NEM Price Analysis: New blockchain set to launch in late 2019

The first half of 2019 has been a key transitional period for the NEM blockchain and the XEM token. The digital currency’s price gains over the last six months have coincided with a rework of the ecosystem’s inefficient governance structure and speculation surrounding a new underlying blockchain for XEM called Catapult, which is set to launch later this year.

NEM (XEM) is a cryptocurrency network with an original codebase that was launched in March 2015. It is a platform blockchain that uses the ‘proof-of-importance’ consensus algorithm to securely confirm transactions. NEM has a number of other unique blockchain features designed to help the project stand out against competitors such as Ethereum and EOS.

The networks native token, XEM, is used to pay for network transaction fees, for staking on key network governance decisions, and it has utility within the ecosystem for value transfers and payments. Since hitting an apparent bear market bottom on February 6th, the price of the token has bounced ~156% and is currently trading at ~USD.0.09. At present, NEM occupies the 20th position on Brave New Coin’s market cap table.

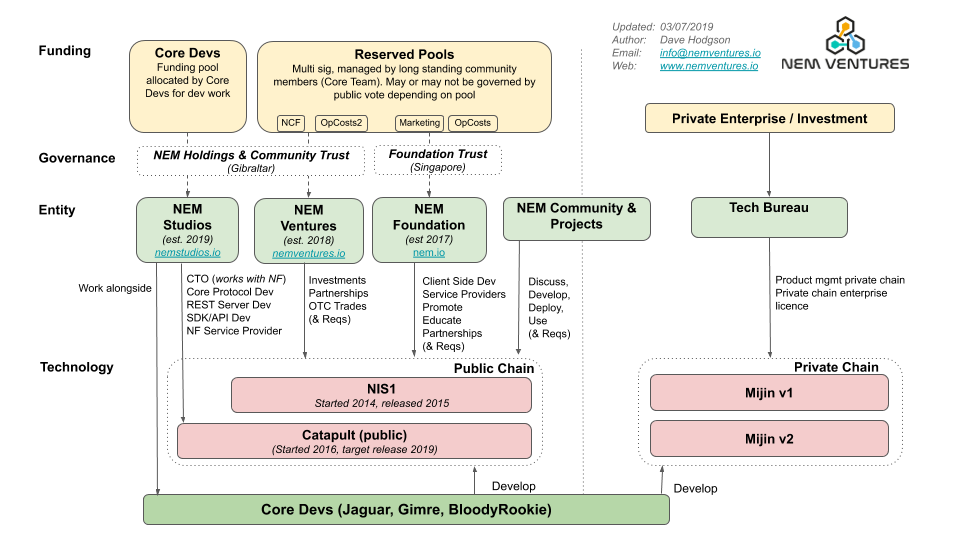

Mapping the NEM ecosystem

The complex NEM ecosystem includes more than a blockchain and development team. There are a number of different entities in the ecosystem, and there has occasionally been confusion about the different roles and responsibilities they have.

The above diagram gives a top-level overview of the key components of the NEM blockchain ecosystem. NIS1 refers to the current NEM public blockchain. This will soon be replaced by version 2, ‘Catapult’, which will add several new features and aim to improve the efficiency of the network.

Entities like the NEM Foundation, NEM Ventures, and NEM Studios support adoption and user growth (network effects) through funding new NEM-centric projects and setting up bounty program designed to ease the transition for Dapps to deploy on the network.

The NEM Foundation was created in 2016, ~2 years after the public chain was launched. It is funded by one of the reserved pools. It is a company limited by guarantee in Singapore. Its focus is on building NEM brand awareness, marketing, training, and partnerships.

NEM Ventures, a more recent addition to the ecosystem, was proposed in August 2018, mandated by the community in September 2018, and incorporated formally by December 2018 in Gibraltar. The entity is mandated by the community to improve the management of Community Funds. 300 million XEM was allocated to the fund during NEM’s ‘Nemesis’ (Genesis) block in 2015.

Previously, the NEM community fund were managed by a grant system run by volunteers, this has transitioned to a structured blockchain venture capital firm that operates much like a traditional VC partner.

The NEM Ventures fund currently contains ~276 million XEM, which equates to ~USD 25.6 million. The value of the fund is affected by the strong volatility of the XEM token, and the wider crypto asset market. To manage these fluctuations, USD 10 million worth of XEM is always maintained by the fund. Investments into new projects are made using XEM and fiat. Depending on the success of individual NEM venture investments, the program may extend the reach and adoption of the XEM ecosystem.

