Loopring Price Analysis – Bullish momentum in the short term

The Loopring native token has performed strongly since the start of January benefiting from favourable market conditions and the growth in trading activity of Binance altcoins. Network activity remains lackluster, however, with active user numbers low even by crypto standards. Nonetheless, major updates deliver the potential for a bright future.

Loopring (LRC) is an open protocol designed to support the building of Decentralized exchanges. It functions as a set of smart contracts verifying tradeable orders performing trade settlement on-chain, while keeping all order management off-chain. At a base level Loopring works by pooling all orders sent to its networks, and filling these orders using the order books of multiple exchanges. The Loopring protocol operates as a sidechain of the Ethereum network.

The price of Loopring’s native token LRC, has risen ~70% since January 1st, after key network updates were released towards the end of December 2018. LRC currently trades at ~USD 0.070 and remains down ~96% from its all time high achieved in January 2018.

The Loopring solution aims to provide low fees, liquidity, transparency and security, challenging some of the inherent issues within both centralized and decentralized crypto exchange models.

Loopring organizes trade orders by using a unidirectional order model (UDOM). In this format, trades are formatted as "exchange requests", where there is no price in a common currency as per normal trading systems, but instead a direct exchange of tokens. Users remain in control of their own keys and funds throughout the exchange process.

For example, a quote could be presented as 1000 LRC for 4 ETH. Loopring collects quotes to create an order-ring matching system that allows disparate trading pairs to be stitched together in a circular trade. Unique base/quote orders are mixed between pairs in a ring expanding potential liquidity by increasing the number of potential trading counterparties. In this example the 4 ETH could be filled with an ETH for WBTC order via communication within the order ring.

Orders in a ring also do not need to be fully matched, in the earlier example, the 4 ETH could have been filled with an order selling 6 ETH for WBTC, with the 2nd order, if unable to be filled fully, being sent to the next order ring to find a liquidity partner to fully complete the order to satisfaction.

To begin the transaction process, a trader makes an order from a Loopring protocol supported blockchain wallet or DEX. The order is then sent to a meshed network of relays, relays then update their orders and communicate with each other to match orders & find the best exchange orders, ring miners then organize trades into single order rings and runs matching order algorithms in order to submit them to the smart contract for execution, the Loopring smart contract then executes matching trades, swaps the tokens between the respective traders, and pays fees to wallets. A user can be both a ring miner and relay within Loopring.

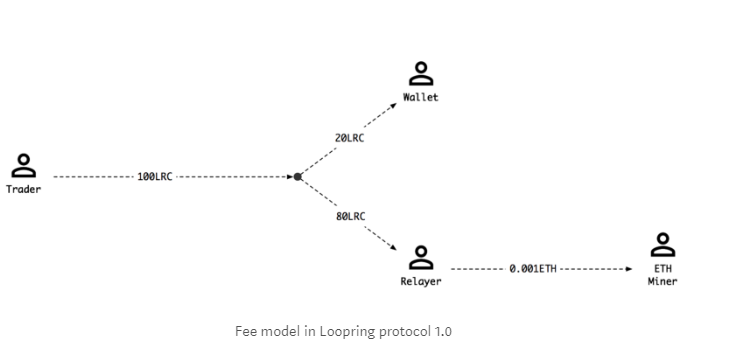

Each facilitator in the Loopring protocol; the wallet, relayer, ring miner and the smart contract, are paid for their services. Traders pay a transaction fee to wallet’s/DEX’s and to the ring miners for their services, with ring miners generally earning a higher share. The ring miner, with this fee, then pays the Ethereum miner’s gas.

Because of an apparent lack of demand for the LRC token, Loopring has recently restructured the network fee system and inherent utility of the LRC token.

