STATUS Price Analysis: Unique Dapp solution attempts to gain traction

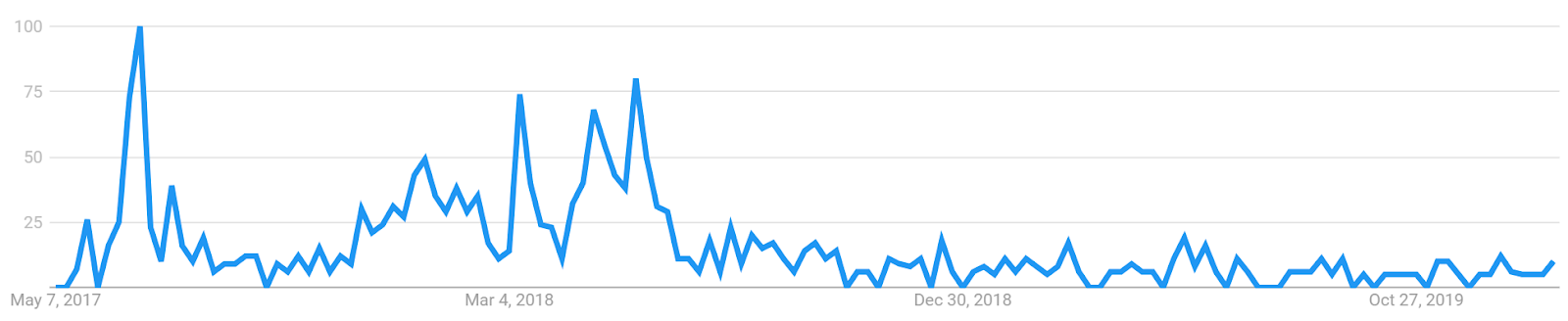

Following an impressive ICO and price appreciation during 2017's bull run, the bear market has significantly diminished the market cap of SNT. Unlike many alts that have shown signs of a price reversal, the price of SNT is yet to find a clear bottom, despite signs that the project is developing and implementing new solutions.

Status (SNT) is an open-source messaging platform and mobile interface designed to interact with decentralized applications that run on the Ethereum blockchain. Status operates three core solutions; a peer-to-peer private messaging app with end-to-end encryption, a crypto wallet for storing ERC-20 and ERC-721 tokens, and a decentralized Web3.0 browser. The browser lets users navigate and interact with the growing ecosystem of marketplaces, exchanges, and games.

The Status platform’s native token, SNT (Status Network Token), acts as a multi-purpose utility token for the platform. SNT is used to access the Status decentralized push notification service. This is used as a conduit for Status governance, and to participate in Status community content creation. In the future, SNT will have functionality within a proposed fiat-to-crypto exchange service, a decentralized application (Dapp) directory and a stickers-for-messenger market.

However, the most relevant use-case for SNT may be as a medium to make speculative trades based on market signals, and the development of Status and the Dapp ecosystem, in order to make a profit trading on crypto exchanges like Binance, Bittrex or Bitfinex.

The price and trading volume of SNT picked up significantly for a brief period around mid-January 2019. This was likely driven by buying on key exchanges such as Binance. The price of the SNT/BTC pair rose nearly 20% in a day of trading on January 15.

The January SNT price increase coincided with a number of other Binance altcoin pairs, including Augur (REP), Loopring (LRC) and Power-Ledger (POWR). Each had a similar price increase around the same period, however, bitcoin and other crypto assets did not. This suggests that the price increase was not due to any fundamental factors related to Status, and was instead likely co-ordinated, algorithm trading.

SNT/BTC market, Binance (January 15th spike)

REP/BTC market, Binance (January 15th spike)

LRC/BTC market, Binance (January 15th spike)

DASH/BTC market, Binance (Control, no spike with other alts)

Travis Kling, Chief Investment Officer of Ikigai Capital said, “Owning Ethereum today is a call option on what you think the network is going to be in the future.” Similarly, while most SNT buyers are likely looking for short term trading opportunities, some are buying SNT with the expectation of future use cases as the blockchain matures.

The Status Network Token ICO was conducted in Switzerland during June 2017. The ICO raised nearly $100 million dollars worth of ETH in one day. This funds the development of the project.

