The CBDC Push is here – 3 Questions that Must be Answered

With Central Banks around the world appearing to move ever closer to the launch of Central Bank Digital Currencies, BNC Founder Fran Strajnar suggests we are sleepwalking into a dystopian quagmire.

The road to hell is paved with good intentions.

For years I have read endless research reports on CBDCs, including the widely referenced BIS report, and more recently the 162 page CitiBank “Money, Tokens and Games” report with a long CBDC section. Hundreds of similar reports have been published.

In all of the literature I have still not found a clear answer for these 3 most important questions;

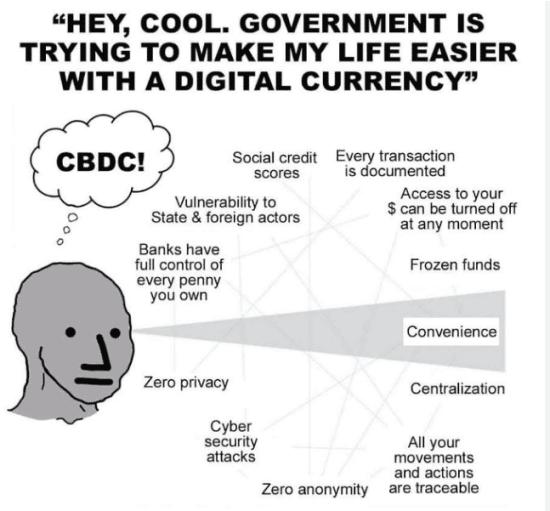

- Will CBDCs create centrally programmable conditions and restrictions?

- Which problems are CBDCs solving?

- Are CBDCs consolidating Fiscal and Monetary Policy into a single set of hands?

Ultimately the public wants to know if money will still be money.

A) Currently we have cash, where I can take a $10 note and buy a couple of coffees at a café (well maybe only 1 with inflation!). There is no friction. I pull it out of my wallet and since it’s Legal Tender, the vendor accepts payment for goods and services.

B) And we have a multitude of digital payments – online banking, NeoBanks, FinTech solutions etc where users may have a balance and make payments of various types. Currently we live in a society where there are growing safety checks to use these app balances due to compliance, regulation and various treaties.

So what impact will CBDCs have on our current social order impacting A & B?

"Will my life change?" is really the question.

Over the past few years, parallel to the decentralized crypto industry’s hyperbolic growth was a steady stream of Sovereigns and Central Banks exploring Central Bank Digital Currencies.

A slow then sudden rush to explore CBDCs

Led out of the UK Central bank at first, the pilot programs and CBDC efforts have expanded to include 100+ countries now. Having seen CBDCs from the inside go from concept, RFP’s, testing and refinement since inception, I have a unique perspective over its evolution and trajectory.

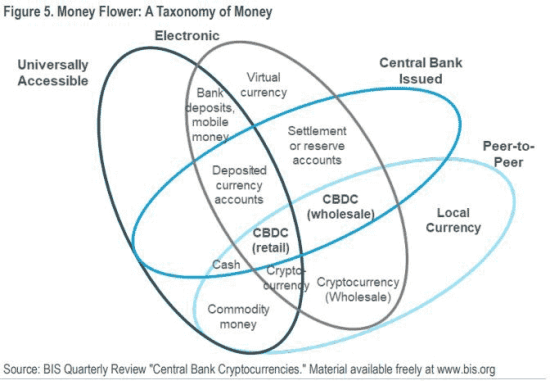

It’s easier to understand if we break it down into Retail vs Wholesale CBDCs;

Source: From the BIS and quoted in CitiBank’s report.

Conceptually it’s claimed there are these two ways to look at the 100+ Central Banks experimenting with CBDCs.

Wholesale:

It is described that CBDCs will offer a reduction of systemic risk, improved transparency, cost savings to the banking sector which can be passed down to end-users.

So does this mean they will use a public ledger? And the public will be able to see how NGO’s and Government spending is deployed?

Retail:

It is described that CBDCs will be more convenient. Automated taxes, smart-payments and so on.

So does this mean they will use a public ledger? Will the public have the same process as using cash or will every payment be known and permissioned?

