Coins to watch in 2022: Polygon covers all sides of the blockchain scaling challenge

Polygon has emerged from a group of strong competitors to become the largest and most popular Ethereum scaling solution in the space. What's next for one of crypto's most exciting and well-funded projects as it expands its scaling solutions and grows its interoperability?

The Polygon (MATIC) network is a blockchain scalability platform that offers tools to improve the speed, costs, complexity, and interconnectedness of existing blockchain platforms. Polygon is currently focused addressing the limitations of the largest platform blockchain in the world, Ethereum (ETH).

When Ethereum is busy it becomes congested. This leads to issues like high transaction costs and delayed transaction time. The current cost of selling an NFT on Ethereum is ~US$50.50 and the cost of making a swap on Uniswap ~US$46.98. This high transaction cost means many potential users – particularly for lower value transactions – are priced out of Ethereum.

Polygon offers a variety of solutions to Ethereum Decentralized Application (Dapp) developers and users to circumvent these scaling issues.

Source: Polygon

MATIC is the native coin of the Polygon network. It is used for paying network gas fees. Network nodes need to stake MATIC to participate in the network’s Proof-Of-Stake style consensus models, and it is used for participating in protocol governance.

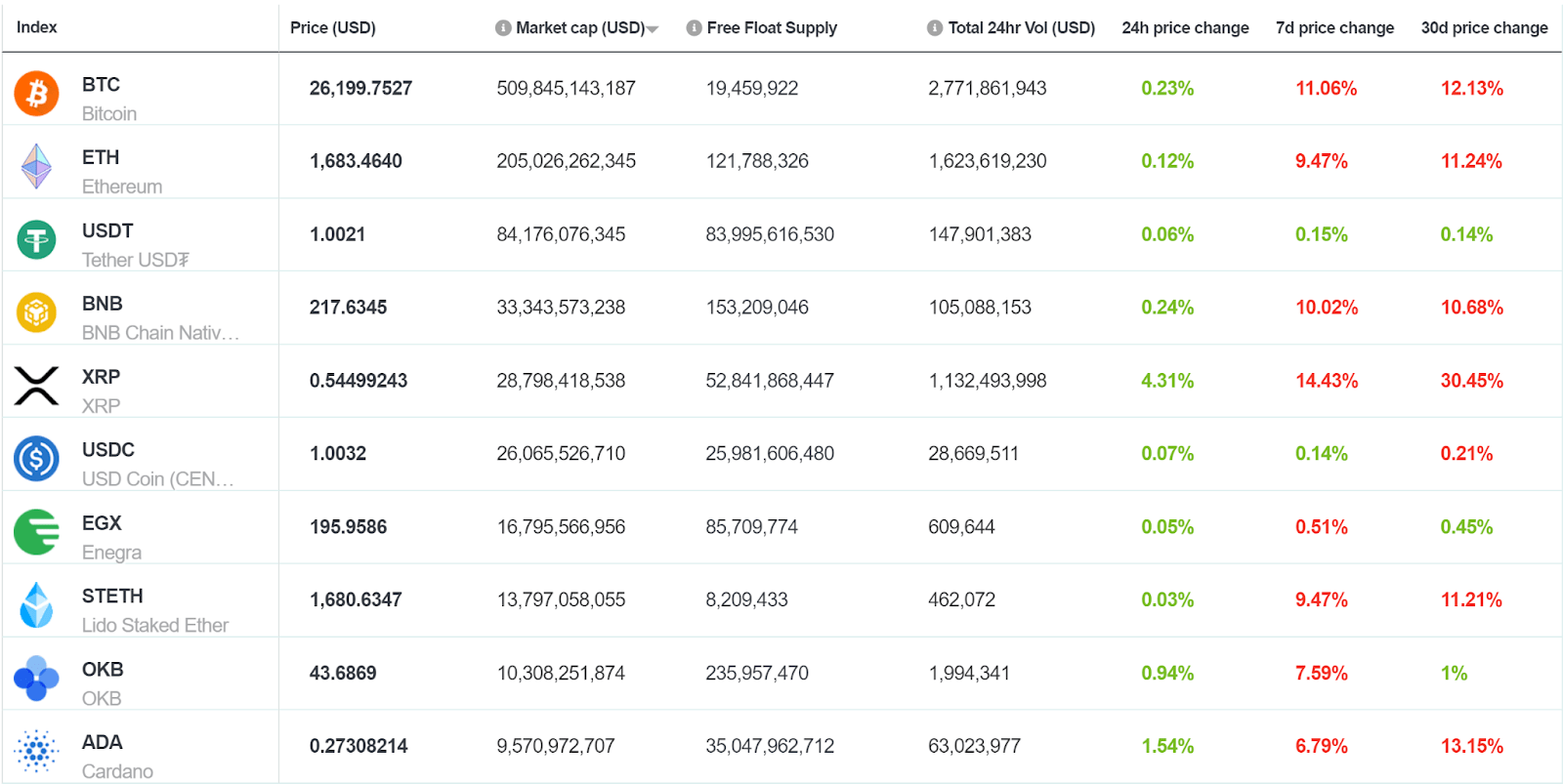

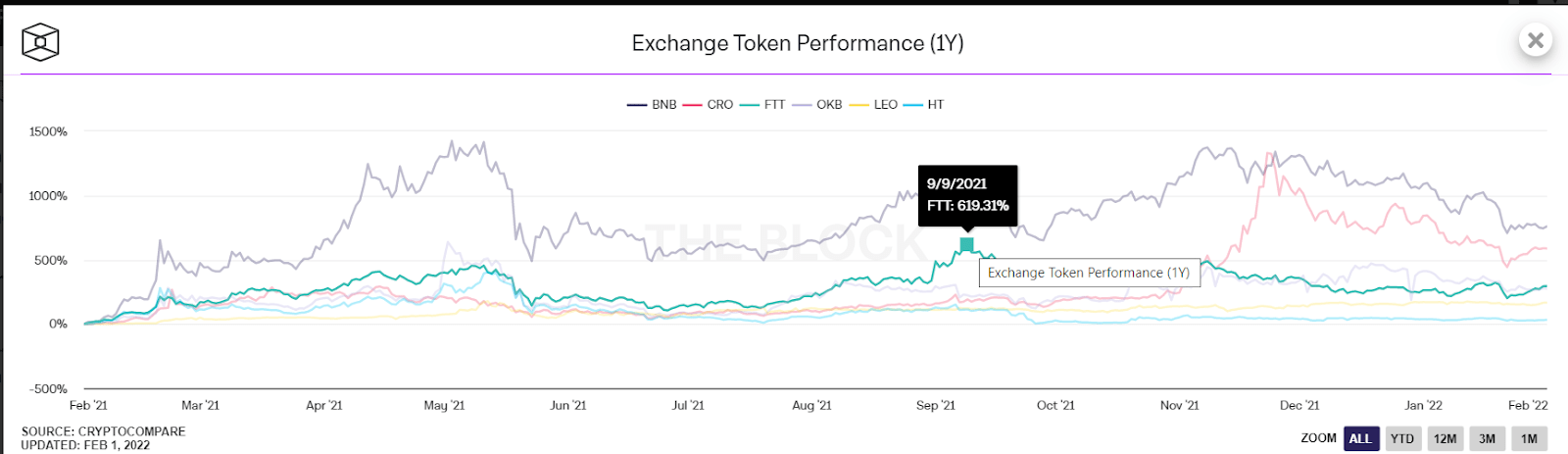

MATIC Price Surge Impresses

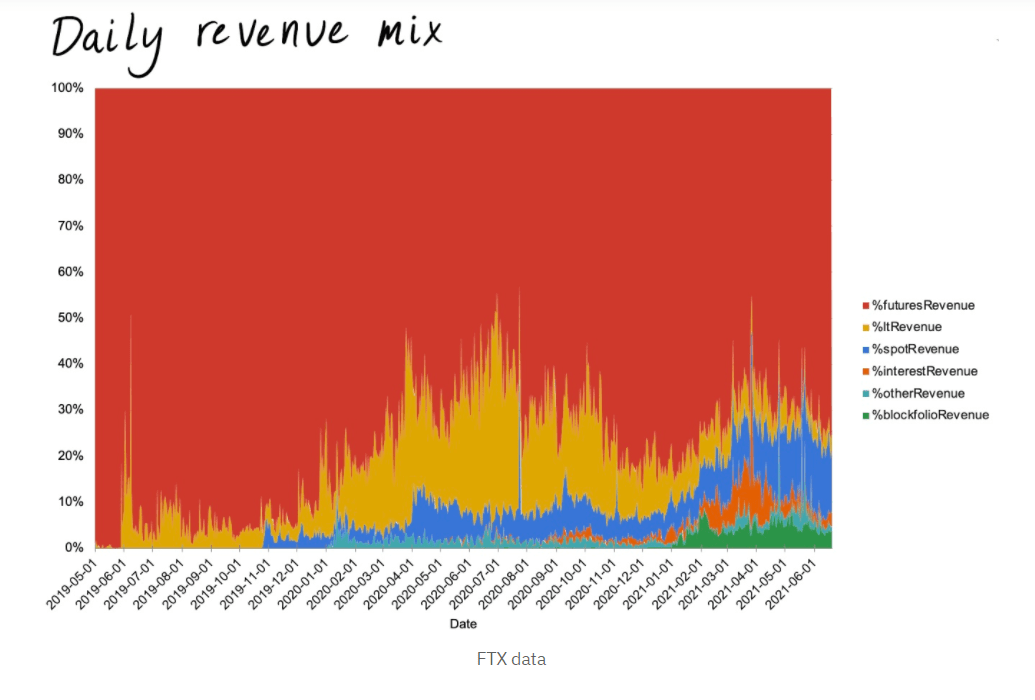

Since the beginning of 2021, the price of MATIC is up ~8371%. It currently trades for US$1.50. At the beginning of 2021, MATIC was the 113th largest asset in crypto and had a market capitalization of US$96 million. It is now the 17th largest asset in crypto and has a market cap of US$10.2 billion.

Source: Coingecko

MATIC market cap growth. Source: Footprint Analytics

The growth in value of MATIC has correlated with a boom in Ethereum’s Decentralized Finance, NFT, and Play-to-Earn gaming sectors. As Ethereum has become more popular, its fees have increased in parallel. The need for infrastructure solutions to support the network has become more pertinent and Polygon has stepped in to provide this support.

On its website, Polygon leverages how its developer experience is ‘equivalent’ to Ethereum and portrays its compatibility with ETH to be a key feature of the project.

Source:Polygon.technology

