The transition to digital currencies and decentralized finance is accelerating

The COVID-19 pandemic has accelerated a number of pre-existing trends, including remote work, home-schooling, the transition to digital currency, and the adoption of crypto trading.

The COVID-19 pandemic has killed over two million people globally and impacted the lives of everyone on the planet. Planes have been grounded, borders have closed, and unemployment has surged as governments have been forced into implementing lockdown procedures to stem the spread of the virus. As a result, the global economy has experienced a downturn. In response, central banks have printed money and injected it back into the system to prop up asset prices.

The COVID-19 pandemic has accelerated a number of pre-existing trends, including remote work, home-schooling, nationalism, crypto holders, social isolation, and distrust in governments and institutions. Last week’s Robinhood GameStop saga has added rocket fuel to some of these trends with a new generation of internet users losing faith in the government and the existing financial system.

The future is decentralized

The current legacy financial system is slowly being disrupted by decentralized finance. 20th-century backends can’t keep up with 21st-century workloads. In the digital world, the new generation simply won’t accept solutions that aren’t fast, seamless, global, and frictionless.

Technology forecaster Balaji Srinivasan says that we already have digital books, music, mail, and games. Digital gold and digital finance are next. “Regulations have slowed the advance of the internet into finance, healthcare, education but they can’t stop it. And smart states will adopt it,” he says.

Just as the internet made it possible to turn desktop software into web services, crypto is gradually making it possible to turn more products into protocols. The first example of this is DeFi’s disruption of FinTech.

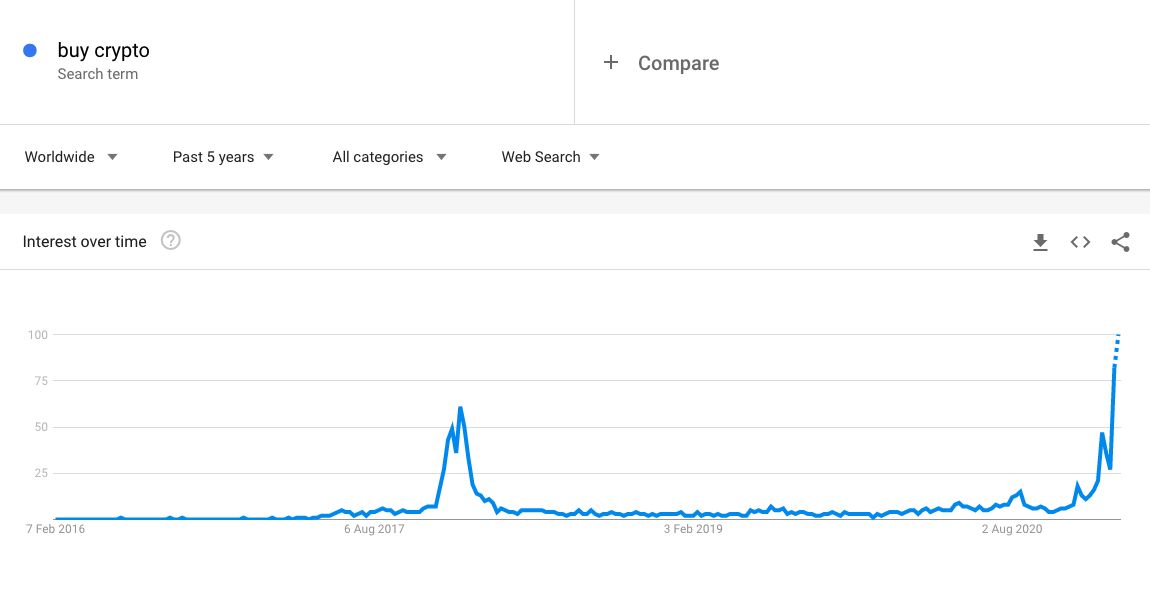

The 2021 crypto bull run is helping to accelerate these trends. As new users set up accounts at crypto exchanges and make their first purchases of crypto assets the transition to a decentralized blockchain economy has begun.

Source: Google Trends

Crypto makes payments contactless

Banknotes, whether made of paper, polymer, or cotton and linen as is the case with the U.S. dollar, can carry viruses. This was confirmed by the World Health Organization (WHO) in comments to The Telegraph, and in a study from Germany which found the Coronavirus can survive on notes, coins, and the plastic exteriors of ATMs for several days.

Yang Dong, Director of Blockchain Research at China’s Renmin University, says this means it is time to roll out the digital yuan.