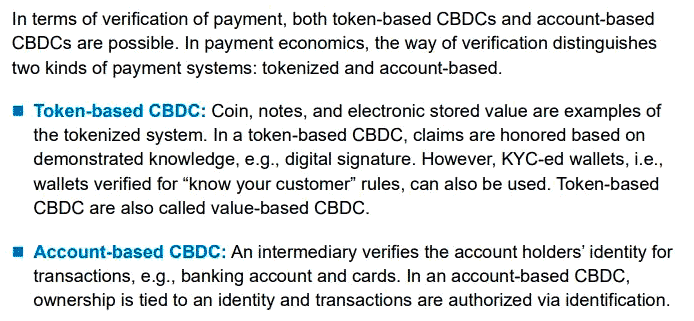

We are told repeatedly in various literature that Privacy will be built in and retail CBDCs in particular are ‘cash equivalents’ but looking at the research it seems that is not the case:

Note the "however" part of the Token-Based description. It seems the feature could exist where you might have a wallet but it is identified and thus restrictions and conditions can be added moving value between users wallets. That is vastly different to my $10 note safely tucked away in my wallet away from prying eyes.

Note the "intermediary verifies" on the Account-Based description, where a 3rd party (be it a regulated regional bank or FinTech) is by technological design and/or legislation enforcing transfers between user-accounts.

If CBDCs for the public are "just like cash" and "privacy will be maintained" that means I’ll be able to send/receive just like walking my $10 note into a café – Right? Money is still money right?

Since much of the literature references the Bank of International Settlements, let’s take a look what Augustin Carstens – GM Of BIS has to say:

Augustin Carstens

Quote 1: "The Central Bank will have absolute control over the rules and regulations that will determine the use of that expression of Central Bank Liability (CBDCs) and we will have the technology to enforce that."

Quote 2: “We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000 peso bill today. The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.”

This is in stark contrast to the official discussion forums, working groups and research reports I have poured over which perpetually stress that citizens privacy will be assured.

We must ask ourselves some basic questions here;

- “Why would unelected offshore internationalists need to know everything about every transaction everywhere?”

- “What impact on national sovereignty and society at large would occur if regional governments allow unelected internationalists to enforce regional fiscal and monetary policy?”

It seems to be that the literature, peppered with jargon and buzzwords, is wildly different to the open statements made by BIS which most of the Central Bank working groups, research and forums are always referencing.

So there is a disparity here.

The only thing to do is look at real world use cases of CBDC pilot programs to get a sense of what this thing looks like in the wild?

This would be a logical way to get a sense of what to expect, no?

1 – The Digital Yuan

The Digital Yuan is a full expression of technology convergence. It is available through WeChat and other digital payments apps and is fully integrated with the CCP’s Social Credit System, Covid Health Pass and Digital Identity systems.

When a regional bank hit a solvency problem late 2022 and protestors amassed outside of banks demanding their own money, the government ordered all citizens tracked and tagged at those locations to turn their covid status to ‘positive’. Meaning they were suddenly subject and in breach of brutal covid enforcements. Reuters was one of the few media outlets that dared cover the event, reporting that a “China bank protest stopped by health codes turning red…”

Many months later, now, with the rise (from where?) of the “15 minute city” concept, reports are slowly coming out stating that users cannot use their Digital Yuan outside of their ‘districts’.

It seems that anything is now possible.

Including having CBDCs simply not work outside your zone, or perhaps purchases cost 50% more outside your zone or any other policy can programmatically be enforced.

Thus our top question of limitations and restrictions is answered from observing the largest current Pilot program;

“China reveals digital yuan with expiry date where people are forced to spend and not allowed to save”

Source: Bitcoin Magazine Article

China’s Conclusion: CBDCs are clearly replacing cash, lack privacy for citizens and are FULLY integrated into digital identity, social credit-score-system and policy for restrictions and limitations is already being tested.

2 – The Nigerian eNaira

In Nigeria cash is king. A great deal of the population doesn’t have a bank account.

This one can skip straight to the headlines:

- Less than 0.5% Nigerians have used the country’s CBDC e-Naira a year after its launch

- Africa’s first e-currency is off to a shaky start

Turns out nobody wants it.

The adoption is sub 1% on launch. Think of this as if it were a product launch by Microsoft or Google – it would be classified as a spectacular failure (similar to digital streaming service CNN+ which cost $500m, flopped and was entirely scrapped after less than 1 month).

In the real world a product-launch disaster on the scale of CNN+ or Nigeria’s eNaira would mean a quick stop in further efforts – but it seems to not be the case when it comes to CBDCs.

When the carrot doesn’t work, out comes the stick:

- Nigeria Puts ATM Withdrawal Limits For Faster Adoption Of CBDC

- Nigeria Caps ATM Cash Withdrawals at $45 Daily to Push Digital Payments

And a few months later from: Nigerians’ Rejection of Their CBDC Is a Cautionary Tale for Other Countries.

