The Bitcoin bull run — When is the top likely?

With Bitcoin at an all-time high and firmly in a strong bull market, technical analyst Rekt Capital looks at when the bull run might reach its peak.

The crypto bull run 2021 is well underway and we often hear about where Bitcoin might peak price-wise – but we rarely talk about exactly when that could happen. To come up with a hypothesis of when this Bitcoin peak might take place it is useful to take a look at the curious role of time in the context of each of Bitcoin’s halvings.

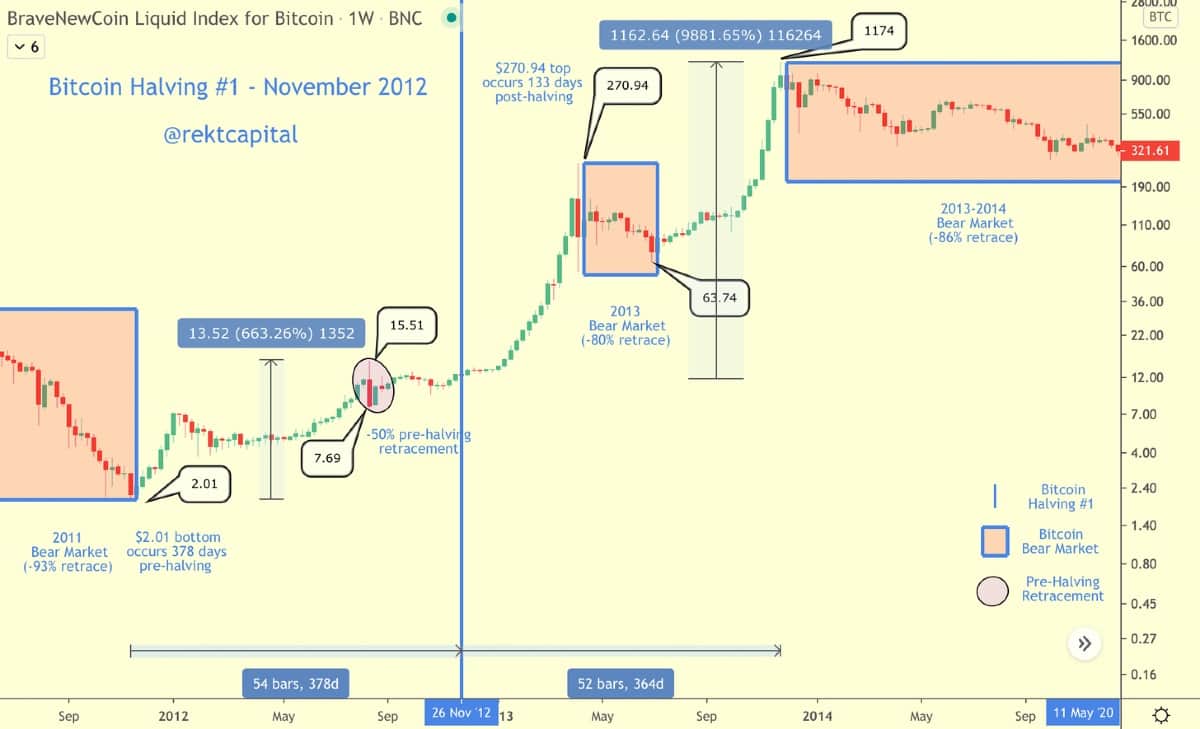

Bitcoin halving 1

How many days did Bitcoin bottom before its first-ever halving?

378 days.

How many days did Bitcoin top out after its first-ever halving?

364 days.

_It took roughly the same amount of time for Bitcoin to bottom prior to halving #1 (378 days) as it took for Bitcoin to rally before topping out after its second post-Halving #1 Market Cycle (364 days).

