Tron Price Analysis – Platform redefines itself as a fee free DeFi alternative

The Tron price is up over 90% so far in 2020 as fundamentals for the project have been boosted by an emerging DeFi sector and the debut of Tron 4.0.

Tron (TRX) is a platform blockchain with its own native currency TRX, that enables smart contracts and decentralized applications to be built on it. The project was founded by Chinese entrepreneur Justin Sun in 2017 and raised USD70 million in 2017 shortly before China banned Initial Coin Offerings (ICOs). The development of Tron is now managed by the Singapore based Tron Foundation with Sun in the position of CEO.

The Tron price is currently ~USD0.025 and the TRX token has enjoyed a strong 2020 so far, up ~92.5% year-to-date. Big Tron news this year has been the launch of the 4th full version of its native protocol and Tron moving more into the DeFi protocol space to challenge smart contract rival Ethereum (ETH).

After initially crowdfunding using the ERC20 token standard on the Ethereum platform, Tron launched its own mainnet platform with TRX as its native token in May 2018. In August of that year the Tron virtual machine (an adapted version of the Ethereum Virtual Machine) was officially launched, which allowed developers to test and execute smart contracts.

The Tron blockchain is broken up into three layers, a core layer, an application layer, and a storage layer. The core layer computes instructions provided in either Java or the Solidity smart contract language and executes programming logic. The application layer is utilized by developers to create applications powered by the TRX token. The storage layer is designed to store blockchain data and network state data, which preserves the status of smart contracts.

Tron smart contracts run on a dual-format system. There is an option to freeze TRX tokens (stake) to access network energy and bandwidth, foregoing standard TRX based individual smart contract operation gas fees. This lets users conduct transactions on Tron without paying fees, as long as they are willing to freeze tokens for a period of time. This system has given Tron appeal as a cheaper alternative to smart contract platforms like Ethereum where gas needs to be paid for each computational effort on the network.