SNT token allocation: Genesis Token holders are community members who contribute to the ecosystem in non-monetary ways like code contribution

The index price of SNT is currently $0.021 and it currently occupies the 71st position on the Brave New Coin market cap table. Its price has fallen ~7% in the last 7 days and 26% over the last 30 days. It is very close to its ICO price of ~USD0.02 and is down ~96% from an all-time high achieved in early January 2018.

The core value proposition and disruption potential of Status is comparable to other decentralized/blockchain social network projects such as the Brave web browser and Basic Attention Token project. Legacy media and communication networks allow the free use of their platforms in return for a user’s private data. This user data is routinely exploited by large corporations, used for precise ad targeting, and is vulnerable to hacks. Users have no say in the development or management of the networks they contribute to.

The Status network aims to empower users to become direct stakeholders and decision-makers in the networks they participate in. The platform lets users control the data they share and receive. They can also choose to vote on the future development of the network.

The Status network, for example, has a unique approach to push notifications. A push notification is the delivery of information to a computing device from an application server, where the request for the transaction is initiated by the server, rather than at the request of the client.

Push notifications are used by application owners and advertisers as marketing and communication funnels. It’s an efficient communication channel because push notifications can be seen, even behind a mobile lock screen, multiple times a day. Unlike a pop-up, which only appears when visiting an associated website, when a user elects to receive an app’s push notifications, middlemen have a free channel to advertise and promote their apps.

Status uses a decentralized push notification service. The platform, at a price paid in SNT, allows a user to pick which nodes in the network can provide push notification services to them, who their push notification providers will be, and adds flexibility for privacy and opt-out options.

The Status push notification services model gives ownership of personal data back to users but adds significant friction in terms of making users pay for these services. Traditionally push notification services are free because users become the product, and companies like Amazon and Google are willing to cover server costs indirectly through advertising revenue.

The platform uses Ethereum communication subprotocol Whisper (SHH), to decentralize elements of the social network user experience such as notifications when a user receives a message from a friend. Numerous operations within the Status messaging service are transactional. This implies Gas consumption fees. Whisper, however, has features that let app creators delegate nodes to store messaging when clients are offline. This helps ease some short term fee requirements.

For example, a Status user may be an early adopter in Cuba, has been using SNT to pay for push notifications, but Google’s Firebase has been blocked in his country. He can seamlessly change to a different provider, like Amazon SNS, from within Status.

There are a number of other ways in which fees and payments are built into its social model. ‘Tribute to talk’ is a spam-filter similar in design to an early Bitcoin network use case suggested by Satoshi Nakamoto. A Status user can set a minimum amount of SNT to be deposited by another user, from outside of their network, in order to become contactable. Once a recipient responds, the initial messenger loses their SNT deposit as a ‘tribute’.

The concept of offering a tribute in order to communicate with, say, a high profile figure within one’s industry, is not dissimilar to existing tools such as Linkedin Premium and Cent. The Status network’s blockchain layer also adds positive externalities of payment transparency due to Ethereum’s viewable ledger.

A core value proposition of the Status Network Token is giving stakeholders (users) the ability to choose the direction that the platform’s software is developed towards. The token is used to make decisions on development proposals, which can be made by any stakeholder.

Status has stuck to the core principles of personal liberty and self-sovereignty across their SNT utility solutions. They appear to be committed to a model that adds a payment layer to their social network to give users control of their interactions and data. This model may limit the near-to-medium term value potential of Status because of the many free, user-as-product, social network/messaging alternatives like Facebook and Instagram that dominate the market.

However, if the trend towards greater control over personal data gains traction, and regular users begin switching away from legacy social networks, Status may be building a social network model that will create user curiosity and possibly adoption.

This ambiguity surrounding whether a lack of present demand will be converted into future demand if the market moves toward a self-sovereign social network, means price discovery is difficult to determine. The Status network’s straightforward value proposition and unique solution is one reason why its ICO performed so well in 2017 and provides some justification for its present multi-million dollar market cap.

The Status mobile client is in beta (version 0.0.12 is available for download on Apple iOS and Android). The app has been downloaded over 10,000 times, and the decentralized mobile wallet solution with serverless key storage has immediate utility to a number of ERC-20 and ERC-721 token holders. The version 0.0.12 was launched on May 1st, and is titled ‘discover’.