"Institutions and individuals will be more inclined to use non-direct contact transaction media including digital currencies in a short period of time, and this tendency will quickly form a user stickiness. Digital currencies will use this as an opportunity to accelerate Its distribution and application," said Dong in an interview with the local newspaper China Daily.

An inflection point for virtual currency

Most transactions in China are already conducted digitally using WeChat Pay or AliPay. But as China-based blockchain consultant Robert Van Aert told Brave New Coin, the "social governance" aspects of a government virtual currency—which might feed into a social credit system—could prove helpful for keeping tabs on quarantined citizens.

In the rest of the world, the focus on improving personal hygiene makes virtual cash an attractive proposition.

As the virus has spread and citizens have been placed under lockdown, paper notes have followed. Banknotes have been disinfected with ultraviolet light and high-temperature ovens in China, and placed in a 14 day quarantine period in places as far afield as Hungary and the U.S.

If the trend continues and prompts widespread distaste for physical cash, the credit card industry is likely to benefit, along with payment firms like PayPal, and card-issuing banks.

World’s largest payment processor launches Crypto services

On October 21st, 2020, Paypal announced that it would launch a new service enabling users to buy, hold and sell digital assets. In a blog post announcing the launch of the new functionality, Paypal explained the rationale behind the decision. “The migration toward digital payments and digital representations of value continues to accelerate, driven by the COVID-19 pandemic and the increased interest in digital currencies from central banks and consumers.”

Paypal also hopes to significantly increase the utility of digital currencies by making them available as a funding source for payments to their 26 million merchants worldwide. The Paypal CEO said that a shift to digital currencies is inevitable as they offer clear advantages of financial inclusion and access; efficiency, speed, and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly.

Momentum for Paypal’s crypto product is growing. On January 12th, Paypal cleared USD242 million in crypto sales through its exchange partner ItBit, more than double its previous trading record. On January 15th, Mizuno analyst Dan Dolev upped his price for Paypal Holdings inc. (PYPL) Stock from USD250 to USD350 specifically citing the positive reaction to Paypal’s new crypto services. "Both our survey and management commentary unveil a dramatic increase in engagement due to crypto," Dolev said. "As evidence, PayPal recently said that 50% of its crypto users are opening the PayPal app daily."

CBDC’s come into focus

On the other hand, if authorities recognize the opportunity to seize tighter control over the economy, governments could be galvanized into releasing their own central bank digital currencies. This would enable a new era of economic experimentation as governments tighten the reins around the currency to drive through unpopular economic measures like quantitative easing and negative interest rates.

Agustín Carstens, the General Manager for the Bank for International Settlements and noted Bitcoin critic recently responded to the question “Do we need new digital currencies? If so, who should issue them?”

Speaking at the Hoover institution policy seminar on 27th January 2021, Carstens began by explaining that there have been numerous advances in information technology and communications. He added, “the Covid-19 pandemic may have further accelerated the pace of digital change.”

Carstens, however, suggests that central banks must control the issuance and management of digital money. This is because they have the structure to support digital currency. “For digital money to exist, the central bank must play a fundamental role, guaranteeing the stability of the value, ensuring the elasticity of the aggregate supply of said money, and overseeing the general security of the system,” he said.

During the same speech, Carstens bashed Bitcoin saying it is “more of a speculative asset than money” and that Bitcoin is like “Tesla without the cars”. “Above all, investors must be cognisant that Bitcoin may well break down altogether. Scarcity and cryptography alone do not suffice to guarantee an exchange,” he said.

Crypto Cybercrime escalates during the pandemic

Cybersecurity specialist Kaspersky has predicted a rise in crypto crime as a result of the pandemic hitting national economies. In a recent report assessing financial threats for 2021, the firm explains that weakening local currencies as a result of the pandemic will drive more bitcoin theft and fraud.

It also suggests that a greater number of cybercriminals may use transition currencies with privacy features like Monero as a more efficient way to cover their tracks. This shift will occur because of the improved capabilities of national governments’ ability to track and seize illegal payments that involve Bitcoin. Kaspersky cites the recent capture of funds by the US department Department of Justice from an account believed to be associated with Silk Road.

Ransomware attacks are also expected to continue in 2021. In the last year smartwatch maker Garmin, Foreign exchange company Travelex, alcohol producer Campari, and the Baltimore public school system were subjected to ransomware attacks where hackers threatened to shut off or expose computer systems they had gained access to unless they were paid a ransom in crypto.

Don’t miss out – Find out more today