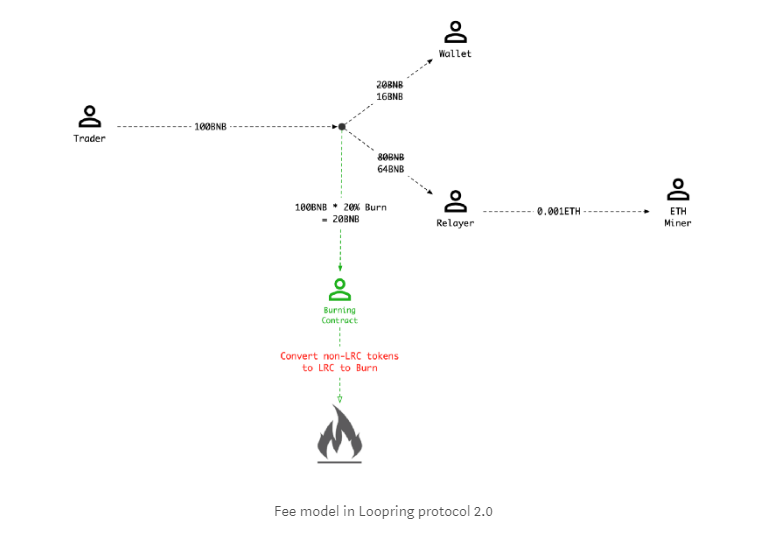

Before Loopring 2.0 was launched in late December 2018, all network fees were paid in LRC, but now in addition to LRC traders can pay trading fees in ERC-20 tokens and WETH (Wrapped, Smart contract compliant ETH).

Additionally, for every trading fee payment, a cut is taken and an equivalent amount of LRC (owned by the Loopring foundation) is burnt by the Loopring smart contract .

The Loopring 2.0 model is designed so that traders who pay for trading fees with LRC pay lowest rates. Transaction fee paid in LRC also burns the fewest token. Traders and ring miners can also lock LRC for access to cheaper fees and greater fee percentage retention.

The burn model artificially reduces supply and is designed to make LRC more appealing to the community and projects holding it because; with each transaction burn the community holds more tokens vs the Loopring Foundation, and there are incentives to accumulate LRC because it is now a ‘scarce’ resource that directly reduces as network activity grows giving it a store of value appeal.

Price and volume of LRC have both picked up since January 2019 and this effect is more visible on key altcoin exchanges like Binance. This and the 70% rise since early January is a bullish signal that the LRC token value restructuring may be working as intended.

The January LRC bump coincided with a number of other Binance altcoin markets, including Augur (REP), Power-Ledger (POWR) and Status(SNT), having similar price jumps around the same period (Bitcoin and other cryptos did not shift in the same way). This suggests that the pump likely did not happen because of specific fundamental factors tied to Loopring.

REP/BTC market on Binance exchange

LRC/BTC market on Binance exchange

DASH/BTC market on Binance exchange (Control)

Source: Binance Trading Dashboard

LRC volumes have remained strong post January (sitting higher than mid to late 2018 levels) and while there has been a price correction following the pump at the start of the year, it has not been a full reversal. This may suggest that the token has remained in the Binance user base consciousness, and is potentially being accumulated.

Recent pick up in altcoin markets and Ethereum trading activity has contributed positively to the inherent fundamental value of LRC and speculative considerations towards the token. While Loopring’s new burn and accumulation incentives may well be positive drivers, eventual inherent LRC value will be determined by how many traders use Loopring’s exchange system and how well it stands up against other Ethereum DEX solutions.

Demand for transactions/trading activity on the Loopring protocol drives value into the LRC token. This means LRC is a token tied closely to crypto market cycles, with token value possibly correlated to demand for trading crypto assets and size of the Ethereum ecosystem.

