Tezos Price Analysis: Security token deals highlight Q3 2019

The XTZ token has performed well in 2019. Strong fundamental signals include the soon to be completed community-backed protocol amendment, inclusion within the Coinbase Custody platform, and recent deals with security token projects. These have helped support price gains of ~125% year-to-date. Technicals for the project lean bearish, however, and other fundamental concerns may effect the project's value in the medium term.

Tezos (XTZ) is a blockchain platform designed to support an ecosystem of smart contracts and decentralized applications. It is notable for an on-chain governance layer designed to enable efficient network upgrades and an efficient, transparent, democratic stakeholder community.

The project generated negative headlines in 2018 following a legal battle for control of the $232 million raised in its 2017 ICO. After a protracted and distracting legal stoush, the matter was successfully resolved. Developers and the token holding community have since moved on and the optimism that characterized the project’s early days has returned.

The price of the XTZ token is ~$1.08 as per Brave New Coin’s global spot prices. XTZ currently occupies the 20th position on the market cap table. The price of XTZ has risen ~28.5% in the last 7 days but has fallen ~10% in the last month.

The Tezos blockchain has the unique value proposition of being the world’s first ‘self-amending’ blockchain. Tezos is programmed using the OCaml language. The ecosystem is similar to the Ethereum network in that both are designed to support smart contracts and decentralized applications. The two projects offer Turing complete smart contract languages that allow for programmable loops. Where Ethereum uses the Solidity programming language for smart contracts, Tezos uses Michelson. XTZ, like ETH, is used for powering computations.

While both platforms allow for programmable loops, to prevent infinite loops, Ethereum uses the gas system; while Tezos limits the number of steps a computation can use. However, smart contracts within Tezos can call other smart contracts within the ecosystem, meaning this limit can be extended. XTZ, like ETH, is used for powering computations.

Tezos differentiates itself from other platform blockchains with one key factor – its protocol can be changed directly by stakeholders. What the Tezos blockchain offers in theory, is decentralized governance via an immutable blockchain that directly bakes protocol decision making and updating into the network’s core program. This is designed to solve for bloated bureaucracy and internal politics.

Changes are verified within the protocol itself through amendment votes, as opposed to the informal, or governance-by-fork style used by major networks like Ethereum and Bitcoin. Historically, if a segment of the community disagrees with the direction of an open source project, it has been accepted practise for that group to fork the project. This creates a new project, with one set of users using the code in one way, and another a different way.

The Tezos mainnet successfully launched in September 2018 and the network’s first set of self-amendment protocols, Athens A and Athens B, were released for the blockchain’s mainnet on May 28th. Athens A proposed to reduce the current roll size (amount required to bake) from 10,000 XTZ to 8,000 XTZ. Bakers are the equivalent of miners on proof-of-work networks like Bitcoin and are responsible for operations like network block production and transaction verification. In order to become a Tezos baker, a significant collateral investment is required.

The daily number of bakers on the Tezos blockchain. This daily rate has not been affected by the implementation of Athens A. Source: Tzscan.io

Athens A made it easier to become a Tezos miner. Athens A also reduces the minimum investment required to participate directly in network consensus. This may lead to more holders deciding to solo-bake as opposed to delegating tokens to a representative baker and passing over fiduciary responsibility.

While the tangible effects of Athens A may take time to materialize, Tezos leads other competitor proof-of-stake platform blockchains in the total number of nodes, a potential indicator of decentralization. Source: Paradigm fund

Athens B proposes to increase the gas limit on the network, which would likely result in more transactions and complexity in each block but will lead to greater CPU usage requirements for nodes. The update will likely increase the fees earned but also paves the way for more complex Dapps to be built on Tezos.

Whether or not the protocol updates make the network function more efficiently in the short run is immaterial to long term Tezos bulls. It’s more important that the voting process demonstrate that a democracy-by-code philosophy can function smoothly within a blockchain network. It also evidences the efficacy of a governance participation token reward model and may increase the incentives for some to buy into the network.

The voting and implementation period for the Athens A and Athens B proposals coincided with an extended period of bullish XTZ price activity. Stable voting cycles with strong turnouts may be key bull flags for the token going forward.

