been mixed, because of negative perceptions around the quality of platform solutions offered by TRON and EOS, and potential scope creep.

The core of the Loom network is an SDK (Software Developer Kit) which lets developers build scalable internal blockchains. The Loom network does this by deploying on sidechains, or Dappchains, which are layer 2 networks built on top of Ethereum.

The SDK enables developers to build Dapps that verify transactions using an alternative consensus rule, like Delegated Proof-of-Stake (DPoS), which offer benefits like faster throughput and cheaper, more deterministic (or even 0) fees. Loom Dappchains use Ethereum based ERC-20 and ERC-721 tokens and still offer the final transaction settlement security of the Ethereum mainchain by using plasma based relays. The Loom network self-prescribes its product as ‘EOS on top of Ethereum’.

The Loom network has built a core mainnet Plasma-based chain called Plasmachain (formerly known as Zombiechain) a DPoS based chain which Dapps can deploy onto to increase scaling capabilities. Developers do have the option to build their own, native Dappchains using the Loom network.

Plasma works by using smart contracts which act as child versions/Layer 2’s (LOOM SDK powered Dappchains) of the root or parent or Layer 1 chain (Ethereum in this case), to handle the bulk of transaction operations before final verification (and mining) occurs on the main chain. Plasma child chains can have their own tokens to reward/incentivize validators. Bad actors can immediately be caught by asking for transaction confirmation of child chain operations from the root chain.

The recent ERC-20, EOS and TRON integrations into the LOOM network, will let users make a purchase transaction on Layer 1(Ethereum, EOS or TRON) and receive the purchased item on the Layer 2 Dappchain game or Dapp. The user can also sign for all Layer 2 transactions using a native Layer 1 wallet like Metamask for Ethereum or Scatter for EOS. These updates are designed to make the Loom network’s scaling capabilities accessible for a wider Dapp using audience.

The LOOM token is designed to be an all-access membership token that gives users access to Dapps and network operations that run on the Loom network.

LOOM tokens are required to be staked in large amounts in order to become a validator node on a LOOM DPoS Dappchain, and in order to elect these validators users need to stake tokens for voting rights.

For developers, LOOM is used for token staking and as payments to run Dapps on existing LOOM sidechains like the DPoS-based Plasmachain. Once a developer decides they would like to deploy their solution on the Loom network they are required to stake tokens every month. An amount of tokens are deducted based on how much network bandwidth (transactions per second) a Dapp uses and the deducted tokens are reallocated to transaction validators of the Dappchain.

Loom Dappchain operators do not pay for Ethereum Gas fees and network payments are all derived from the monthly stake.

For users, LOOM can be used for in-Dapp purchases, for example, the Loom powered Zombiebattleground game lets users sign up for ‘game membership’ using LOOM and gain access to free game cards every month.

For developers who would like to run a Dappchain of their own, Loom offers premium enterprise support at a cost of 100,000 LOOM per year or ~USD7000 in today’s prices.

LOOM token supply is fixed at 1 billion tokens. The Loom network company/operators hold 35% of current supply, 10% is held by team members and advisors with a lockup period ranging from 6–12 months. This suggests somewhere between 55-65% of token supply is currently circulating depending on if team members/advisors have sold their allocated tokens.

A potential criticism and barrier for adoption of the Loom network solution is the inherent sacrifice of decentralization that comes with it. Developers that build on existing Loom sidechains place a high level of trust on external validators. Validators are voted in, so developers can punish and replace underperforming/bad actor nodes, however, governance of DPoS chains has often proved challenging to implement in practice.

EOS, which the Loom network models its DPoS after, has faced challenges post-mainnet launch with bad actor validators openly exchanging votes for block rewards, a case of obvious corruption. These incidents led to significant frustrations from the EOS token holding community and calls for constitutional changes to the EOS governance structure.

The Loom network’s deployment of DPoS side chains is still at an early stage, the plasmachain solution only opened for public nodes on February 19th and at this stage determining how challenging it will be for the Loom network to manage multiple economic voting communities/sidechains is unclear.