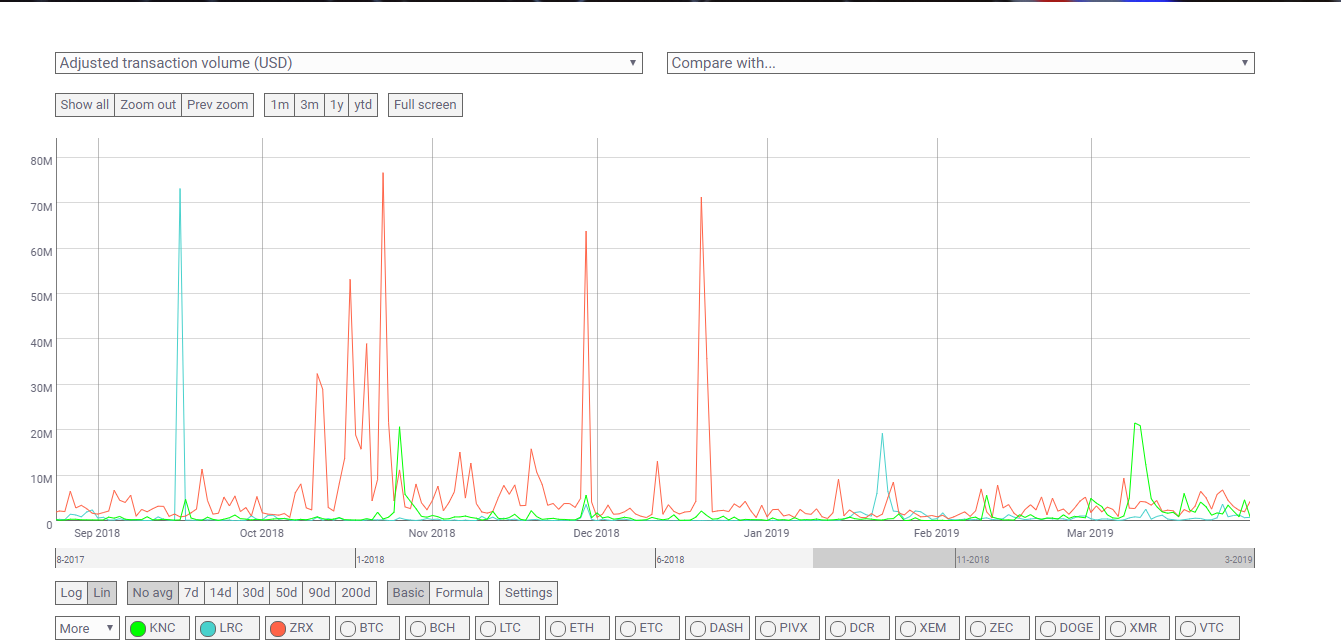

Another consideration is how Ethereum based DEX and token-swap protocol solutions like 0x and Kyber Swap eat into Loopring’s potential market share. Each solution has unique selling points, however, and have managed to build sizable market caps. ZRX occupies the 36th position on Brave New Coin’s market cap table with a market cap of ~USD197 million, LRC occupies the 89th position on the table with a market cap of ~USD56.5 million, while Kyber Network Crystal occupies the 107th position with a market cap of ~USD46.2 million.

Loopring and ZRX are similar in many ways in their present incarnations. Both focus on facilitating the trading of ERC-20 tokens and ETH, both settle transactions onchain via smart contracts while managing orders offchain and both are confronted with the challenges of potentially slow transaction settlement and variable gas fees on the Ethereum network.

Source coinmetrics.io: Onchain volume comparison

Loopring’s UDOM model and ring based matching system is novel, potentially offering greater liquidity by having the capability of trading mismatched pairs, and smoother prices if relays are able to find the best exchange rates. It also has a model to prevent frontrunning a classic challenge with Ethereum DEX’s with dual authoring technology.

0x’s traditional trading system solution may currently be more digestible for DEX builders and traders, with asset pricing being more traditional and trading strategies more accessible. At this stage the market may feel more comfortable using 0x style DEX’s vs Loopring style solutions.

Notable Loopring partnerships include the integration of Loopring into Morpheus and Mytoken blockchain wallets. Loopring has also built in-house solutions trading such as Loopr and Circulr.

Loopring is designed to be blockchain agnostic, meaning its solution can integrate with non-Ethereum blockchains. Last year Loopring released Loopring NEO and the LRN token designed to finalize and run trading systems on the NEO network.

However, Loopring NEO had significant challenges delivering a workable NEO DEX solution. In a Reddit AMA, Loopring founder Daniel Wan explained that the "most outstanding issue with NEO platform is that the cost (gas assumption) of both deploying the protocol and settlement of even the most straightforward ring of two orders is too high; thus there is no way to put such a protocol into production."

In its 2019 roadmap, the Loopring foundation announced plans to launch ‘Loopring chain’ an application specific side-chain exclusively used for Loopring protocol orders.The Loopring Chain will be an Ethereum compatible, public side-chain, and will allow ERC-20 tokens to be exchanged between the two chains 1:1, without trust. So rather than use the NEO network to support cross chain payments, Loopring will build its own chain that interacts with the Loopring built on Ethereum, and LRN will act as the payment, utility and governance token of this new chain. Loopring Chain will be application specific used solely for Loopring protocol orders.

For some, the active steps Loopring is taking to create value and utility for its network’s native tokens may be a breath of fresh air, and a sign that LRC and the Loopring protocol have a team behind the project willing to learn from bear market lessons. For others, though, there may be a feeling of scope creep given how drastically the Loopring foundation has redefined the value proposition of the core LRC token, and the announcements of plans to build a new public sidechain for the project.