The central bank created a cash-shortage to push eNaira adoption and it backfired resulting in riots with many citizens setting fire to countless cash-machines and banks:

This video on YouTube is censored (meta data says ‘video not found) but the link works and it is the best on-the-ground footage.

I was half expecting CNN to write an article titled "Fiery but mostly peaceful protests".

Here is a handy breakdown from a Nigerian local explaining the launch and chaos of combined eNaira launch and cash restrictions:

Full video of Nigerian ATMs here.

This all happened late 2022 and due to the immense outrage from the public the central bank has ever so graciously increased withdrawals from $45 to $225 per user per day. The eNaira adoption rate had a blip but is still abysmal at sub 1%.

Note that during this time Nigeria was (and still is) suffering from significant systemic bank solvency issues.

Limiting cash-withdrawals and forcing adoption of CBDCs is clearly an effort to avoid a wider collapse of Nigeria’s banking system which has a long history of corruption. In 2009 Vanguard plotted to take over the top 5 banks, by generating ..’panic and uncertainty in the industry and make the target banks look unsafe for depositors’.

What a mess!

Again – we’re forced to look at real-life examples of CBDC rollouts to understand the answer to our main questions.

Nigeria’s Conclusion: CBDCs are clearly replacing cash, lack privacy and have technical design implementation where policy for restrictions and limitations can be integrated – thus money is no longer money and the people are rejecting it.

3 – Japan

Japan’s CBDC pilot is not live but it’s a good temperature reading on G20 efforts.

Again, the headlines speak for themselves;

- “Central bank digital currency cast aside in Japan” – Asia Times

- “Japan Doesn’t Need a Digital Yen, Asserts BOJ Official” – CoinDesk

“A digital yen could have serious unintended consequences, the Bank of Japan’s deputy governor warned.”

Since 2020, working groups, feasibility studies and efforts were established to create a CBDC for Japan.

However after several public consultations the “lack of public interest” (and the fact that Japan authorities seem to actually listen and not just ignore feedback from public consultations) they scrapped the CBDC efforts.

Then 6 months later, miraculously, yet another 180 U-turn:

- Japan’s central bank to pilot digital currency starting in April

- Japan edges closer toward issuing digital yen with plans for new panel

The legacy banking system is continuously upgraded with centralized infrastructure – using an open blockchain like Bitcoin, Ethereum, etc could very well improve efficiency in the issuance of Fiat Dollars (of any type). But there is little to no value for everyday users identified at this time.

Meanwhile, the early adopters and supporters of Bitcoin, and the separation of Money from State, understand CBDCs are a growing concern at best – a significant threat to society at large in reality. The battle continues.

Japan Conclusion: Clearly factions of power in Japan are battling and thus resulting in this on-again, off-again, on-again flip flop to pilot CBDCs. Keep watching.

4 – Commonwealth Nations

Australia, UK, NZ, Canada et al are singing the same tune.

They all have plans for a pilot program soon.

I have personally observed the language used in the public CDBC documentation go from stressing "We won’t get rid of cash", "Privacy first", "No policy programmability – we wouldn’t do that" to essentially scrapping the use of this language over time.

These Central Bank CBDC working groups are filled with intelligent people honestly trying to build a better future.

The problem is that the road to Hell is paved with good intentions and there is typically a culture where discussion on the 3 big questions posted at the top of this article is given sufficient air-time.

The societal consequences and the will of the people is not factored in. In fact, most of these countries have done public submissions which resulted in 70-90+% negative feedback and these public feedback submissions are largely ignored or siloed into the category of ‘Conspiracy Theorists’.

Again; think of it as a digital product rollout from Google or Apple – this level of "no thanks" would in a sane rational product management lifecycle, result in scrapping the project – not with CBDCs however.

Consider that the world is currently waking up to a very rude hangover generated from extremely wasteful Covid spending / money printing at the tail end of a 10-15 year zero interest rate environment. This is now resulting in aggressive rate hikes, inflation and catastrophic cost of living crisis AND considering the never-seen-before collapse in the public’s trust in government administrations due to Lockdowns and Mandates, bad energy policies and a multitude of other scandals across the Commonwealth in the past 3 years. In my view, launching a CBDC anywhere in the Commonwealth, no matter how bad the banking system or economy get, would result in the most spectacular product launch disaster in human history.

It would make CNN+ launch look like a sunny day on the beach. It is political suicide to try and launch a CBDC in the Commonwealth in the current social environment and will only result in citizens demanding accountability for everyone involved in these efforts.