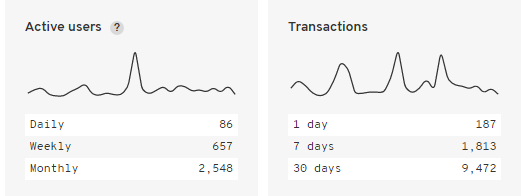

Stateofthedapps.com currently lists the Loom network as the 102nd most popular Dapp in the Ethereum ecosystem. Daily active users on the platform appears to hover around ~85 per day, while based on monthly figures, daily transactions tend to hover ~320 transactions per day.

Source: Stateofthedapps.com

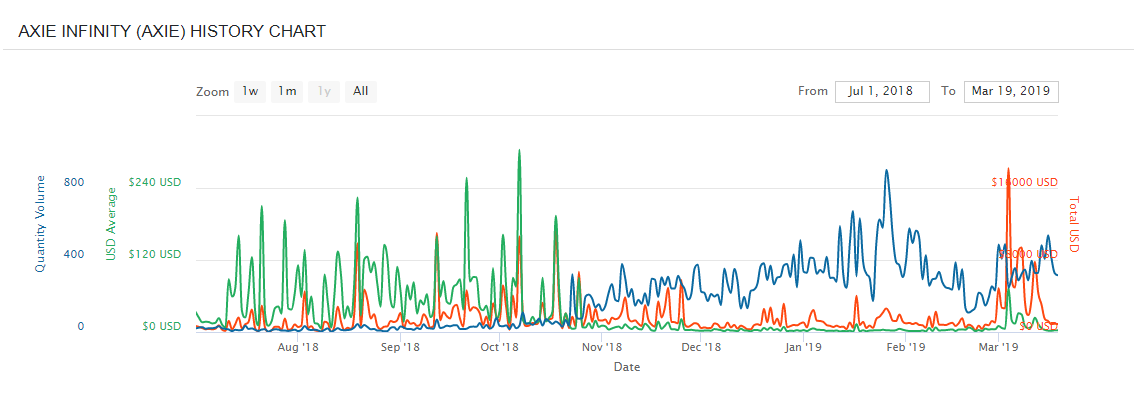

Loom has attracted some notable partners within the Ethereum ecosystem to implement its scaling solution. Axie Infinity is a notable non-fungible token game, similar to Cryptokitties, that lets users breed and battle ‘fantasy pets’ over the Ethereum blockchain and in June 2018 it was announced that it would be implementing the Loom SDK Plasmachain solution for scaling purposes.

The Loom SDK natively supports non-fungible ERC-721 tokens and lets data like wins, losses and participation happen off the Ethereum main chain without incurring gas costs.

Key players on the Loom team have discussed the projects prime focus on building strong UX solutions for consumer focused Dapps within sectors like gaming and social media by providing a seamless transaction experience. The Axie infinity deal fits well into this characterization.

Source: Nonfungible.com

The Axie infinity platform has shown steady growth in the quantity of Axie’s sold (each Axie or ‘fantasy pet’ represents a unique ERC-721 non-fungible smart contract). There has also been a sharp spike in the total USD volume generated in the Axie infinity ecosystem in the last month. This is a bullish signal that Loom network support can help existing Dapp projects scale.

The Loom network also operates Crypto Zombies, one of the world’s most popular Ethereum coding schools. The platform helps developers learn the basics of Solidity & SolidityX and eventually teaches them how to deploy Dappchains within the Loom network. The Crypto Zombies user base spans over 200 countries with meetups in places such as Tokyo, Sydney and Tegucigalpa, Honduras.

Crypto Zombies helps to internally encourage the first wave of Loom network Dapps, while also growing the wider Ethereum ecosystem. To investors and retail traders it is a sign that the Loom network is at the forefront of Ethereum Dapp development and may create some underlying buying pressure for LOOM.