Network design

The Tezos on-chain governance solution is designed to minimize the effect of potentially disruptive hard forks. Changes are verified within the protocol itself, as opposed to the informal, governance-by-fork style used by networks such as Ethereum and Bitcoin. Historically, if a community is irreparably split over the direction of an open-source blockchain project, it has been accepted practice to fork the project as a last resort.

Because blockchain-based crypto assets benefit from network effects (security, immutability, number of users), network and user splits due to hard forks have been detrimental to the value of these (existing and post-fork) projects. The Bitcoin Cash, Bitcoin SV, and Ethereum Classic forks are examples of this.

Instead of forking, Tezos aims to always coordinate discussions around the one chain, implementing the highest quality updates for it as they become available. Making changes to the Tezos network is implemented via a multi-stage voting process that takes three months to complete.

608 million XTZ were distributed when the Genesis block was issued in June 2018. The remaining XTZ was released to governance participants at an inflation rate expected to be around 5%. There is no limit on supply, simply non-dilutionary inflation.

Tezos operates using a proof-of-stake model for network transaction activity and governance. A user can stake their tokens to become a delegate or allocate their tokens to a delegate. Their XTZ holdings will grow with inflation at a ~5% rate, otherwise, they become diluted.

If a user elects not to stake, they won’t lose their tokens or miss out on profits because of external market-driven price movements, but they will miss the opportunity to make a passive return. Staking creates an incentive for all holders to participate in network decision making. At present 80% of Tezos tokens are assigned for staking (Source: Tzscan.io).

‘Participation’ comes in several different forms on the Tezos network. Delegates are Tezos accounts assigned the responsibility of managing a node and handling protocol amendments, software updates and patches. They pay a bond as security and need to own at least 8,000 XTZ to become a delegate or baker (making Tezos a PoS network). They also charge network users for their services as network amenders and block producers.

If a user cannot afford the bond or is not technically inclined, they can delegate their XTZ to a delegation service, a network operation in itself, and still receive the inflation benefit. The users retain the right to their tokens during delegation, and value is added to the delegate’s pool. Protocol amendments are adopted over election cycles every 131,072 blocks or approximately every three months.

Solutions like the Coinbase custody institutional staking based investment product further reduces the barriers to access passive incomes through XTZ investments.

Delegates need to become bakers first. Bakers are the network’s block producers and are randomly assigned to the Tezos network to mine on it and verify transactions. A group of 32 randomly selected nodes become endorsers, and vote on the validity of blocks. Bakers provide a bond, like delegates, which is lost if they attempt any malicious activity (i.e. publishing empty blocks).

Block rewards are dependent on the inflation rate, which relies on the number of tokens staked, while endorsers receive two XTZ per block they endorse.

Backers of the Tezos solution include the Winklevoss twins (who include it as one of only four digital assets included in their investment portfolio along with Bitcoin, Ethereum and Zcash), Tim Draper and Meltem Demirors of Coinshares. Tezos founders, Arthur and Kathleen Breitman can also be considered influencers in the space, as sought after speakers at crypto conferences.

Tezos network statistics: https://stakingrewards.com/asset/xtz

The Dune Fork

After multiple disagreements, the OCamlPro development team decided to conduct a hard fork of the Tezos network — which will result in the creation of a new cryptocurrency called “Dune.” The fork is scheduled to occur in September 2019.

OCamlPro has been working on blockchains since 2014 when they began working with Arthur Breitman. The idea behind Tezos was ambitious, and OCamlpro collaborated with Breitman to write a specification and turn the specification into OCaml code. OCamlPro also helped develop network infrastructure like the Tzscan.io, Tezos block explorer.

Perceptions of the fork have been affected by OCamlPro’s history of making bold claims and demands related to Tezos. The leadership of the development team claims to have built 90% of the Tezos code and tools. In the past, they have demanded that all Tezos foundations should go through OcamlPro leadership for approval.

Many within the community have written off OCamlPro’s threatened hard fork as a veiled attempt at extortion and an attempt to have a final payday before moving on from Tezos development.