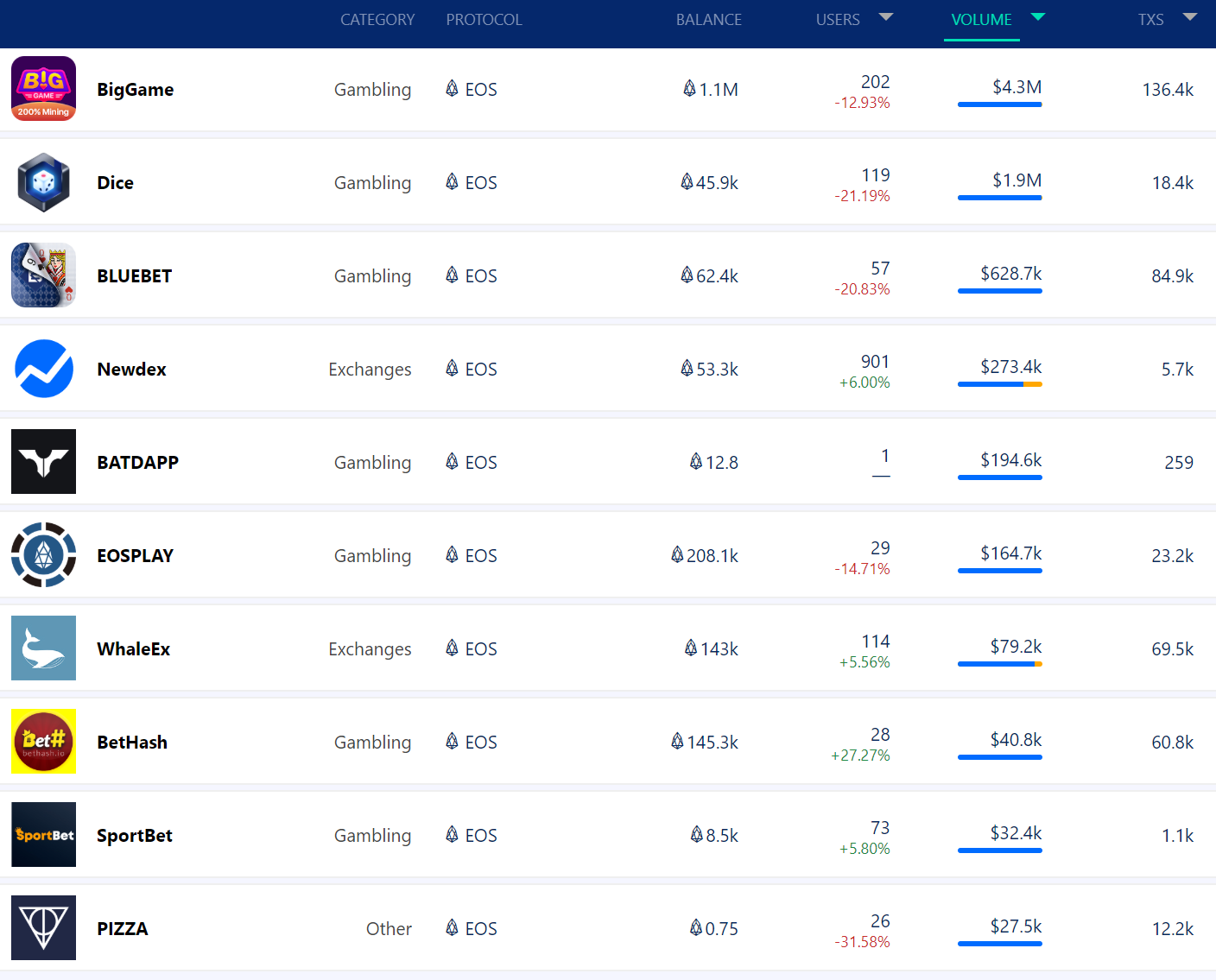

Source: Stateofthedapps

Dapp ranker Stateofthedapps tracks the main Status smart contracts. It ranks Status as the 2nd most popular Ethereum ‘wallet’ based Dapp, and the 25th most popular overall Dapp in the platform blockchain ecosystem.

Status co-founder Jarrad Hope made a frank announcement at an internal town hall event in December 2018. He described the challenges the team has faced in managing its treasury due to the 2018 crypto bear market. Like many other crypto companies, the company was forced to cut 25% of its workforce.

The transcript from the town hall describes the issues. ETH in December 2018 was worth one-third of what it was at the time of the Status raise. This was below what Status had prepared for in its financial planning.