Developer activity

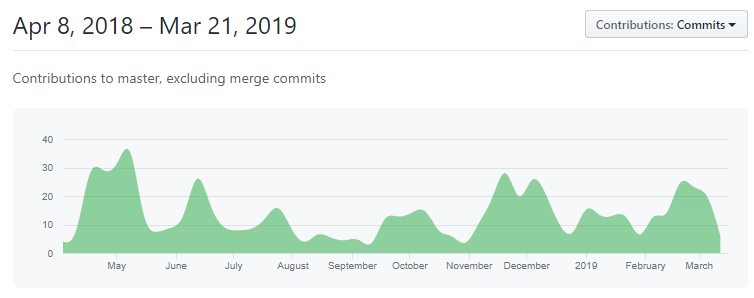

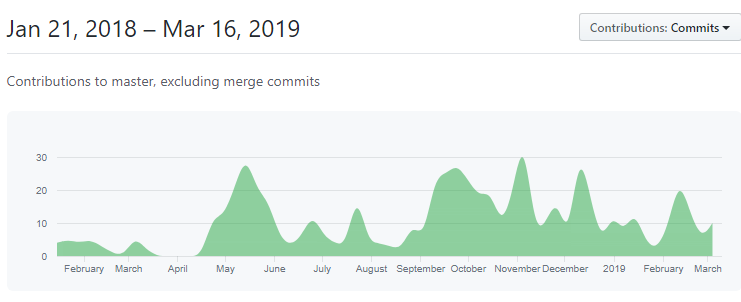

The Loom network has 90 repos on GitHub with the highest activity occurring on repos focused on core Go implementation and JS libraries for building apps.

Most coins use Github as their open development platform, where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Commits on the Loom network’s two most popular ‘repos’, ‘go-Loom’ and ‘loom-js’ appear to be relatively consistent throughout the last year, with some pickup in activity beginning from around the third quarter of 2018.

Loom network/go-loom commits, source: github

Loom network/loom-js commits, source: github

network Activity

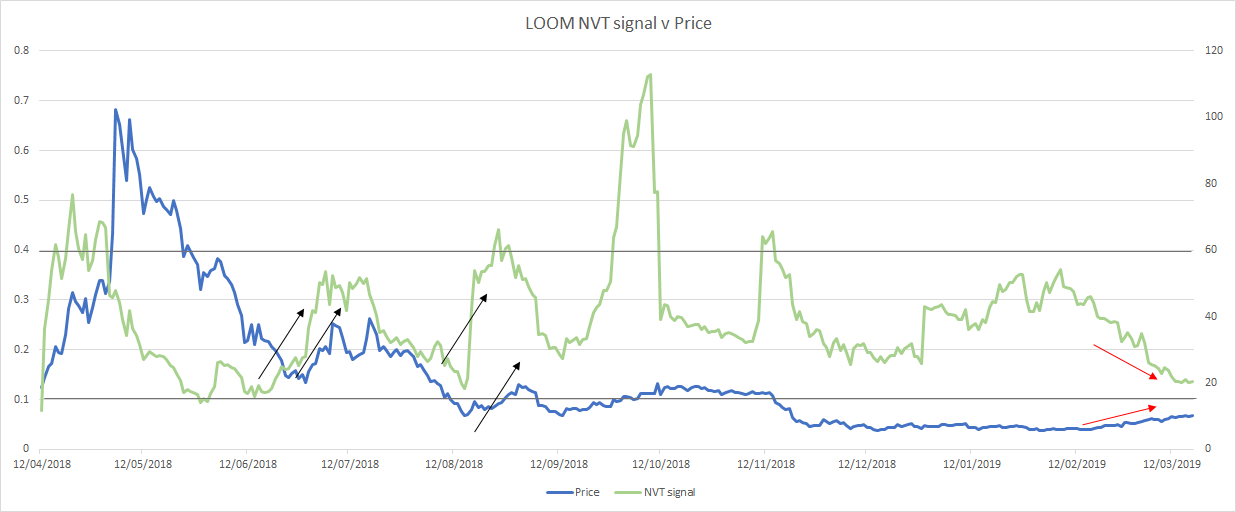

**NVT signal **

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin. Crypto markets are prone to bubbles of speculative purchasing, not backed up by underlying network performance and activity.

The NVT signal provides some insight into at what stage of this price cycle a token may be.

A high NVT signal is indicative of a network that is going through one of these bubble periods, and may move towards a position of becoming overbought/overvalued, because of the market’s speculative assessments running out of steam.

Data sources: Brave New Coin, Coinmetrics.io

Historically, periods of sharply rising NVT signal derived from bounces off inflection levels have preceded short term price jumps of the LOOM token. Currently the LOOM NVT signal appears to be close to hitting a historically indicated inflection point of ~15 points. Touching this level would be a bullish fundamental indicator that recent price gains of Loom-token may be set to continue.

Another bullish observation is that falling NVT signal has coincided with the recent price run of LOOM, this means onchain volume is rising more quickly the token’s market cap/value. This pattern suggests that the period of rising external value is being backed by tangible economic activity and is a sign of bubbling underlying medium-long term momentum.