It appears unlikely that existing Tezos bakers will leave their well established current positions to join the newly created Dune chain. This suggests that tokens launched on the newly created network may lose value quickly if the fork does not gain more supporters.

There is a chance that the Tezos network will lose value as a result of the hard fork but at this stage, its impact looks minimal. Arthur Breitman has also announced that Tezos nodes coded in Rust, not OCaml, are being funded and developed. The incident may affect some investor perceptions of Tezos being ‘un hard-forkable’.

Security token deals

In early July it was announced that BTG Pactual, Brazil’s fifth-largest bank, plans to utilize the Tezos blockchain for security token offerings potentially worth $1 billion. Dubai based Dalma Capital will also support the deal and team up with BTG Pactual to issue new security tokens. The deal will include tokenized property and other exotic assets like sports clubs.

Following the initial BTG Pactual deal announcements in early July, Tokensoft, a leading security token issuance, and management platform announced that it officially supported the issuance of security tokens on the Tezos blockchain. Tokensoft clients will be able to build and issue compliant security tokens on the Tezos network and utilize Tokensoft institutional-grade custody solutions.

Tokensoft considered several factors in their decision to select Tezos as a security token issuance platform. Tezos offers institutional-grade coding solutions through formally verified smart contracts. It also offers secure custody through native support for multi-signature smart contracts. The Tezos on-chain governance model offers long term flexibility and upgradeability for projects building on the chain because of liquid democracy and stakeholders improving the chain by voting in protocol amendment rounds.

The proposal creation process has been aided by a developer reward scheme. Developers are encouraged to submit improvements to be implemented at a price and this creates competition to submit ideas. For example, the work within the Brest A submissions will net creator Tzscan baker 1 roll or 8,000 XTZ if approved. Discussions may become messy if multiple proposals are submitted for a single round, however, the community voting and fame based developer rating system should ensure that the best proposals are identified quickly.

Tezos development house Cryptium labs have an excellent series on their planned proposals for upgrades and the preparation process for these upgrades. Suggested protocol amendment ideas revolve around simplifying the stake delegation process and optimizing the size of Tezos smart contracts. Another core protocol upgrade suggestion that has been particularly touted is the integration of zero-knowledge cryptography solutions, such as zk-SNARKs, to enable private transactions on Tezos. Zero-knowledge related protocol proposals are expected to be pushed towards the end of 2019.

Tezos has not yet gained traction within the wider Dapp and smart contract developer and user communities. Platform blockchains like Ethereum, EOS, and Tron have a deeper base of projects and users. This is due to the learning curve for devs building Michelson smart contracts, and doubt surrounding the security of a proof-of-stake blockchain.

Social posts have reflected the frustration of the XTZ token holding community feels due to the lack of early adoption of the Tezos blockchain as a platform to build on. There is currently a negligible list of Dapps building on top of Tezos. Token holders will hope that the emergence of security token issuers looking to build on Tezos creates buying pressure and new utility for XTZ tokens.

Developer activity

Most coins use Github as their open development platform, however, Tezos uses the direct alternative Gitlab. Gitlab lets projects assign roles with specific authentication levels, whereas in Github permission is set at read or write.

Using Gitlab may be logical for Tezos because code development for the project is led by a single research and development team, Nomadic Labs, based in Paris. The team has 30 permanent staff all focused on the research and development of Tezos.

Files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Between April 6th and July 22nd, the master repo for the project has had 2000 commits and averaged 4.2 commits per day.

Tezos Gitlab – issues raised and closed. Consistent activity maintained throughout the last year.https://gitlab.com/nomadic-labs/tezos/insights

Objective on-chain indicators

NVT signal

Derived from the NVT (Network Value to Transactions) ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin. It is akin to the price/earnings ratio signals used in traditional equity markets. Crypto markets are prone to bubbles of speculative purchasing, that are not reflective of underlying network performance and activity. The NVT signal is a tool to assess drivers of these patterns.

The NVT signal provides some insight into what stage of a price cycle a token is at. A high NVT signal is indicative of a network that is going through one of these bubble periods and may move towards a position of becoming overbought/overvalued, as market speculation runs out of steam.

