Stablecoin Regulations Inch Closer in the UK and U.S.

The Bank of England and the US House Financial Services Committee are considering new rules and regulations for stablecoins. Stablecoins offer the possibility of greater efficiency and functionality in payments, but currently sit outside a regulated framework.

The Bank of England has recently announced that it is considering imposing new limits and controls on stablecoins. They are consulting on new rules for the sector because of their utility for payment outside of traditional finance rails.

The day after the BoE made these statements, the US House Financial Services Committee unveiled a draft bill proposing its own framework for stablecoin regulators. There appear to be clear similarities between the two regulatory approaches, including proposing stricter practices for redemptions, no depositor insurance, and an emphasis on stablecoins that are ‘used for payments’.

The Deputy Governor of the BoE, Jon Cuncliffe, said in a speech on April 18th that stablecoins “offer the possibility of greater efficiency and functionality in payments.” He said despite this “they currently sit outside most of the regulated framework”. He said they most likely don’t fit under the standards for “robustness and uniformity” that the BoE currently applies both to commercial bank money and the existing payment systems that transfer commercial bank money between the parties to a transaction.

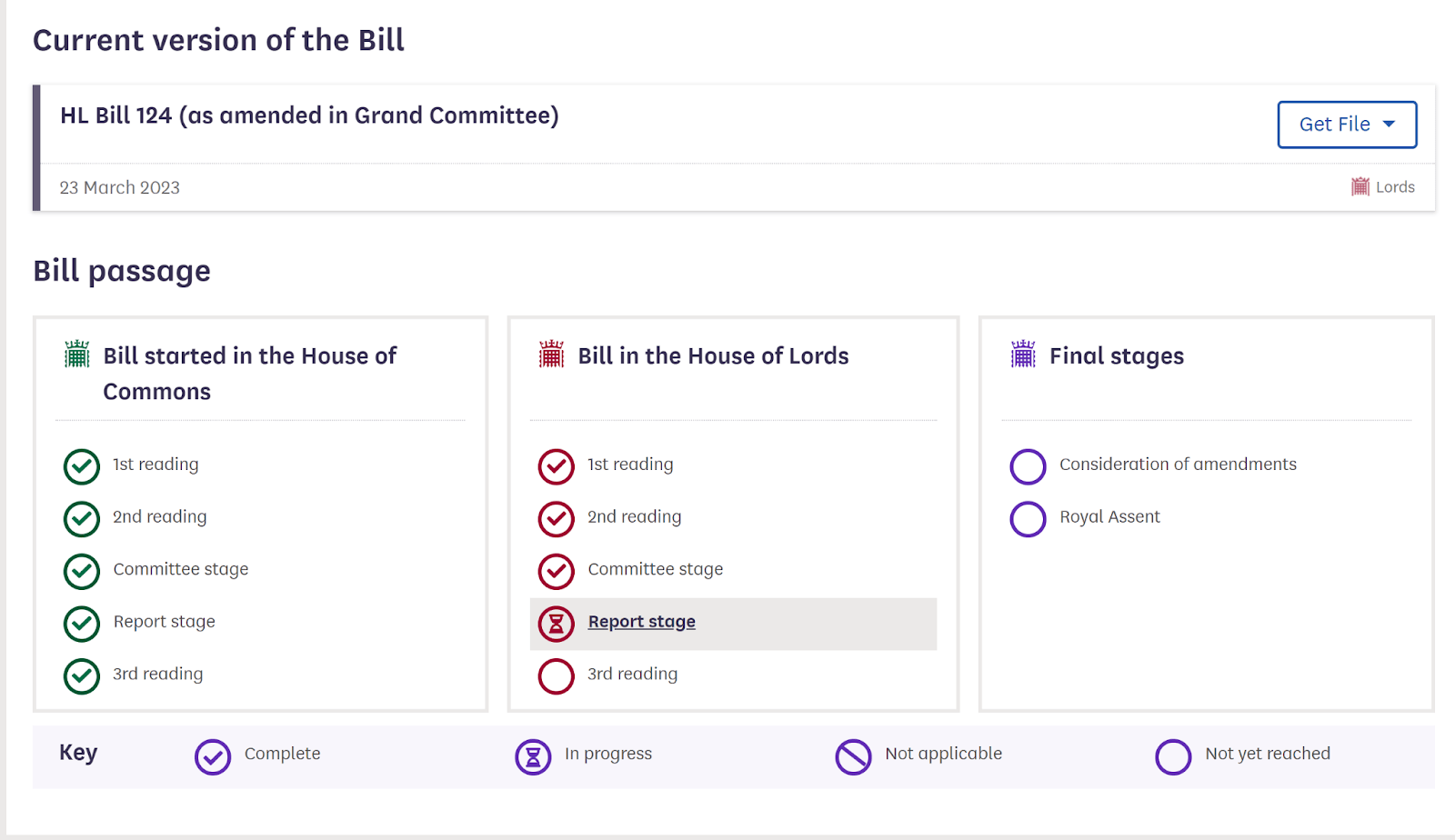

Cuncliffe mentioned the Financial Services and Markets Bill, a bill that gives the Bank of England powers to regulate operators’ systemic payment systems and systemic service providers using “digital settlement assets”, this likely includes stablecoins. It would also give the FCA powers to regulate the issuing and custody of fiat-referenced stablecoins for conduct and market integrity. The bill is moving along the various houses of the UK parliament and is close to being passed.