Recently funded projects include a ~USD 500,000 investment in Vimba in March 2019 and investments into ride sharing service Mobi and Ample, a machine-learning smart meter company aiming to reduce environmental footprint using blockchain and behavioural economics. Vimba is a financial services company based out of New Zealand that offers multiple products including a regular monthly crypto savings model that allows customers to automatically save fiat currency from a bank account and have the savings sent as cryptocurrency to their wallet.

Underlying the NEM Foundation and NEM Studios entities is the not-for-profit company, NEM Holdings.NEM Foundation is separate to this group structure.

NEM’s complex organizational structure has occasionally confused its community and even created concerns surrounding the transparency and state of the NEM treasury funds. On January 1st 2019, the NEM secretariat office released a public statement informing the community that the NEM Foundation was running low on both XEM and fiat funds following the challenging 2018 crypto winter. The NEM representative, describing the historic business operations of the foundation, stated,

“We saw efforts being duplicated, and inconsistent metrics of success. We saw very little accountability for funds and questionable ROI, leading to a burn rate of 9 million XEM per month. In terms of running an effective organization, the existing structure failed.”

The statement announced that the NEM Foundation would continue, but with a new senior management team who would make significant changes to operations.

The new NEM Foundation team promises more tangible investment returns for XEM holders, less extravagant XEM spending (burning) by the foundation, more transparency, and a greater focus on core goals like growing the enterprise adoption of NEM as a blockchain solution.

The statement endorsed the release of the NEM 2.0 blockchain, Catapult, as being a key catalyst for the reinvention of the NEM ecosystem. Catapult adds a number of new transaction and usability features designed to expand the relevance and market appeal of NEM.

Outside of external market-related price action, the NEM ecosystem has clearly gone through a period of internal governance related turmoil over the last 6-12 months. However, this appears to have been resolved. The newly structured NEM Foundation and the upcoming launch of Catapult does create positive fundamental market signals and may reinvigorate new buying pressure for XEM.

Underlying Blockchain solution

Since the announcement of the newly reorganized NEM Foundation on January 31st, the price of XEM has risen by ~100% suggesting bulls may be front running the release of Catapult and the new operational robustness of the NEM governance model.

The NEM code base is completely novel, written in Java. Catapult is written in C++, in addition there a SDK/APIs for numerous languages including JavaScript among others, there is also a REST API that can be used from any modern language

It uses an original consensus algorithm called proof-of-importance (PoI), which allocates block rewards to nodes based on stake, as well as the number and quality of transactions, and how long the stake has been vested for.

The genesis block of NEM generated all 9 billion tokens which will make up XEM’s entire possible total supply. XEM has never been ‘mined’, all rewards for creating blocks are earned through transaction fees. The nature of this reduced economic incentive means the NEM blockchain operates with a small faction of 486 ‘supernodes’. 3 million XEM is required to host a supernode

[

In order to become a ‘harvester’ (a NEM block producer), a user must accumulate an importance score. In order to be assigned an importance score, a NEM user must have at least 10,000 XEM vested in a NEM wallet.

XEM becomes ‘vested’ once it has spent a certain amount of time in a NEM wallet, this is dependent on the amount of NEM vested. Once the vesting point is hit, a user can start creating blocks. A one-time fee is paid to start up, with the blockchain setting limits for difficulty and rewards fluctuating around a 5% level.

While vesting makes up some portion of a node’s importance score, another influential factor is transaction activity. At a reducing rate, users are given greater importance based on how often they send XEM between unique accounts.

_NEM current network statistics, source: stakingrewards.com. These numbers suggest the 10,000 minimum stake required to operate a NEM delegated harvesting earns ~420 XEM yearly, equivalent to ~$39. Stakingrewards, based on ROI, stability, and frequency, rates NEM’s reward rate as ‘moderate’. _

The distribution to supernodes is roughly 300 XEM a day historically but tends to fluctuate within a bound of about 20-30 XEM each side. The amount paid out is calculated as 140,000 XEM/number of supernodes. The payments are completed on a daily basis.

The system proposes to have a number of advantages over traditional blockchain consensus models. Greater influence is given to users who have been long term participants and those who are actively using NEM. This is opposed to PoS, where influence is generally weighted towards the richest in the network. Proof-of-importance and node reputation is also complimented with the complex Eigen-trust protocol.