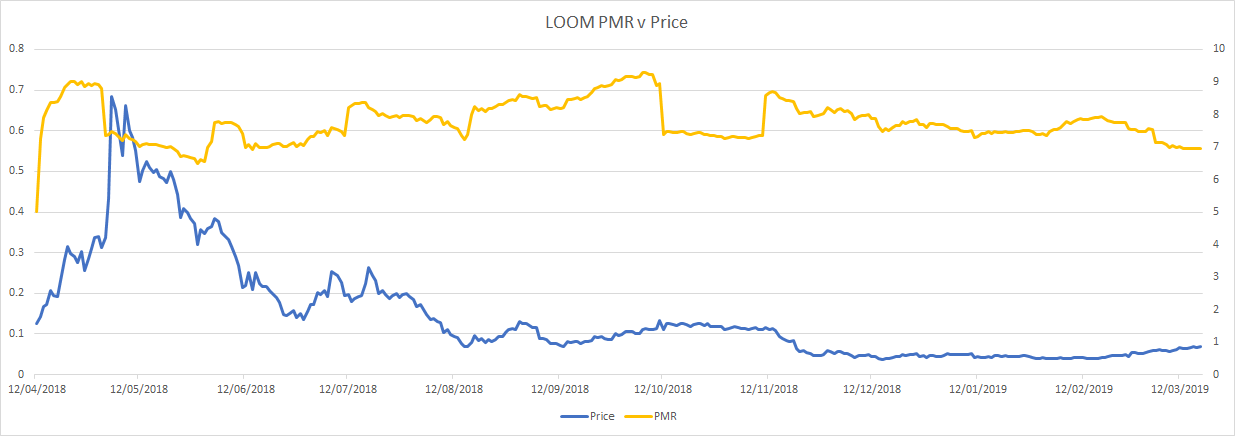

PMR signal

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin, and by comparing it to price, can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to implement versus onchain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

This makes it a relatively transparent metric as compared to onchain volume. However, there may be a question of the granularity of the data, and who controls these addresses.

Data sources: Brave New Coin, Coinmetrics.io

The PMR for the LOOM network has been historically high and has hovered between 7-9 natural log points since early 2018. This implies that token value dominates vs number of active addresses of LOOM and that the token derives little value from wider community effects. As such PMR does not appear to have much effect on price, and for long term maturity of the asset, LOOM holders should want the PMR to be closer to levels between 2-4 log points.

Social metrics

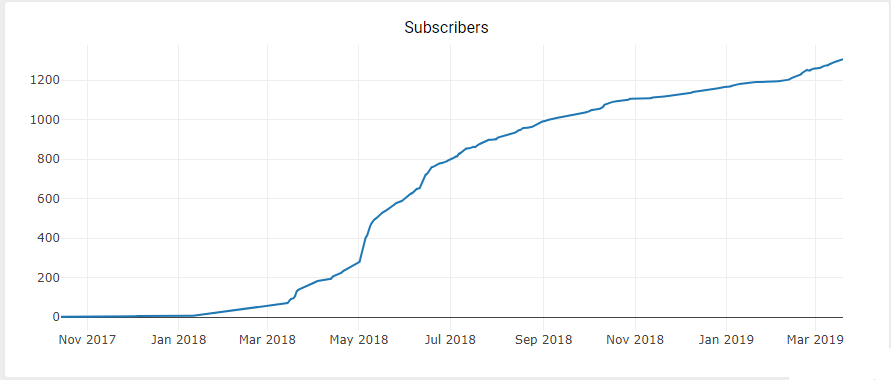

The Loom network subreddit r/loomnetwork currently has 1,306 subscribers and ranks as the 20,701st most popular subreddit on reddit. The subreddit averages 3 comments and 4 posts per day. Most popular posts relate to a tweet by key Ethereum figure Vitalik Buterin endorsing the Loom network as a top Plasma solution and a tweet announcing the release of Zombie battleground the first scalable Ethereum game to be built on Ethereum.

Most popular keyword tags include Mainnet, dapp and SDK.

Source: Subredditstats.com

Despite a low number of subscribers compared to other crypto tokens on reddit, the Loom network has grown steadily over the last 18 months.

