The Bitcoin mining hardware race is on

The ASIC mining hardware manufacturing industry has so far largely been dominated by Chinese manufacturer Bitmain, which has sold equipment equivalent to about 60% of the current hashrate. However, several reputable companies have made promising announcements lately about entering the ASIC mining hardware industry with cutting-edge new equipment.

The ASIC mining hardware manufacturing industry has so far largely been dominated by Chinese manufacturer Bitmain, which has sold equipment equivalent to about 60% of the current hashrate. However, several reputable companies have made promising announcements lately about entering the ASIC mining hardware industry with cutting-edge new equipment.

Bitmain’s leading mining rig, the Antminer S9, uses a 16nm process to make a chip that is still the world’s most efficient bitcoin mining solution for the consumer market. Although S9s are sold worldwide, and account for the majority of Bitcoin’s hashrate, Antminer will only accept bitcoin cash (BCH) for their products. Packed with 189 chips each, the current batch of S9s which are due to ship on the 21st of January, sell for $1,415 worth of BCH each, and deliver a respectable 13.5 terrahashes per second (Th/S).

Bitmain’s tight grip on the market may be shaken up, however, with new entries from Japan, China and Russia accepting pre-orders for their products — with some saying their new rigs could be mining as early as December.

The first company to announce plans was the Russian Mining Company (RMC One). Co-founder Dmitry Marinichev is best known as Russia’s Internet Ombudsman and a technology advisor to Russian President Vladimir Putin. Over the summer, RMC One ran a successful ICO and raised a reported $37 million worth of bitcoin and ether to fund the development of its mining solution, which they call the Sunrise S11i. Although the 16nm process chips are still accepting pre-orders, the company claims that the S11i will provide an impressive 22.6 Th/s using only 2.3 kW, due to the large number of chips that are inside each mining rig, giving it the best-in-class efficiency.

— RMC One’s Sunrise S11i

However, RMC One is only selling their rigs for $1,600 worth of their RMC tokens, which must be bought first for those who did not obtain them in the ICO. Also, in order to use one of the Sunrise S11i, miners must join the RMC pool, which ‘charges’ 4.6 Th of the 22.6 for participation, which leaves the owner with only 18Th/s. While it may deliver more hashes for the dollar, power requirements for this rig may be too hefty for most miners.

Chinese manufacturer Halong Mining announced its flagship DragonMint 16T miner during the Thanksgiving weekend, emblazing it with a Dragon logo similar to the Dragon’s Den logo used facetiously by the Bitcoin core development community and their supporters. Shipping in March 2018, Halong claims the DragonMint 16T will be the world’s most efficient Bitcoin mining rig, delivering 16 Th/s each and running 30% cooler than Bitmain’s S9. The company says its upcoming product is the culmination of around $30 million dollars and 12 months of research and development by over 100 developers and technicians.

— Halong Mining’s DragonMint 16T

A video on YouTube shows the test results for the 16T, and Blockstream CEO Adam Back — the inventor behind the mining process that Satoshi used to create bitcoin mining — claimed he has viewed the miners in action, stating “I can confirm I have seen DragonMint’s operating in person, they are very real, specs as advertised. This is huge, biggest Bitcoin news this year.” Halong is accepting orders available for international shipping for five or more 16T units per order and accepts payment in Bitcoin.

Within a day of DragonMint’s announcement, another Chinese mining hardware company, Ebang, announced it will soon be launching the E10 line of 10nm process ASIC chips. Specifications of the upcoming model are still scarce at press time, but the company has sold earlier lines of ASIC hardware before based on a 14nm process. The company offered four models as recently as this year and their E9 Plus 9T model sold for $1,250 offering 9 Th/s.

The largest investment in ASIC mining hardware by any company to date, however, was that from the GMO Group, the largest Internet Service provider in Japan, and owner of the country’s leading Forex market exchange and bitcoin exchange GMO Coin. According to GMO Group president Masatoshi Kumagai, the company plans to invest 10 Billion yen, or about US$8.9m, over the next few years on mining hardware.

Planning to manufacture a wide range of chips and mining rigs for both their Scandinavian mining farm operation and for consumer sale, the company is currently in research and development for multiple lines of ASIC mining chips, including those with 7nm, 5nm, and 3.5nm processes. A full launch of the new business wing is planned for the first half of 2018, although GMO Group has not said if it will sell the product to its consumers first or mine for itself with its new technology.

Japanese financial services giant SBI Group is another organisation making major investments in all corners of the Bitcoin world, including mining hardware. According to its bi-yearly financial securities report, SBI Group plans to expand quickly into the cryptocurrency space with eight new business ventures. The report reveals plans for a wide range of Bitcoin and cryptocurrency products and services, and to eventually become a one-stop shop for all things Bitcoin.

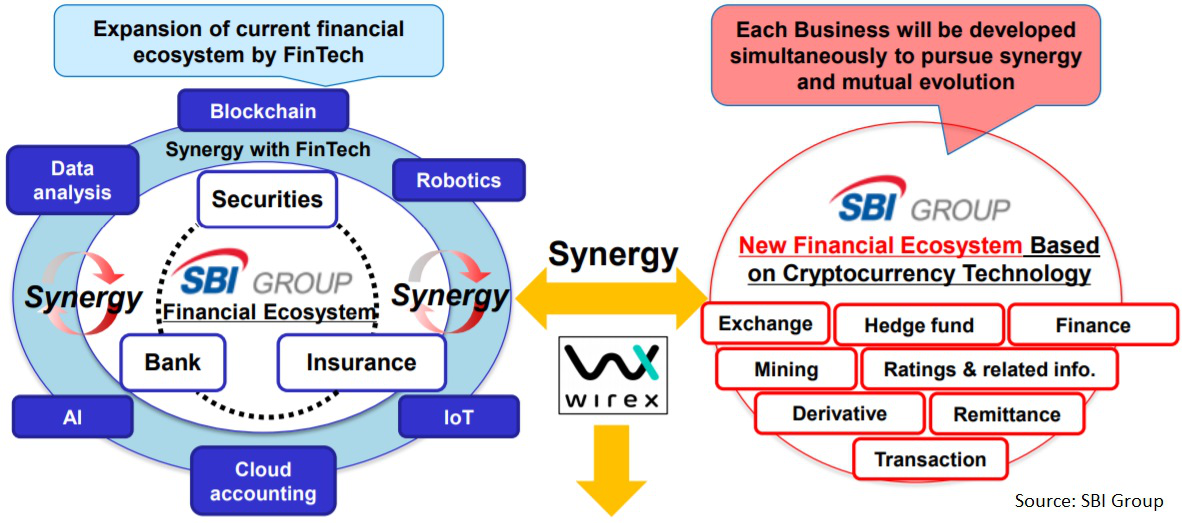

The Group already offers fintech products for an impressive financial ecosystem consisting of securities, banking and insurance products. SBI President and CEO Yoshitaka Kitao expects that cryptocurrencies will soon become a part of that ecosystem, and recently disclosed that the company is "pursuing synergies between [its] current financial ecosystem and [a] new financial ecosystem based on cryptocurrency."

The plans call for the establishment of a dominant cryptocurrency exchange platform, amid other platforms, based on the ‘customer-centric principle.’ To supply the exchange with enough inexpensive coins to do so, the plans state that they must “acquire cryptocurrency share through mining, in order to stabilize the market." However, there has been no word on when they will start manufacturing mining hardware.

Don’t miss out – Find out more today