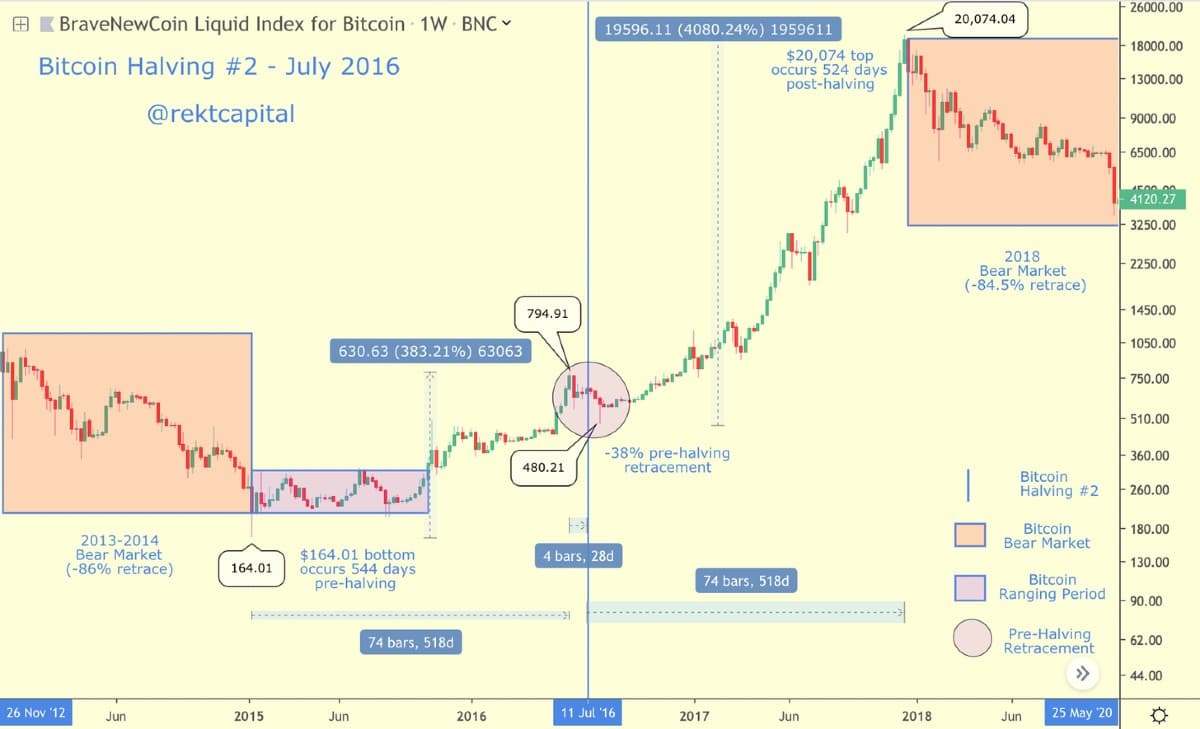

Bitcoin halving 2

This curious role of time prior to, and after halving #1 is also evident in the context of halving #2.

How many days did Bitcoin bottom before its second halving?

546 days.

How many days did Bitcoin top out after its second halving?

518 days.

It took roughly the same amount of time for Bitcoin to bottom prior to halving #2 (546 days) as it took for Bitcoin to rally before topping out after its second post-halving #1 market cycle (518 days).

Based on halving 1 and halving 2 –

It takes approximately the same amount of time for Bitcoin to bottom prior to the halving event as it takes to peak after the halving event.

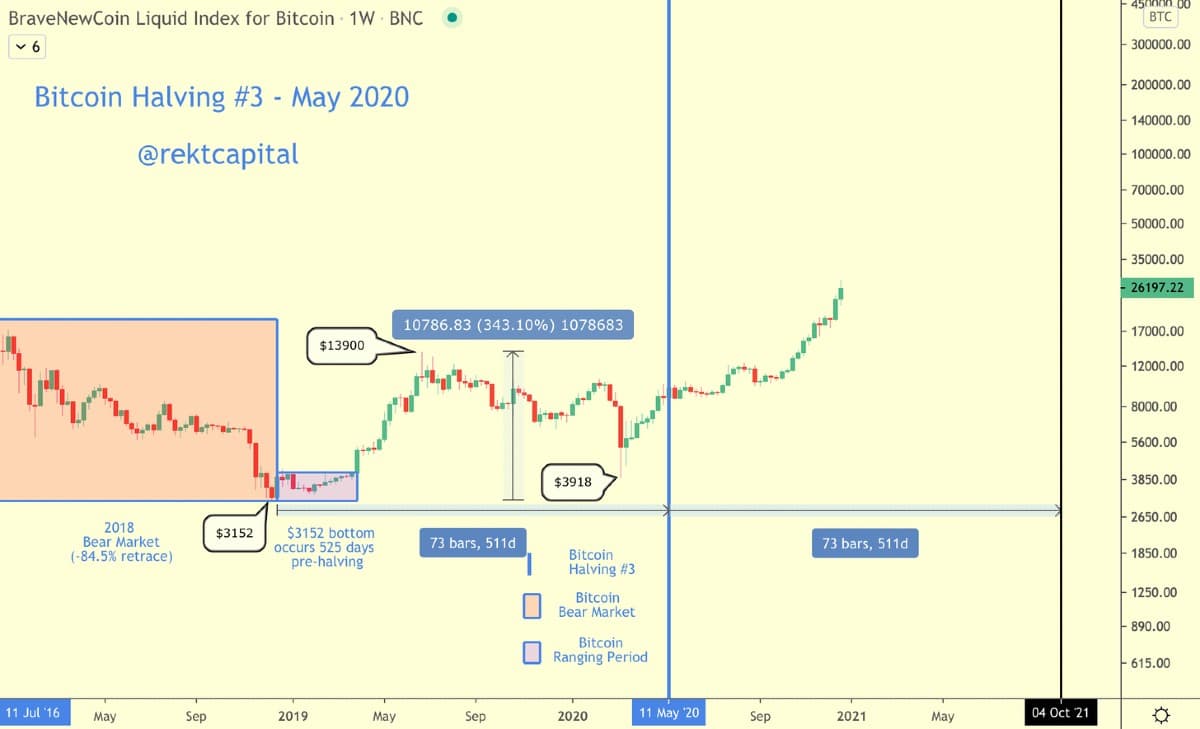

Bitcoin halving 3

What if this curious role of time continues in the context of halving #3?