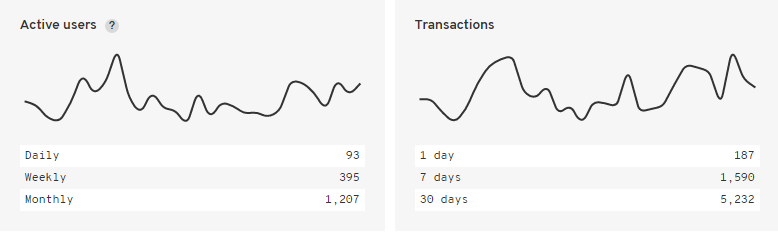

StateoftheDapps currently lists Loopring as the 109th most popular Ethereum Dapp, with ~40 users a day based on the number of monthly users. By comparison, the most popular Ethereum decentralized trading Dapp IDEX, averages over 450 users a day. IDEX has also had 50 times as many transactions as Loopring in the last month.

Onchain metrics

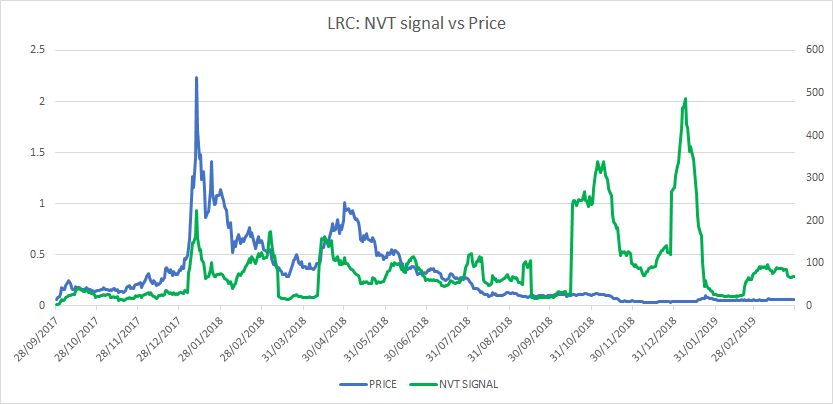

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin.

Crypto markets are prone to bubbles of speculative purchasing, not backed up by underlying network performance and activity.

The NVT signal provides some insight into at what stage of this price cycle a token may be.

A high NVT signal is indicative of a network that is going through one of these bubble periods, and may move towards a position of becoming overbought/overvalued, because of the market’s speculative assessments running out of steam.

There has been a sharp drop in the NVT signal of LRC following the launch of Loopring 2.0 in December 2018. This suggests some pick up in Onchain activity against the token following the redefinition of the LRC’s utility and potentially some accumulation effects because of the new incentives to hold LRC long term.

It is difficult to determine a bullish target for NVT signal because of the recent protocol change. NVT signal currently sits at ~70 points, while the 90 day low was ~20 points, any approach towards the 90 day low may signal a pick up in demand for LRC utility and an upcoming period of price bullishness.

PMR Signal

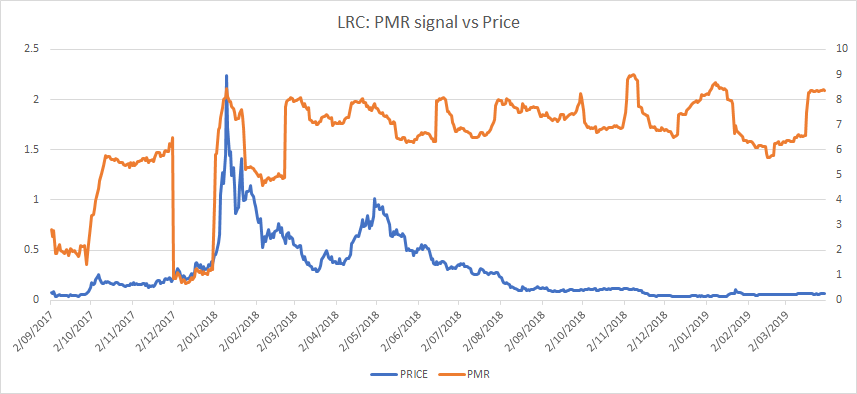

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin, and by comparing it to price, can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to implement versus onchain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

This makes it a relatively transparent metric as compared to onchain volume.

