Binance vs Coinbase: The biggest exchanges compared

As the Bitcoin price hovers around its all-time-high, many new buyers are looking to open a crypto exchange account for the first time. This article compares the offerings of the two biggest crypto exchanges and reveals why one might choose to trade on one versus the other.

For both new and existing crypto traders and investors, the Binance or Coinbase question can be difficult to answer. There are a multitude of factors to take into consideration: fees, fiat onramps, coins available to trade, margin trading, regulatory compliance, etc.

The two exchanges are the most popular in the crypto industry and both are available to US customers. As the US is the single largest market for cryptocurrency, the way exchanges position themselves in this market is particularly important for themselves and for traders and investors. This article provides a helpful guide to answering the Binance vs Coinbase question – specifically from the perspective of US residents – and examines the offerings of both exchanges.

Binance and Binance US

Binance was founded in 2017 by ex OKCoin CTO, Changpeng Zhao (CZ), who raised US$15M to fund the company through an initial coin offering. The token sold was Binance Coin (BNB), which initially gave discounts on trading fees for users who held the token in their exchange wallet. BNB has been developed into an entire ecosystem since then – BNB coin has its own purpose built blockchain, is used to buy into Initial Exchange Offerings (IEO’s), and has many other applications within the Binance ecosystem.

Binance has also launched two native blockchain networks, the Binance chain (BC) and the Binance smart chain (BSC). The Binance chain powers Binance’s decentralized asset exchange and is based on a high performance matching engine built on distributed consensus. The Binance smart chain allows users to build decentralized apps and digital assets. It is compatible with Ethereum’s Virtual Machine (EVM.)

Binance’s rapid growth since 2017 has knocked several smaller exchanges to the wayside — taking market share from Bittrex, Poloniex, and other similar altcoin-focused platforms that couldn’t match its security standards, user-interface, and range of cryptocurrencies offered. The exchange has built its reputation and much of its popularity based on the broad range of alternative cryptocurrencies or ‘alt-coins’ that can be traded on it.

In September 2019, Binance launched Binance US, a version of the exchange meant specifically for US customers. Due to the lack of clear federal & state regulations in the United States (especially when it comes to securities legislation) operating a compliant crypto exchange in the US is a challenge to say the least. Given that, Binance US is a scaled-back version of the ‘original’ Binance exchange, with more stringent Know-Your-Customer (KYC) and Anti-Money-Laundering (AML) requirements, fewer trading pairs, and no margin trading.

Catherine Coley, the CEO of Binance US, spoke to Brave New Coin about some of the product design choices the exchange has made. She says Binance US took a hybrid approach to trade types – realizing they were not interacting with a single ‘type’ of user in the US. For example, for ‘entry level’ traders, Binance US offers one-click Buying and Selling on its website – and for “extreme and experienced” traders offers more advanced order types, and API trading.

Coley says the challenges of opening a crypto-asset exchange in the United States are not regionally unique but some of the challenges are unique to crypto. “It’s about education, UI/UX, and really just letting people know what crypto is all about.”

Coinbase and Coinbase Pro

Coinbase is one of the oldest and arguably the most well-established crypto exchanges in the industry and has over 30 million customers. It was first founded in 2012 by Brian Armstrong and Fred Ehrsam and is based out of San Francisco in the US. Coinbase has raised approximately US$550M since its inception from a number of high profile investors, including Andreessen Horowitz and Tiger Global Management. The company was also the first crypto company to become a ‘unicorn’ – a company that’s valued at more than US$1B.

Like Binance, Coinbase offers instant buy and sell services on its main site, and exchange trading occurs under the Coinbase Pro brand (formerly known as GDAX) which offers a wider range of coins. Since the company was founded in the US, compliance with US regulations has always been a priority for the exchange. As such, its KYC and AML policies are among the strictest in the industry.

The Coinbase IPO

Coinbase announced on December 18th that it had submitted a draft registration statement on Form S-1 with the Securities and Exchange Commission (SEC) for a Coinbase Initial Public Offering (IPO). Form S-1 is the initial registration form for new securities required by the SEC for US companies that want to be traded on national exchanges like the New York Stock Exchange (NYSE). Coinbase has announced plans to go public via a direct listing. This means, just like other leading public offerings in recent times from Spotify and Slack, Coinbase will sell its shares directly to the public without an intermediary. The Coinbase registration is currently being reviewed by the SEC and there is no confirmed date for the company’s IPO.

Who can trade on Binance US?

Binance US has recently permitted residents of Florida, Alabama, North Carolina, Georgia and Alaska to trade on the exchange – bringing the total number of states that can trade to 42. Binance US still restricts users from the following states from trading on the exchange: Alabama, Connecticut, Hawaii, Idaho, Louisiana, Texas, Vermont, and Washington.