The current version of the bill

Source: https://bills.parliament.uk/bills/3326

In his speech, Cuncliffe explains that the expectation once the legislation passes will be that the BoE regulatory framework covering stablecoins will include the issuance of stablecoins that are used for payments, the systems for transferring these coins, and accessory supervision that covers elements like custody wallets used in stablecoin arrangements.

He also said there would be two expectations for stablecoins — that stablecoins should be regulated to standards equivalent to ones used in traditional payments. Secondly, stablecoins used for payments should meet the standards that are set for commercial bank money.

Brave New Coin discussed the UK’s new potential policy towards stablecoins with Joey Garcia, Director and Head of Public Affairs at Xapo Bank. He views the consultation as necessary. “It is important that both Virtual Asset Service Providers (VASPs), and the stablecoins and payments networks within this space, operate at a level that consumers and users can place trust in, and feel secure dealing with. It is not a question of trust in the technology, but in the operators, businesses, or intermediaries that give access to those networks, services, or assets,” he said.

Despite this, he says that trying to fit stablecoins into the existing payments infrastructure is not an adequate solution. “It is not correct in my view to simply bring these technologies, assets or services within existing or ‘traditional’ payments infrastructure, because they represent an entirely new form of technology and infrastructure, within entirely new rules and standards that can exist to manage risk.”

Garcia discussed the unique possibilities that exist to regulate the stablecoin payments space. “Zero-knowledge-based on-chain compliance as a concept is fascinating, but is it possible to introduce this to paper notes, or the SWIFT network? No. New rules, frameworks and standards need to be produced in consultation and dialogue with the experts in the field, and not simply by trying to migrate new technologies into legacy frameworks and standards.”

Zero-Knowledge compliance would involve the usage of Zero Knowledge Proofs. The system would involve a trusted third party validating personal information and then issuing cryptographic proof to users to a personal wallet, to meet the compliance requirements of regulators without giving up personal information or worrying about data leaks. As Garcia explains, technology can only be supported by blockchain-based stablecoins and not traditional payment currencies.

Garcia previously co-chaired the Gibraltar Government’s working group on Blockchain for three years – which had a novel approach to stablecoin regulation. The country introduced specific Distributed Ledger Technology legislation in 2018, becoming an early driver of a purpose-built regulatory framework for businesses using blockchain or DLT.

Garcia explained that Gibraltar’s position is that stablecoins that fall outside the scope of existing E-Money definitions, and would fall under the scope of the country’s VASP frameworks as a unit of value. He says that Gibraltar’s “principles based regime has allowed the framework to develop and evolve as the application and use of the technology adapts and evolves and it remains one of the strongest frameworks in the world.”

Blockchain businesses that have chosen to register in Gibraltar, likely because of the regulatory clarity, include —

- Xapo

- Bitso, the largest exchange in Central and Latin America

- Huobi, a large international exchange

- LMAX, one of the largest institutional crypto and FX platforms in the UK market

Stablecoins have also been a focal point for the US House Financial Services Committee. As mentioned earlier, the committee published a new draft of a potential Stablecoin bill. This bill, however, seems a little undercooked and may soon change.

On April 19th, Maxine Waters suggested lawmakers are “starting from scratch” after Republicans made changes to the aforementioned bill, the Stablecoin TRUST Act, which was almost completely dead last year.

In a quote shared with Brave New Coin, Jackson Mueller, Director of Policy and Government Relations at Securrency, also suggests the bill needs some work. “If there’s one overarching takeaway from the draft stablecoin legislation published by the House Financial Services Committee a few days ago, it’s that this bill is still, very much so, a work in progress,” Mueller told BNC.

The bill creates a specific definition for ‘payment stablecoin issuers’ referring to companies behind any stablecoin that’s used specifically for payments and settlements. The issuers themselves must be a state or federally licensed entity, and can only be insured by insured depository institutions or an approved non-bank entity.

Mueller says the current structure of the bill will mean payment stablecoin issuers, particularly if they are non-banks “are going to run up against similar, if not the same, brick walls that other FinTechs have run into in the past.” He says further, “several provisions are simply non-starters for various lawmakers and outside stakeholders. For instance, a payment stablecoin issuer’s application being “deemed approved” if Federal regulators do not render a decision within a specific timeframe is likely to elicit opposition from several lawmakers and financial stability advocates.”

The bill essentially bans the usage of algorithmic stablecoins. Additionally, it clarifies the reserves stablecoins will be allowed to have. These will be — United States coins and currency, Treasury bills with a maturity of 90 days or less, repurchase agreements with a maturity of 7 days or less that are backed by Treasury bills with a maturity of 90 days or less, or Central Bank Reserve Deposits.

Redemptions for stablecoins would also have to occur within one day. Researcher Bennet Tomlin, explains that the new bill may make it challenging for the operator of the world’s biggest stablecoin Tether-USD (USDT) to operate within the United States.

Conclusion

Both the Bank of England and the US House Financial Services Committee are considering imposing new rules and regulations on stablecoins. It appears that in both countries it is acknowledged that stablecoins offer the possibility of greater efficiency and functionality in payments, however, they currently sit outside most of the regulated framework.

The expectation is that stablecoins should be regulated to standards equivalent to the ones used in traditional payments, and those used for payments should meet the standards set for commercial bank money. Stablecoins, however, clearly have unique characteristics that separate them from traditional payment assets. In the USA, more work needs to be done before stablecoin regulation is finalized.

In the UK it appears that potential legislation may be closer. These bills are likely also driven by factors like the potential release of CBDCs and public interest in cryptocurrencies. It is important that regulation for stablecoins is clear and considers the unique attributes of a very specific form of cryptographic asset.

Don’t miss out – Find out more today