Since January 2021, the number of onchain transactions on Polygon’s Proof-of-Stake network has increased by ~7500%. From transactions being in the tens of thousands to presently sitting at 2.6 million a day. The number of transactions on the network maxed out in mid-June at 8.9 million a day.

Source: Polygonscan

The number of active addresses on Polygon has also increased significantly since the beginning of 2021. Polygon scan reports that at the start of January 2021 there were 127,048 addresses on the Polygon network and as of February 20th, 2022 there were 137.3 million.

Source: Polygonscan

Polygon: Origins and growth

Polygon was founded in India by Jayanti Kanani, Sandeep Naliwal, and Anurag Arjun. The trio have become India’s first crypto billionaires. Polygon was initially known as the Matic Network and began the project with a mission to address Ethereum’s scaling challenges through a technology called Plasma. Polygon has since expanded to cover a wider space of Ethereum layer-2 and off-chain transaction processing models.

In 2019, Polygon (Matic, at the time) announced that it had completed a seed funding round with Coinbase Ventures as the lead investor. In the same year, Polygon raised US$5.6 million as part of an Initial Exchange Offering (IEO) conducted on the Binance Exchange Platform.

In 2021, it was announced that Shark Tank investor and owner of the Dallas Mavericks, Mark Cuban, had invested in the Polygon network.