The indications given by XTZ’s NVT signal lean marginally bullish. Since about the beginning of June 2019, the NVT signal for XTZ has flipped and began trending upwards. This suggests there is currently positive fundamental price pressure for the token and, potentially is a signal for the end of a bearish period of price activity which began around April 2019.

Another bullish flag is that the XTZ NVTS is at present below its price line. Historically, this pattern has often preceded short term price gains and the pieces may be in place for it play out again. Any potential on-chain volume-driven price gains will likely also be dependent on wider external market conditions.

PMR

Metcalfe’s law is a measure of the connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

Indications given by XTZ’s PMR lean marginally bearish. Unlike the NVTS, the PMR line has not flipped in recent months and remains on a downtrend. This suggests it has not yet hit a cycle floor and will continue to drop, potentially putting downward pressure on price.

A cryptocurrency’s network effects increase when new users join and strengthen the network, making it more valuable for existing users. The most direct network effects are improved liquidity and utility. More daily active users can be indicative of increased demand for Tezos staking solutions and developer interest in Dapp development. Factors like the expansion of Tezos based security token issuance may be a driver of short term user adoption and active address growth.

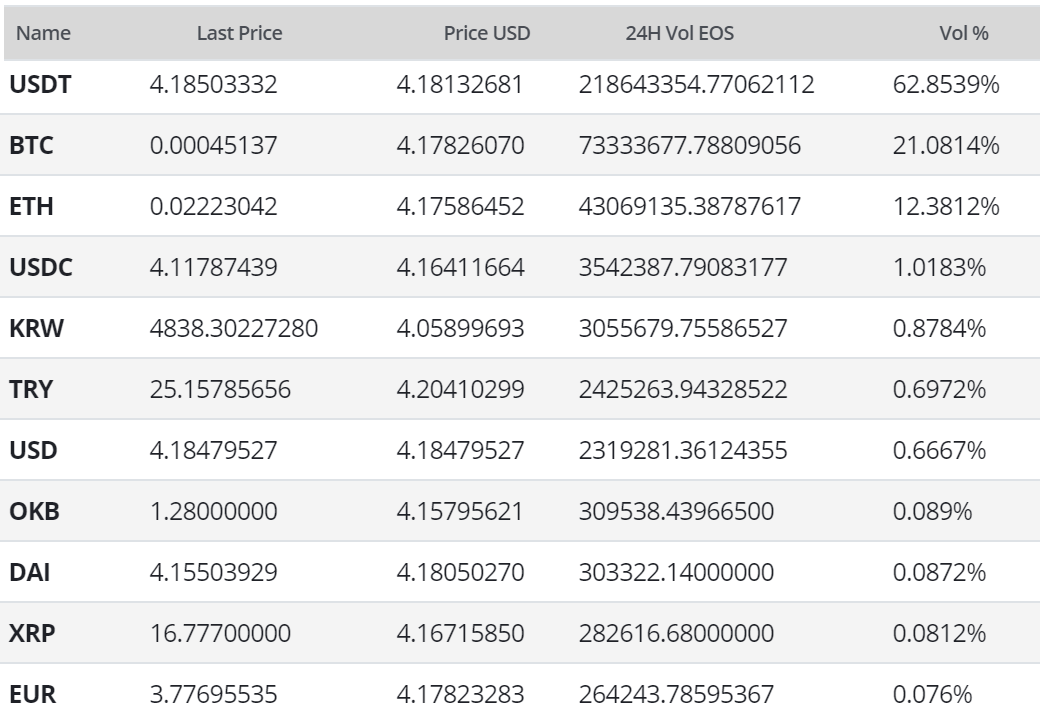

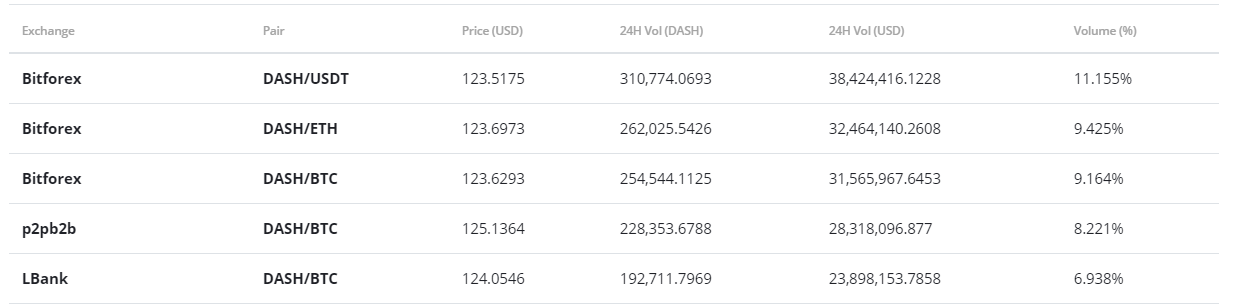

Exchanges and trading pairs

The most popular trading option for XTZ is BTC with the pair handling ~41% of the daily trading volume. The second most popular market is the XTZ/USDT stablecoin pair. Together the top two pairs make up over 65% of the daily trading volume. The total USD value of the daily volume of the entire XTZ trading market is just ~USD 2.8 Million.

A mix of exchanges dominates the XTZ trading marketplace, with 4 different platforms operating the top 5 trading pairs. The XTZ/USDT market on Gate.io is the most active in the ecosystem. XTZ is also tradeable on high profile exchanges such as Kraken and Bitfinex.

Technical Analysis

Moving Averages and Price Momentum

XTZ has experienced a strong 2019, rising ~132% and currently sitting at $1.07. Despite the positive performance, on the 1D chart, XTZ’s golden cross, which has persisted since late-April, appears to be nearing a reversal any day (black circle). Furthermore, price is currently below both 50 and 200 day EMAs, which lends more fuel to the impending death cross in the coming days or weeks.

