RociFi’s $ROCI Token To Launch Sept 19th

RociFi is the first Onchain Credit Scoring Primitive allowing web3 users to monetize their onchain history via lower borrowing rates, higher loan-to-value ratios, or boosted token rewards based on their credit history in DeFi. The RociFi system is designed to be governed, decentralized, and maintained by the $ROCI token.

$ROCI Token Basics

Ticker: ROCI

Blockchain Network: Ethereum Mainnet

Token Supply: 1 billion

Venue: Fjord Foundry LBP

Date: September 19-21

$ROCI Utility

The $ROCI token is designed to encourage sustainable growth of the network while rewarding long-term stakeholders. Holders of $ROCI will derive three utilities:

- Staking for Data Node Operators

- RociFi’s decentralized credit oracle network will operate similarly to Chainlink whereby a decentralized cohort of Nodes push credit data onchain. Nodes will be required to stake collateral that will be slashed if they report incorrect data. Good Nodes will be rewarded with 100% of protocol revenue plus staking rewards from the Growth Mining program; paid out in $ROCI.

- At launch, Nodes will be required to lock their staked position for 12 months to promote continuity of the network as it grows. However, bad Nodes may be churned on an as needed basis. At launch, Nodes will be required to stake 1M $ROCI as collateral.

- Transaction Fees

- Protocols that query our Oracle API more than 100 times per month will be charged 100 $ROCI per each 100 calls afterwards. Users on blockchains with account abstraction that pay in other assets will have their proceeds swapped to $ROCI.

- When protocols call the borrow function in our Smart pools (see Litepaper), a small transaction fee is charged in the native gas token of the protocol blockchain which is used to buy and burn ROCI.

- Governance

- Users looking to vote in governance will need to stake $ROCI for veROCI, the voting token for the RociFi DAO; rewarding long term stakers with more voting power and reducing whale dominance.

- 1 veROCI for every 4 year lock of $ROCI

- 0.75 veROCI for every 3 year lock of $ROCI

- 0.50 veROCI for every 2 year lock of $ROCI

- 0.25 veROCI for every 1 year lock of $ROCI

- 0.02 veROCI for every 1 month lock of $ROCI

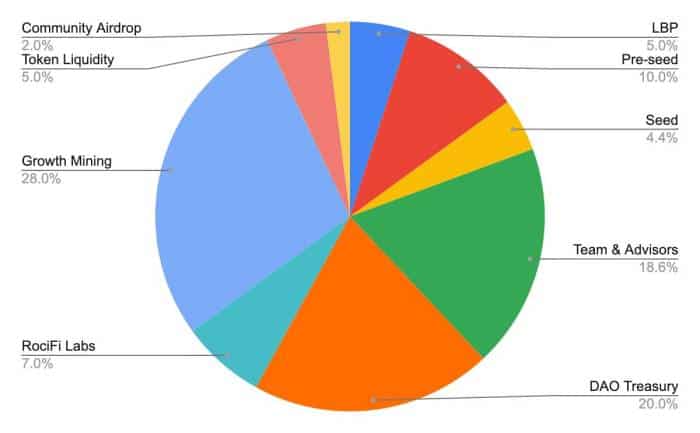

$ROCI Distribution

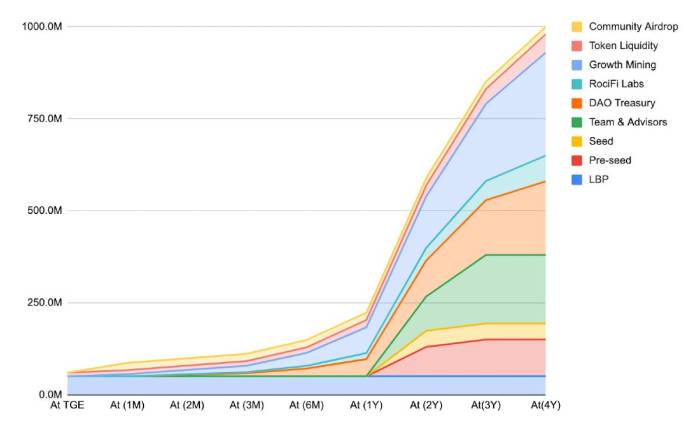

$ROCI Emission Schedule

$ROCI emissions are designed to be lower throughout Year 1 to promote growth of the network without overwhelming price with an abundance of supply. At token launch, 6% of total supply will be in circulation. At the end of Year 1, 22.32% of total supply will be in circulation.

Conclusion

The current DeFi space urgently requires a reliable and performant credit data network that allows Web3 users to monetize their onchain history via lower borrowing rates and higher loan-to-value ratios.

Learn More:

Liquidity Bootstrapping Pool:

https://fjordfoundry.com/pools/mainnet/0x641fa21e96860B494764Ed29C66dD189ACe75654

Linktree:https://linktr.ee/rocifi

Litepaper: https://blog.roci.fi/rocifi-2-0-litepaper-ddb8f6f6eb01

Don’t miss out – Find out more today