PoI is potentially gameable. For example, it is possible the importance score could be boosted by a potential discretely sending and receiving tokens to itself (different addresses) in an attempt to increase the chances of claiming future block rewards in the form of collected transaction fees or other subsidies. However, the NEM blockchain has shown historic resilience and NIS1 has not had any major failures.

Opportunities to game this system are sanctioned. An individual may control multiple accounts and continuously resend XEM between them but the NEM proof-of-importance score reduces with activity like transaction spamming and hoarding.

NEM Namespaces are like accounts and currently use a domain naming system similar to the internet’s centralized ICANN domain name system. Within Namespaces, there are higher level domains and subdomains, allowing one entity with one domain to create many different subdomains for different projects or outside business accounts. Smart Assets, similar to Ethereum’s ERC-20 protocol, allows users to create mosaics that can represent any asset. Mosaics are attached to the Namespaces that they are created and for example, a mosaic can go dead if the Namespace it is attached to does not renew itself.

There is a fee of 100 XEM to establish or renew (yearly) a Namespace for an account in NIS1. As part of Catapult, Namespace creators will be able to choose the renting duration of their Namespace. During the renting period, it will also be possible to extend the rental by sending another register transaction with the extra-confirmed block to rent the Namespace. Mosaics, now detached from Namespaces, have an independent expiration time. Catapult introduces the possibility to create mosaics that never expire, which is not possible in NIS1.

Despite the apparent scaling and cost advantages of other consensus models, Ethereum, a proof-of-work based network, leads other platform blockchains in terms of the number of active addresses. Source: Coinmetrics.io

Catapulting over new fences

Catapult is a yet to be publicly released version of the NEM blockchain engine. It is designed to power the token creation and smart contract requirements for both public and private networks. The protocol will become the new core of the NEM ecosystem and has a number of unique and ambitious features.

New features that will be added to the NEM blockchain as part of the Catapult release include; an aggregated transaction model that will power decentralized swaps and multi-asset escrowed transactions, and a new multi-level, nested multi-signature account model (“AND/OR” logic added to multi-signature accounts) which has potential utility for fraud detection and account recovery.

NEM is often characterized as a blockchain for ‘enterprise’. Catapult is designed to support multiple layers and businesses dealing with NEM by not forcing them to deal with a potentially foreign blockchain layer.

NEM’s blockchain can be accessed by clients using a powerful API interface. This is designed to provide an output that can be used with any programming language, not a specific ‘smart contract’ language. NEM’s API layer and software developer kit is designed to allow developers to build more easily on top of NEM as compared to other platform blockchains.

In late June 2019, a new ecosystem entity NEM Studios was created as a dedicated strategy and back end development unit to support the ongoing development of Catapult, in preparation for its release later this year.

The NEM ecosystem’s use of NEM Ventures and NEM Studios to aggressively pursue and develop external projects is in contrast to the more ‘open source’, ‘build it and they will come’ philosophy of most other open-source blockchains. The strategy is likely designed to help bootstrap the initial growth and adoption of Catapult by enterprises.

Objective on-chain indicators

NVT Signal

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitry Kalichkin.

Crypto markets are prone to bubbles of speculative purchasing that don’t reflect underlying network fundamentals. The NVT signal (or 90 day adjusted NVT) provides insight into what stage of this price cycle a token may be at.

A high NVT signal is indicative of a network that is going through one of these bubble periods and may move towards a position of becoming overbought/overvalued, as the market’s speculative momentum slows. Note that these assessments are made based on NIS1 data and on-chain patterns are likely to recalibrate following the launch of Catapult.

Short term fundamental indicators given by XEM’s NVT signal lean bullish. At the end of 2018, there was a sharp drop in NVTS from around 420 points to around 70 points, which suggested that the token had run out of speculative fuel to create new buying pressure and was readjusting from a point of being overvalued. The drop coincided with a period of stagnating price activity.

Since May 2019 however, XEM’s NVTS has begun steadily rising along with price suggesting that there has been a trend reversal and a new bubble of speculative buying pressure may be building. XEM’s NVTS currently sits at ~110 points suggesting that there is plenty of room for price and NVTS to grow in the short term before hitting a point of becoming overvalued again.

Factors behind the recent rise in on-chain volume activity may be due to increased interest to trial NIS before the switch to Catapult later in 2019.