Since early 2018, LRC Metcalfe’s law value have been extremely low compared to token value (PMR). Currently, there are generally less than 200 active LRC addresses every day. This suggests that Loopring remains an immature product with very little traction or interest in its core solution from the wider crypto ecosystem. The Loopring foundation will hope this eventually changes with the new transaction fee model and incentive system.

As such, active addresses/network effect appears to have very little impact on the value of LRC.

This suggests that most token holders are purchasing LRC as a speculative bet on future relevance, essentially buying at today’s prices as a call option on what they believe the Loopring protocol will be in the future. The recent uptick in price may be based on positive market signals being sent by recent Loopring protocol updates.

However, for gains to be consolidated, the network will actually have to be used at a viable level at some point, and more than a few 100 users will have to start to use Loopring DEX’s/wallets.

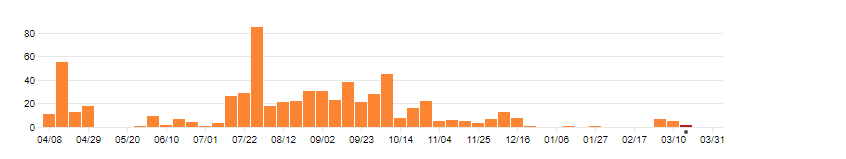

Turning to developer activity, Loopring has 49 repos on GitHub with core backend activity occurring on repos focused on Loopring protocol implementation on Ethereum, and core frontend activity occurring in a javascript library.

Most coins use Github as their open development platform, where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Loopring’s core Ethereum repo has been archived (made read-only), along with the Javascript Repo. The Loopring protocol Medium account is the best source for insights on ongoing developer activity and a recent update from the Loopring Foundation has stated that the Loopring core dev team is driving forward the building of Loopring 3.0 with a design doc soon to be released. Loopring 3.0 dev activity is not currently viewable on Github and an open source repo may be released in the future.