Bitcoin bottomed 511 days before halving 3.

So if it takes Bitcoin 511 days after the halving to peak…

That means that Bitcoin is likely to top out in early Q4, 2021. Specifically — in October 2021.

Bitcoin to peak in Q4, 2021?

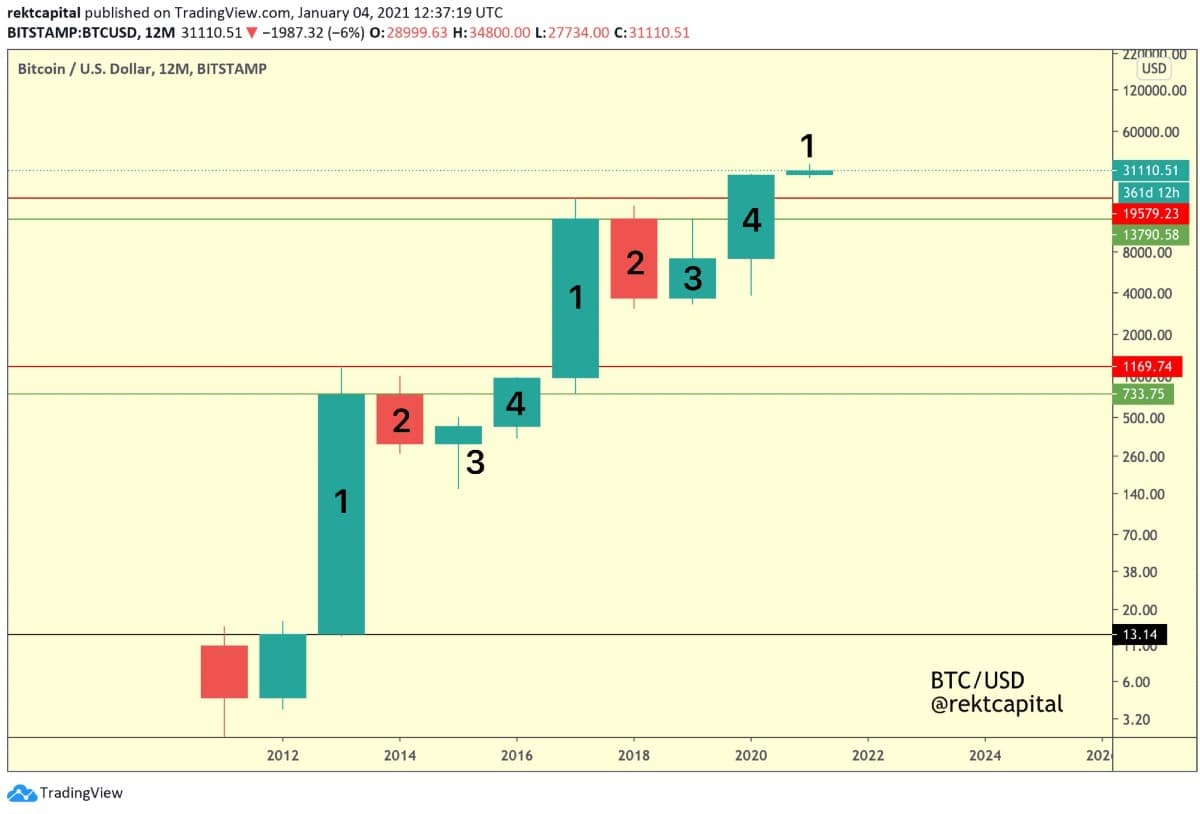

The Bitcoin Four Year Cycle theory appears to support this:

The 4-Year cycle suggests that the Bitcoin price will experience exponential growth in 2021 (i.e. Candle 1) and peak before the end of the year. After all — every Candle 1 has a short upside wick, demonstrating that price closes lower than peak.

While historically recurring price tendencies carry more weight over such temporal observations – this curious role of time in the context of Bitcoin’s halvings should not be understated.

So how long will the crypto bull market last? If this theory is correct, Bitcoin has ample room for exponential growth (with corrections along the way) before it eventually tops out in or around October.

If you liked this analysis, you’ll find value in the Rekt Capital newsletter where I feature more extensive, in-depth analysis.

Don’t miss out – Find out more today