Report: Bitcoin in heavy accumulation

Deep into the bear markets of both 2012 and 2015, Adamant Capital published a Bitcoin report advising investors that bitcoin was undervalued with significant potential for price appreciation to come. Each report was issued when bitcoin was down more than 80% from all-time highs. Investors who bought bitcoin at the time of each report will have seen excellent returns.

Now, 16 months after the all-time-high of December 2017, the firm has issued a new report, Bitcoin in Heavy Accumulation. With Bitcoin now approximately 75% below its 2017 all-time-high, the report suggests the current bear market represents an "exceptional opportunity for value investors. During this accumulation phase, we expect for Bitcoin to trade in a range of $3,000 to $6,500, until the new bull market permanently cements the denarian cryptocurrency as a multi-trillion dollar asset class."

The report pulls together on-chain data, and technical and fundamental analysis, to generate two key takeaways — as a payment network, bitcoin is set to make “significant inroads” over the next five years, and as an investment vehicle, bitcoin is eventually set for a trillion dollar valuation.

Weak hands shaken out

Using Adamant Capital’s own metric of Bitcoin Unrealized Profit/Loss, based on the dollar value of every coin at the time it was last moved, the report concludes that globally, bitcoin investor portfolios are now sitting at an average of 14% unrealized profit — a number that corresponds with previous market cycle lows.

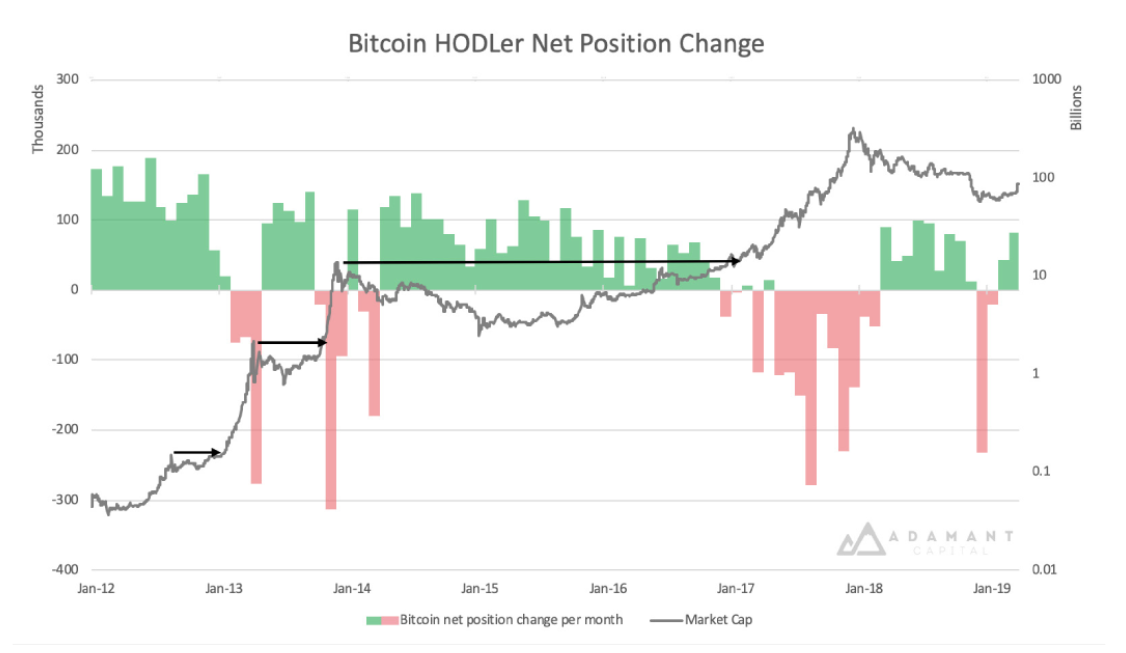

Weak hands, “who didn’t anticipate how long and brutal this bear market could become”, have now been shaken out of the market, according to Adamant Capital’s Tuur Demeester and Michiel Lescrauwaet, a verdict that is also backed by another of the firm’s metrics — HODLer Net Position Change. This measures on chain data to find the estimated monthly position change among long term bitcoin holders. Green bars represent bitcoin investors holding or increasing their position, and red bars representing investors selling:

The dip below $6k, which took place from November 14th-15th 2018, is singled out as the key moment that caused many investors or weak hands to capitulate and sell their holdings:

Dubbed ‘Bloody Wednesday’, this day also marked the lowest market sentiment — a sense of “disgust” in the market, with many traders expressing their frustration by insulting other investors on Crypto Twitter.

Meanwhile, general interest in bitcoin was lower than ever — with Google trends for the keyword “buying bitcoin” dropping to levels last seen in March 2017 when Bitcoin was trading below $1,500.

On the charts, technical factors also suggest this was a pivotal moment. The report compares the percentage drawdowns of previous bear markets, to find that after reaching its first major peak in 2011, bitcoin dropped 92 percent. Then in 2011, bitcoin dropped 85 percent, and finally, the peak of 2017 induced a drop to $3,100 — a similar total decline of 84 percent.

Catalysts of the next bull market

While bitcoin may be in the final stages of the bear market, Adamant capital’s report says the market could still dip back down to retest 2018’s lows to further digest the hundredfold run-up of 2015-2017.

There are several risk factors with the potential to cause, “negative demand shocks” — miner capitulation, regulatory threats, contentious hard forks, and even a macro economic downturn are all cited as, “credible catalysts for lower prices.”

But the focus of the report is on the fundamental factors expected to catalyse the next bull run. These are identified as financialization (increasing institutional interest), second layer scaling, and the increasing adoption by millenials, who have a more positive attitude to cryptocurrency than older generations.

In early April, bitcoin’s price increased almost 20 percent within 24 hours. Adamant suggests that institutions have already secured a sizable position pointing to the growth of the LedgerX Bitcoin Futures platform and the CME Bitcoin Futures product with new products and platforms in the pipeline. CME data shows that following the April breakout a majority of institutional asset managers are net long on $BTC for the first time since April 2018.

Institutions are credited with funding the development of the next wave of infrastructure. The report singles out Goldman Sachs for its investment in crypto custodian BitGo, TD Ameritrade for its backing of ErisX, Fidelity’s own digital custody platform, and ICE’s Bakkt.

This institutional involvement, combined with improvements like the Lightning Network, is expected to help push bitcoin to be realised more widely as a store of value:

“Bitcoin’s qualities of political neutrality, unparalleled security, globally accessible liquidity, and predictable financial policy are provably improving,” states the report. “As it matures, we expect for Bitcoin to disrupt the $100 trillion investment vertical of Liquid Store of Value, and become a globally used digital gold and reserve asset.”

You can download the report here.

Don’t miss out – Find out more today