Uniswap leads 2021’s best decentralized exchanges

Growth in trading on decentralized exchanges boomed in 2020 and is continuing its surge into 2021. So which is the best decentralized exchange, and why is the sector booming?

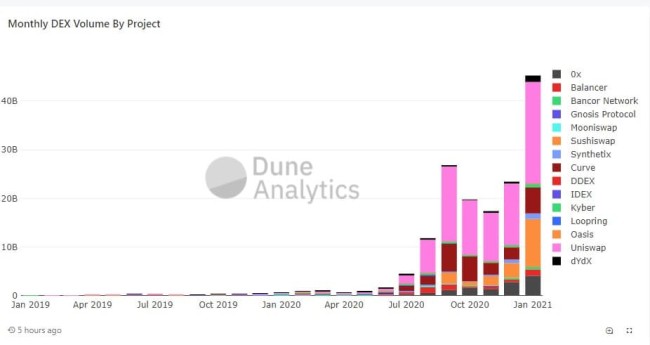

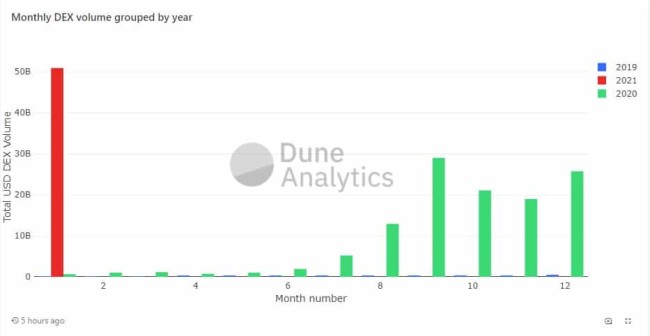

Data from blockchain analytics firm Dune shows trading volume on decentralized crypto has recently hit new all-time highs, achieving parabolic growth over the last two years. So far in January 2021, USD51 billion worth of volume has been traded on decentralized exchanges, a new monthly record.

This shattered the previous volume record of USD28.9 billion handled in September 2020. After a few early years of middling growth, inefficient solutions and a lack of market interest, the decentralized exchange space has caught fire and is now cemented as a viable alternative to centralized crypto exchanges.

This number is even more staggering when contrasted with DEX volume a year earlier in January 2020 at USD644 million, and January 2019 at USD40 million. In a year, monthly volumes in the DEX space rose 7,819%, building on growth from the previous year of 1510%. The DeFi space has been on a hockey stick growth trajectory with a handle that continues to grow longer.

Why Decentralized Exchanges are booming

The volume growth is being driven by a rising demand to trade new ERC20 tokens, accompanying a booming decentralized finance (DeFi) sector built on Ethereum (ETH). At the start of 2019 there were just five major Dexes operating, the space has since evolved to include names like Curve, Leverj, Balancer and Synthetix that offer sleeker technological solutions for decentralized trading through synthetic assets and community driven market making.

DEXs have many inherent advantages over centralized exchanges. These include stronger security, customer control of funds, improved privacy and greater financial inclusiveness. With legacy market platforms currently experiencing severe turbulence and accusations of market manipulation following the chaos of the Wallstreetbets and Gamestop incident, decentralized exchange evangelists are now saying “I told you so”.

This week popular trading app Robinhood took the drastic decision of disabling buying of certain stocks following a surge in interest on the platform to buy assets that were heavily shorted. The longs sprung up based on strategies shared on the public reddit forum r/wallstreetbets. Some of the biggest shorters of these assets were hedge funds like Melvin Capital, which are now facing mounting losses after retail traders decided to mobilize and countertrade them.

The irony of Robinhood, a company with a claimed mission of democratize wealth and giving retail traders a chance to compete on a more level field with institutional traders, essentially protecting large hedge funds has not been lost. Following the delistings, Robinhood received over 100,000 1 star reviews in an hour on the Google play store, tanking its overall rating. Google subsequently made moves to delete these negative reviews.

With users revolting against the information asymmetry in legacy markets, decentralized exchange tailwinds are now blowing even stronger. The realization of the value of truly open finance markets, where anyone can compete fairly, irrespective of starting capital or opinion – has arrived. Decentralized exchanges are an obvious beneficiary.

The best decentralized exchanges

The first generation of decentralized exchanges created a frustrating experience for users. While the blockchain-based trading and settlement processes of early Ethereum DEXs provided security and anonymity for users, traders were faced with slippage, high spreads, and all the problems associated with poor liquidity.

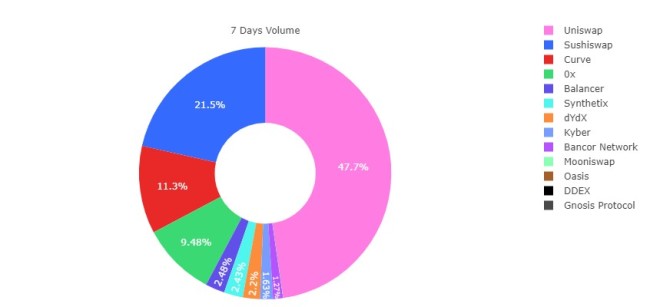

Trader enthusiasm is a good indication of which are the best decentralized exchanges and market share tells that story well, with the top four exchanges Uniswap, Sushiswap, Curve and 0x accounting for over 90% of all DEX volume. Of these, Uniswap is far and away the leader with a market share of 47.7% according to Dune Analytics. A Uniswap clone, Sushiswap, is the second largest DEX in the space – evidencing how popular the Automated Market Maker that Uniswap invented is.