PMR

Metcalfe’s law is a measure of the connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

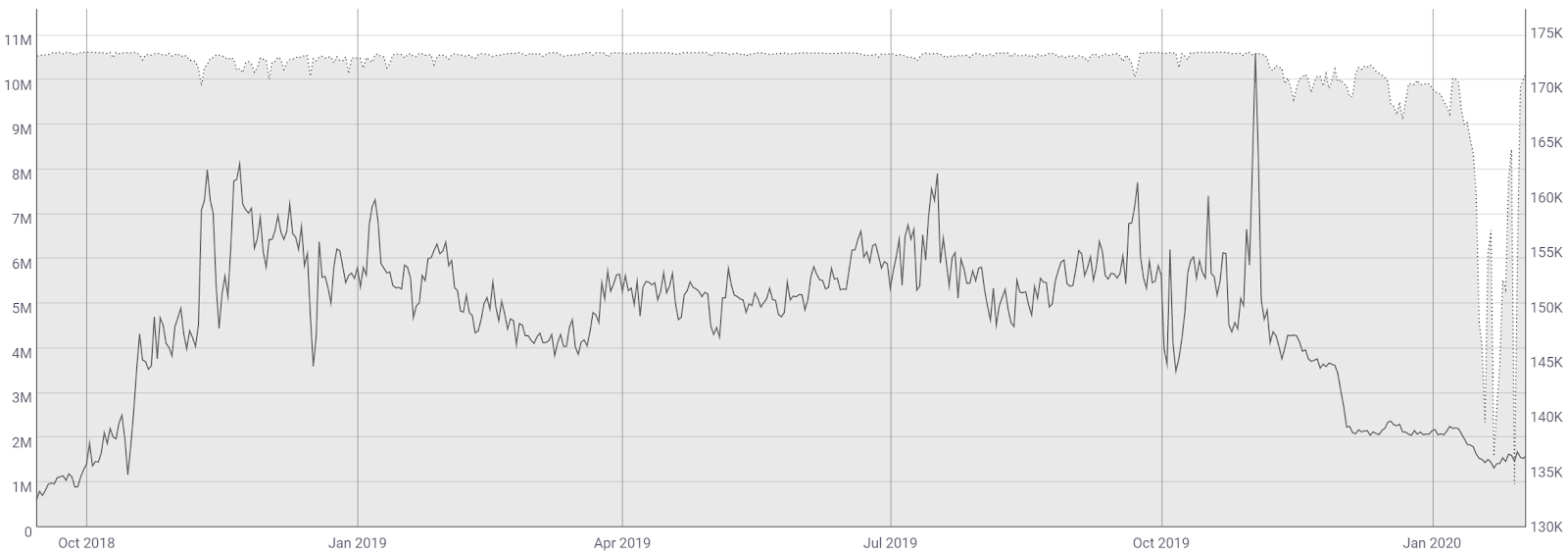

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

Like NVTS, short term signals sent by XEM’s PMR lean bullish. There has been a sharp fall in the network’s PMR beginning around late 2017, meaning there has been a sharp rise in active addresses versus the market value (market cap) of XEM over the last 18 months or so. This may suggest that NEM is currently undervalued. However, issues with price discovery and noise within the active address metric mean this undervalued implication is not fully robust.

A cryptocurrency’s network effects increase when new users join and strengthen the network, making it more valuable for existing users. The most direct network effects are improved liquidity and utility. More daily active users can be indicative of a higher level of developer adoption to build projects on NEM (more places to spend XEM) and more counterparties willing to accept XEM for payments.

