Tether market cap hits all-time-high

Controversial stablecoin Tether is growing rapidly. The market cap of the cryptocurrency has doubled since January and now sits at a cool $4 billion dollars. What’s driving the demand for Tether?

As is often the case with Tether, the reasons behind the recent growth are complex and multi-faceted.

Some suggest the surge is related to recent adjustments on the Tether network — with tokens migrating from the Bitcoin second layer protocol Omni to a range of other blockchains including Ethereum and Tron.

Another key factor is demand from China, where merchants and traders use Tether to sidestep strict capital controls and to gain unfettered access to global markets. USDT is used for approximately half of all transactions on Asian exchanges such as Huobi and Binance.

Blockchain migration

For most of its five year lifetime, Tether has been confined to the Omni network, but over the last few months, different versions of the stablecoin have been pushed out to multiple blockchains.

Though 2.5 of the 4.1 billion tokens are still on the Omni network, the remaining 1.6 are now distributed across other top blockchains including EOS and Ethereum, smaller side-chains like Blockstream’s Liquid Network and the Bitcoin Lightning Network, and niche networks like Algorand — the pure proof-of-stake blockchain founded by MIT professor Silvio Micali.

Anecdotal reports confirm that demand stemming from these new networks could be one source of the Tether growth, as highlighted in July when $5 billion Tether was ‘accidentally’ minted on the Tron blockchain after a Tether team member fat-fingered a decimal point on a $50 million transfer.

While Tether has not issued an official statement giving reasons for the growing market cap, Coinmetrics claim it could be spurred by deficiencies on the Omni network, which is reported to suffer from a lack of active development.

The biggest recipient of the new tokens has been Ethereum, and the data analysis firm’s State of the Network report concludes that "strong growth in Tether total supply can be almost all attributed to Ethereum. USDT-ETH active addresses (the count of unique addresses that were active in the network as a recipient or originator of a ledger change) skyrocketed over the past week, jumping from 38,600 on August 19 to over 78,800 on 8/23.”

Major exchanges making the switch from Omni to Ethereum-based Tether tokens include Binance, which announced last month that it would remove Omni-based Tether addresses, and Poloniex, which said it would shift to Ethereum so users can benefit from "faster and cheaper" transactions.

Tether is thought to be responsible for at least 40 percent of all transactions on Binance alone, and with other big exchanges supporting the transition, the Ethereum-based version of Tether has gained significant momentum.

Data from Coinmetrics shows that despite the fact that over 60 percent of Tether tokens remain on the Omni network, the number of transactions made using Tether on Ethereum has now surpassed the number of transactions on the Omni-based equivalent.

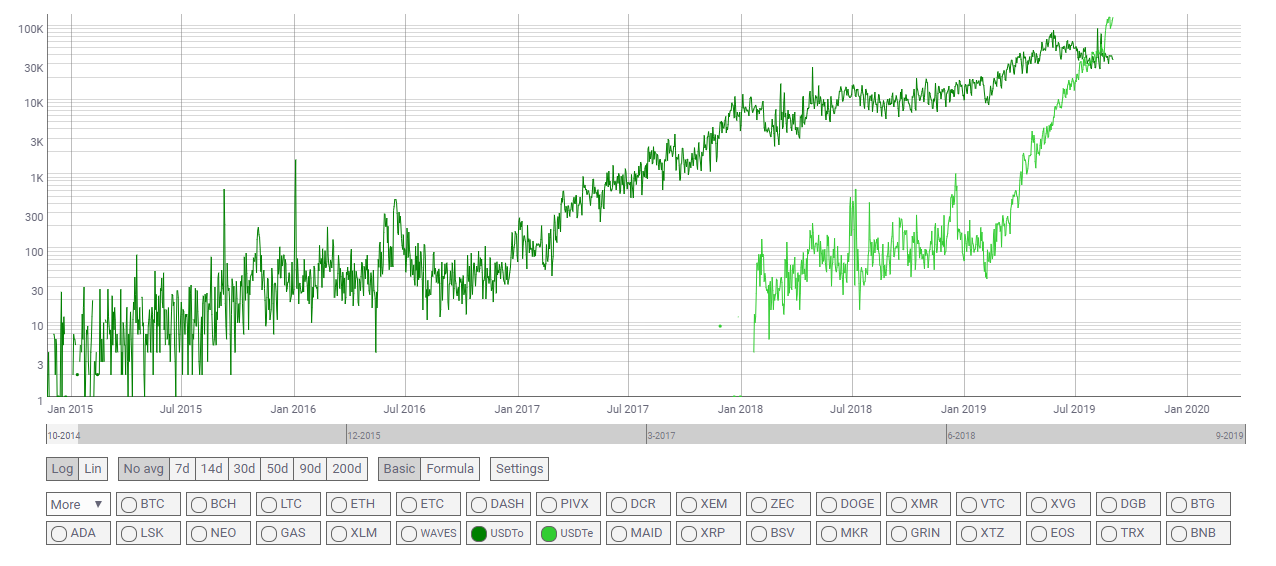

The number of transactions on Omni-based Tether (dark green) Vs Erc-20-based Tether (light green). Chart from Coinmetrics

Chinese and Russian merchants

As the most popular crypto asset pegged to the U.S. dollar, Tether offers a way to sidestep sanctions and capital controls without the volatility that can make life difficult when using cryptocurrencies.

This gives Tether a niche in a grey area of the global financial system, particularly in China where the coin is reported to be used not just for capital flight — by investors fleeing from the falling yuan — but also for day-to-day transactions by Chinese importers in Russia, who are reported to be buying millions of Tether from Moscow’s over-the-counter trading desks.

“There are a lot of OTCs here in Moscow City, a bunch of offices in every building, and the volume can reach several dozens of millions of dollars a day. It’s all paid for in cash,” said Maya Shakhnazarova, head of OTC trading at Huobi to Coindesk, pointing out that merchants switched from Bitcoin to Tether during the bear market of 2018.

The demand has been confirmed by research firm DIAR, which found in June that exiled Chinese cryptocurrency exchanges facilitate 60 percent of all Tether trading globally.

Whether merchants and traders or Tether’s own mysterious blockchain expansion plans are responsible, research released last year suggests the outcome will be the same — when Tethers flood the market, cryptocurrency buyers soon follow.

Don’t miss out – Find out more today