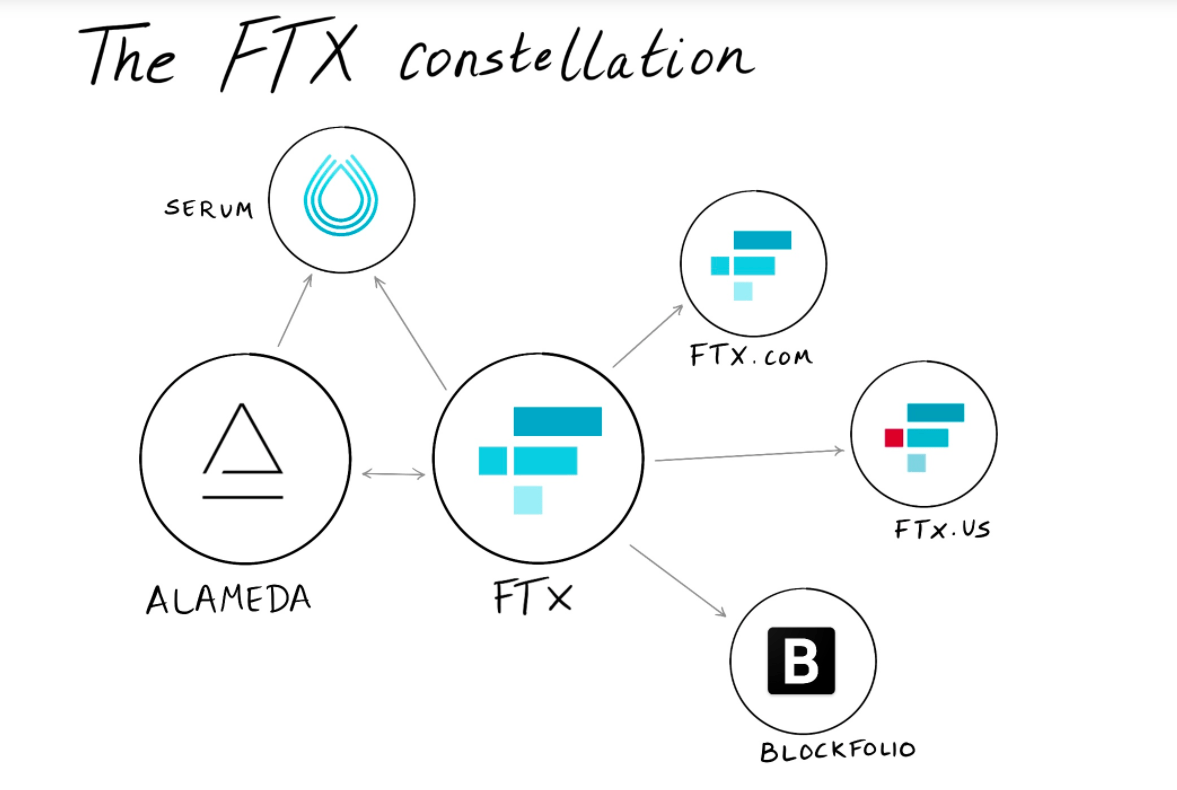

In 2022, the project raised US$450 million in its first major venture financing round. The round was led by the Indian branch of famed VC firm Sequoia Capital. Other participants included Softbank, Tiger Global, Galaxy Digital, Alameda Research, and Kevin O’Leary. The funds were raised through a private MATIC token sale.

The round was notable because it signaled many of these big-name VC firms had invested in an Ethereum scaling solution or a blockchain infrastructure play. Polygon will use the funds to expand its Ethereum scaling capabilities and use it to attract a larger developer ecosystem.

Some of the largest projects on Ethereum and on other EVM compatible chains now have Polygon versions. This includes Bluechip DeFi projects like Aave, Curve, Sushiswap, and Balancer. There is US$4.1 billion worth of assets locked into the Polygon according to Footprint Analytics.

Bluechip Ethereum Dapps like Aave, Curve, and Sushiswap dominate the Dapp market share on the Polygon network. Quickswap, a Uniswap fork built natively on Polygon stands out because it was not originally created as a Dapp on Ethereum, and is native to the Polygon network.

Source:Footprint Analytics

While Dex and token swapping platforms used to dominate the value on Polygon, assets locked into lending protocols have now become more prevalent.

Source: Footprint Analytics

How does Polygon work?