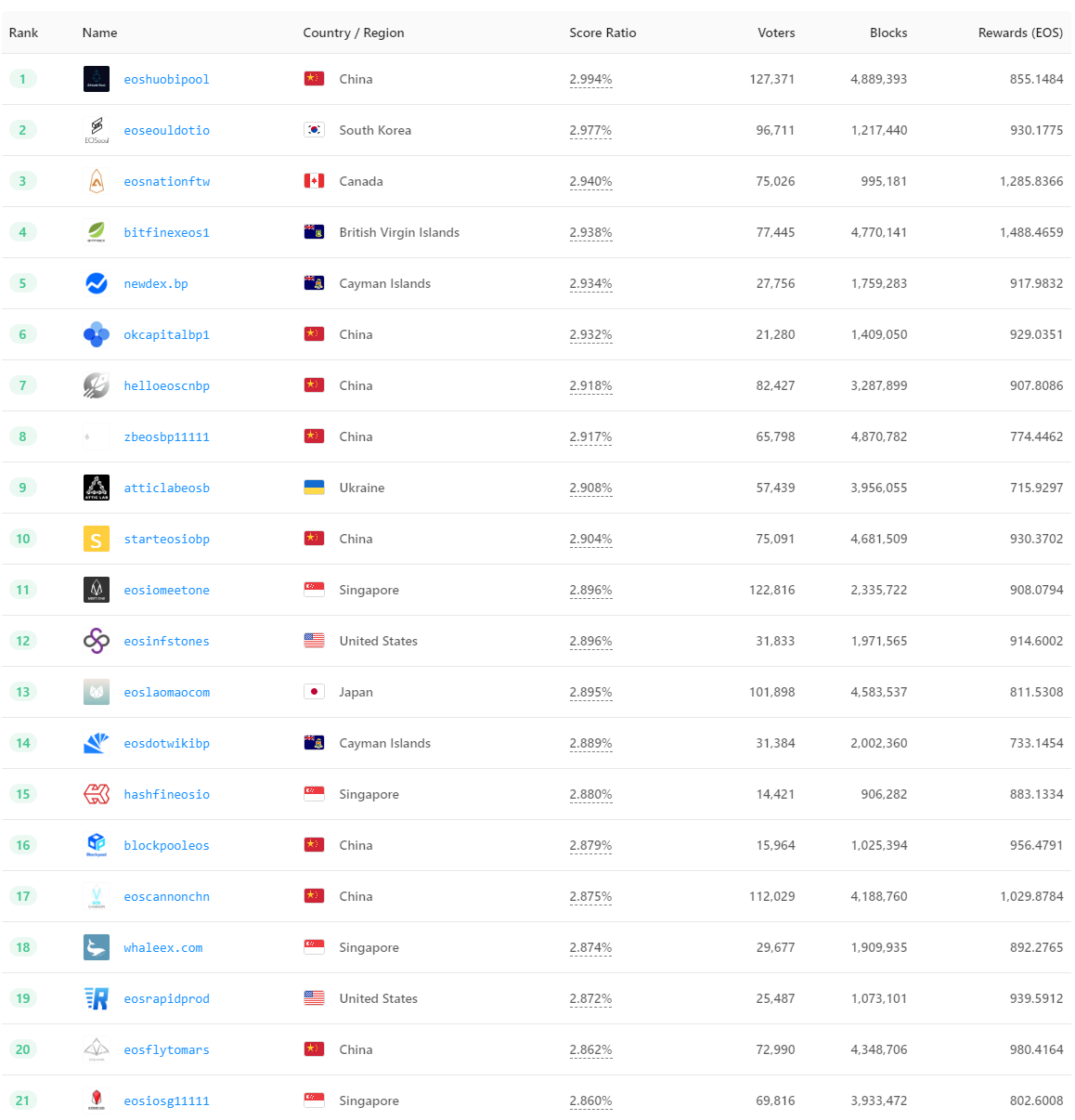

For consensus, Tron uses a modified version of Delegated Proof of Stake (DPoS) called Tron Proof of Stake (TPoS). There are three types of nodes within the Tron network – Witnesses (Super Representatives), Full Nodes, and Solidity Nodes. A Witness is responsible for block production, a Full Node provides APIs and broadcasts transactions and blocks, and a Solidity Node synchronizes irrevocable blocks and provides inquiry APIs.

Super Representatives (SRs) represent the ‘delegated’ aspect of the Tron consensus model. There are 27 Super Representatives that can be picked from a pool of 127 possible candidates. The 27 are selected every six hours to perform their tasks. The pool of 127 possible block producers is selected by the entire TRX token holding community. TRX holders can vote for Tron SR candidates by freezing their tokens and can divide their votes between up to five SRs. The election is done through a six hour window voting cycle. At the end of each cycle, the 27 SRs receiving the maximum number of votes are elected. Super Representatives (SR) set a reward rate. Depending on this rate, they will redistribute some of their earning to their voters. Stakingrewards.com estimates the annual rewards for TRX holders voting for Super representatives to be 3.34%.

The 28th to 127th candidates become Super Partners (SPs). SRs are responsible for producing blocks and packing transactions while SPs only receive voting rewards and do not have to perform the tasks that SRs do. Super Partners and Super Representatives have the right to raise proposals to modify parameters on the Tron network.

The Tron network generates a block every three seconds, with each block awarding 16 TRX to Super Representatives. With every block produced, the top 127 share 160 TRX. This reward is split based on the votes each candidate receives. There will be no inflation on the Tron network before January 1, 2021 and the Tron Foundation will award 100% block rewards and candidate rewards before that date.

The Tron representative voting model has potentially been rigged in the past with accusations of vote-buying by candidates emerging from the community. There have also been issues with low voter participation and turnouts. Former Tron foundation CTO Lucien Chen said in a now-deleted Medium post that his decision to leave his position was because the network had become ‘overly centralized’ and that Tron’s current direction and state was an ‘irreconcilable contradiction’ to the original Tron ethos to ‘decentralize the web’. He blamed these issues on the TPOS model and the control over the network direction that the 27 Super Representatives exert.

The fourth major iteration of the Tron blockchain was unveiled on the 7th of July 2020.There were four core new features added to the protocol as part of the Tron 4.0 update. These were:

- The TRONZ Smart Contract protocol, that is said to be the first privacy enabled smart contract utilizing Zk-Snarks supported by a virtual machine.

- A modified version of the TPoS model that will combine Delegated Proof-of-Stake and Practical Byzantine Fault Tolerance (PBFT) to reduce block confirmation times from 57 seconds to three seconds.

- A new TICP cross-chain protocol that will enable Tron protocol developers to initially connect with three other public blockchain platforms.

- A financial institution and enterprise blockchain solution that will allow financial institutions and business developers to deploy custom blockchain applications on the Tron protocol.

The team behind the private smart contracts, TronX state that the protocol upgrade “will not make TRX anonymous in any way, nor will it have added privacy features.” It will, however, allow developers to add shielded transaction features to custom TRC-20 contract tokens through adding a smart contract to them. TRC-20 is a technical standard used for smart contracts on the Tron blockchain that allows developers to implement custom tokens.

TRONZ explains that zk-SNARKs for TRC-20 smart contract tokens will come in three forms, mint, transfer, and burn. Mint converts any TRC-20 from shielded to unshielded. Transfer shields TRC20 transactions to hide the transaction amount and addresses of the sender and recipient. Burn converts a shielded TRC20 token into a public one.