The company was forced to reduce operational expenses and make some difficult decisions around its product roadmap. The post acknowledges that the team has made mistakes. It says the team will push forward with a renewed focus on delivering on core whitepaper promises, creating a usable app, and onboarding new customers.

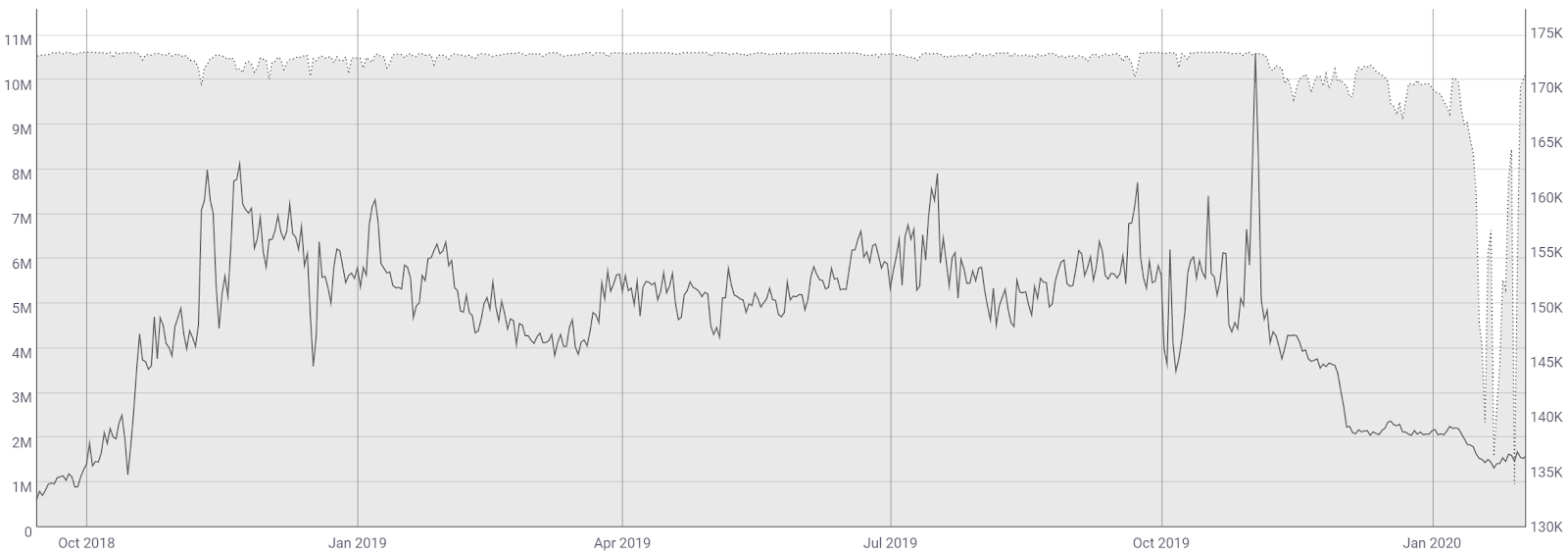

Source: https://app.santiment.net/projects/status (Red bars indicate ETH spend over time)

Blockchain wallet data indicates that the Status project was likely forced into selling large chunks of ETH during the bear market. The team sold ~38,000 ETH between November 15th and November 30th when the price of the token ranged between $176-$115.

The SNT ICO began and ended on June 20th, 2017 when the price of ETH was ~$359 (BNC Ethereum liquidity index price). Status raised 299,898 ETH during its ICO and to this date retains ~163,000 ETH.

Recent development activity may suggest future bullish price action. A recent ERC-20 token project development activity review listed Status as the 2nd most active ERC-20 project by development activity out of 853 tracked projects.

Commit activity has revolved around the 0.0.12 beta Status mobile app release. V1 of Discover is a standalone react web app (https://dap.ps/) which will deliver an SNT based curation mechanism for listing and discovering Dapps.

NVT signal

Derived from the NVT Ratio (Network value/on-chain transactions), the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin. Crypto markets are prone to bubbles of speculative purchasing that don’t reflect underlying network fundamentals. The NVT signal provides insight into what stage of this price cycle a token may be at.

A high NVT signal is indicative of a network that is going through one of these bubble periods and may move towards a position of becoming overbought/overvalued, as the market’s speculative momentum slows.

Between the inception of the SNT token and August 2018, the NVT signal of SNT tended to range between 50 and 150 points. Following this period, however, the NVT signal has touched new highs multiple times and approached 250 points on multiple occasions.