Source: Subredditstats.com

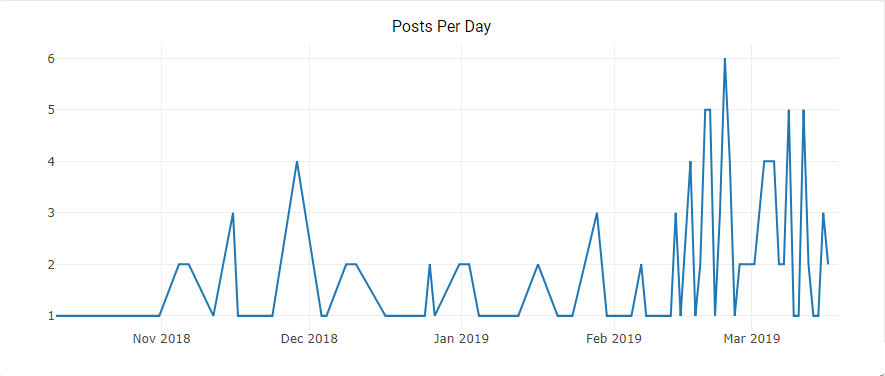

In terms of Posts per day, on most days in the last 6 months there was just 1 new post on the Loom subreddit, however, there appears to have been a sharp uptick in post activity beginning around the second half of February 2019.

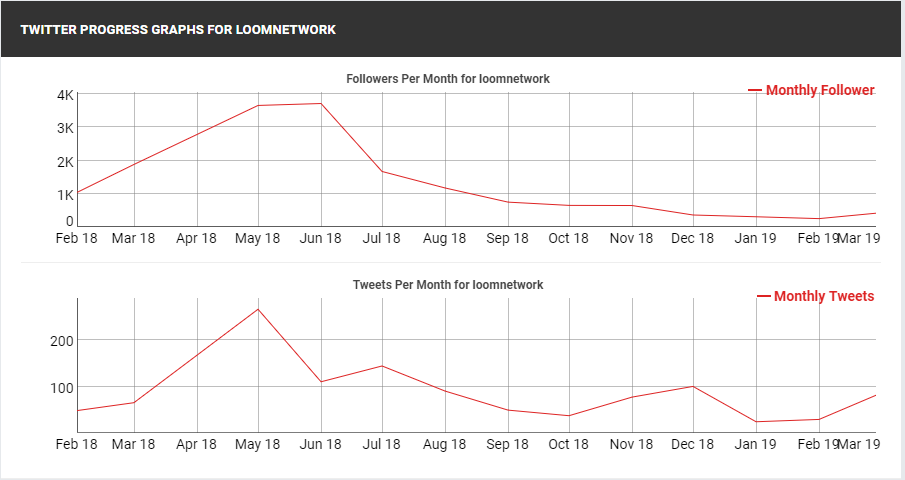

Turning to Twitter activity, the @loomnetwork account currently 18,039 subscribers and is ranked as the 305,550th largest account on twitter. It averages 20 retweets and 72 likes per post.

Source: Socialblade.com

The Loom network Twitter account has grown steadily over the last year. There were a number of months in the middle of 2018 when the account added well over a 1000 new followers a month. Since the start of 2019, the account tends to collect a 100 or so new followers a month.

Tweets per month from the @loomnetwork have ranged between 50-200 tweets for the last year. There was a pick up in tweets around the launch of the main DPoS Loom network Dappchain Plasmachain/Zombiechain