In June 2018 Justin Sun purchased the BitTorrent protocol for a reported USD $120 million beating off competition from other notable buyers like the NEO blockchain project. Since the purchase, BitTorrent has been integrated into the Tron platform utilizing Bittorrent Speed – an application that runs on top of the BitTorrent client Utorrent. It offers users rewards automatically for seeding files to BitTorrent in the form of BTT tokens, a utility token that uses Tron’s TRC-10 token standard. When downloading torrents, BitTorrent Speed automatically bids BitTorrent (BTT) to other users for faster speeds.

Source: Dappradar.com

As per data from Dappradar.com, the top Dapps on the Tron platform are a mix of high risk (these appear to work like pyramid schemes), gambling, and decentralized finance applications. Gambling Dapps have been historically popular on Tron because the blockchain’s gasless transaction model allows users to have as many turns as possible during gaming sessions.

Decentralized finance applications offer financial services like lending, trading, and synthetic asset issuance through blockchain-enforced smart contracts. DeFi is permissionless and programmable, allowing developers and users in the space room for financial experimentation at the speed that lightweight software can be built, without any major constraints around regulation.

DeFi has exploded in popularity in the second half of 2020 and Tron’s main rival, the Ethereum platform, has been the primary sandbox for builders. Apps like Uniswap, YFI, and Aave have surged in popularity as Ethereum’s users have clamored to offer them liquidity and buy a share of their governance rights. Demand to interact with these DeFi protocols has led to all time highs in transaction fees, volume, and miner revenue on the Ethereum platform in recent months.

Tron is now attempting to establish itself as a viable DeFi platform alternative to Ethereum, with protocols like the Justswap DEX, 2nd on the Dapprader list, which uses the automated market maker pricing model and Liquidity Provider (LP) token model popularized by Uniswap. Liquidity on the platform is now over USD250 billion and daily trading volumes sit at ~USD19 million. While similar to Uniswap in many ways, Justswap appears to primarily target the Chinese crypto community. The livestream celebrating the launch of the DEX attracted 763,000 viewers on the Chinese periscope variant, Yizhibo.

Justswap was the first of a number of Tron Dapps that mimic DeFi protocols already created on the Ethereum platform. Pearl.finance, Salmon.finance, and Carrot.finance, all built on Tron, feature liquidity mining incentives that entice investors to deposit TRX into liquidity pools operating the protocols to mint a governance token. These protocols mirror governance token issuance solutions first built on Ethereum – like Compound, YFI, and Sushiswap. Tron’s gasless transaction fee model also offers users a reprieve from the ballooning gas fees on Ethereum, where single operations have cost as much as USD60 in recent times.

In the last month the SUN genesis mining program was launched to offer new mining options for tokens like TRX, BTT, JST, WIN and the platform’s native governance token SUN. The SUN platform is planned to be an incentivization layer for Tron’s DeFi ecosystem and a transit center of crosschain assets. Currently users can also earn SUN by staking JustSwap’s SUN/TRX, JST/TRX, and USDT/TRX Liquidity Provider (LP) tokens.

The SUN token will be the first token to be released on the Binance exchange’s newly-launched Innovation Zone. The Innovation Zone is described as a “a dedicated trading zone where users can trade new, innovative tokens that are likely to have higher volatility and pose a higher risk than other tokens.”

Reaction to Tron’s recent foray into DeFi has been mixed, with users on Western social media platforms suggesting the network is too centralized to truly offer DeFi and accusing it of attempting to jump onto a bandwagon.

Source: Tronscan.io

Total daily transactions have been on an uptrend since July with a number of pronounced spikes during this period. The total daily transactions currently hover around 1.9 million a day which is well below the all-time high of 5.2 million transactions a day hit in July 2019

Source:Tronscan.io

Like total transactions, daily active accounts on the Tron network have been on a consistent uptrend in the last few months. It also appears that during this period the metric is less prone to spiking and dropping. This may suggest that there is now a more consistent base of users returning to interact with the platform daily.