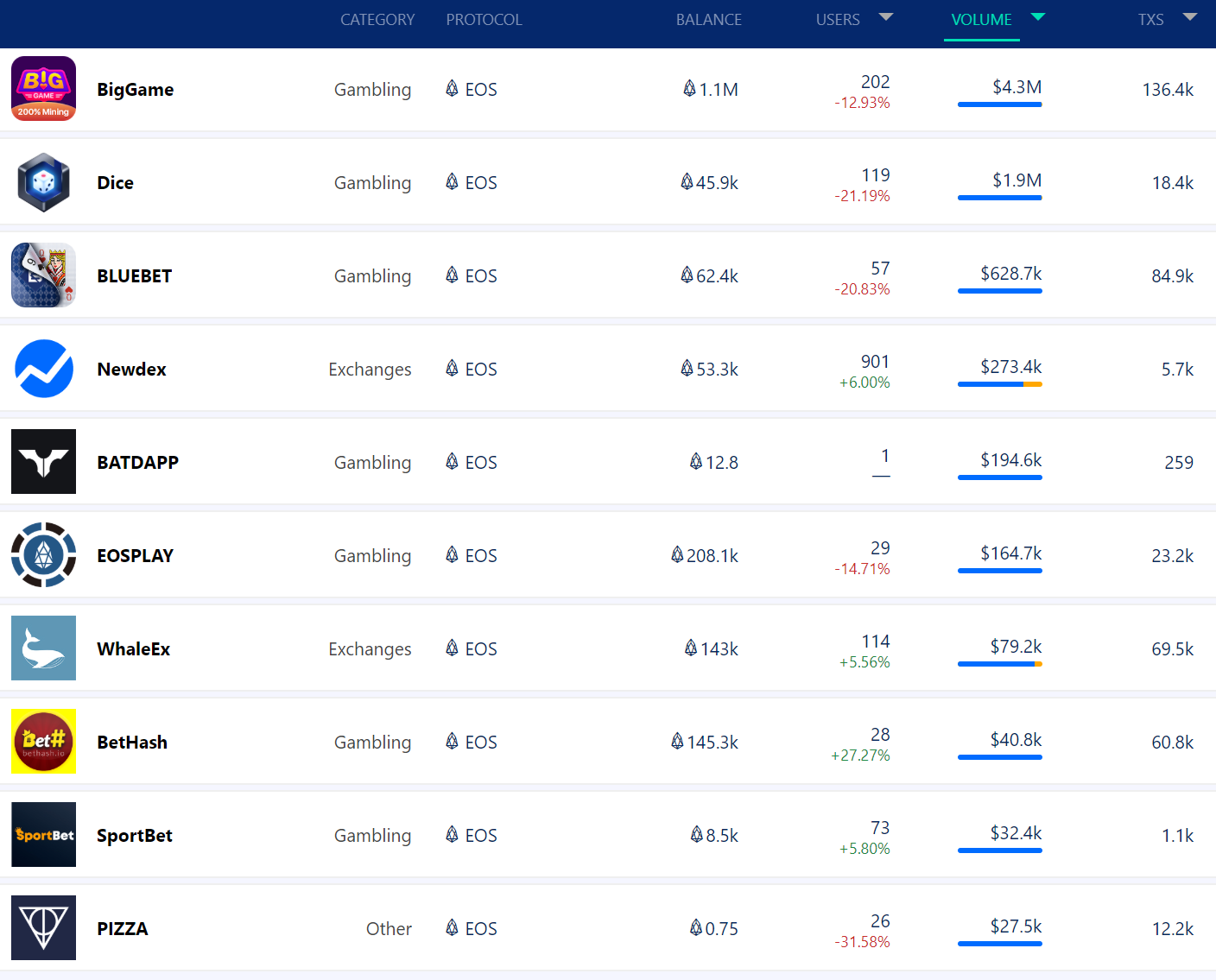

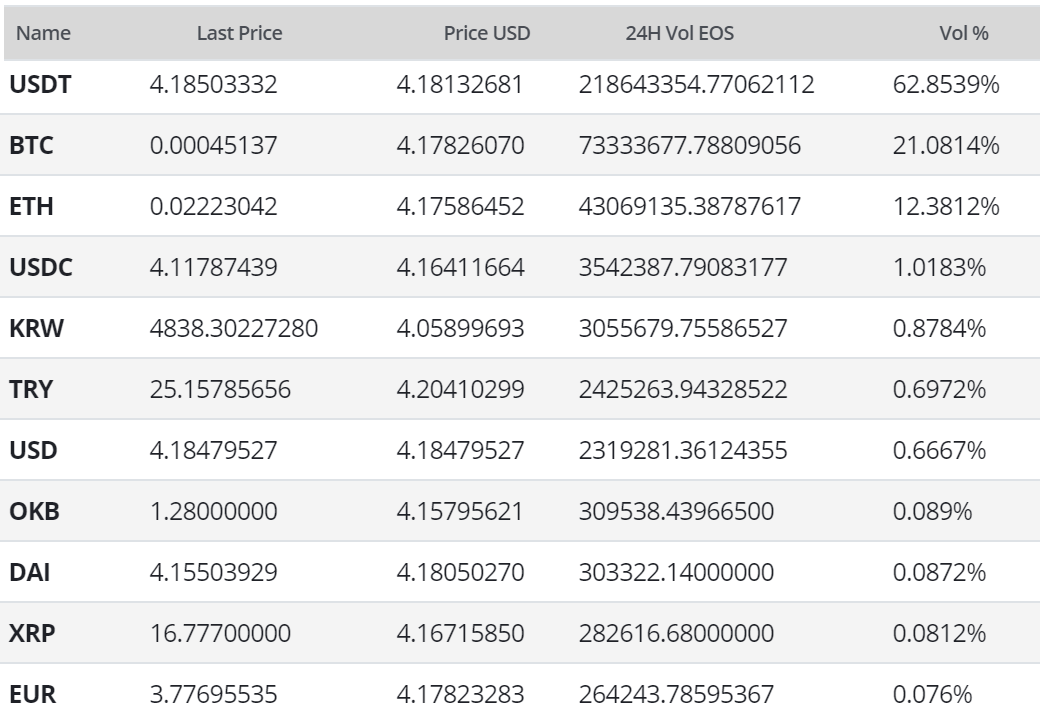

Exchanges and Trading Pairs

The most popular trading option for XEM is BTC with the pair currently handling over 31% of daily trading volumes. The second most popular market is the XEM/ETH pair. Together the top two pairs make up 59% of the daily trading volume. Fiat trading for XEM is most popular in between Japanese Yen and Korean Won pairs suggesting the token has strong liquidity for Asian traders.

The USD value of the daily volume of the entire XEM trading market is ~USD 18 million.

A mix of exchange dominate the XEM trading market places, with 5 different entities operating the top 5 XEM trading pairs. The XEM/ETH market on Kryptono is the most active market in the ecosystem. GRIN is also tradeable on high profile exchanges such as Binance and Bittrex.

Technical Analysis

Over the past month, XEM has been held within a tight consolidation pattern as other mid-cap alts have moved higher. A potential roadmap for upcoming price movements can be found using exponential moving averages (EMAs), volume (VPVR), Pitchforks (PFs), chart patterns, and Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

On the daily chart, the price found significant bullish momentum in mid June leading to a bullish 50-day EMA and 200-day EMA cross, ending a 455-day bear market. This Golden Cross suggests further bullish upside. The 200-day EMA at US$0.080 should now act as support. There are no active RSI or volume divergences currently.

Further, a bullish consolidation pattern, the flag, has formed suggestive of continuation. Hallmarks of this pattern include a fixed range with horizontal resistance and support. The pattern carries a 1.618 and measured move target of US$0.1317 and US$0.1640, respectively. If successful, this bullish flag should lead to an additional markup phase.

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the daily time frame, with doubled settings (20/60/120/30) for more accurate signals, are currently bullish; price is above the Cloud, the Cloud is bullish, the TK cross is bullish, and the Lagging Span is above Cloud and in price. Until May of this year, price had spent over 400 days below the Cloud, which is suggestive of a resounding end to the previous bear market. The current trend will continue to have a bullish bias so long as price remains above Cloud.