Exchanges and trading pairs

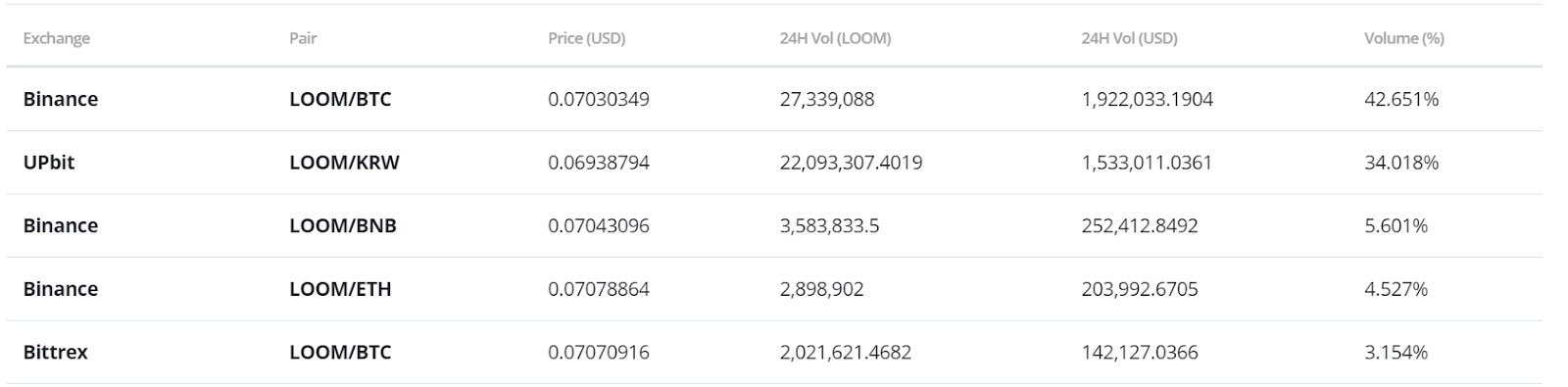

Source: Bravenewcoin.com

The most popular trading option for LOOM is BTC, handling just 50% of daily trading volume. The second most popular market is the LOOM/KRW pair and together the top two pairs make up over 84% of daily trading volume for LOOM. Fiat transactions with LOOM are also available in the US dollar, Indian Rupee and the Ruble, however, there is almost no trading activity in these markets. The USD value of daily volume of the entire BNB market is ~ USD 109 million.

Markets from mega-exchange Binance dominate the LOOM trading ecosystem, operating three of the top five LOOM pairs by exchange. LOOM is also tradeable on visible and trusted exchanges such as Bittrex, Coinbase Pro and Poloniex.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart, LOOM has followed a negative linear price trend with a Pearson’s R correlation between time and price of ~0.78 since 2018, coupled with a persistent death cross. However, since February 2019, price has been demonstrably positive and currently sits near USD0.07. On the 4H chart, LOOM’s recent momentum resulted in a golden cross (circle) with price currently using the 50 period EMA as support (arrow).

On the 1D chart, the 30 day TRIX and volume flow indicator (VFI) are well above 0 and still trending higher, respectively. Additionally, SAR confirms the current momentum and illustrates very few down waves within this larger up wave.

Last, using Fibonacci retracement, price appears stalled at the 0.5 Fibonacci level of USD0.075, but currently using the 0.382 level of USD0.066 as support. If price can breakthrough resistance, a target of USD0.084 is likely.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals is bullish; price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price has completed and maintained a Kumo breakout since the end of February, and appears poised to move higher. One warning sign would be the RSI in well-overbought territory. As mentioned above, price may retest lower levels in the interim with support at USD0.066, USD0.063, and USD0.06. If the breakout holds, likely price targets are USD0.077 and USD0.087.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is mixed; price is in the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is above the price and in the Cloud.

Using slower settings, the outlook for LOOM is slightly less optimistic. Currently, price is attempting a Kumo breakout with the Cloud "exit level" of USD0.077 acting as formidable resistance given the current RSI metric. If price does complete a breakout, targets are USD0.087 and USD0.095.

Conclusion

The Loom network is notable for being the first Ethereum Dapp scaling solution to publicly release a working product and has recently made big steps to expand its user base by integrating ERC-20 tokens and EOS and TRON users into its Dapp ecosystem.

Recent changes have helped the network to grow strongly so far in 2019 and fundamental network activity suggests that onchain volume is growing quickly against token value – implying that the good times may continue.

Some wider concerns surrounding the validity of DPoS based blockchain solutions and the possibility of scope creep do remain, nevertheless the Loom-token shows signs of being an alt-coin hidden gem.

The technicals for LOOM are bullish in the near term, but offer cautiousness in the mid-term. The short term trader (10/30/60/30) will carefully watch the USD0.077 level as a possible trend reversal spot, while the longer term trader (20/60/120/30), on the 1D chart, will await a positive TK cross and Kumo breakout above USD0.077 before entering a long position. Both trader’s support levels are USD0.066, USD0.063, and USD0.06, and price targets are USD0.077 and USD0.087 (faster settings) and USD0.087 and USD0.095 (slower settings).

Don’t miss out – Find out more today