As an Ethereum layer-2 scaling solution Polygon utilizes sidechains and takes transactions off-chain to achieve speed & low costs while not sacrificing security. Layer-2 refers to any secondary framework or protocol built on top of an existing blockchain that adds features that generally improve the scaling capabilities of the base chain.

One of the key advantages of layer-2 solutions is that they don’t require any structural changes of the base layer chain. Polygon uses tools like smart contracts as communication tools to offload much of the processes that occur on the main Ethereum chain. This allows Ethereum to carry on normally and maintain its own development schedule, leaving the present-day scaling issues to Polygon.

Layer-2’s also leverages the security of the main chain periodically to maintain their security. Theoretically, they offer a best of both worlds solution.

The Polygon ecosystem is broken down into four layers. The first layer is the Ethereum layer which contains a set of smart contracts that enable communication between Polygon and the Ethereum chain. The smart contracts indeed handle things like transaction finality (checkpoints) and staking.

The next layer is a security layer that offers a “validator-as-a-service” role that allows chains connected to MATIC to benefit from leasable security.

The third layer is the Polygon networks layer, which is where the various blockchains connected to Polygon live. An example of one of these blockchains is Polygon PoS. The final layer is the execution layer, which holds Polygon’s Ethereum Virtual Machine (EVM) implementation that is used for executing smart contracts.

Polygon’s core technology to support the protocol is a plasma framework and a decentralized Proof-of-Stake consensus model.

The core of the current Polygon ecosystem is the Polygon Proof-of-Stake (PoS) sidechain (sometimes called a commit chain). The data referenced earlier in terms of Polygon’s unique address activity and transaction activity is sourced from the Polygon Proof-of-Stake chain.

The Proof-of-Stake model used by Polygon is inherently more scalable and allows for faster throughput than the Proof-of-Work model used by Ethereum. The Polygon PoS supports faster and cheaper transactions for the Ethereum main chain by running a parallel sidechain, with its own consensus model and token, which periodically checks in with the base chain for security purposes.

The Polygon (PoS) requires a set of validators to operate and secure the network. On Proof-of-work networks miners process transactions that are broadcast to the network by users. On Proof-of-Stake networks “validators” carry out a similar function and generally have a few other hats to wear.

Polygon PoS validators run full nodes, participate and authorize transactions, and commit checkpoints to the main chain. Large Ethereum development house Consensys uses a parent/child metaphor to describe the checkpoint model. “The checkpoints are similar to a puppy tromping out into the world, smelling things, nibbling on grass or playing with new friends. But the puppy will always, at some point, need to check back with its mother either for reassurance or sustenance.”

Layer 2 generally operates separately from the mainnet, conducting its own activity and generating its own network data. It does, however, have to regularly check back with the mainnet and reconcile data for security purposes.