Source: Github

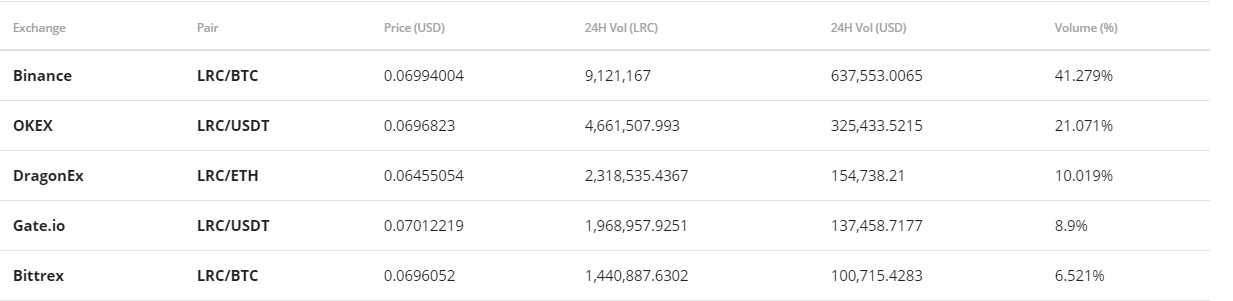

Exchanges and trading pairs

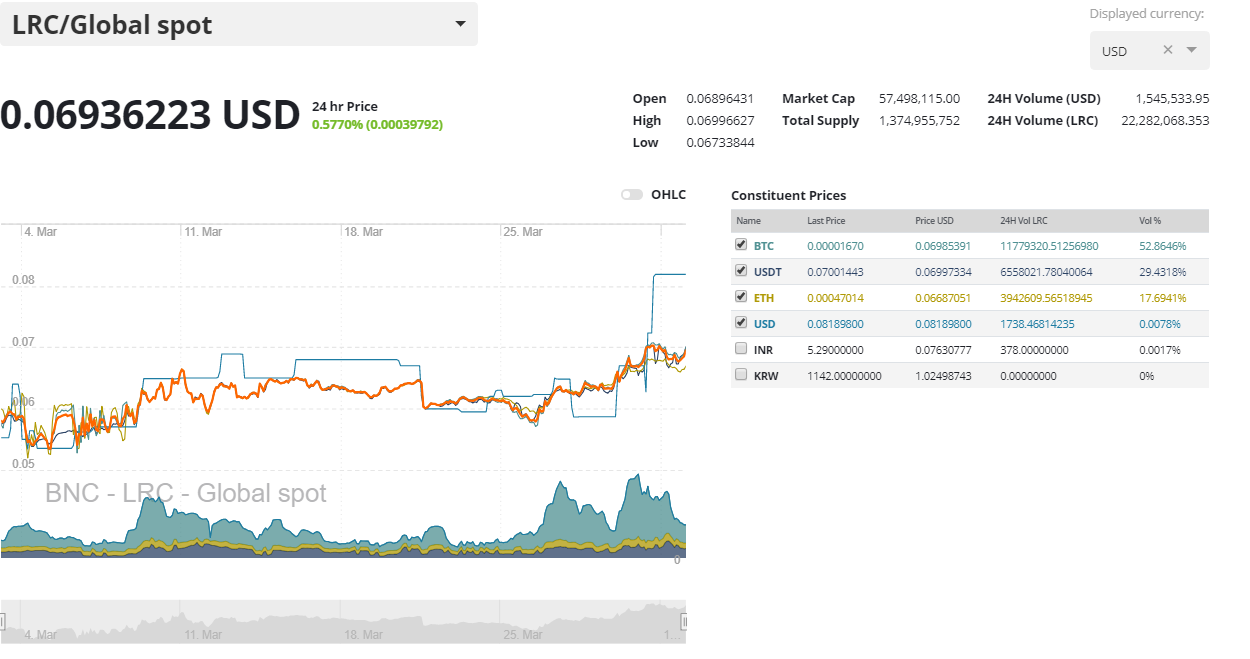

The most popular trading option for LRC is BTC, handling over 50% of daily trading volume. The second and third most popular markets are LRC/USDT and LRC/ETH pairs and together the three pairs make up over 99% of daily trading volume. The USD value of daily volume of the entire KCS market is ~ USD 1.5 million.

The most popular platform to trade LRC is the Binance exchange. With the LRC/BTC market on Binance being by far the most liquid trading option for LRC. LRC is also available for trading on notable crypto exchanges like Bittrex and Bitfinex.

Technical analysis

Moving Averages and Price Momentum

On the 1D chart, LRC has followed a negative linear price trend with a Pearson’s R correlation between time and price of ~0.83 since 2018 (not shown), which has resulted in a death cross since late-June. However, since mid-January 2019, price has since come to life, and begun trending upward; currently sitting near $0.069.

Also, on the 4H chart, LRC’s recent momentum has produced a golden cross with price currently sitting above the 50 period EMA.

Additionally, on the 1D chart, the 30 day TRIX and volume flow indicator (VFI) are both above 0 and trending higher, respectively. This positive price momentum is further corroborated on the faster time frames (not shown), e.g. 1 hour and 4 hour charts, which means the upward price trajectory is likely to continue in the near term.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals is mixed; price is in the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is above price and in the Cloud.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price is currently attempting a Kumo breakout with Cloud resistance, Senkou B, $0.075, being the last hurdle to complete the breakout. Price has failed to breach this level twice already, which poses a short term risk to LRC; especially considering RSI is touching overbought territory. However, as mentioned above, if price’s short term momentum persists, LRC is likely to complete a Kumo breakout in the near term, which would result in price targets of $0.08 and $0.086. Alternatively, if momentum breaks down, the price is likely to falter during this breakout attempt, and support levels of $0.063, $0.06, and $0.056 come into play.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is mixed; price is in the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is above the price and below the Cloud.

The analysis using slower settings is almost identical.

Conclusion

The Loopring protocol has built a unique solution to classic decentralized exchange liquidity and order matching challenges that appears to have gained speculative traction, indicated by a sizable market cap and a recent pick-up in trading volume on mega exchange Binance. The Loopring 2.0 model has redefined the utility of the LRC and since the network update, the price of the token has performed strongly.

However, the protocol’s actual product is barely being used with both Dapp usage and active address activity scarce even when compared to other blockchain based DEX solutions. This suggests a precarious price position given a lack of any tangible present day fundamental activity.

The technical indicators for LRC show bullish momentum in the short term, but offer a hint of cautiousness over the same period given the Cloud resistance levels ahead, coupled with current RSI. Both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30), on the 1D chart, will await a Kumo breakout above $0.075 before entering a long position. Both trader’s price targets and support levels are $0.08 and $0.086, and $0.063, $0.06, and $0.056, respectively.

Don’t miss out – Find out more today