As ‘next generation’ Ethereum DEXs, Uniswap, Balancer, and Curve offer traders a similar KYC-less and transparent blockchain-based trading system but with more stable pricing, better UX/UI and an overall less frustrating trading experience. Part of how they have done this through the usage of shared liquidity pools and algorithmic pricing models. In addition, the business models used by these modern DEXs are also popular with market makers because they offer an additional yield based income for liquidity providers, creating a win-win situation for both sides of a decentralized marketplace.

What is Uniswap?

The main driver for the rising prominence of decentralized exchanges has been the success of Uniswap, an open-source project developed by Hayden Adams that allows users to swap in and out of ERC-20 tokens. Adams built the protocol based on ideas expressed by Ethereum founder Vitalik Buterin and announced the platform via a Twitter post on November 2nd, 2018.

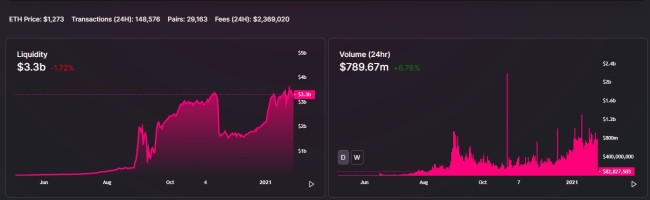

Daily trading volumes hit USD2.19 billion on October 26th, 2020 – which was a new all time high for the platform that grew aggressively in the second half of 2020. To put this in perspective, Uniswap’s daily trading volumes now exceed popular centralized exchanges like Bittrex, FTX, and Bithumb. Data from Dappradar shows that there were about 29,200 active wallets interacting with the platform in the last 24 hours.

Uniswap protocol is built as a decentralized marketplace of various Ethereum token trading pairs, with automatic liquidity provision. Each pair on the platform is composed of liquidity reserves of two tokens on an equivalent 1:1 value basis and is managed by a separate smart-contract. The model allows any user to become a liquidity provider (LP) for a given pair if they provide the appropriate reserves to the pair’s pooled assets.

Users who provide liquidity for token pairs earn LP shares proportional to their services which can be redeemed at any time for the underlying tokens they represent. The 0.3% trading fee charged by Uniswap is also distributed equally amongst the LPs in a given pool.

Uniswap’s DEX uses an alternative to the traditional order-book based method used by most exchanges. Prices for token swaps are decided by a deterministic algorithm, called an automated market maker (AMM) which automatically sets and balances the pricing for a pair depending on the demand for a token and the available liquidity of each of the tokens in a pool.

The Uniswap model is an example of a non-custodial AMM. User deposits for trading pairs are pooled within a smart contract, which any trader can then leverage for token swap liquidity. Thus, users trade against the liquidity available in a smart contract (pooled assets) as opposed to directly with a counterparty as they would in traditional order book based exchanges. This method helps traders find swaps even when pairs are illiquid and is a barrier against traditional DEX issues of front-running and manipulation.

In May 2020, Uniswap V2.0 was launched and implemented a number of key protocol changes. Prior to V2.0 Liquidity pools on Uniswap had to be created with ETH and an ERC20 token, V2.0 enabled arbitrary trading between ERC20 tokens meaning pools could be created with just two ERC20 tokens and no ETH. Despite the availability of arbitrary trading between ERC20 tokens, the majority of top 10 trading pairs on Uniswap contain ETH. The two pairs in the top 10 are Frax (FRAX)/USDC and (Hong Kong Monetary Token)HMT/USDT.

The update also added price oracles that allowed other contracts to estimate the time-weighted average price of a pair over a given interval, and flash swaps which allow traders to receive assets and use them elsewhere before paying for them later in a transaction.

The platform has seen a sharp surge in liquidity and 24-hour trading volumes in the last month. Source: Uniswap.info

Stablecoins, which offer excellent yields for liquidity providers and are needed to participate in leading Defi earning schemes like Yearn.Finance’s Ypool lending pool are counterparties to some of the most popular trading pairs on Uniswap.

Rise of the Defi token

Additionally, the native tokens of defi protocols like Compound (COMPOUND), Aave (AAVE) and Synthetix (SNX) are also heavily traded tokens on the platform. During the DeFi summer of 2020, when the total value locked into DeFi first hit USD1 billion and the monthly volumes traded on decentralized exchanges first hit USD1 billion, a wave of popular new altcoins hit the market. The launch of tokens like YFI, UNI, and DPI, which initially were only available for trading on decentralized platforms such as Uniswap, drove users to the platform. Many stayed and traded on the platform after initially being tempted to trade specific DeFi tokens.

These DeFi tokens are designed to act as governance tokens that empower holders to vote on proposals to update the DeFi protocols they are native to. In recent times they have gained value as speculative assets.

For example, the native tokens of the DeFi protocols Aave (AAVE), Synthetic Network (SNT), and Compound (COMPOUND) rose ~430%, ~365%, and ~87% respectively in just the last six months. UNI, the governance token of decentralized exchange protocol Uniswap, rose 324% over the same period and currently has a market cap of USD4.15 billion. The price of UNI recently hit a new all-time-high of ~USD15.50.

Increasingly DeFi projects like these are also choosing to launch native tokens on DEXs like Uniswap. DEXs allow tokens to access a trading marketplace without paying the hefty listing fees charged by centralized exchanges. They are permissionless, allowing any Defi builder or token community to make use of a publicly available trading infrastructure to launch tokens and create liquidity for a token via decentralized smart contracts. Uniswap has also gained new users in recent months because it is often the only place to buy or sell a particular DeFi token that may be unavailable on centralized exchanges.

Don’t miss out – Find out more today