But my guess is that Western Central Banks have no choice because the Fractional Reserve System after 110 years as a whole is quickly reaching its limits. More on that in a separate article later this month.

Which way Western man? Return to Sound-Money by backing Fiat Currencies with Bullion, hard assets and responsible spending like the BRICS nations are + Central Banks (or cooperation with private sector) operating basically a Stablecoin to achieve the desired benefits from blockchain technology…

OR

A rushed rollout to replace Commonwealth currencies with CBDCs, risking societal breakdowns, sovereign defaults, currency debasements, civil unrest and ultimately regime change?

Commonwealth Conclusion: The wording is visibly changing in the official documents and the public feedback is being ignored. The stakes are extremely high. Keep watching.

5 – USA

FedNOW, which is described by mainstream media as NOT being a CBDC, is in-fact a CBDC platform and it is being rolled out TODAY for initial testing.

It is expected to be fully operational around July.

The US Banking sector and the global USD De-Dollarization is long and complex – I will cover this in a dedicated article soon.

USA Conclusion: The G20 will follow US direction. Keep watching.

CBDC – 3 top questions – Conclusion

CBDCs are not a life extension for the Fiat Dollar System like taking the USD off the gold standard in 1971 or Quantitative Easing and later ‘going direct’ ‘QE forever’ after the GFC 2009 – CBDC’s are a permanent replacement.

Under CBDC’s Money is no longer currency.

1) Will CBDC’s create centrally programmable conditions and restrictions?

Yes – CBDC retail system is a complete control system. This is the apex of “Going Direct”. Where a central bank goes directly into your bank account and controls it. Direct to the individual depositor.

- If you watch BIS GM’s video he clearly states it’s not your money – it’s the “Central Bank’s expression of liability” – i.e. it is their money. It belongs and is controlled by the Central Bank.

- There is no live example of "Wholesale Only" CBDC’s and all the literature suggests Wholesale CBDCs would suffer the same policy programmability issues.

2) Which problems are CBDC’s solving?

This remains unclear – because it’s digital, they can make the rules of how, when, and where it can be used. It does not matter if CBDCs are "Retail" or "Wholesale" because if the attack-vector exists (the "programmability") then current and future administrations can choose to roll out whatever policy they want.

- If they don’t want you shopping more than 5 miles from your home – your transactions won’t work beyond 5 miles. If they don’t want you buying steak or eggs, well that’s easy to program. If you say something on social media that goes against official narratives – they can simply fine you or shut off your account.

Money becomes coupons that can expire, increase or decrease in balance, have restrictions at ANY time of ANY type and are not safe from any wild policy a future administration cooks up.

An appropriate term for CBDCs (words are important!) would thus be “Policy Coupons”.

3) Are CBDCs consolidating Fiscal and Monetary Policy into a single set of hands?

Yes – Words of assurance are meaningless, without actual technological design assurances that CBDCs will not be built without ‘programmability’ for policy to wreak havoc, it is clear that Fiscal and Monetary Policy are consolidating. Policy programmability vectors WILL exist for both Retail and Wholesale implementations of CBDCs and therefore WILL be abused by future administrations.

Imagine trying to buy a beef burger and your payment declines, not because of insufficient credits, but because you exceeded your carbon credit this month. Thus ‘money’ becomes tickets or coupons for specific things according to policy.

Or say you posted an awesome Meme on twitter 10 years ago which a future government decides is ‘wrong-think’ – your ‘money’ can simply be deleted, frozen, restricted or reduced and no amount of working groups, forums, research papers can stop this because "if the feature exists – the attack vector exists".

The only ‘Safe’ CBDC concept is one where the Treasury Dept of each nation uses a public ledger like Bitcoin, Ethereum etc to issue freely-transferable stablecoins without the ability for future administrations to bake in programmable policy restrictions (ie a true digital cash for Retail CBDCs). But even this is not useful if the real problem of Fractional Reserve Banking is not addressed in the first place.

I wish this was all theoretical but having been provided with no assurances in the official discussions, research and working groups, we can only look at live implementations to understand what to expect from CBDC rollouts in any given country. And the results are not instilling confidence are they?

This "Commercial" answers my top 3 questions far better than the mountains of research, forums and working-group literature available online:

I would also highly recommend watching this Catherine Austin Fitts interview here, starting at the 31min mark discussing CBDCs for further context.

Lastly – users can simply opt out of the coming CBDC uncertainty by converting their various dollars to Bullion with Rush.Gold or Bitcoin with Techemy Capital info@techemy.co

Don’t miss out – Find out more today