Since the bottom, price has followed Fibonacci retracement levels fairly closely. In mid-May, price failed to break above the 1.618 level ($1.84), which has seen price melt lower ever since. Recently, price fell through the critical support level of 0.786 ($1.08). Currently, price has failed to re-break above this resistance level, which makes a retest of the 0.618 support level ($0.93) more likely. The continued lower highs and lows, i.e. downtrend (black arrow), suggest that 0.618 will not hold and a fall to 0.5 level of $0.82 is probable in the coming weeks or months.

On the 1D chart, the volume flow indicator (VFI) is currently still above 0, but trending downward. Additionally, the VFI level of 8 appears to have been historical support; including recently. If this support level holds, price will need to recover and hold key resistance levels before any new uptrend can transpire. If this support fails, that will likely be the catalyst that sends price to the 0.5 Fibonacci level, i.e. $0.82.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are bearish: price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Since mid-May, XTZ has trended strongly downward, which subsequently erased a Kumo breakout. Currently, price is beneath the Cloud and showing few signs of recovery; likely confounded by a death cross. Furthermore, RSI has been trending downward since late-March with few signs of reversal (arrow). Any reversal of fortune for XTZ would need price to breach $1.34. Given the current trend, support levels of $0.93 and $0.84 are more relevant.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are bearish: price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and price.

The slower settings offer a similar picture for XTZ with price failing its initial attempt at re-entering the Cloud and critical support level of $0.73.

Conclusion

The price of the XTZ token recently enjoyed a period of positive price activity buffered by fundamental signals sent by a pair of recently signed security tokens. The BTG Pactual and Tokensoft deals are endorsements of the Tezos smart contract platform solution and compliment recently completed protocol amendments and robust staking solutions. This suggests the still immature blockchain is continuing to progress.

However, recent internal struggles, the lack of Dapp development and minimal network effects affect the assessment of the XTZ token’s inherent value. Several barriers to growth remain, yet to be fully addressed.

The technicals for XTZ are bearish and offer few signs of revival without a demonstrable defense of key support levels. On the 1 day chart, and both setting traders, a new Kumo breakout will need price to break and hold above $1.34. Given the impending death cross, negative RSI trend, and faltering buying volume, the support levels of $0.93, $0.84, and $0.73 are likely to come into play over the coming weeks or months.

Don’t miss out – Find out more today