This suggests that post-August 2018, external or speculative value has played a larger role in SNT’s network value than in the past. This may be because the crypto bear market has turned users off from using blocking ecosystem solutions. This would create a fall in user and transaction demand. A fall in on-chain activity for a Dapp project triggered by the crypto bear market would not be unique to Status and SNT. Many other Ethereum Dapps and Dapp tokens have followed a similar pattern.

It is important to note that the core product of Status, the mobile client which hosts the Status network social apps, is still in beta. When the app launches, without bugs, with updated UI, and with smoothed interactions with the Ethereum network, on-chain transaction volumes should begin to increase. Based on roadmap suggestions and developer boards, May 12, 2019, is a key date. New UX onboarding, chat features, and reliable messaging protocols are set to be released on this date. Full product launch dates have not been announced.

In the short term, NVTS leans bearish. For most of the last year, a rising NVT signal has not been a forward indicator of positive price runs implying that the fundamental value of the network may be detached from external token value. In the broader market context, the NVTS is rising while the price is static. This means on-chain volume is falling and not providing any potential pressure to drive an oversold price reversal.

PMR signal

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

The PMR value of SNT has historically been high, ranging between 5-8 natural log points since the launch of the token. This means that token value/market cap by far exceeds the number of active SNT addresses.

This suggests any potential network effects within the Status ecosystem are minimal or non-existent. It appears that the relationship between price and PMR is not a useful indicator, and is driven by token value and not active addresses.

There is a pattern of users falling away despite the significant updates and added features built for the core application over the last year. This suggests issues with onboarding users and the bearish ecosystem is turning users away.