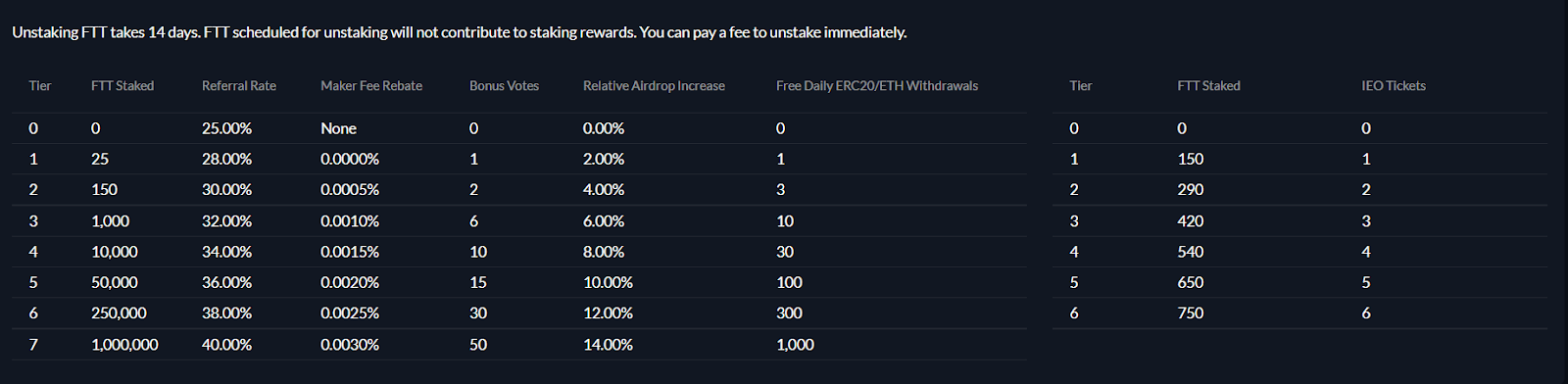

To become a validator, a user needs to stake MATIC tokens with a staking contract that sits on the Ethereum chain. Rewards are distributed to all MATIC stakers proportional to the size of their stake to the Polygon POS chain.

A validator can get slashed and lose all of their committed stake if they commit a malicious act like a double spend.

Stakingrewards.com assesses Polygon PoS to be the 10th largest Proof-of-Stake chain in crypto. The total amount staked on the Polygon is US$3.9 billion but only 35% of MATIC is committed to staking.

MATIC holders can delegate their tokens to a staking pool that will, for a fee, participate in the network’s proof-of-stake consensus on behalf of the delegator. Or they can run a node themselves and directly participate in consensus. Stakingrewards.com describes the complexity of delegating MATIC to a staking pool as ‘easy’. It assesses the complexity of running your own node as ‘very hard’.

The current reward for delegators is ~2.96% and the reward rate for Validators is ~3.21%. Almost 99% of validators are delegators as opposed to stakers. Both delegators and stakers are required to lock up their tokens for 21 days.

The future of Polygon

While the Polygon PoS currently dominates the activity of the Polygon ecosystem, there is a long-term goal to create an ecosystem of blockchain that can seamlessly interact. Much like the vision of projects like Cosmos, Polygon wants to build an interoperable network of decentralized applications (dApps) facilitated by hubs and which doesn’t have to go through intermediaries or processes like wrapping.

Polygon’s layer-2 modeling means that this interoperable ecosystem can perhaps be built with the trifecta of low fees, throughput maintained at scale, and security.

Beyond the Polygon PoS chain, Polygon has already launched Polygon Hermez, a ZK-rollup enabled solution. ZK-rollups are a privacy-enabled alternative scaling solution that utilizes Zero-Knowledge Proof. ZK-rollup chains bundle up large numbers of transactions off-chain into single verifiable transactions which are then recorded on the Ethereum main chain.

Other chains core to the network:

- Plasma chains – These chains make use of a scaling technology known as Plasma to move assets between Child chains and Root chains via Plasma bridges. Users can currently move assets between Ethereum and Polygon blockchains using Plasma bridges.

- Optimistic Rollups – This is another form of layer 2 that connects with the Ethereum base chain through an alternative focused on fraud-proofs.

Polygon appears to be hedging its bets on what will be the eventual winning layer-2 scaling solution. Some models sacrifice decentralization for simplicity and network effects, others favour complexity to maintain decentralization. In the end, however, the Polygon model of utilizing a number of different layer 2 solutions means it can adapt to markets and always offer users the best option.

As an Ethereum layer 2 solution first, Polygon’s shared security model with Ethereum means it is theoretically more secure than other major interoperability projects like Polkadot and Cosmos. Polygon always has a watchful parent, Ethereum, to check in with.

Polygon Dapp ecosystem

According to Polygon.technology, there are over 7000 Dapps live on Polygon. Dappradar reports that Play-to-Earn (P2E) gaming Dapps Crazy Defense Horses and Pegaxy are the most popular Dapps on Polygon by the number of daily users. Quickswap is the most popular dApp on the platform by daily trading volume.

DefiLlama reports that Polygon is the 8th largest platform blockchain in Crypto. Borrowing and lending protocol, Aave, dominates the TVL on Polygon accounting for 31.74% of the assets on the platform.

The TVL on Polygon currently sits at US$3.96 billion. The TVL on Polygon maxed out in mid-June-2021 when it reached US$10.94 billion. Since August 2021, the TVL on Polygon has marginally fallen.