Lastly, on the daily XEM/BTC chart, price sits near a multi-year low with all trend indicators pointing to bearish continuation. Price is below the Cloud and both the 50-day and 200-day EMA. There are also no bullish divergences currently, which could suggest bearish exhaustion. Based on historic volume (horizontal bars), there is strong support at 400 sats and below. The trend is likely to remain bearish so long as price remains below the 200-day EMA and the Cloud.

Conclusion

2019 represents a watershed moment for the NEM blockchain and the XEM token. The start of the year heralded major changes to the ecosystem’s governance model and a new operational structure has been put in place. This is designed to correct previous mistakes and bottlenecks. The market appears to have responded well to these changes, and the XEM price gains suggest there may be renewed interest in the project from the crypto trading and investment space.

Much of this turnaround appears to be related to the release of a new underlying blockchain protocol for the ecosystem, Catapult. It is set to launch at some stage late in 2019 (no specific date has been set) and appears to address a number of flaws within NIS1, as well as adding new features such as aggregated transactions and multi-signature account capabilities. With a new, feature-rich, efficient blockchain protocol, NEM appears poised to remain a standout performer in the platform blockchain space.

Technicals for the XEM/USD pair suggest a nascent confirmed bull trend with an active bullish consolidation pattern. This consolidation should resolve over the next month leading to breakout toward the US$0.1317 to US$0.1640 range. Any additional upside in the near term will likely find significant resistance at the psychological level of US$0.20. Technicals for the XEM/BTC pair are heavily bearish with no suggestion of reversal. Buyers will likely return if price breaches below the 400 sat zone or above the 1000 sat zone, the former being more likely in the near term.

*Editorial Disclosure: Brave New Coin’s parent company, Techemy Limited holds a quantity of XEM tokens. *

Don’t miss out – Find out more today