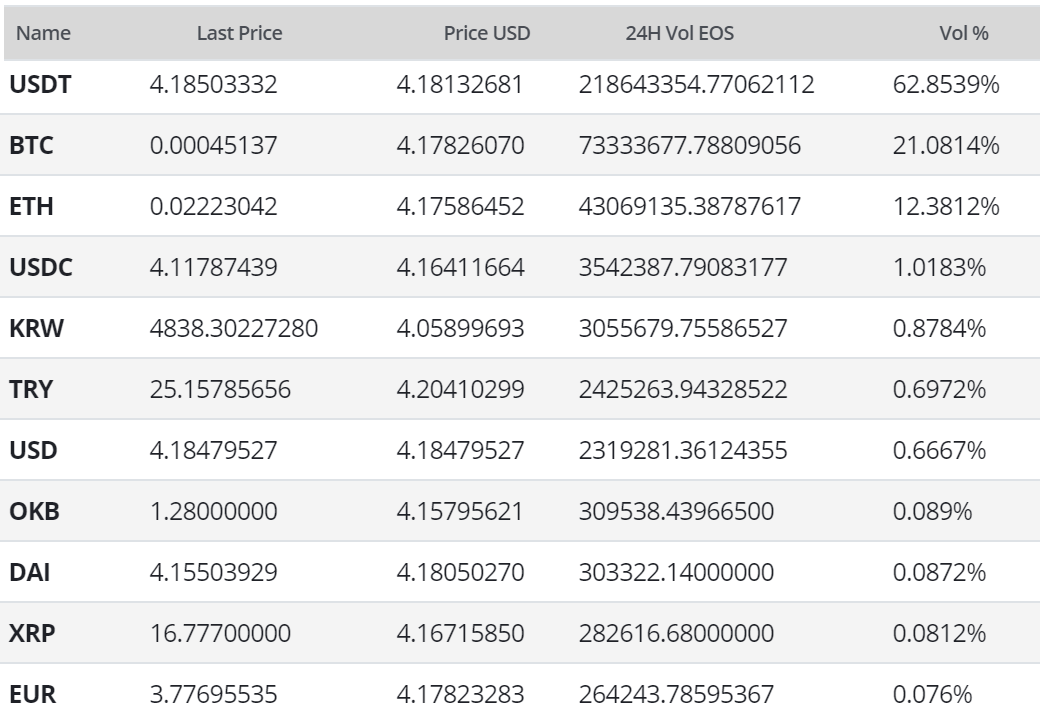

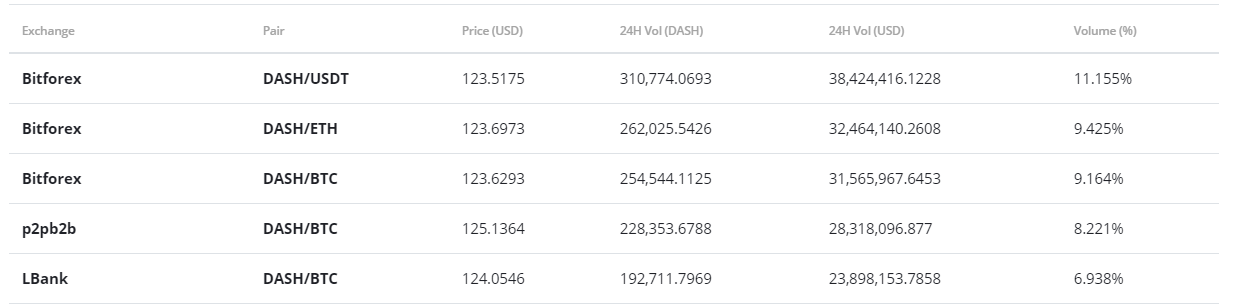

Exchanges and trading pairs

The most popular trading option for SNT is BTC with the pair handling close to 39% of daily trading volumes. The second most popular market is the SNT/ETH pair. Together the top two pairs make up over 62% of the daily trading volume. The USD value of the daily volume of the entire SNT trading market is just ~USD 1.1 Million.

A mix of exchanges make-up the SNT trading ecosystem. Markets on major exchanges, OKEx and Upbit, operate the top two pairs in the ecosystem. SNT is also tradeable on large, trusted exchanges such as Binance, Bittrex, and Poloniex.

Technical analysis

Moving averages and price momentum

On the 1D chart, SNT has followed a negative linear price trend with a Pearson’s R correlation between time and price of ~0.76 (not shown), which has allowed a death cross to persist 2018. However, SNT has seen a 69% surge since mid-December, which has price sitting near $0.022 currently. Unfortunately, despite the recent uptrend, price failed to break above the 200 day EMA (arrow) and currently sits beneath the 50 day EMA.

On the 1D chart, one glimmer of positivity is that price currently sits at the Fibonacci retracement level of 0.382. At the moment, this support level looks solid, thus If it holds in the near term, price is likely to begin moving higher once again; with the 0.5 Fibonacci level of $0.0257 being the next price target and resistance.

Lastly, on the 1D chart, the volume flow indicator (VFI) is still strongly above 0 with a positive trend still intact, despite the recent price weakness. Continued buying strength coupled with a solid support level may bode well for resumed price appreciation.

Ichimoku clouds with relative strength indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are bearish: price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is touching price and above the Cloud.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price originally completed a Kumo breakout in late-March 2019, but has struggled to maintain it since then. Recently, price has fallen beneath the Cloud and currently sits at Senkou B support, which coincides with Fibonacci retracement level of 0.382.

However, there are a few positive factors for SNT:

- Senkou B support coincides with Fibonacci support

- VFI is still in the bulls’ favor

- RSI is currently at a decent level of 40.

However, despite the narrowed Cloud, buying momentum and volume will need to pick up demonstrably in order for SNT to re-complete a Kumo breakout above $0.027. In the event of a new breakout, price targets are $0.03 and $0.035. If the breakout does not hold, support levels are $0.02, $0.017, and $0.014.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is bearish: price is below the Cloud, Cloud is flat, the TK cross is bearish, and the Lagging Span is in the Cloud and below price.

The slower settings yield similar results with price currently sitting beneath the Cloud; including similar price targets and support levels.

Conclusion

The Status network is an easy project to admire due to its value proposition to give users data sovereignty and reduce the ability of large corporations to exploit user data for advertising purposes.

Following an impressive ICO raise, and gains accrued during the 2017 bull run, the crypto bear market severely impacted the project. The price of SNT is yet to find a clear bottom and has not seen the same bullish accumulation that many other crypto assets have benefited from in 2019.

The active development signs are positive, however, and suggest potential future market relevance. The high number of mobile client downloads suggests a base of users is present.

A more robust onboarding strategy is needed to drive on on-chain SNT volume.

The technical indicators for SNT favor the bears, while the bulls’ primary hope is that current support levels hold. On the 1D chart, both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30) will await price to complete a new Kumo breakout above $0.027 before entering a long position. Success will yield price targets of $0.03 and $0.035. Failure will highlight support levels of $0.02, $0.017, and $0.014.

Don’t miss out – Find out more today