Layer-2 challenges

There is an elephant in the room with all layer-2 solutions which is what happens if or when the base chain implements upgrades that fix the issues the layer-2 solution has been built to address.

In Polygon’s case, Ethereum is currently in the midst of implementing its overarching Eth2 upgrade. Eth2 will involve the transition of the existing Eth1 blockchain to a new network that utilizes Proof-of-Stake.

Proof-of-Stake separates itself from Proof-of-Work because it does not only use processing power to secure the network. With Proof-of-Stake, block producers are selected based on how much crypto they have staked and how long they have staked for. The need for processing power is replaced with a commitment to the network.

Since PoS uses much less power than PoW it scales much more easily. With more users, it does not need to slow down or become more expensive. This means throughput on the network can be maintained during periods of network growth and transactions should not get more expensive or slower.

So how do layer-2 solutions fit into a future where Ethereum is Proof-of-Stake? This very question was asked on the r/Ethereum Reddit forum a year ago and Matt Finestone, the former head of Business and Operations at leading Ethereum layer-2 Loopring, responded to it.

According to Finestone and other users, Eth2 and layer-2’s should be able to stack together, Finestone says Eth2 will be a ‘rocket booster’ for Loopring. The view from within the Ethereum community appears to be that layer-2’s offering even faster and cheaper transactions at scale than Eth2 is not a bad thing.

At the end of 2021, Polygon announced that it had been hacked in early December. The hacker stole 801,601 MATIC before the team was able fix the security breach. Polygon announced that the hack was connected to the Immunefi platform that Polygon was using to host an ongoing bug bounty program. Following the internal reveal of the hack, Polygon worked with the Immunefi to patch the compromise and upgrade 80% of the network without any stoppages occurring

A blog post explains that in the days following the upgrade “Polygon’s core team has carried out an extensive post mortem and identified a number of existing processes that can be improved as well as actions that will make the network and our community more resilient in the future.”

Blockchain interoperability and smart contract communication are both technology stacks that are prone to compromises. The importance of frequent audits and robust post mortems cannot be understated. Polygon has a strong history of providing this type of documentation.

Polygon is a large, professional, well-funded project and does not have many of the red flags of historically compromised DeFi protocols – like anonymous team members, for example. It is also backed by some of the largest mainstream VC firms in the world who are likely to set high development and security standards for the Polygon team.

These factors considered, hacks of large, well-funded crypto projects still happen. Wormhole, a well-funded blockchain bridging project lost more than US$300 million in an exploit this year. Wormhole had major backers in the space like Jump Trading & Alameda Research, and, a security audit that was conducted between July 2021 and September 2021. The audit did detect some vulnerabilities but noted that they “were resolved before the bridge went live.”

Jump Trading bailed out Wormhole following the hack and paid out of its own pocket to replace the funds lost during the hack. Jump explained why it conducted the bailout on Twitter, saying it believes in a multichain future and that “Wormhole is essential infrastructure.”

The Wormhole incident indicates that even with high-security standards exploits still happen in crypto, particularly in sectors with multiple separated moving parts like bridging protocols and cross-chain. Last month Vitalik Buterin, the founder of Ethereum explained on Reddit that he believes that the future will be multi-chain and not cross-chain. Buterin explained that this was because there are fundamentals to the security of bridges that hop across multiple “zones of sovereignty”.

Polygon’s interoperability visions will involve bridges with more Ethereum and EVM compatible chains, as such it is essential that it maintains very high security standards.

Conclusion

Polygon has emerged as a clear leader within the Ethereum layer-2 space. It has enjoyed staggering growth in transaction activity and users over the last year. The price of MATIC, the platform’s native token required for making payments on the network and staking, has skyrocketed over the same period. It has offered its backers the face-melting quadruple-digit percentage gains that crypto investors dream of capturing when they first back projects.

Polygon is clearly a project that has delivered on its initial promises. It is a fast, cheap, stable, EVM-compatible Ethereum alternative that comes with the added benefit of sharing security with Ethereum.

What will excite backers is Polygon’s plans for the future which include many more Polygon blockchains and interoperable ecosystem networks that will challenge the likes of Cosmos and Polkadot.

Don’t miss out – Find out more today