Binance verification levels

Binance’s ‘basic’ level of verification allows for up to US$5,000 to be withdrawn per day and requires users to share their name, gender, date-of-birth, address, and social security number. Approval for the basic level typically takes a few minutes and allows individuals to start buying and selling cryptocurrencies. Advanced verification, which allows users to withdraw up to US$1M per day, requires a user to submit the same information as the basic verification as well as a photo of their ID (driver’s license, passport, green card, or state ID) and proof of address (bank statement, utility bill). According to user feedback on Reddit, advanced verification for Binance can take up to 100 days or more. Binance US cites record volumes and increased applications as the factors behind the longer wait times.

Who can trade on Coinbase Pro?

For Coinbase Pro users based in the US, there is no ‘basic’ verification option, and all users must go through the full verification process. In order to trade, a user must submit the following information: name, date-of-birth, address, social security number, source of funds, income/employment information (US only) , and explanation of activity (US only). In addition to this, a photo of the user’s ID (driver’s license, passport, green card, or state ID) and a selfie are required. Coinbase Pro account holders have a daily withdrawal limit of US$25k / day, which applies across all currencies.

Fiat onramps for Binance US

Until 2019, there were no fiat on-ramps for Binance which restricted the number of people that the exchange appealed to. During the 2017 cryptocurrency bull run, the likes of Coinbase and Gemini remained the preferred fiat gateway for those buying bitcoin in US dollars. However, in 2019 Binance integrated with Simplex to provide a fiat gateway via credit card. Binance US supports deposits and purchasing via bank transfer (ACH), debit card, or wire transfer, and withdrawals via bank transfer.

Fiat onramps for Coinbase Pro

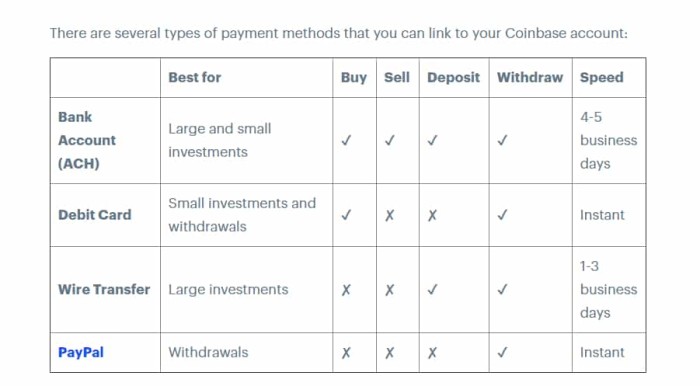

Coinbase Pro supports several different payment methods for US customers. Account holders can deposit USD or purchase cryptocurrency using either bank transfers (ACH), a debit card, or wire transfer, and can withdraw USD via bank transfer, wire transfer, or PayPal.

With some of these payment methods, there are extra verification steps. For example, when paying with a debit card, photo identification is required before adding a card.

Coins offered

Binance US offers trading for 52 different coins across 104 USD, various USD stablecoins, and BTC pairs. For comparison, Binance international offers trading for 281 different coins across a range of 935 pairs, including various stablecoins and fiat currencies. Coinbase Pro offers trading 43 different coins across 125 USD, USDc (stablecoin), and BTC pairs.

Binance vs Coinbase fees

Binance US has a tiered fee schedule which is dependent on a user’s trade volume over a trailing 30-day period. For accounts that have traded less than US$50k over the previous 30-day period, Binance US charges a 0.1% fee for spot trading (both maker and taker), 0.5% fee for instant buy/sell, and offers a 25% discount if the fee is paid in BNB. Users are also offered discounts based on the size of their daily BNB balances.

Coinbase Pro also has a tiered fee schedule that is dependent on a user’s trade volume over a trailing 30-day period. For accounts that have traded less than 10k USD over the previous 30-day period, Coinbase Pro charges a 0.5% maker fee and a 0.5% taker fee. At the highest level, traders with over 1 billion USD of trading volume, pay just 0.04% in taker fees and nothing in Maker fees.

Margin trading

From the perspective of US based users for margin trading in a Binance vs Coinbase Pro match up, Binance US does not offer the product. Coinbase used to but announced in November 2020 that it would no longer do so. Binance international does offer margin trading.

Staking & Lending

Whilst Binance international offers a range of coins that can be staked and lent out for margin trading, Binance US currently only supports staking for a few cryptocurrencies. The yields range from between 1% and 10% annually, with the following coins supported: Qtum (QTUM), EOS (EOS) Vechain (VET), Tezos (XTZ), Cosmos (ATOM), and Algorand (ALGO). Currently, only Tezos is supported for staking on Coinbase Pro. On the Coinbase.com wallet users can also stake their Cosmos (ATOM).

Coinbase or Binance?

In a Coinbase vs Binance match up, the decision for US customers to trade on Binance US or Coinbase Pro largely comes down to one’s personal trading or investing strategy. For example, for those looking to trade a wide range of different cryptocurrencies with reasonable fees, Binance US is an appealing option. However, Coinbase’s reputation and regulatory compliance are second to none, which may better suit risk-averse and institutional traders. All that being said, there’s no reason why a user cannot have the best of both worlds and open accounts with both exchanges. And if neither Coinbase or Binance have exactly what you’re looking for, check this article on how to choose a crypto exchange that’s right for you.

Don’t miss out – Find out more today