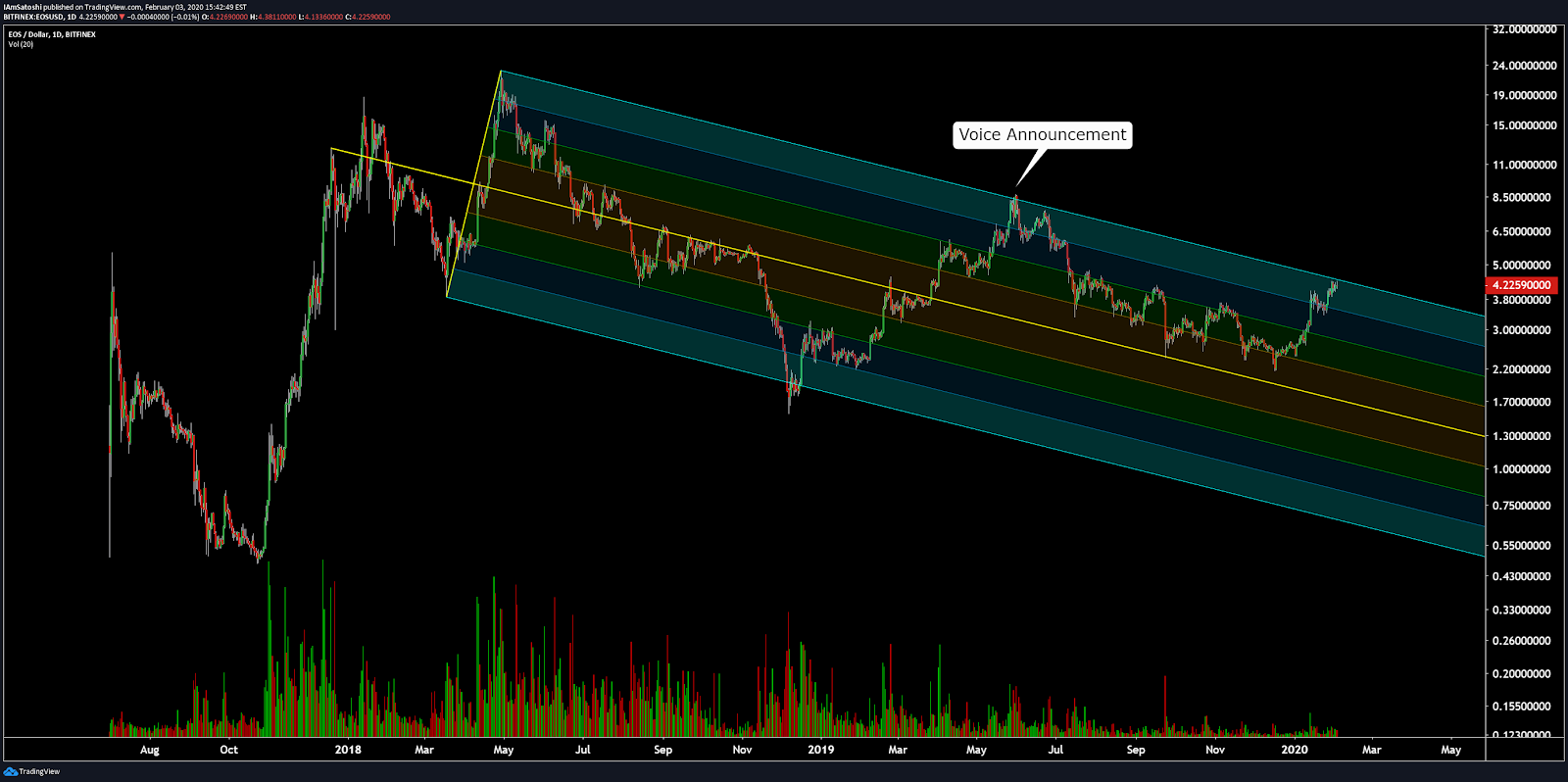

Tron technical analysis

Currently, TRX is trading at $0.025. On the 4-hour chart, price seems to be finding a local bottom as it is forming an accumulation pattern at its current level. Currently, the relative strength index (RSI) is recovering strongly and signaling a bullish divergence. Additionally, price is currently bumping into its downtrend resistance, thus if it can breakout, price is likely to retest Cloud resistance of $0.029.

However, the volume flow indicator (VFI) is still trending downward and recently fell below 0 (bearish signal). Additionally, price remains demonstrably beneath the Kumo Cloud, which suggests the overarching trend is bearish, i.e. price bounces are likely to fail at Cloud resistance levels. Thus, if the bullish divergence gains momentum, price gains will likely be capped at $0.029 (Cloud resistance).

The 1-day chart offers a more optimistic outlook with price still above the Kumo Cloud, i.e. Kumo breakout. Currently, price is trading near critical Cloud support, which has held to-date. Additionally, RSI is currently at a level where it has found support recently, but still not within oversold levels.

The confluence of RSI approaching oversold and Kumo support on the daily chart might be enough to stave-off the current price downtrend on the 4-hour chart. If so, price could look to retest $0.029 in the near-term. However, if TRX enters the Cloud on the daily chart, near-term targets of $0.022 are likely, with deeper losses back to $0.02 on the table if price falls beneath the Cloud.

Don’t miss out – Find out more today